Auscap: A savings boom is driving huge post-pandemic potential

Record-level household savings, robust demand for Australian commodities and a rapidly recovering domestic economy add up to a rosy outlook for Australian equities, says Auscap Asset Management portfolio manager Tim Carleton.

He discussed the rapid recovery in employment figures, resurgent retail traffic and China’s unwavering construction activity during a broad-ranging webinar addressing macro themes and specific stock calls.

“Do we need to worry about ballooning government debt? The short answer is no,” Carleton said. “The private sector is in rude health, and we expect that health to shine through in economic growth over the coming years.”

Some of his most striking statements related to some mid-COVID assumptions that proved to be not only exaggerated but in a few cases back-to-front.

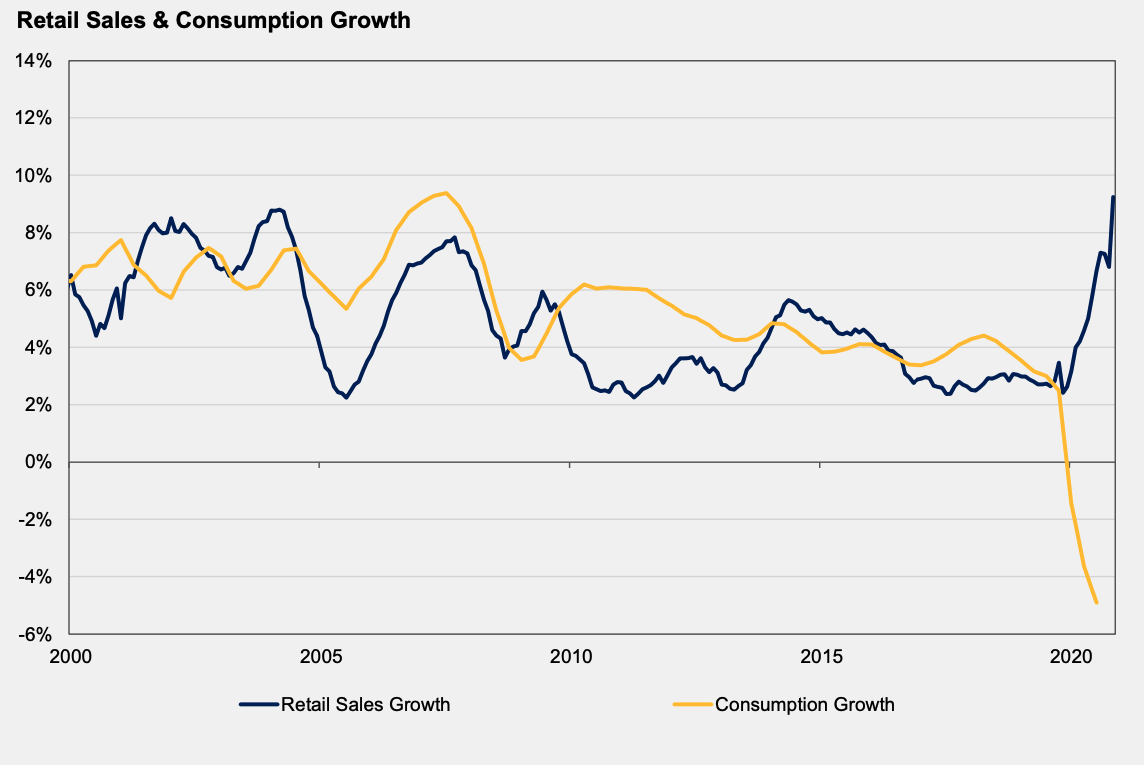

Retail sales grew by 7%, “but within the context of overall consumption falling meaningfully,” Carleton said.

“For all the pantry-stuffing articles that we read last year, spending on food and alcohol only increased 3.5% on the prior year.”

We all heard about the rush on home hardware goods and building materials from the likes of Bunnings and Mitre10 last year. Many commentators assumed purchases of furniture and homewares had also gone through the roof during the pandemic.

“But for all of the talk of massive boosts to spending around the home and on furniture, expenditure in that category only grew 10% year-on-year,” Carleton said.

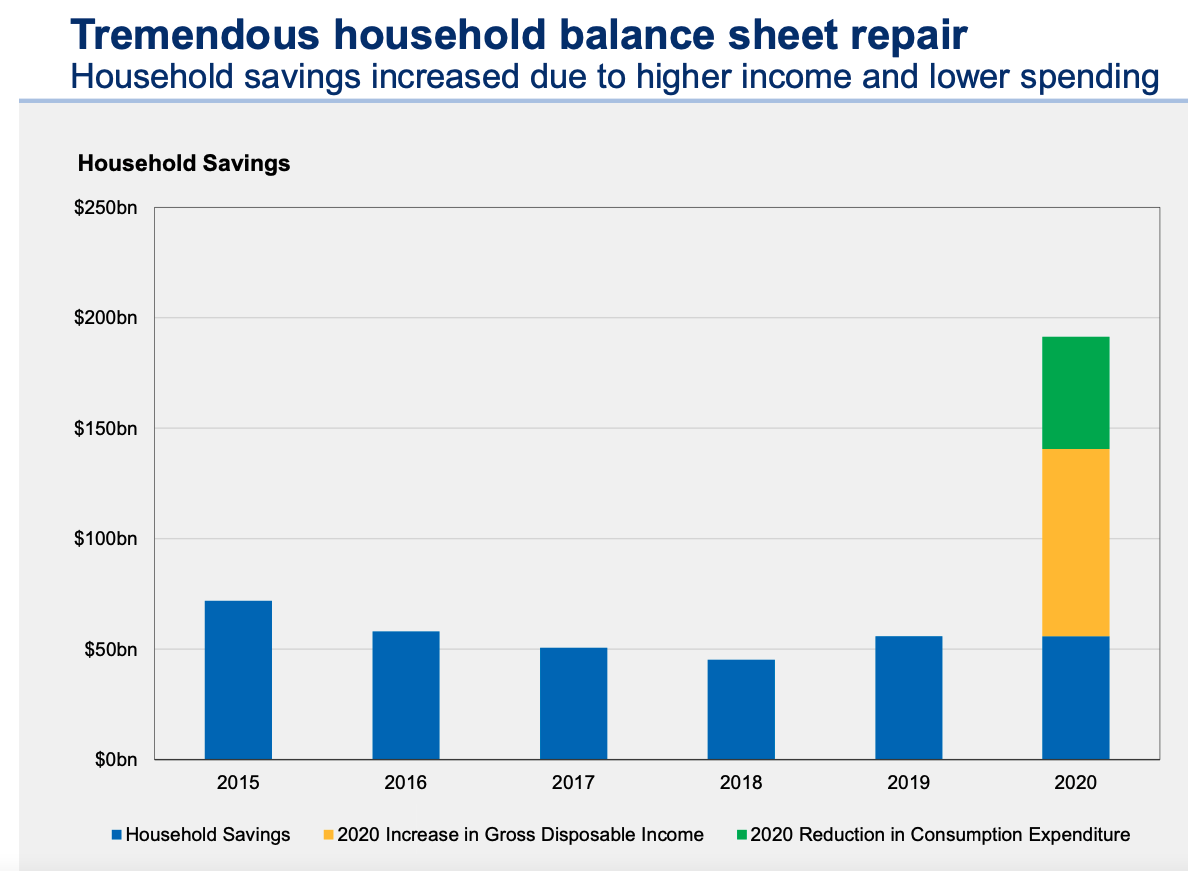

In short, rather than a spending boom, COVID mitigation measures including lockdowns and closed borders instead led to a savings boom. Even as disposable incomes grew at the fastest rate in nearly a decade, rising more than 6%, consumption declined. This led to a big jump in the savings ratio of Australian households.

Household interest payments, as a percentage of income, are below 6% for the first time ever, and well below where the levels of 2007 and 2010 when there was extreme concern about the cost of servicing mortgages.

“Households and small businesses are in a remarkable position,” said Carleton. This view is reflected in the Westpac Consumer Confidence survey, which sits at decade highs as people feel “remarkably confident” about their individual circumstances.

Source: ABS, Auscap

The state of Australia’s housing market was a key topic of discussion during the webinar, as a bellwether of consumer confidence and a key component of the financial sector.

“We’ve seen more housing approvals in the last few months than have ever been recorded in such a short time period in the history of the data set, and it’s leading to aggregate dwelling approvals seeing a meaningful uptick after three or four years of declines,” said Carleton.

He anticipates this period of decline will be on an upward trajectory again from 2022.

Key reasons for this include:

- The rising level of new home starts

- Robust house price growth

- Potential NSW changes to stamp duty.

On this last point, a policy proposal that would allow homeowners to opt-out of Stamp Duty in favour of an annual land tax, Carleton suggests it could see an increase of property turnover in NSW of around 50% a year.

One of his plays on this housing theme is furniture retailer Nick Scali (ASX: NCK), which Auscap regards as an extremely high-quality business. In addition to being a founder-led company, he points to its 50% return on equity: “That’s extraordinary, the highest ROE that we’re aware of in the general market.”

Management estimates for the planned increase in store numbers from 61 to 85 over the years ahead are conservative, says Carleton. He also highlights earnings margins he regards as stellar, with 55% online EBIT margins among the highest of any online retailer. “For comparison, Temple+Webster have only guided to EBITDA margins of 2 to 4% for next year,” Carleton says.

Consumers unleashed

Dramatic accelerations in the rate of online shopping and working from home are two of the most prominent trends that emerged early in the pandemic. And while many pundits were calling them both structural, it seems they were only half right. The way we work is going to be experiencing some structural change, while shopping online doesn’t seem to have stuck as fast.

“We’re reasonably cautious on office exposure in our portfolio…but by contrast, the moment people felt safe again, they flocked back to the shops,” Carleton said.

Source: ABS, Auscap

Foot traffic in the retail homemaker centres operated by Aventus Group (ASX: AVN) has surpassed pre-pandemic levels over the last seven months, averaging between 107% and 110% of the figures recorded before last February. And even at another mall operator, Vicinity Centres, where several retailers remain closed, foot traffic is already around 95% of the pre-COVID level.

Auscap is particularly positive on Aventus because the company’s rents considerably undercut its competitors, leaving plenty of room to ratchet them up.

Pent-up consumer demand

Another retail exposure, but with a broader global footprint, is Unibail-Rodamco-Westfield (ASX: URW). It also operates large shopping centres across Europe and the US.

“Obviously they’ve suffered greatly, with Europe having had incredible lockdowns…but we’ve seen what happens in Australia, Singapore, New Zealand and China once people feel safe, and they’ve flocked back to the shops,” Carleton said.

The company also ticks several other boxes for the Auscap team, including a highly experienced management team – having recently replaced the previous board, CEO and CIO. They have embarked on a cost-out strategy and have a vested interest in the business, taking 5% stakes in URW and increasing this considerably since.

What about the miners?

Commodities are an unmissable topic, given the sector's huge role in local GDP and iron ore prices that sit at record highs of more than US$200 a tonne.

“Why did commodities hold up so much better than everyone anticipated? Because of China,” said Carleton.

And along with healthy balance sheets thanks to the debt reduction strategies many of our biggest miners pursued pre-pandemic, they’re also currently shipping record levels of iron ore.

One of Auscap’s largest portfolio positions is in Mineral Resources (ASX: MIN). The mining company is currently Australia’s fifth-largest iron ore producer, and Carleton anticipates it will be the fifth-largest globally within five years.

The company is currently trading on a PE multiple of less than 4-times and with attractively low levels of debt on its balance sheet. “It’s the only mining company we’re aware of that has consistently delivered a high return on equity over the last 15 years, averaging 21% per annum,” said Carleton.

The service economy

Education and tourism are two key Australian service areas that were subject to some of the direst forecasts as the pandemic took hold. But the contribution of education to Australian GDP only declined from around $40 billion to just under $32 billion, which Carleton said is far less than had been anticipated.

Which sectors are the losers?

“It’s been a very rare situation that has so many green lights for our domestic economy, it makes us extremely positive and this should be a reasonably good environment for Australian equities,” he said.

Asked about sectors Auscap views as currently expensive, Carleton pointed to healthcare, technology and travel.

In healthcare, the defensive nature of the sector saw investors pile in, driving up valuations enormously. But he expects a pullback as the recovery gathers momentum and stock investors move into other areas of the economy.

Carleton regards technology stocks as a considerable near-term risk, given many companies are cycling out of big mid-pandemic sales figures and online penetration has fallen so sharply over the last six months. “They’re also going to have some revenue and earnings headwinds,” he said.

And on travel, he said these are “the first stocks anyone wants to buy once borders reopen.”

“But the valuations look extraordinarily stretched to us, many of them have market caps that are within 10-15% of their pre-COVID highs,” said Carleton.

“We understand why it’s happening – many people are focusing on share prices more than the market caps – but a recovery is well and truly priced in for stocks that may have seen some structural changes in their business models.”

As an example, he refers to looming uncertainty around whether business travel will ever return to pre-COVID levels – even after the world is vaccinated and borders are reopened - given the rise of videoconferencing.

As an example of a stock Auscap is avoiding, he refers to Sydney Airport (ASX: SYD). In addition to the effect of a structural decline in business travel, he suggests that by the time international travel has recovered in 2024-2025, the new competitor airport in Badgery’s Creek on Sydney’s outskirts will be operating.

Four reasons to register for Livewire’s 100 Top-Rated Funds Series

Livewire's Top-Rated Fund Series gives subscribers exclusive access to data and insights that will help them make more informed decisions.

Click here to view the dedicated website, which includes:

- The full list of Australia’s 100 top-rated funds.

- Detailed fund profile pages, with data powered by Morningstar.

- Exclusive interviews with expert researchers from Lonsec, Morningstar and Zenith.

- Videos and articles featuring 16 top-rated fund managers.

3 topics

5 stocks mentioned

2 contributors mentioned