Bassanese Bites: Equity investors are asking the wrong question as rates rise

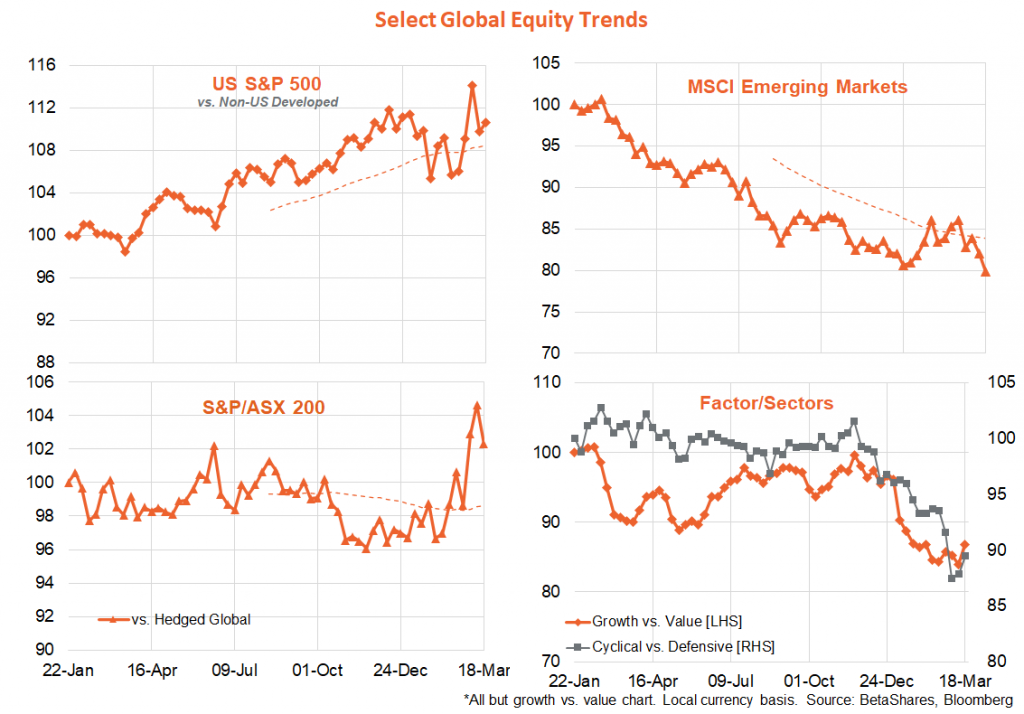

What a week! Despite the ongoing Ukraine war and a more hawkish than expected Fed meeting, global equities saw fit to surge in what I can only attribute to a ‘sell the rumour, buy the fact’ mentality. In other words, investors had been fearful leading up to the Fed meeting, with a relief rally (or at least short covering squeeze) taking place in its aftermath.

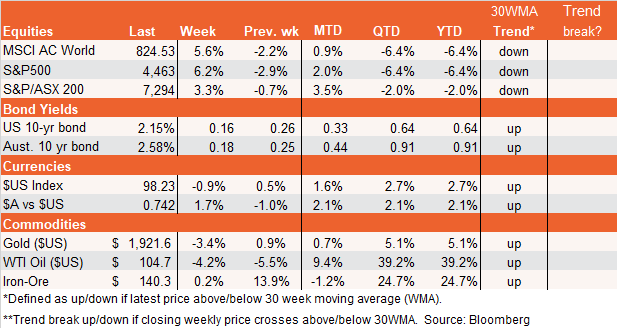

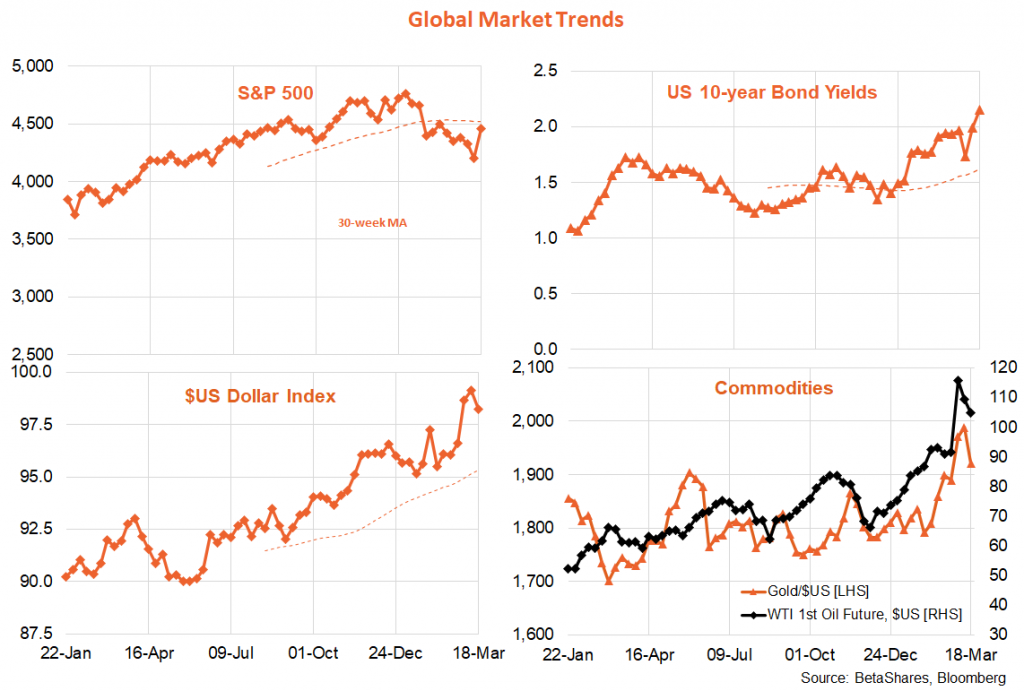

Yes, the Fed only hiked rates by 0.25% – not 0.5% as once feared. But it has also penciled in a further 1.5% in rate hikes this year, and 0.75-1% next year – taking the Fed funds rate from 0% only a week ago to just under 3% by end-2023. This is in line with what the market had already priced in, but less than most thought the Fed would admit to at last week’s meeting. After an initial sell-off on the news, however, equities rebounded on relief that Fed chair did not see a high risk of recession anytime soon (though what else could he say!). Nonetheless, bond yields moved higher even as oil prices and the $US eased.

Another equity positive last week was China’s tech pivot, with news reports suggesting officials will try to be somewhat more supportive of the sector – and less draconian in terms of regulation. That helped give Chinese stocks, and technology stocks especially, a lift. Markets also hoped that Russia and Ukraine could strike a peace deal sometime soon, with some easing back in oil prices.

Ultimately, however, equity investors seem to be hoping that either aggressive Fed rate hikes won’t drive the economy into recession, or the Fed will likely pivot if any material risk of a recession emerges. To my mind, this is asking the wrong question. The real question is how much economic slowing will be required to tame inflation – as only this will determine how aggressive the Fed needs to be. If the Fed is truly concerned about inflation (as it should be), it will likely slow growth materially – even risking recession – if inflation (notably wage inflation) remains uncomfortably high. My concern is that that even if supply-chain bottleneck pressures ease somewhat soon, the U.S. labour market will still be left red hot with overly strong wage growth. There’s only one way that problem can be solved – a material growth slowdown brought on by higher rates – both of which could pressure corporate earnings and equity valuations. As a result, I suspect the U.S. equity market correction is not over – and the ultimate decline could be at least 20%, even without a recession.

Indeed, my call of U.S. 10-year bond yields reaching 2.25% in H1’22 is almost achieved, and I am now targeting a rise in this key financial indicator to 3% by end-March 2023. Assuming we’re not in WW3 by then, my base case is that the Fed will raise rates by 0.5% at the upcoming May meeting.

In terms of the week ahead, there will be lots of Fed speakers giving their opinions on the outlook for the economy and interest rates – I suspect most will err on the side of being hawkish. Also of note will be the U.S. manufacturing and service sector PMI surveys, with interest in the degree of ongoing cost pressures and supply disruption.

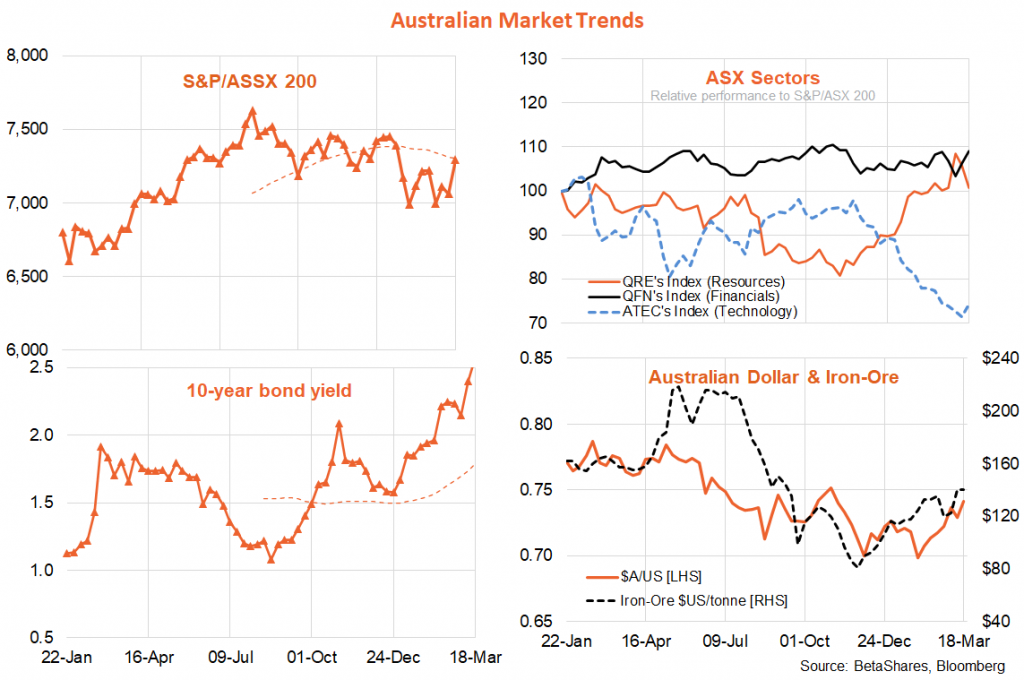

Australian market

The key local development last week was the very strong February labour market report, with a 77k gain in employment and a drop in the unemployment rate to a 13 year low of 4.0%. This is supportive of the RBA hiking rates in coming months, but it’s still less than clear whether such apparent labour market tightness will lead to much wage growth (indeed, causality could even be reversed – maybe it is surprisingly active job seekers and benign wage growth that is allowing so many jobs to be created?).

The other notable development is the ongoing strength in commodity prices, which has helped the $A and local resource stocks outperform in recent weeks. Surprisingly strong iron-ore prices will give the Morrison Government even more money to spend in next week’s pre-election budget.

There’s little on the local data front this week, with RBA Governor Lowe giving a speech to business journalists tomorrow – which is unlikely to be too policy specific.

Follow for more Bassanese Bites

Each week I publish my latest thoughts on the macro events shaping the ETF landscape. To be the first to read my insights, hit the follow button below.

Trusted by hundreds of thousands of Australian investors, BetaShares offers cost-effective, simple and liquid access to the broadest range of ETF investment solutions available on the ASX, covering almost every asset class and investment strategy.

2 topics