ASX 200 to rise, S&P 500 flat, ECB cuts rates for first time since 2019

Get up to date on overnight market activity and the big events for the day.

ASX 200 futures are trading 22 points higher, up 0.18% as of 8:30 am AEST.

S&P 500 SESSION CHART

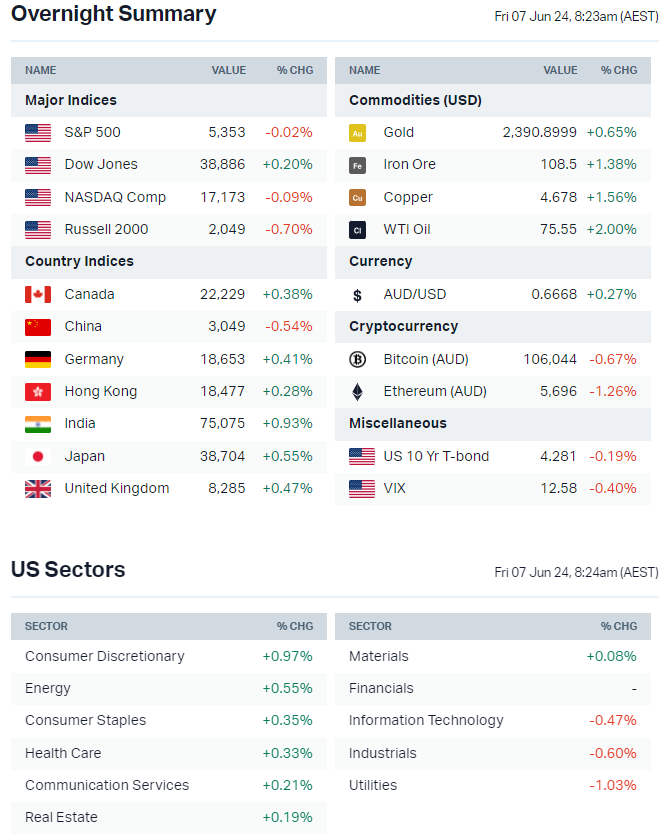

OVERNIGHT MARKETS

- Major US benchmarks finished around breakeven after yesterday’s strength that pushed the S&P 500 and Nasdaq to record highs

- Nvidia weighed (-1.1%) and eased back below US$3 trillion market cap

- AI enthusiasm offset by concentration concerns (Microsoft, Nvidia and Apple account for ~20% of the S&P 500) as well as growth slowdown concerns

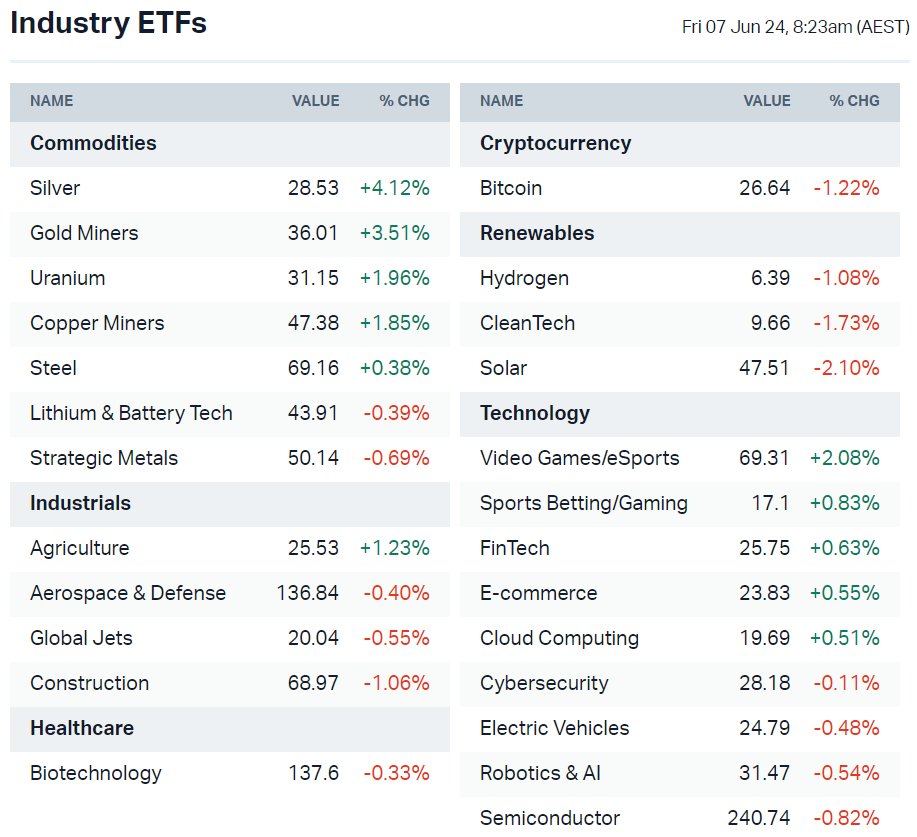

- Resource-related equities ticked higher, including gold, uranium and copper

- Upcoming seasonal tailwind as the first 15 days of July have been the best two-week trading period for US markets since 1928, according to Goldman Sachs (Bloomberg)

- Bonds tracking for longest daily winning streak since late 2023 (Bloomberg)

INTERNATIONAL STOCKS

- GameStop and other meme stocks surge as Roaring Kitty schedules YouTube livestream for Friday (Bloomberg)

- Intel, AMD, Qualcomm and Nvidia battle to get latest processes into next wave of AI enabled PCs (FT)

- TSMC hits record high amid positive news across chip industry, AI demand surges (WSJ

- Lululemon tops quarterly estimates on solid China demand, says consumers are still spending but selective of where they spend and what they buy (Reuters)

CENTRAL BANKS

- ECB cuts rates for first time in nearly five years, following Canadian and Swiss cuts (FT)

- RBI seen to hold rates steady on Friday amid robust economic growth and uncertain inflation outlook (Bloomberg)

GEOPOLITICS

- Israel and Hezbollah tensions escalate (Bloomberg)

- Modi wins coalition support to form government for the third term (Bloomberg)

- Japan PM Kishida faces narrower path to re-election (Nikkei)

ECONOMY

ASX TODAY

- ASX 200 set to open higher buoyed by an overnight uptick in commodity prices

- Market appears to be in for a quiet one – Will be interesting to see how CBA trades after yesterday's all-time high while names like Woodside and Fortescue are trading near lows

- Gold, silver, copper and oil prices starting to bounce after recent 5-10% drawdowns

- Bega Cheese launches strategic review of Queensland peanut processing facility, sale of the business could raise around $20m (The Aus)

- Cooper Energy holder First Sentier Investors lifts holding from 9.78% to 13.57% (COE)

- Dexus seeking a partner to bid for Powerco stake (AFR)

- Droneshield will have 37.8m shares released (at 80 cents vs. yesterday's close of $1.29) as part of tranche 2 of recent placement (DRO)

- GQG Partners reports 31-May FUM of $150.1bn vs. $142.0bn a month ago (GQG)

- Life360 prices its 5.8m shares US IPO at $27.00 per share through Goldman Sachs, Evercore and UBS (The Aus)

BROKER MOVES

- IGO initiated Buy with $8.80 target (Argonaut Securities)

- Lendlease downgraded to Sell from Neutral; target cut to $5.56 from $7.10 (UBS)

- Mineral Resources upgraded to Buy from Neutral; target up to $82 from $79 (BofA)

- Mineral Resources downgraded to Underperform from Outperform; target cut to $75 from $76.50 (CLSA)

- Region Group upgraded to Overweight from Equal-weight; target up to $2.50 from $2.44 (Morgan Stanley)

KEY EVENTS

Companies trading ex-dividend:

- Fri 7 June: None

- Mon 10 June: None

- Tue 11 June: None

- Wed 12 June: Tower (TWR) – $0.024, ALS (ALQ) – $0.196

- Thu 13 June: Plato Income Maximiser (PL8) – $0.006, Incitec Pivot (IPL) – $0.043

Other ASX corporate actions today:

- Dividends paid: Tamawood (TWD) – $0.11, Tasmea (TEA) – $0.025

- Listing: None

Economic calendar (AEST):

- 1:00 pm: China Balance of Trade (May)

- 4:00 pm: Germany Balance of Trade (Apr)

- 10:30 pm: Canada Unemployment Rate (May)

- 10:30 pm: US Non Farm Payrolls (May)

- 10:30 pm: US Unemployment Rate (May)

This Morning Wrap was written by Kerry Sun.

Never miss an update

Enjoy this wire? Hit the ‘like’ button to let us know.

Stay up to date with my current content by

following me below and you’ll be notified every time I post a wire

Livewire and Market Index's pre-opening bell news and analysis wrap. Available weekday mornings and written by Kerry Sun.

........

Livewire gives readers access to information and educational content provided by financial services professionals and companies (“Livewire Contributors”). Livewire does not operate under an Australian financial services licence and relies on the exemption available under section 911A(2)(eb) of the Corporations Act 2001 (Cth) in respect of any advice given. Any advice on this site is general in nature and does not take into consideration your objectives, financial situation or needs. Before making a decision please consider these and any relevant Product Disclosure Statement. Livewire has commercial relationships with some Livewire Contributors.

1 contributor mentioned

Comments

Comments

Sign In or Join Free to comment

most popular

Equities

What a 40% year taught us: 4 lessons from the past 12 months (and 3 new stocks to buy)

Seneca Financial Solutions

Equities

2 stocks to drive future performance following a 35% return in six months

Katana Asset Management