ASX 200 to rise, S&P 500 and Nasdaq close at record highs

Get up to date on overnight market activity and the big events for the day.

ASX 200 futures are trading 42 points higher, up 0.54% as of 8:30 am AEST.

S&P 500 SESSION CHART

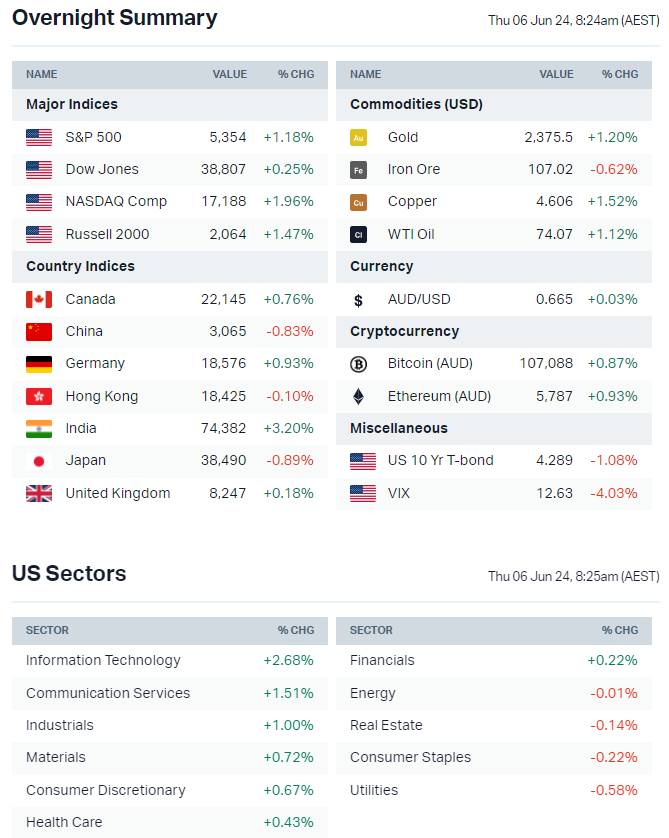

OVERNIGHT MARKETS

- S&P 500 and Nasdaq rallied, finished near best levels and at record highs

- Big tech extended recent outperformance, led by Nvidia (+5.1%), Meta (+3.8%), Microsoft (+1.9%) and Alphabet (+1.1%)

- Defensives like Utilities, Staples and Real Estate finished in red – The Equal Weight S&P 500 underperformed the official benchmark by 57 bps

- Tech earnings were a bright spot, with better-than-expected numbers from CrowdStrike and Hewlett Packard – both companies highlighted strong AI-related demand

- Commodities including oil, gold and copper bounced after Wednesday’s selloff

- Bond yields fell for a sixth straight session, with the US 2-year closing a two-month low

- Goldman Sachs expects "wall of money" into equities in early July (Bloomberg)

- Global investors have withdrawn a net US$40bn from ESG funds this year, including a record US$14bn in April (FT)

- ASML now second-biggest listed stock in Europe, overtaking LVMH (Bloomberg)

- Traders resuming Fed easing bets with futures pricing in rate cut by Nov (Bloomberg)

- FX strategists see dollar weakening over next 12 months (Reuters)

INTERNATIONAL STOCKS

- CrowdStrike shares jump as AI boosts cybersecurity demand (Reuters)

- Hewlett Packard Enterprise sees third-quarter revenue above estimates on robust AI demand (Reuters)

- Apollo Global to acquire 49% interest in Intel's Irish facility for US$11bn (Reuters)

- Tesla's institutional shareholders are giving up on the stock (Reuters)

- Nvidia overtakes Apple as the second most valuable company (Reuters)

CENTRAL BANKS

- Bank of Canada becomes first G7 central bank to cut and sees further cuts if inflation continues to ease (FT)

- RBA Governor Bullock says won't hesitate to hike again if inflation is sticky (Bloomberg)

GEOPOLITICS

- China AI chip companies skirting US sanctions by designing less powerful processors to retain access to TSMC's production (Reuters)

- Indian PM Modi forced into coalition talks as BJP loses majority in surprise result (FT)

- Israel steps up military offensive in Gaza amid renewed truce efforts (FT)

- US ready to back US$50bn loan to Ukraine provided EU extend sanctions against Russian state assets (FT)

ECONOMY

- US services PMI rebounds more than expected in May and back into growth (Reuters)

- China Caixin Services PMI marks fastest growth in ten months (Reuters)

- Eurozone composite PMI showed economy growing at fastest rate in a year (Reuters)

- UK PMI data showed services sector continued to support economic expansion (Reuters)

- Japan base wages rose by most since 1994 after March pay negotiations (Bloomberg)

- Japan service activity extends gains in May while price pressures persist (Reuters)

ASX TODAY

- ASX 200 to open higher after a strong lead from Wall Street, lower bond yields and higher overnight commodity prices

- Copper and Gold Miner ETFs bounced overnight but still down 2-3% in the last two sessions – a local name like Sandfire sold off 5.6% on Wednesday, so let's see if it can recoup some of those losses

- S&P Biotech ETF rallied 3.2% overnight to a two-month high – the local biotech sector has been heating up and those with successful trials have been rewarded (thinking about LTP, BOT, CU6 even larger caps like TLX, PNV, PME)

- ASX 200 Financials Index is less than 1% away from all-time highs and CBA closed at a record high on Wednesday

- Australian Treasury introduces new consumer protection legislation for BNPL that will see operators regulated as consumer credit (Treasury Press Release)

- Baby Bunting holder HMC Capital discloses 12.3% stake, up from 10.3% (BBN)

- Hanwha continues work on bid for Austal (The Aus)

- MinRes sells 49% stake in Onslow Iron haul road to Morgan Stanley Infrastructure Partners for $1.3 billion (MIN)

- SRG Global awarded multi-year term contracts in the resource sector totalling $125 million (SRG)

BROKER MOVES

- Lovisa upgraded to Outperform from Neutral; target up to $33.70 from $26.90 (Macquarie)

KEY EVENTS

Companies trading ex-dividend:

- Thu 6 June: None

- Fri 7 June: None

- Mon 10 June: None

- Tue 11 June: None

- Wed 12 June: Tower (TWR) – $0.024, ALS (ALQ) – $0.196

Other ASX corporate actions today:

- Dividends paid: United Overseas Australia (UOS) – $0.02

- Listing: None

Economic calendar (AEST):

- 11:30 am: Australia Balance of Trade (Apr)

- 10:15 pm: ECB Interest Rate Decision

- 10:45 pm: ECB Press Conference

This Morning Wrap was written by Kerry Sun.

Never miss an update

Enjoy this wire? Hit the ‘like’ button to let us know.

Stay up to date with my current content by

following me below and you’ll be notified every time I post a wire

Livewire and Market Index's pre-opening bell news and analysis wrap. Available weekday mornings and written by Kerry Sun.

........

Livewire gives readers access to information and educational content provided by financial services professionals and companies (“Livewire Contributors”). Livewire does not operate under an Australian financial services licence and relies on the exemption available under section 911A(2)(eb) of the Corporations Act 2001 (Cth) in respect of any advice given. Any advice on this site is general in nature and does not take into consideration your objectives, financial situation or needs. Before making a decision please consider these and any relevant Product Disclosure Statement. Livewire has commercial relationships with some Livewire Contributors.

1 contributor mentioned

Comments

Comments

Sign In or Join Free to comment

most popular

Equities

What a 40% year taught us: 4 lessons from the past 12 months (and 3 new stocks to buy)

Seneca Financial Solutions

Equities

2 stocks to drive future performance following a 35% return in six months

Katana Asset Management