ASX 200 to rise, S&P 500 posts biggest weekly gain of the year

Get up to date on overnight market activity and the big events for the day.

ASX 200 futures are trading 7 points higher, up 0.08% as of 8:30 am AEDT.

S&P 500 SESSION CHART

ASX TODAY

- ASX 200 set to open relatively flat following a mixed lead from Wall Street

- ASX 200 up 1.29% last week, led by Materials (+2.35%), Real Estate (+1.88%) and Financials (+1.44%)

- Buy now, pay later stocks reacted positively to the RBA’s decision to drop its tightening bias, led by Zip (+13.5%), Block (+3.6%) and Humm Group (+3.0%) last week

- Cyan Renewables to acquire MMA Offshore for $2.60 cash per share

- Star Entertainment CFO Christina Katsibouba to leave to pursue other interests

- Star Entertainment CEO Robbie Cooke to depart, effective from 22-Mar

- Business Council of Australia pushes back against Green’s bill proposing powers to split grocery retailers (AFR)

- Macquarie mulls acquisition of UK’s largest airport (The Telegraph)

- Newmont’s Akyem Ghana Gold Mine draws Chinese interest (Bloomberg)

- WA's TAB fails to attract sufficient interest (AFR)

- Westpac considering a tech-related acquisition (The Australian)

BROKER MOVES

- APM Human Services downgraded to Hold from Buy but target remains $1.80 (Jefferies)

- Fisher & Paykel upgraded to Sector Perform and target increased to NZ$23 from NZ$20 (RBC Capital Markets)

- Retail Food Group resumed Buy with 10 cent target (Shaw and Partners)

- Sims upgraded to Buy from Neutral and target increased to $14.50 from $13.60 (UBS)

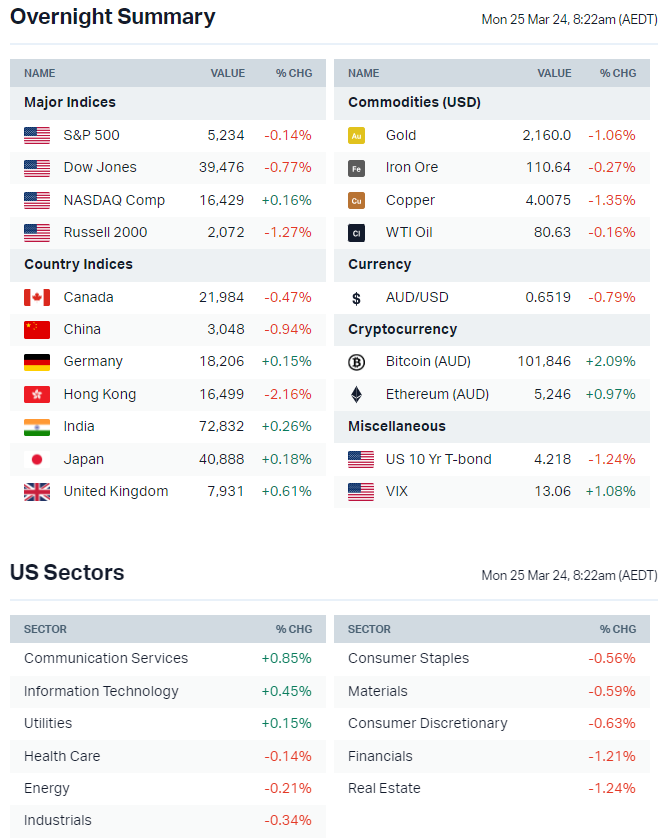

MARKETS

- S&P 500 higher but off best levels amid a very quiet Friday session

- S&P 500 marked its best weekly performance (+2.29%) this year, underpinned by lower bond yields and dovish Fed takeaways

- Bond yields continued to fall – The US 10-year yield fell for a fourth straight session, down a total 12 bps

- BofA says stock funds saw biggest outflow since December '22 in advance of this week's FOMC (Bloomberg)

- Bezos, Zuckerberg among tech leaders selling hundreds of millions of shares (FT)

- Goldman Sachs strategists see Big Tech potentially leading S&P 500 up another 15% (Bloomberg)

- Record amount flows into US corporate bond funds amid demand to lock in higher yields (FT)

- Gold briefly surges above $2,200 for the first time, before retreating (Bloomberg)

- Yuan snaps to four-month low (Bloomberg)

- Yuan increasingly popular as a funding currency for carry trade after BoJ, Taiwan rate hikes (Bloomberg)

INTERNATIONAL STOCKS

- Tesla reducing EV production in China amid softer sales and stiffer competition (Bloomberg)

- Lululemon shares plummet on weak guidance and slowing North American growth (CNBC)

- Nike shares slide on lackluster outlook and slowing China sales (CNBC)

- Didi reports 55% year-on-year revenue growth in Q4 ahead of its IPO this year (Bloomberg)

CENTRAL BANKS

- BoE Governor Bailey says markets correct to expect more than one rate cut in 2024 (Bloomberg)

- BOC officials says QT will likely end in 2025 (Bloomberg)

- BOJ expected to hike again by October with yen weakness posing risk of additional tightening (Bloomberg)

- China's central bank ramps up spending to support economy and avoid worsening local government debt risks (Bloomberg)

- Atlanta Fed's Bostic says he sees just one rate cut this year (Bloomberg)

GEOPOLITICS

- Russia arrests 11 following attack that killed 133 in Moscow as Isis claims responsibility (FT)

- Secretary of State Blinken arrives in Israel to continue Gaza ceasefire talks (NY Times)

- China President Xi plans to meet with US executives in Beijing next week (Bloomberg)

- US lawmakers introduce bill that would bar US mutual funds from investing in indexes that track Chinese stocks (Bloomberg)

ECONOMY

- Japan core inflation remains above BOJ target but food price inflation eases (Bloomberg)

KEY EVENTS

Companies trading ex-dividend:

- Monday, 25 March: Perenti (PRN) – $0.02, Cash Converters (CCV) – $0.001, Naos Emerging Opportunities (NCC) – $0.037, Lycopodium (LYL) – $0.37, NRW Holdings (NWH) – $0.06, Cedar Woods (CWP) – $0.08

- Tuesday, 26 March: Civmec (CVL) – $0.025, New Zealand Oil & Gas (NZO) – $0.025, Flight Centre (FLT) – $0.10, Southern Cross Electrical (SXE) – $0.01

- Wednesday, 27 March: Myer (MYR) – $0.03, Waypoint REIT (WPR) – $0.04, IPD Group (IPG) – $0.04, Garda Property (GDF) – $0.016, Rural Funds (RFF) – $0.02, Dexus Convenience Retail REIT (DXC) – $0.05, Reece (REH) – $0.08, Wiseway Group (WWG) – $0.002, 360 Capital REIT (TOT) – $0.015, 360 Capital Mortgage REIT (TCF) – $0.035, Centuria Office REIT (COF) – $0.03, Centuria Retail REIT (CIP) – $0.04, Australian Unity Office Fund (ARF) – $0.015, Arena REIT (ARF) – $0.04

- Thursday, 28 March: Australian Clinical Labs (ACL) – $0.03, Sigma Healthcare (SIG) – $0.033

- Friday, 29 March: None

Other ASX corporate actions today:

- Dividends paid: GR Engineering (GNG) – $0.09, Australian Finance Group (AFG) – $0.04, Teaminvest Private (TIP) – $0.015

- Listing: None

Economic calendar (AEDT):

No major economic announcements.

This Morning Wrap was written by Kerry Sun.

Never miss an update

Enjoy this wire? Hit the ‘like’ button to let us know.

Stay up to date with my current content by

following me below and you’ll be notified every time I post a wire

Livewire and Market Index's pre-opening bell news and analysis wrap. Available weekday mornings and written by Kerry Sun.

........

Livewire gives readers access to information and educational content provided by financial services professionals and companies (“Livewire Contributors”). Livewire does not operate under an Australian financial services licence and relies on the exemption available under section 911A(2)(eb) of the Corporations Act 2001 (Cth) in respect of any advice given. Any advice on this site is general in nature and does not take into consideration your objectives, financial situation or needs. Before making a decision please consider these and any relevant Product Disclosure Statement. Livewire has commercial relationships with some Livewire Contributors.

1 contributor mentioned

Comments

Comments

Sign In or Join Free to comment

most popular

Equities

21 ASX stocks that should be on your radar

Livewire Markets

Equities

Wisetech tanks 17% on earnings miss but margins shine

Livewire Markets