Australia 2021: Positioned for outperformance

This month, amid the resurgence of offshore virus cases and the imminent US election, we take the time to focus on Australia. We canvass the reasons why we see the economy (and currency) as positioned to outperform in 2021, and the sectors of the equity market that could profit most. We maintain our overweight to domestic equities (largely against an underweight to the US). We also keep our modest overweight to equities relative to sovereign bonds, seeking to add risk ahead if and when uncertainty eases.

Looking through elevated uncertainty to a 2021 recovery

As we write, the 2020 US presidential election is imminent. The latest national polls continue to show a durable lead for Democratic candidate and former Vice President Joe Biden, and one that modestly exceeds Hillary Clinton’s lead at this time in 2016. But political analysts focusing on the key swing US states, as well as the lessons from the last election (including 2018), suggest President Trump maintains a significant chance of retaining power.

Uncertainty for markets is elevated in the short term. Who will sit in the Oval Office? Moreover, how long will it take to ascertain that, given the risk of a close, potentially contested fight? Will the new president control Congress, increasing the likelihood of his agenda being passed? And what are the implications for key sectors, such as old and new energy, healthcare, tech, and infrastructure, as well as the US dollar (see our election preview here)?

The outlook for near-term growth has also become more uncertain over the past month, as Europe and the US confront severe second and third waves of the COVID-19 virus—more severe than the first. Once again, governments have been forced to adopt more stringent mobility restrictions. As such, while Q3 global growth has rebounded strongly, as evidenced by recent data for the US and Europe (adding to China’s earlier recovery), risks are now increasing that momentum will fade through Q4. The failure of the US Congress to agree on additional fiscal stimulus only adds to that risk.

We are now seeing the ‘whites of the eyes’ of the risks—the US election and a renewed virus wave—that had been cautioning us against adding to our current modest equities overweight. Still, governments’ reluctance to reinstate severe economy-wide mobility restrictions (our key medium-term growth risk) leaves our central case of a moderate, albeit stop/start, 2021 global recovery intact. Both the International Monetary Fund and Organisation for Economic Development (OECD) continue to forecast a 5% world growth rebound next year. Ongoing massive global monetary and fiscal easing support this, while it remains likely that the virus case trends (accelerating in advanced countries with modern health systems) will once again be contained. The US election will pass, and there remains a high probability that the new president will not own the 60 votes in Congress needed to secure major policy shifts. Progress toward a vaccine, while uncertain, continues.

Reflecting this, we retain our modest risk-on stance in portfolios. A multi-year outlook for near-zero interest rates globally sees us favouring risk assets such as equities (particularly domestic) and listed credit (particularly global). Such assets will also likely do well should inflation risks start to build later next year, as will alternatives, such as real assets, where we are now sourcing greater defensive ballast for portfolios. We continue to see opportunities in unlisted private equity and debt strategies, as well as multi-strategy hedge funds that are able to benefit from market dislocations. Finally, from a portfolio management viewpoint, while sovereign bonds remain relatively unattractive, we caution against being too underweight in the short term ahead of more certainty on the shape of the recovery through 2021 and 2022.

Australia’s economy is positioned to outperform ahead

In contrast to much of the rest of the world, the economic outlook for Australia has improved over the past couple of months. There have been three key drivers to that improvement, namely:

- Sharply improved COVID-19 new case trends that have led to the renewed re-opening of Victoria (24% of national output), as well as further easing of restrictions and planned state border openings across the country. Increased mobility will support a faster pace of consumer spending, and repair of the weak jobs market, over the coming months.

- Additional monetary and fiscal support, with the October budget adding more than 2% of stimulus to each of the next two years via immediate consumer tax cuts and business investment incentives. The Reserve Bank of Australia (RBA) is widely seen trimming the cash rate further from 0.25% to 0.10% at its early November meeting, in addition to enlarging its quantitative easing (QE) to lower borrowing costs further.

- Continued outperformance of the Asian region in terms of both the recovery in growth and recent virus trends. China’s growth has picked-up further in Q3 and virus trends in Asia are better contained. More than 60% of Australia’s exports are directed to the Asian region.

Of course, Australia’s outlook is not without its challenges. As evidenced by the new pandemic epicentres in the US and Europe, containing the COVID-19 virus will require significant effort and ongoing restrictions on activity in a number of sectors, such as hospitality and recreation. In particular, with international borders likely to remain closed for much of 2021, a lack of international visitors and migrants will likely weigh heavily on the education, tourism and housing sectors. History suggests responsibility is also likely to fall to Australia to get on the front foot and begin repairing the recently ‘chilled’ relationship with China, which has seen China selectively imposing non-tariff barriers on some key Australian export sectors.

What do the key forecasts look like for Australia in 2021?

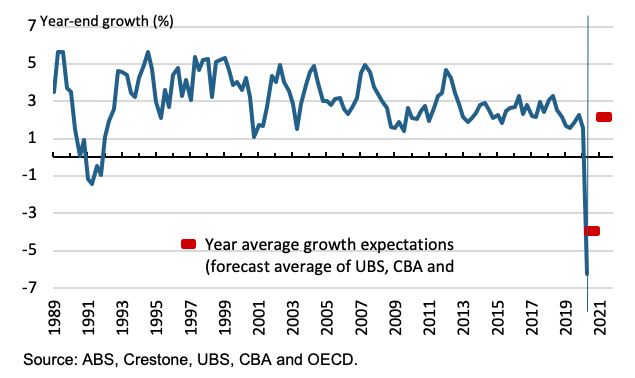

The OECD is forecasting a rebound in growth of 2.5% in 2021 after a decline of 4.1% in 2020, both recently upgraded from their mid-year estimates. These compare with forecast growth in 2021 of 3.0% and 2.5% by UBS and CBA respectively. More interestingly, momentum in Australia’s growth profile is now improving relative to elsewhere, with the timing of Victoria’s severe lockdown during Q3 and opening up in Q4 suggesting the path for growth in Australia will be stronger into end-year than in other major economies, such as in the US and Europe where renewed virus outbreaks are now emerging.

The RBA is expected to keep policy uber-accommodative throughout 2021, with the policy rate likely to be unchanged at 0.10%, following an expected rate cut at its November meeting. A refocus of the RBA’s bond-buying program further out the yield curve is also likely to support government bonds, with the yield likely to be at or below its current 0.83% level well into 2021. This is likely to continue until signs of a durable economic recovery, here and overseas, emerge.

Australia’s annual growth outlook—a 2021

recovery forecast

Amid the elevated uncertainty currently in global markets, together with expected further RBA easing, the Australian dollar is vulnerable to near-term downside risks. However, consensus continues to expect a weaker US dollar trend in 2021 to underpin a steady rise in the Australia dollar. CBA is targeting USD 0.76 mid-2021 and USD 0.78 end-2021, while UBS forecasts USD 0.77 by the end of next year. Gains against other currencies are likely less significant.

Looking across the key sectors

Consumer spending—over the coming year, behavioural changes due to the pandemic may continue to weigh on consumer spending patterns. Moreover, fading direct government handouts, despite recent tax cuts, and a weak jobs market could also be a headwind for consumers. However, both UBS and CBA forecast a material turnaround in nominal consumer spending in 2021, from a fall of 6-7% in 2020 to a gain of 4-5% in 2021.

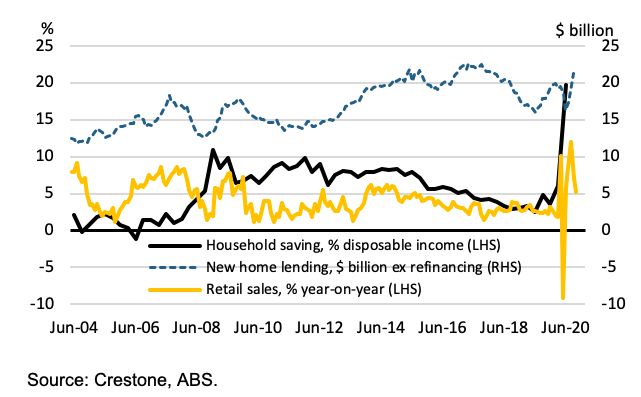

This is likely to reflect the progressive easing of lockdowns, that is already underpinning improved spending trends. According to CBA, “credit and debit card spending data indicates that household expenditure has stepped up”. The re-opening of Victoria should also strengthen an otherwise soft jobs market, with new jobs expected to rise. Significant household savings (due to reduced spending and government hand-outs) should also be a tailwind, supporting the recent pick-up in discretionary spending, while increased first homeowner activity should also support consumer durables demand in 2021.

Housing—Investor demand is likely to be challenged by elevated vacancies (particularly in Sydney and Melbourne) and weak rental growth. Loan deferrals that may be delaying stress for some borrowers may also be a headwind. But low rates are clearly supporting a pick-up in loan demand—up over 19% in the year to September—largely driven by owner-occupiers. This appears to be supporting prices, which have only slowed from 8% to 5% during the pandemic, while auction clearance rates in Sydney (and recently Melbourne) have been rising. The “combination of resilient clearance rates and limited supply remains supportive of housing in the near term,” according to UBS.

While building approvals have fallen from an annual pace of almost 200,000 (and peaks of 250,000 in 2017-2018) to 164,000 in August, this remains above the 150,000 average through prior decades. Near-zero migration is likely to limit any near-term acceleration in new building. Nonetheless, UBS expects housing construction to improve from -11% in 2020 to +4% in 2021, in contrast to CBA who still forecasts a further 5% decline in 2021.

Capex—Despite incentives in the October budget, business demand for new equipment is seen subdued in the year ahead. Both UBS and CBA expect business capex to drag on 2021 growth, though by less than in 2020. However, public infrastructure is expected to add to growth moderately in 2021, aided by recent government decisions to expedite projects.

Trade—Exports of tourism and education services are expected to remain weak through much of 2020, albeit this is subject to decisions around border openings. In contrast, goods exports, particulary commodities, are expected to be strong. Resource exports should reflect a syncronised global recovery in 2021, while strong winter crop production is likely to underpin rural exports.

Australia’s retail sales, home lending and saving have picked up

Reasons why domestic equities should outperform

In a global context, there are several reasons to suggest domestic equities will outperform their global counterparts in the period ahead.

Some of these are macro-related and canvassed earlier, such as Australia’s success (to date) in containing COVID-19. Given the underperformance of the domestic equity market during Victoria’s Q3 lockdown—one of the longest and strictest in the world—the return to some sort of normality for consumers and businesses should support domestic equity returns (and at a time when restrictions globally are increasing). Other macro drivers include the significant monetary and fiscal support being thrown at the economy (while the prospects of further US fiscal stimulus remain in dispute).

Some reasons are more tactical. These include Australia’s more benign event risk. There is considerable tension between Australia and our major trading partner China. However, in the context of a highly anticipated US election, the US fiscal impasse and pending deadlines surrounding Brexit, Australia stands out as being a market where investors can make single stock decisions without the overhang of major political uncertainty. Another reason includes the analysis by Credit Suisse that shows that (despite Australia’s positive virus trends) the domestic market has been the third most sensitive to positive vaccine developments. Australia’s exposure to travel, tourism and inbound education are likely to be part of that story, as is our exposure to commodities that feed into the global industrial and manufacturing cycle.

Finally, some reasons reflect valuation. On a one-year forward price-to-earnings (P/E) basis, domestic equities trade 12% cheaper than the S&P 500, not far from the 14% lows of the past decade. Although dividend cuts (and equity raises) were the largest in the world, the financial year 2022 dividend yield on the S&P/ASX 200 index, at 3.75%, is still commanding 300 basis points (bps) over the 10-year sovereign bond yield (compared with less than 200bps over the past decade). Importantly, this comes at a time when both earnings and dividend expectations have started to inflect higher.

So, where should investors be positioned?

At a sector level, the banks stand out as a key beneficiary of better macro certainty. Despite our long-held relative underweight bias to the banks, the easing of the responsible lending rules is the first sign that the anti-bank regulatory and political pendulum is swinging more to the middle. Combined with an interest rate environment where most of the damage has already been factored in and valuations are below book values, the banks are the quintessential pro-cyclical exposure.

‘Re-opening’ sectors, linked to easing mobility restrictions and/or a vaccine, should benefit profoundly. Engineering and contractors and the travel sector are obvious candidates. Whilst many might be reticent, given the limited likelihood of international travel, the prospect of 1 million more Australians home for Christmas and significant pent-up travel demand bodes well for domestic travel bookings. Casinos and wagering companies have shown that once mobility restrictions are eased activity rebounds quickly.

Importantly, there are a number of stocks that at first glance might not appear beneficiaries but were significantly disrupted by COVID-19. In the healthcare sector, private hospital operators are set to see much higher utilisation rates. The return of elective surgery should also benefit companies with significant device sales. Comparatively higher fixed-cost businesses—hospitals, funeral parlours, casinos, infrastructure assets—all stand to be relative beneficiaries vis-à-vis the outperformance that was seen by capital-light business models during COVID-19 (which remain very good business models).

Lastly, although we prefer to shy away from labels such a value and growth, preferring to simply own quality companies with the ability to grow, the recent performance of these indices in Australia, when mobility restrictions were being eased, suggests that a rotation towards traditional ‘value’ companies is likely ahead. Indeed, the domestic MSCI Value index outperformed the MSCI Growth index by 16 percentage points from 22 April to 10 June.

Learn what Crestone can do for your portfolio

With access to an unrivalled network of strategic partners and specialist investment managers, Crestone Wealth Management offer one of the most comprehensive and global product and service offerings in Australian wealth management. Click 'contact' below to find out more.

1 contributor mentioned