Bitcoin industry news for May 2023

Welcome to the 7th edition of our monthly Bitcoin news wrap-up.

Here's what happened in the bitcoin industry during May 2023.

Top Events

Australia’s largest digital currency exchange lost its banking facilities.

Popular bitcoin payments app Strike was finally made available in Australia.

The Human Rights Foundation (HRF) gave US$455,000 to 12 bitcoin projects worldwide. This is 1) an interesting look at some important projects around the globe, and 2) further recognition that bitcoin is ‘freedom money’.

The largest stablecoin Tether (market cap: US$83 billion) revealed that 15% of their excess reserves will now be used to purchase bitcoin. At current prices, this would be about 6% of bitcoin issuance. Tether is making huge profits these days because of interest rates on their cash and bond holdings.

Lightning Network Updates

Binance halted withdrawals of Bitcoin twice in early May, citing network congestion. The congestion was, in reality, temporarily higher transaction fees due to the ordinal hype competing for block space. So unlike on most highways, Binance could have paid its way out of the queue but chose not to. Withdrawals have resumed, and Binance is now changing its fee policy for Bitcoin withdrawals and planning to integrate the Lightning Network.

Microstrategy (NASDAQ: MSTR) is releasing enterprise software so that businesses can offer rewards programs for employees and customers, denominated in sats over the Lightning Network.

OpenSats has received a US$10 million donation from Jack Dorsey's philanthropic initiative, #startsmall, which will be used to support the development of free and open-source software and projects focusing on bitcoin, nostr, and related technologies.

Bitcoin Mining

A collective of investors have bought assets from Celsius’s bankruptcy sale. The cheekily named Fahrenheit Group – made up of US Bitcoin, Arrington Capital, Proof Group Capital Management, and others – was named the successful bidder for Celsius’s assets, which includes up to US$500 million worth of crypto assets and some 12 EH/s worth of new-generation Bitcoin mining ASICs.

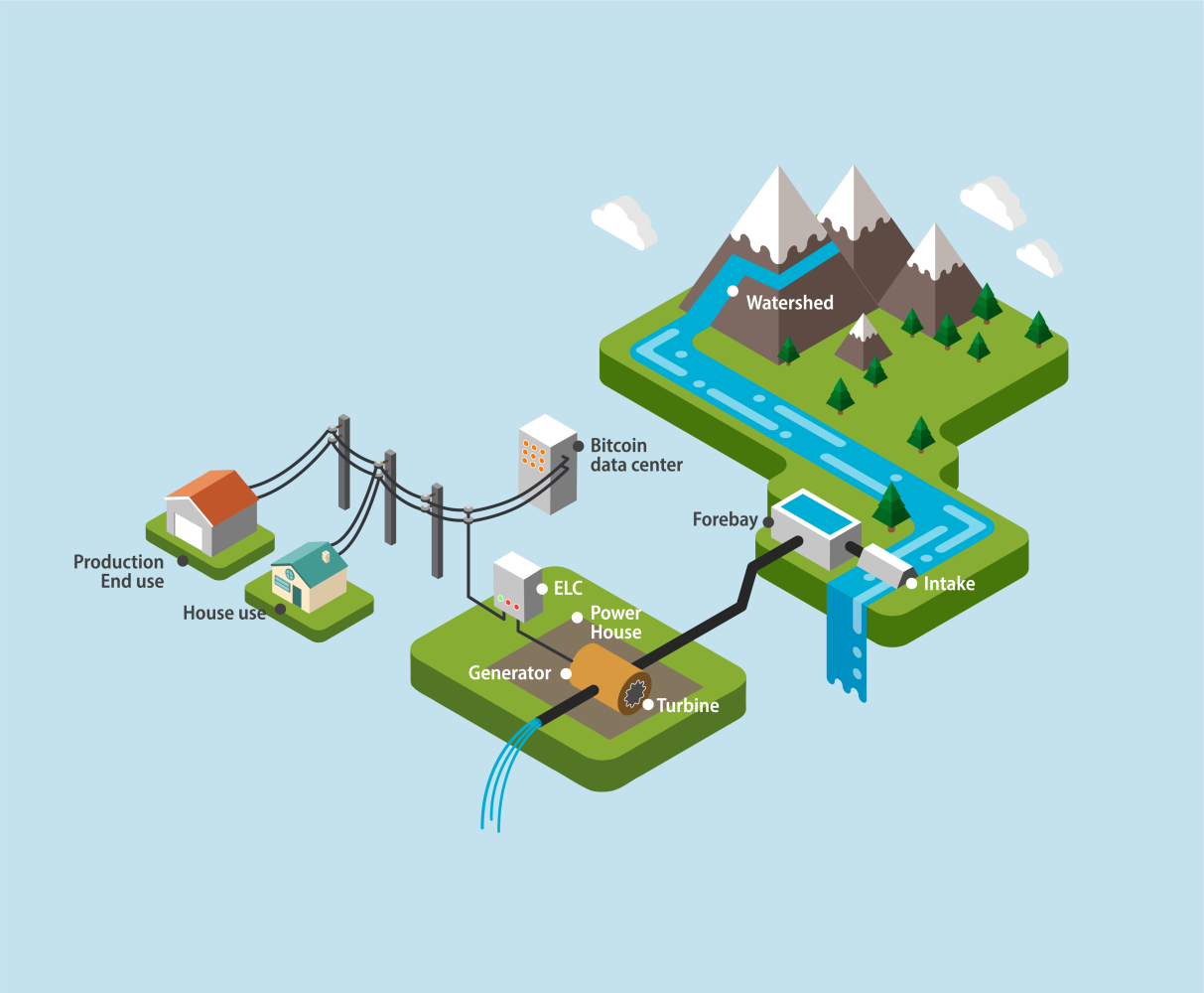

Bhutan could become “the biggest bitcoin miner per capita in the world”. The tiny Himalayan kingdom has abundant sources of hydropower, a crucial industry in the country.

A blueprint for off-grid energy and bitcoin mining in Africa. Combining small-scale bitcoin data centres and renewables-based mini-grids forms the foundation of a new model to expand profitable electrification to communities in emerging markets reducing the need for charity, aid, gifts, or government subsidy.

Diagram of a run-of-river hydroelectric energy generation and minigrid. Image: Erik Hersman/Gridless

Best Articles and Podcasts

We need more apps with Lightning, not more Lightning apps. As good as Lightning is, you can’t yet do that much with it. Many apps that use Lightning are “just” payment apps — wallets. Building apps with more utility will be better for mainstream bitcoin adoption.

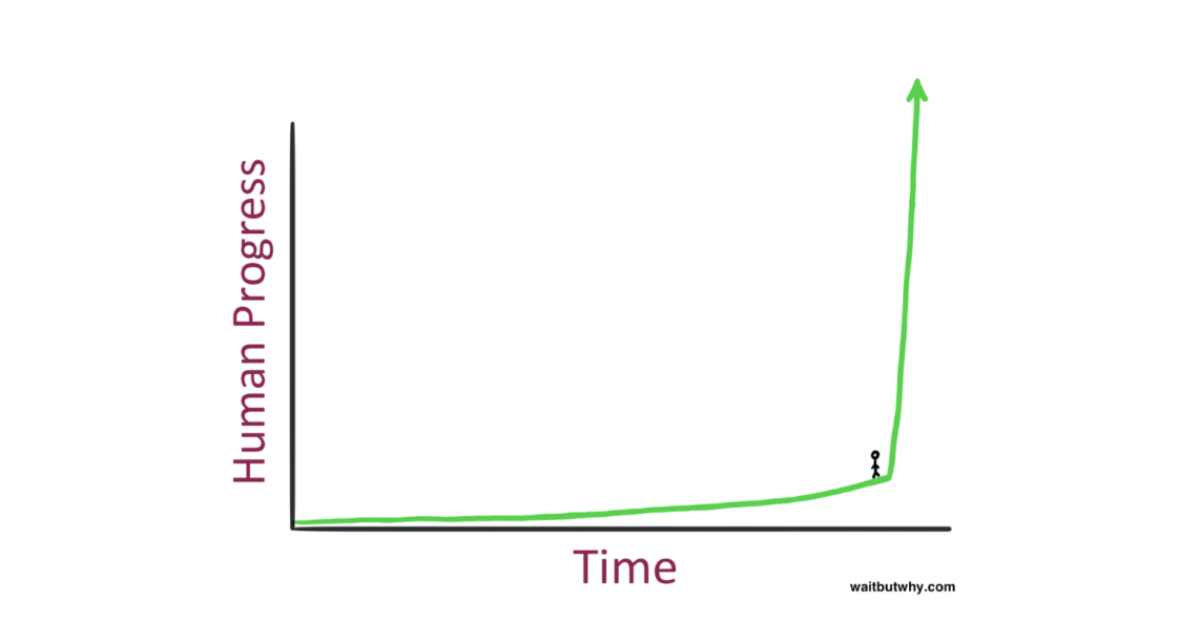

The AI Revolution: The Road to Superintelligence. I urge you to read this. You will need at least half an hour but it will be worth your time. Written in 2015, its forecasts about the speed of human development are absolutely excellent. Among other things, it predicts that right about now we will have artificial intelligence that is about as good as we are.

.png)

Humans are not capable of computing exponents. Image: Wait But Why

Macro and Politics

On average, gold tends to outperform stocks in the two years after a yield curve inversion.

.png)

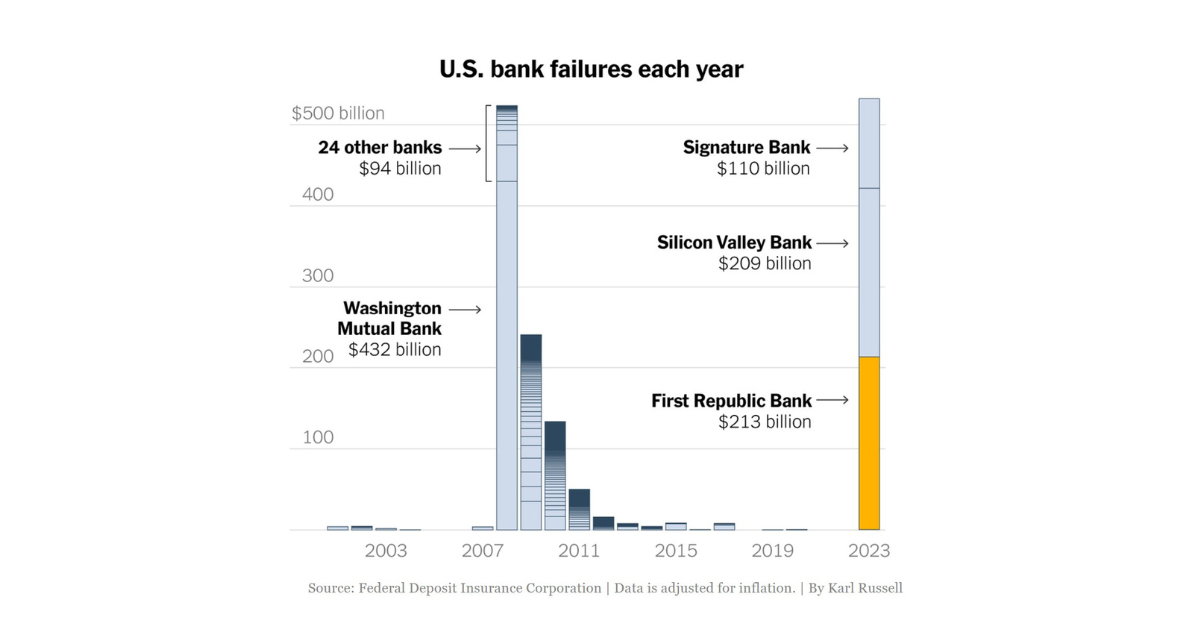

This year’s bank blowups visualised. Image: FDIC/Karl Russell

Meme of the month

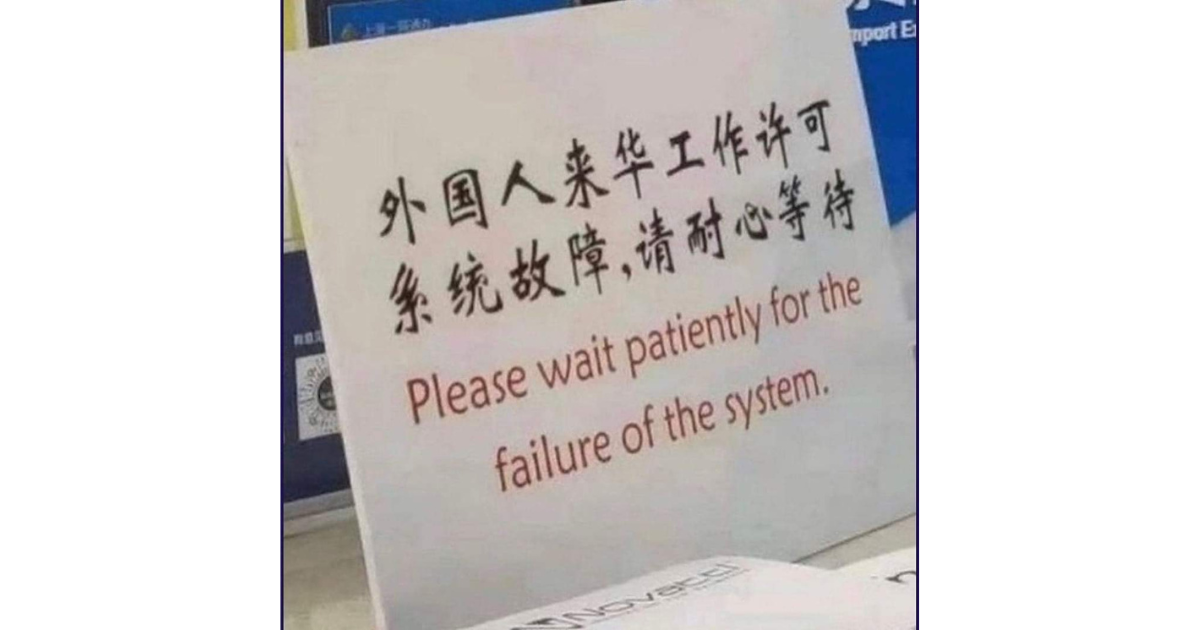

.png)

5 topics

1 stock mentioned