Australia’s doing relatively well…but demons lurk

“We've used monetary policy to try and stimulate our economy. We've used budget policy to try and stimulate our economy…And I think now we're going to have to use structural policy to try and boost productivity. We'll have to try and do more on that front … It means [government] supports measures that keep costs down for running businesses in Australia.” Peter Costello, September 2019.

A lot is going right for Australia at the moment—at least, relatively. Our GDP data yesterday was better than many had feared, falling only 0.3% in Q1. There’s plenty of recessionary pain, and some sectors like tourism and education are in deep recession. But 29 prior years of (soon-to-be-interrupted) growth has meant monetary and fiscal policy had something to give to support the economy. High government debt and negative rates, the experience of some countries, gives little room to stimulate. And our policymakers have given…and in a timely manner. As CBA notes, in April the growth of wages plus government benefits was twice the average…a strong foundation for spending when activity resumes.

Elsewhere, China’s evident recovery from March has been supporting resource export volumes, and our other Asian trading partners have fared relatively well in dealing with COVID-19. Supply issues in Brazil and elsewhere have also driven commodity prices higher, supporting economy-wide income and mining investment during Q1, with more ahead likely in Q2. Given Australia’s strong performance to date in dealing with the pandemic, lockdown restrictions are being eased, and foot traffic, restaurant bookings traffic congestion indicators suggest some improvement in activity ahead. After a likely collapse in Q2 growth, there are signs ‘short-term’ growth will be on the mend in Q3.

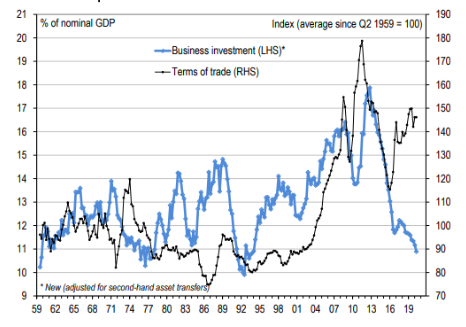

But what about the longer term? As our chart today reveals, Australia’s performance on private business investment is nothing short of dismal. Sure, capex growth fell in Q1 amid a recession. But as the chart shows, as a share of our output, investment has been falling since the end of the mining boom of 2012-13. Moreover, while it paused around average levels in 2016, over the past few years it has collapsed to its lowest since 1994 (26 years) to be only 1% above the lowest points in our 60 years of data.

We bemoan low interest rates from an investment returns perspective. Interest rates will stay low until inflation and real (trend) growth recovers. The key driver of inflation and real output growth is real wage growth, and real wage growth can only be sustained through improving productivity (the true source of a society’s real wealth and real income growth). Productivity comes from new investment. And this is tied up in issues like regulation including red tape and labour laws. It is tied up in our relative (global) company tax rate (see the 10-year old Henry Tax Review on taxing mobile capital lightly). It is tied up in a focus on growth over dividends. It is time for our governments, our businesses and our workers to figure out, courageously if need be, how to lift capex and real wage growth for the benefit of all stakeholders.

Business capex now lowest since 1994

Source: Australian Bureau of Statistics, UBS.

Be the first to know

We share Crestone Wealth Management views on a range of macro topics that we're watching. Click the ‘FOLLOW’ button below to be the first to hear from us.

1 contributor mentioned