Big earnings minus the volatility: J.P. Morgan Asset Management's top income fund lands in Australia

No matter your age or experience as an investor, we all relish the moment a big, juicy dividend hits our accounts. Here in Australia, we are used to such icons as the Big Four banks and the big three iron ore miners providing the payouts. And after the year it has been in markets, people are rightly looking for safety and yield at all costs.

That's where the JPMorgan Equity Premium Income (JEPI) fund steps in. As portfolio manager Hamilton Reiner points out, there is no free lunch, and outperforming an equity index is not an expectation. The primary concern is the regular stream of income hitting your bank account.

In this edition of Livewire's Fund Manager Q&A, Reiner joins me to discuss the fund's approach, its huge boom in popularity since the COVID-19 pandemic, and what it wants to do differently in comparison to other income funds.

What problem are you solving?

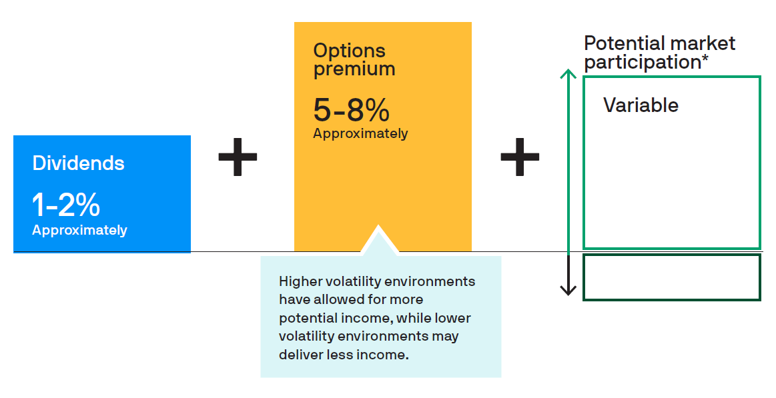

Reiner explains that JPMorgan Equity Premium Income (ASX: JEPI)1 provides a three-pronged approach to total returns – dividends, options premium, and potential capital appreciation.

In terms of how those return streams are generated, Reiner adds that there are two major building blocks on which they sit - a more defensive underlying equity portfolio and an options overlay.

The problem being solved, therefore, is solid income generation but with less downside risk.

"We specifically chose a more conservative approach to equity portfolio of high-quality companies, so the strategy does not eat all of the downsides when the equity market falls, and we use a modernised approach to call overwriting that allows us to balance total return and income generation, seeking to achieve a better risk-adjusted return than the S&P 500 Index over a cycle," says Reiner.

Popular and accessible

The US equity market is full of attractive ideas - namely ideas with big dreams and even larger slide decks. Mega-tech names have seen their share prices fall dramatically, more than 70% in some cases. But when the growth names are so plentiful and charming, how did an income fund amass US$13 billion in funds under management in just over two years?

The answer - Reiner says - is simple; get to the heart of what people need.

"I believe the strategy’s popularity is due to the many ways advisors can use it in a client portfolio. It can work as a cornerstone in an income portfolio, a diversified to traditional total returns, or a replacement for credit exposure."

The other reason Reiner believes the fund is so popular is simply that the team delivers on its whole purpose. Unlike investing in specific equities, which give half-yearly payouts, or even other ETFs which pay out quarterly distributions, this fund pays out monthly with all the trimmings attached.

"We believe our investors are entitled to all the income they earn with us throughout the month. Therefore, what the portfolio makes is what you keep," Reiner said.

Time-tested and proven

In this market, it pays to have experience and knowledge of where you're investing and what you're putting your money into. Between Reiner and his co-PM Raffaele Zingone, they each have over 30 years' worth of market know-how. So how do you perfect your craft? Know what you're doing and be nimble.

"We identify the most attractively valued stocks from long-term earnings and cash flows standpoint, then further narrow the universe by finding those stocks that also have low

volatility from a price and earnings perspective," Reiner revealed.

"To adjust our upside and income to the volatility landscape, we reset a portion of these options on a rolling weekly basis. This means volatility can be a friend to the strategy, with higher volatility allowing for more income and upside potential," he added.

But above all, don't rest on your laurels.

"While our approach is considered best-in-class, we are always looking for improvements," Reiner said.

So is all income derived from dividends?

In short, no. Approximately two-thirds of the fund's income stream is derived from options premia. The fund takes advantage of a concept called "call overwriting". The most commonly used of all the options strategies, the strategy involves the action of selling S&P 500 options. And as Reiner told me, it can make a humble yield much larger.

"The strategy yielded around 8% in 2021. As of 30 September 2022, the portfolio’s trailing 12-month yield has risen to almost 10% as we’ve seen elevated levels of volatility," he said.

Finally... What gets you up in the morning, Hamilton?

"Markets are like snowflakes, no 2 days are the same! Being able to create innovative products and partner with investors to help them meet their long-term goals will always be exciting for me."

Find out more

The actively managed JPMorgan Equity Premium Income ETF (JEPI)1 pursues opportunities for consistent monthly income and appreciation, with lower volatility than the U.S. stock market. Click here for more details.

3 topics

1 stock mentioned

1 fund mentioned