Bitcoin hits another all-time high: is this time really different?

Over the weekend, my colleague Kerry Sun at Market Index wrote that we're now in "Peak bull market", and it's hard to argue with that assessment.

Almost anywhere you look, asset values are up, with many hitting fresh all-time highs on a near-weekly basis.

And Bitcoin is now back in that conversation.

After dropping almost 10% from its last all-time high in August, Bitcoin has now hit US$125,000 for the first time.

October, known as "Uptober" in crypto circles, has historically been Bitcoin's best month, and it's now up almost 10% in the early days of the month so far.

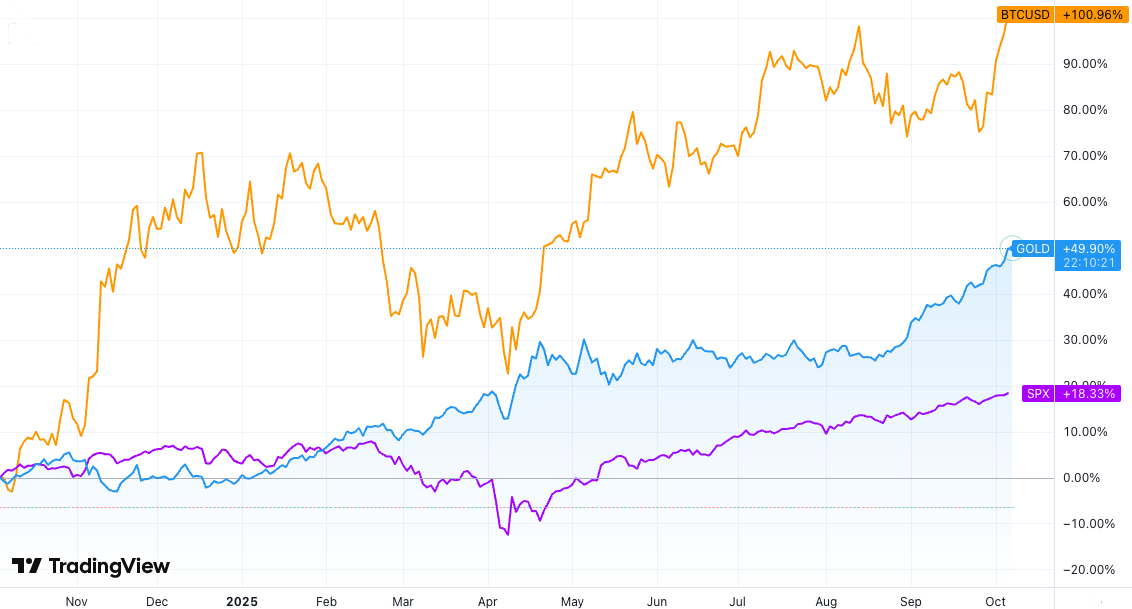

In its relatively brief history, Bitcoin has been prone to much more violent price movements than other assets.

But new all-time highs have often served as launchpads for more dramatic price appreciation in the medium-term.

This may have changed since the advent of spot Bitcoin ETFs and the improvement of institutional access to the cryptocurrency.

Instead of big boom and bust cycles, Bitcoin could settle into a role as a more settled alternative investment, akin to gold.

And like gold, Bitcoin is arguably benefiting from the competing narratives around markets right now.

I argued the other day that gold is now the new growth stock, and I think you could say the same of Bitcoin.

Both are currently benefitting from the growth-driven bull market that equities find themselves in, while also maintaining their positions as potential safe haven hedges against an economy and stock market that goes south.

Last week's US government shutdown saw gold and Bitcoin both shoot higher, although the same was true for the US stock market.

It's 'have your cake and eat it too' investing, at least for now.

Of course, any major stock market crash is likely to impact Bitcoin, especially if it's triggered by a wider economic downturn.

As US interest rates come down (and the value of the US dollar decreases as a result), it's hard to see it having an adverse effect on the price of Bitcoin.

Over the weekend, Morgan Stanley officially recommended investors hold crypto for the first time. The Morgan Stanley Global Investment Committee (GIC) released its portfolio allocation guidelines and suggested a 2-4% allocation to crypto as part of a growth portfolio.

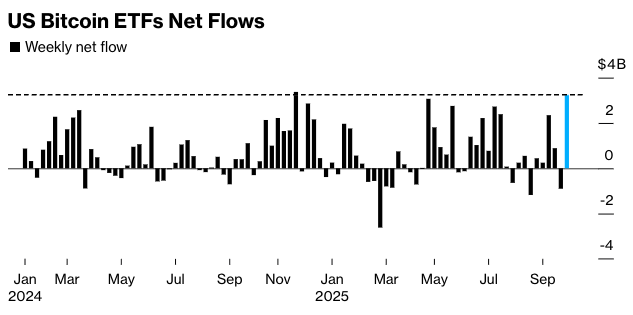

Investors do seem to be piling back in.

US$3.2 billion was invested into 12 US spot Bitcoin ETFs last week, the second-highest weekly inflow since the ETFs were launched in January 2024.

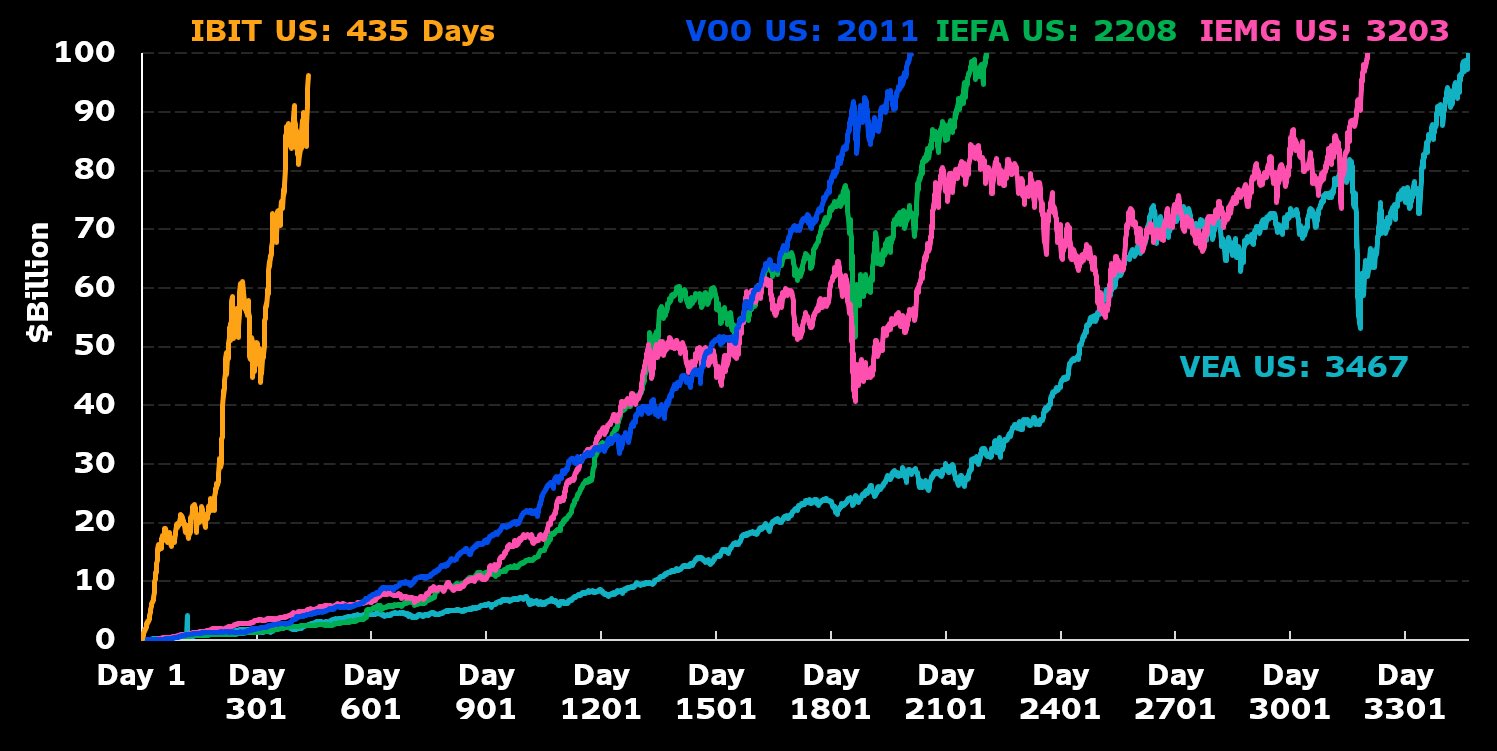

It's certainly been good business for the ETF issuers themselves.

According to Bloomberg's Eric Balchunas, Blackrock's iShares Bitcoin Trust ETF (IBIT) is now its most profitable ETF by a considerable distance, with annual revenue of US$244.5 million.

What makes that even more significant is that IBIT has managed that in a little over 18 months, compared to the 20-plus years that many of Blackrock's broad stock index ETFs have been trading.

IBIT is also on track to smash the record for the fastest ETF to hit US$100 billion AUM, a record currently held by Vanguard's S&P 500 ETF, VOO.

It's clear that investor appetite for Bitcoin remains strong.

So for those betting on the everything bull market continuing on for a while longer, it now could be a case of picking the horse you think will run hardest to the finish line.

Bitcoin is still amongst the leading pack.

4 topics

1 contributor mentioned