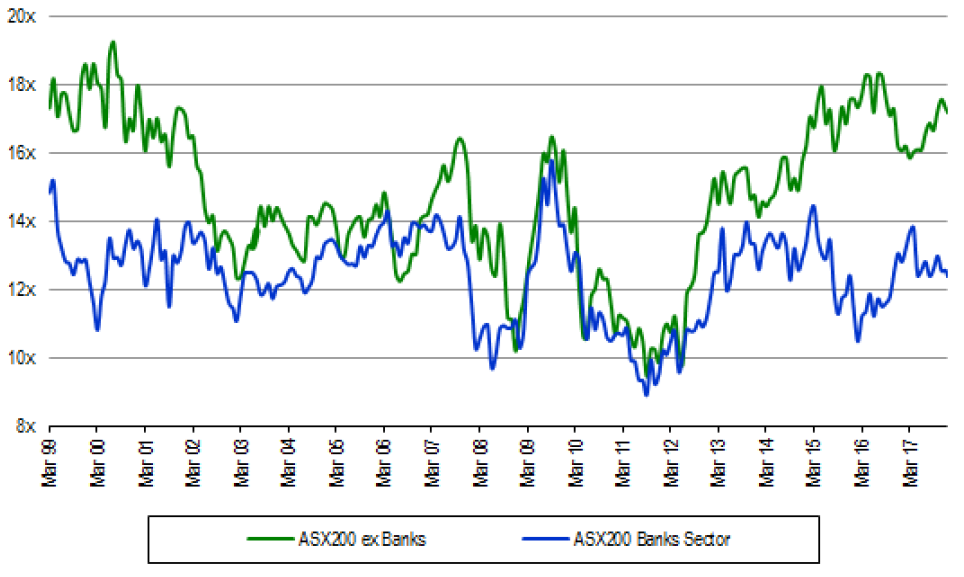

Banks are one standard deviation cheap versus the market

A long anticipated royal commission, Commonwealth Bank of Australia (CBA) tripping over multiple banana skins and Australia and New Zealand Banking Group (ANZ) shrinking to greatness are all areas of interest in banks starting the year.

The issues around capital have now passed with banks selling non-core assets and low returning business to move core equity Tier 1 (CET1) to levels that are within Australian Prudential Regulation Authority’s (APRA) guidance. In the case of ANZ, they arguably have +$6b in excess capital that will be returned to shareholders via on market buybacks.

The Royal Commission into misconduct in the financial system services sector appears to have a much more limited scope than many feared and includes the entire financial sector.

The investigation into misconduct, and any conduct that falls below community standards, will be disruptive for the banks and certainly a distraction for management.

Compensation schemes for impacted consumers and recommended remedies for the causes of the misconduct are likely. It is, however, difficult to determine the ultimate ramifications to the banks both from a penalty and operational perspective.

ANZ and National Australia Bank (NAB) are moving down the cost out path that should result in real costs coming out of the banks rather than some esoteric lowering of the cost to income ratio due to revenue growth. This will be the first time in over a decade that real costs reductions will hit the bottom line. Westpac and Commonwealth Bank are taking the road ‘well- travelled’ and managing costs via the cost to income line. The profit prize for banks to right size their businesses to the current top line growth outlook and technology advances is large.

Asset quality remains benign and impairment charges are at 30- year lows. There has been no systemic poor lending practices that will drive a meaningful bad debt cycle over the short to medium term. Nikko AM Australia valuations assume reversion back to more normal mid-cycle loss rates despite the indications that this seems some time away.

12 Month Forward Rolling PE - Bank Sector vs ASX200 ex Banks

Source: Credit Suisse

Recent research from Merrill Lynch is music to a value manager’s ears. Their work highlighted that valuation is the one common factor in periods of sustained bank outperformance since 1999. Headline grabbing issues such as earnings per share (EPS) growth, return on equity (ROE) and other political/event risk headlines are much less reliable return signals.

The valuation metrics currently suggest that the banks are oversold and certainly look attractive compared with history.

The banks, ex CBA, are all trading +1 standard deviation cheap versus the market; have a benign bad debt outlook but their capital positioning is fine and, in the case of ANZ is in excess. Dividend yields remain high at around 6% fully franked and are sustainable.

Nikko AM Australia’s long term sustainable earnings valuation suggests the banks look great value versus the market – albeit with little growth.

For further insights from the Australian Equity team, please click here

1 topic

4 stocks mentioned