ASX 200 to open higher, S&P 500 and Nasdaq fall for a fourth straight day

ASX 200 futures are trading 20 points higher, up 0.26% as of 8:30 am AEST.

S&P 500 SESSION CHART

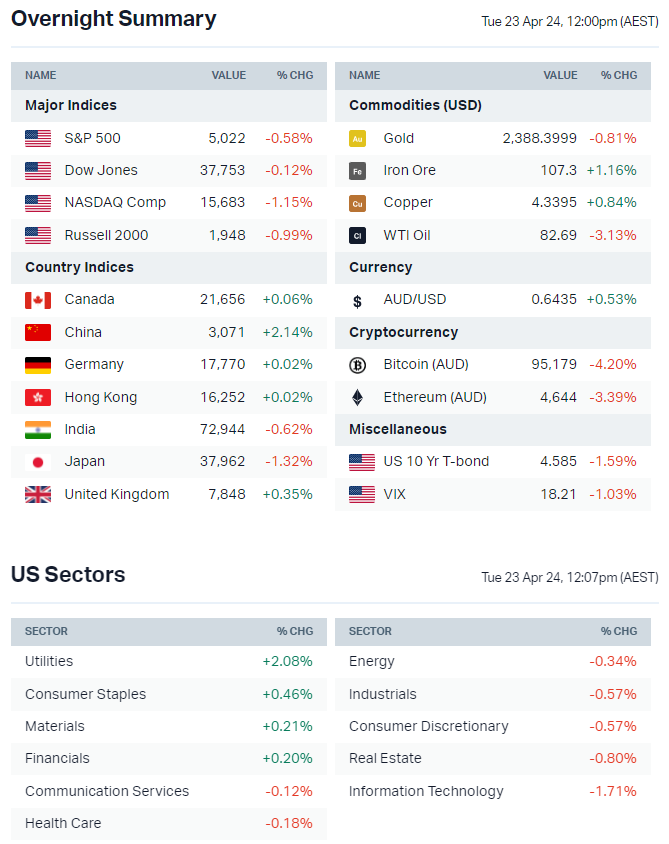

MARKETS

- S&P 500 finished lower, ending near worst levels despite a positive open

- S&P 500 now down 3.4% in the last four sessions and marks the first four-session decline since the start of 2024

- Bond yields lower across the curve after a sharp two-day run-up

- Oil prices fell ~3% as a rise in US commercial inventories, weaker economic data from China and hawkish Fedspeak outweighed Middle East supply risks

- Risk-off narrative continues to focus on the hawkish repricing of Fed rate-cut expectations, geopolitical fears of a wider Middle East war, unwinding of stretched positioning and sentiment indicators

- Higher-for-longer rate regime sticking around threatens painful wake-up call for financial markets (Reuters)

- South Korea policymakers increase warnings over rapidly weakening won (Bloomberg)

- Investors are increasingly confident in 'no landing' scenario for US (YahooFinance)

ASX TODAY

- ASX 200 set to open higher on Thursday after a five-day losing streak

- Companies due to report Q3 results today include Woodside, Santos and Bellevue Gold

- Dexus to exercise preemptive rights to acquire additional $1bn stake in Powerco (The Aus)

- Droneshield preparing $75m placement at 80 cents per share (AFR)

- Telix Pharma reports Q1 revenue up $175m, up 18% vs. quarter ago (TLX)

- Woodside major shareholder LGIM piles more climate pressure on Woodside (AFR)

INTERNATIONAL STOCKS

- ASML new orders missed expectations on waning demand for advanced machines (Bloomberg)

- LVMH sales growth slips on luxury spending slowdown and soft China demand (Reuters)

- United Airlines shares jump as travel demand drives bumper summer (Reuters)

- Google announces more layoffs, moves certain roles outside of US (BI)

CENTRAL BANKS

- Fed Chair Powell signals delay to rate cuts following high inflation readings (FT)

- ECB's Villeroy signals central bank to cut rates throughout 2024 and 2025 (Bloomberg)

- BOE Governor Bailey said UK and EU have less inflation risk than the US (Bloomberg)

GEOPOLITICS

- Iranian President Raisi threatened that the "tiniest invasion" would be met with a massive response (AP)

- Netanyahu pushes back against Western calls for restraint and says Israel will do "everything necessary" to defend itself (Reuters)

- President Biden to call for tariffs on Chinese steel and aluminum to more than triple from current 7.5% level to 25% (Bloomberg)

ECONOMY

- UK inflation eases less than expected, pushing back BoE rate cut bets (Reuters)

- Eurozone inflation slows in March, reinforcing expectations for ECB June rate (Reuters)

ResMed pains

US-listed Resmed CDIs tumbled 5.97% overnight after Eli Lilly announced the trial results for its weight loss drug Tirzepatide. According to the company website:

"Tirzepatide achieved a mean apnea-hypopnea index reduction of up to 63% (about 30 fewer events per hour), meeting all primary and key secondary endpoints in two phase 3 clinical trials."

"Tirzepatide meaningfully improved sleep apnea symptoms in those with moderate-to-severe OSA and obesity with and without PAP therapy, and based on these results Lilly plans to submit these data for global regulatory reviews."

Analysts covering obstructive sleep apnea (OSA) devices were relatively mixed, with some viewing the data as a game changer for OSA therapy while others argued that OSA device stocks are due to rally on relief that the data was not earth-shattering or any worse than feared.

Interestingly, UBS recommended buying Inspire Medical Systems (a US-listed OSA device company) on any weakness, given the lack of impact to fundamentals. The stock finished the overnight session up 9.9%.

Resmed shares tumbled 5.97% overnight to US$173.83. The US-listed CDIs trade on a 10:1 basis and after converting to local currency, implies a fair value open of $27.00.

KEY EVENTS

- Thu 18 April: The Reject Shop (TRS) – $0.10, WAM Capital (WAM) – $0.077, Horizon Oil (HZN) – $0.015, Spheria Emerging Companies (SEC) – $0.03, Plato Income Maximiser (PL8) – $0.006

- Fri 19 April: WAM Research (WAX) – $0.05

- Mon 22 April: MFF Capital (MFF) – $0.06

- Tue 23 April: None

- Wed 24 April None

- Dividends paid: Rio Tinto (RIO) – $3.92, Nine Entertainment (NEC) – $0.04, Brisbane Broncos (BBL) – $0.015, Regal Partners (RPL) – $0.05, Pepper Money (PPM) – $).05, Lovisa (LOV) – $0.50

- Listing: None

- 11:30 am: Australia Unemployment Rate (Mar)

This Morning Wrap was written by Kerry Sun.

1 contributor mentioned