ASX 200 to extend bounce, strong US earnings lift the S&P 500 and Nasdaq

Get up to date on overnight market activity and the big events for the day.

ASX 200 futures are trading 27 points higher, up 0.35% as of 8:30 am AEST.

S&P 500 SESSION CHART

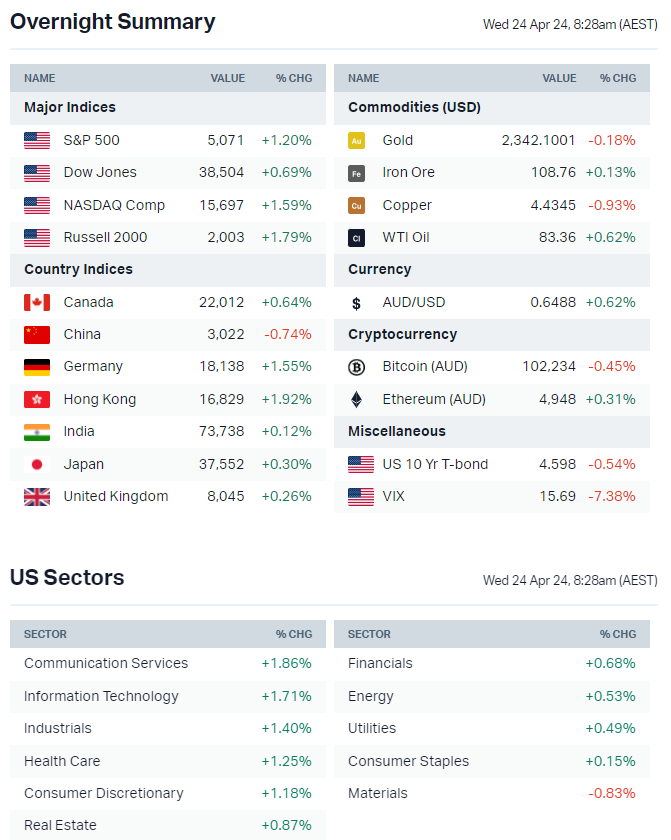

MARKETS

- S&P 500 extends bounce and finished near best levels overnight

- Bounce supported by weakening US dollar and slight easing of bond yields in wake of softer-than-expected PMI data (perhaps the ‘bad news is good news’ theme is back)

- Major bounce beneficiaries include growth, long duration, small caps and lower quality

- Earnings ramping up with SAP (+5.5%) boosted by cloud backlog growth, Pepsi (-2.9%) earnings in-line though North American sales lagged, GE (+8.3%) beat and raised full-year view, UPS (+2.4%) beat and showed improved volumes and more

- Citi strategists say buy the dip as global equities more attractive after the recent rout (Bloomberg)

- Big Tech under increasing pressure to deliver on AI contribution to revenues and profits, BofA says (Bloomberg)

- UBS upgrades China stocks to overweight, citing earnings resilience and capital return (Bloomberg)

INTERNATIONAL STOCKS

- Tesla misses first quarter revenue and earnings expectations, announces plan to accelerate launch of new affordable models (Reuters)

- Microsoft announces cost-effective small language AI model (Reuters)

- SAP stock rallies most since January as AI adoption drives cloud demand (Bloomberg)

- Spotify profits up but lower marketing hits user growth (Reuters)

- Google Search head warns of intensifying competition and regulation (CNBC)

- Amazon launches US$9.99/month unlimited grocery delivery service (Reuters)

- Walmart launches BNPL product with One despite recent expansion of relationship with Affirm (CNBC)

CENTRAL BANKS

- Markets now pricing-in growing risk of Fed rate hike amid stronger US data and hawkish Fedspeak (FT)

- BOJ to leave policy unchanged Friday as economists eye October hike (Bloomberg)

- ECB VP de Guindos says June rate cut seems like a done deal (Bloomberg)

GEOPOLITICS

- US drafting sanctions against Chinese banks for aiding Russia's war effort (WSJ)

- Biden tells Kiev military aid is coming after delayed US$60bn funding approved by House of Representatives (FT)

ECONOMY

- US services and manufacturing PMI for April all miss consensus to hit 4-5 month lows amid signs of weaker demand, inflation measures mixed (Reuters)

- Eurozone PMI expansion gains momentum on services sector activity (Bloomberg)

- Japan flash PMIs show manufacturers stabilising as services strengthen (Reuters)

- Australian flash PMIs show stabilisation in manufacturing activity, with new orders declining at the softest pace since last August (S&P)

ASX TODAY

We're moving the ASX-related sections lower to create a better separation of Wall Street/overnight and local/upcoming headlines and insights

- ASX 200 set to open higher for a third straight session but still down 2.8% from 2-Apr all-time highs

- ASX will be closed on Thursday for Anzac Day

- Australian inflation data at 11:30 am AEST – which could trigger a knee-jerk reaction to the upside/downside

- Several sectors starting to bottom after 10-15% pullback from mid-late March highs – including Homebuilders, Tech, Healthcare, Uranium and more

- Gold experienced a wild swing, down 0.2% on Tuesday, from session lows of -1.5%. Let's see if local gold names can stabilise after yesterday's selloff

- Bluescope Steel could face selling pressure after US peers Nucor (-8.8%) missed earnings expectations amid lower earnings from its steel mills segment

- Seven Group says talk of Cleanaway buyout ‘completely untrue’ (AFR)

- Nick Scali to launch $46-50m capital raise to fund acquisition of Fabb Furniture (AFR)

BROKER MOVES

A few interesting broker notes have popped up since market close on Tuesday.

- 29Metals downgraded to Sell from Underperform; target up to $0.35 from $0.28 (CSLA)

- Accent Group initiated Overweight with $2.20 target (JPMorgan)

- Aurelia Metals upgraded to Buy from Hold; target up to $0.23 from $0.16 (Jefferies)

- Chrysos downgraded to Neutral from Overweight; target cut to $7.25 from $8.05 (Barrenjoey)

- Lifestyle Communities upgraded to Neutral from Sell but target cut to $12.85 from $14.24 (UBS)

- Lovisa initiated Neutral with $29.00 target (JPMorgan)

- Northern Star downgraded to Underperform from Outperform; target up to $14.80 from $13.95 (CSLA)

- Universal Store initiated Overweight with $6.20 target (JPMorgan)

KEY EVENTS

Companies trading ex-dividend:

- Wed 24 April None

- Thu 25 April: None

- Fri 26 April: None

- Mon 29 April: Acrow (ACF) – $0.029, 360 Capital Mortgage REIT (TCF) – $0.035

- Tue 30 April: None

Other ASX corporate actions today:

- Dividends paid: Ridley Corp (RIC) – $0.044, 360 Capital REIT (TOT) – $0.015, Australian Unity office Fund (AOF) – $0.015

- Listing: None

Economic calendar (AEST):

- 11:30 am: Australia Inflation Rate (Mar)

- 10:30 pm: US Durable Goods Orders (Mar)

This Morning Wrap was written by Kerry Sun.

Never miss an update

Enjoy this wire? Hit the ‘like’ button to let us know.

Stay up to date with my current content by

following me below and you’ll be notified every time I post a wire

Livewire and Market Index's pre-opening bell news and analysis wrap. Available weekday mornings and written by Kerry Sun.

........

Livewire gives readers access to information and educational content provided by financial services professionals and companies (“Livewire Contributors”). Livewire does not operate under an Australian financial services licence and relies on the exemption available under section 911A(2)(eb) of the Corporations Act 2001 (Cth) in respect of any advice given. Any advice on this site is general in nature and does not take into consideration your objectives, financial situation or needs. Before making a decision please consider these and any relevant Product Disclosure Statement. Livewire has commercial relationships with some Livewire Contributors.

1 contributor mentioned

Comments

Comments

Sign In or Join Free to comment