ASX 200 to fall, S&P 500 extends losing streak, copper jumps to new 22-month high

Get up to date on overnight market activity and the big events for the day.

ASX 200 futures are trading 55 points lower, down -0.72% as of 8:30 am AEST.

S&P 500 SESSION CHART

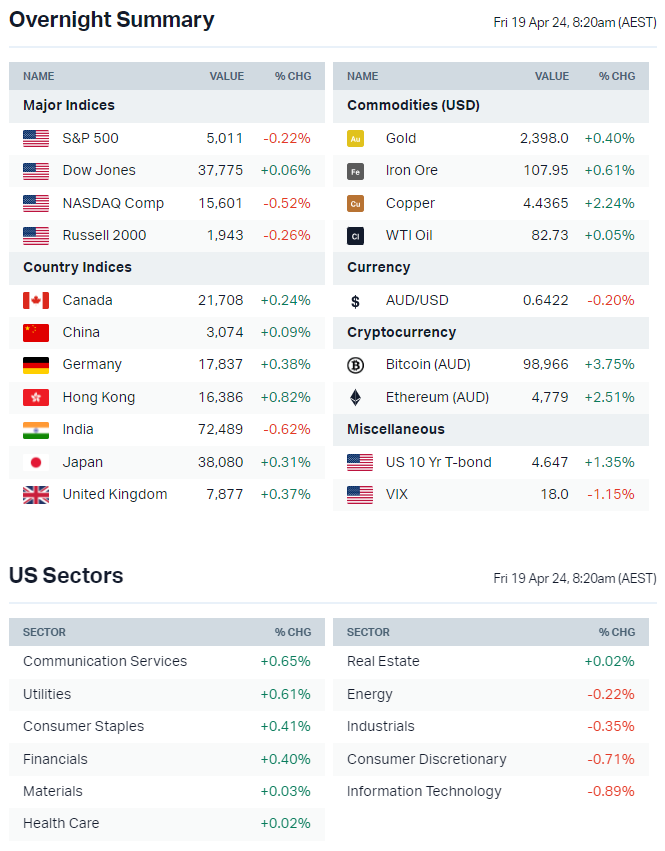

MARKETS

- S&P 500 failed to sustain an early bounce of 0.7% and finished near worst levels, down for a fifth straight session

- US 2-year yield up 5 bps overnight to 4.99%, close to crossing the key 5.0% level for the first time since Nov-23

- Only 6% of the S&P 500 is overbought from recent peak of 60%, while 46% of S&P 500 is oversold, according to Bespoke

- Market continues to focus on the hawkish repricing of Fed rate cut expectations (first of two cuts this year not seen until September), persistent 'higher for longer' Fedspeak, Nvidia falls into correction territory (down 13% from all-time highs) and VIX spiking to near six month highs

- Nvidia and chip stocks drop into technical correction (Bloomberg)

- Rates traders making contrarian bets Fed will cut more aggressively than markets are pricing in (Bloomberg)

- Yuan's share of global transactions rises further as euro and sterling slip (Bloomberg)

ASX TODAY

- ASX 200 set to open lower and give back all of Thursday's gains

- Companies due to report quarterly earnings today include Pilbara Minerals, Iluka Resources, Whitehaven Coal, Perseus Mining, Lynas and more

- Copper stocks set for a strong lead in after prices hit US$4.4/lb for the first time since Jun-22 – A few key names to watch include Sandfire (largest pure-play), BHP (~22% of EBITDA from copper), Aeris Resources (heavy debt position but highly leveraged), Evolution Mining (~30% of earnings from copper)

- DroneShield upsizes capital raise to $100m (AFR)

- EML Payments holder Alta Fox sells 8.14% stake (AFR)

- Pilbara Minerals reports March quarter results (PLS)

- Rio Tinto said to be interest in First Quantum’s Zambia copper assets (Bloomberg)

- Whitehaven’s Blackwater selldown may be upsized, JFE keen (AFR)

- Yancoal reports first quarter coal product of 14.0Mt up 25% year-on-year at an average realised coal price of A$180 a tonne (YAL)

BROKER MOVES

A few broker notes of interest – Most of these were published after market on Thursday.

- Australian Unity Office upgraded to Buy from Hold; target increased to $1.45 from $1.13 (Ord Minnett)

- Australian Vanadium initiated Buy with $0.08 target (Shaw and Partners)

- Bellevue Gold downgraded to Neutral from Outperform but target increased to $2 from $1.90 (Macquarie)

- Chorus upgraded to Neutral from Sell with NZ$7.25 target (UBS)

- IDP Education retained Overweight with $26 target (Barrenjoey)

INTERNATIONAL STOCKS

- Micron to receive more than $6bn in Commerce Department grants for domestic factory projects (Bloomberg)

- TSMC guides stronger-than-expected forecast revenue growth, AI boom fuels demand for advanced chips (Bloomberg)

- UBS, Morgan Stanley and HSBC announce more layoffs across investment banking (Bloomberg)

- L'Oreal first quarter sales up 9.4%, smashing consensus and shrugging off weak consumer concerns (Reuters)

- Meta releases Llama 3 AI model, will integrate into software and hardware (FT)

CENTRAL BANKS

- Fed Beige Book shows slight increase in economic activity, on pace with prior month (Bloomberg)

- Cleveland Fed President Mester reiterates no rush to cut rates and wants more data on inflation (Bloomberg)

- BoE Governor Bailey said UK and EU have less inflation risk than the US (Bloomberg)

- ECB President Lagarde says European economy showing signs of recovery (Bloomberg)

- ECB's Centeno says policy would remain restrictive even after 50 bps of cuts (Reuters)

- BoJ seen by most economists lifting rates again in October (Bloomberg)

GEOPOLITICS

- Biden calls China "xenophobic", tensions rise on his call for higher tariffs (Bloomberg)

- Netanyahu pushes back against Western calls for restraint, says Israel will do "everything necessary" to defend itself (Reuters)

ECONOMY

- Australian employment shrinks but data still indicative of tight labor market (Bloomberg)

- IMF says Middle East economies will grow slower pace this year due to Gaza war and Red Sea tensions (Reuters)

KEY EVENTS

Companies trading ex-dividend:

- Fri 19 April: WAM Research (WAX) – $0.05

- Mon 22 April: MFF Capital (MFF) – $0.06

- Tue 23 April: None

- Wed 24 April None

- Thu 25 April: None

Other ASX corporate actions today:

- Dividends paid: ARB Corp (ARB) – $0.34, PRL Global (PRG) – $0.025, Lindsay Australia (LAU) – $0.02, Copper Strike (CSE) – $0.06, Solvar (SVR) – $0.05, Charter Hall Social Infrastructure REIT (CQE) – $0.04

- Listing: None

Economic calendar (AEST):

- 9:30 am: Japan Inflation (Mar)

- 4:00 pm: UK Retail Sales (Mar)

This Morning wrap was written by Kerry Sun

Never miss an update

Enjoy this wire? Hit the ‘like’ button to let us know.

Stay up to date with my current content by

following me below and you’ll be notified every time I post a wire

Livewire and Market Index's pre-opening bell news and analysis wrap. Available weekday mornings and written by Kerry Sun.

........

Livewire gives readers access to information and educational content provided by financial services professionals and companies (“Livewire Contributors”). Livewire does not operate under an Australian financial services licence and relies on the exemption available under section 911A(2)(eb) of the Corporations Act 2001 (Cth) in respect of any advice given. Any advice on this site is general in nature and does not take into consideration your objectives, financial situation or needs. Before making a decision please consider these and any relevant Product Disclosure Statement. Livewire has commercial relationships with some Livewire Contributors.

1 contributor mentioned

Comments

Comments

Sign In or Join Free to comment