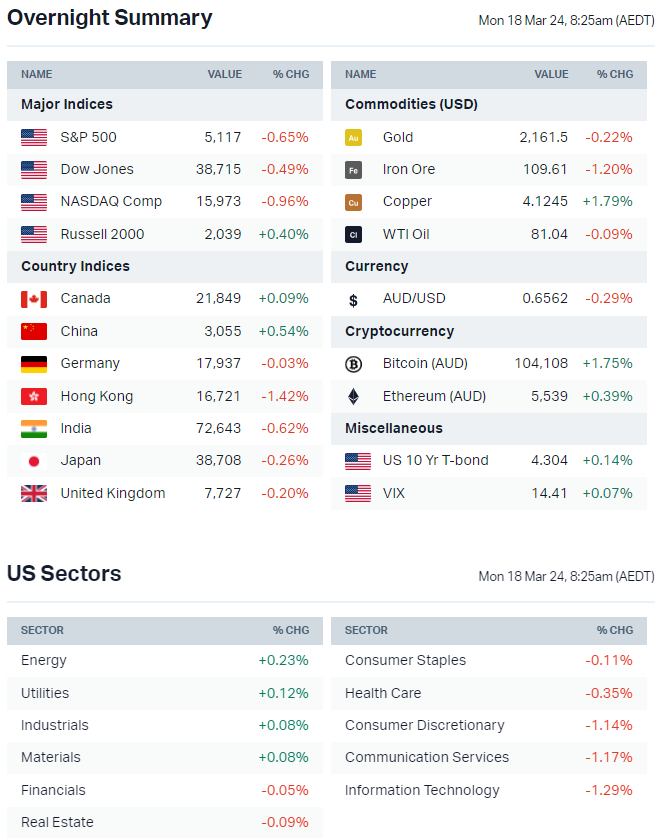

ASX 200 to tick lower, S&P 500 marks second weekly loss, copper extends gains

ASX 200 futures are trading 13 points lower, down -0.17% as of 8:30 am AEDT.

S&P 500 SESSION CHART

ASX TODAY

- ASX 200 set for a relatively choppy session following a weak lead from Wall Street and iron ore prices undercutting US$100 a tonne

- BHP stands down 25% of workforce at West Musgrave (AFR)

- Boral shareholders selling into rally for a quick payday (AFR)

- Ridley Corp shares lapped up by Danish pet food giant (AFR)

- NextDC-backed Sovereign Cloud raises $25m to stay alive (AFR)

BROKER MOVES

- Aurelia Metals downgraded to Hold from Buy with $0.15 target (Jefferies)

- Aussie Broadband reinstated Neutral with $3.75 target (Barrenjoey)

- Clinuvel Pharmaceuticals upgraded to Add from Hold with $16.00 target (Morgans)

- Technology One upgraded to Buy from Hold and target increased to $18.50 from $17.25 (Bell Potter)

MARKETS

- S&P 500 lower, closed off worst levels but down for a third straight session

- S&P 500 finished the week lower, marking the first back-to-back weekly decline since last October

- Megacap tech stocks including Amazon (-2.4%), Microsoft (-2.1%) and Meta (-1.6%) led to the downside

- Small-cap Russell 2000 finished in positive territory, outperforming the S&P 500 bp 100 bps

- US bond yields higher, US 10-year up for a fifth straight session to near three-week high

- Market back in line with Fed on 2024 rate cut expectations, currently expecting only 3 rate cuts by year end (FT)

- More market bubble pushback in the form of underperformance of unprofitable tech companies (Bloomberg)

- Flow data shows investors pumped over US$56bn into US equities, led by tech (Bloomberg)

- Money market assets hit another record high amid dialing back of Fed rate cut expectations (Bloomberg)

INTERNATIONAL STOCKS

- Apple looking more like value stock with shift in market focus to AI secular growth theme (Bloomberg)

- Tesla will increase prices for all Model Y cars in the US by $1,000 (Reuters)

- Hertz replacing CEO following bad bet on EVs (Bloomberg)

- Adobe delivers weak sales outlook for the current quarter amid concerns new AI startups a competitive threat (Bloomberg)

- McDonald's suffering system disruptions globally (Reuters)

- Apple acquires Canadian startup DarwinAI, adds dozens of the Canadian company's staffers to its AI division (Reuters)

CENTRAL BANKS

- Fed focusing on inflation amid challenges of deciphering conflicting signals on growth (link)

- ECB policymaker Pablo Hernandez de Cos latest official to flag likelihood of a June rate cut (Reuters)

- PBOC unexpectedly drains medium-term liquidity for first time since Nov-2022 (Bloomberg)

- BOJ said to be in final preparations for rate hike next week (Reuters)

ECONOMY

- China home price declines accelerates with property support measures yet to bear fruit (Reuters)

- China activity data expected to show slow start to the year (Bloomberg)

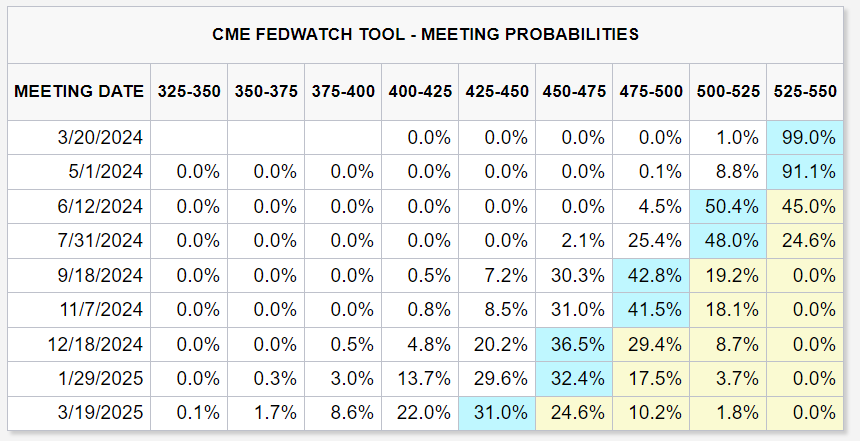

Where'd The Rate Cuts Go?

The market is now expecting just three rate cuts by year end, down from a peak of seven at the beginning of this year. This is the first time that the market's expectations have aligned with the latest Fed guidance.

The likelihood of a rate cut in March sits at just 1.0% and odds of a rate cut in March are down to 8.8%.

Source: CME

All Aboard the Copper Train

It was a somewhat heavy session for major US benchmarks but our ETF list held up relatively well. Most sub-sectors finished higher (but off best levels) including lithium, biotech, steel and agriculture.

Copper had the most pronounced overnight move, with futures prices up 1.95% to US$4.12/lb and the Global X Copper Miners ETF up 2.5%.

- Bloomberg says traders are warming up to the idea that the worst of a global downturn is in the past, particularly for metals like copper that are increasingly used in electric vehicles and renewables

- China's stockpiles for copper hit the highest level since March 2020, according to the Shanghai Futures Exchange

- The main catalyst behind copper's powerful breakout is the ongoing tightening of global output and supply, driven largely by last year's closure of the Panama Mine

- Last week, copper prices jumped after Chinese smelters held an emergency meeting on how to cope with a sharp drop in processing fees due to disruptions in copper concentrate supply

- Goldman Sachs published a note titled "Copper's time is now" and expect prices to rise to US$10,000 a tonne by year end (US$4.54/lb) and then US$12,000 a tonne by 1Q24 (US$5.44/lb)

- The note says there's "incremental evidence now points to a bottoming out in the industrial cycle, with the global manufacturing PMI in expansion for the first time since September 2022 ... Previous inflexions in global manufacturing cycles have been associated with subsequent sustained industrial metals upside, with copper and aluminium rising on average 25% and 9% over the next 12 months."

KEY EVENTS

- Trading ex-div: Hub24 (HUB) – $0.185, Chorus (CNU) – $0.152, Saunders (SND) – $0.02, L1 Long Short Fund (LSF) – $0.058, Prime Financial (PFG) – $0.007

- Dividends paid:

- Listing: None

- 1:00 pm: China Industrial Production (Jan-Feb)

- 1:00 pm: China Retail Sales (Jan-Feb)

- 1:00 pm: China Fixed Asset Investment (Jan-Feb)

This Morning Wrap was written by Kerry Sun.

1 contributor mentioned