Can the bitcoin party continue in 2024?

Since hitting dire lows of under US$16,000 in November 2022, there were plenty of predictions that bitcoin and the rest of the cryptocurrency space would continue to drop further, or that it had finally truly died and would never be able to recover. Whilst it has certainly been volatile, those predictions could not be further from the truth. Since those lows, bitcoin has rallied 323% and is up over 60% YTD and made a new all-time high.

After seeing the investment returns bitcoin has posted, it is hard to not feel like most of the gains have been had, and there may not be much left in it. However let’s look at some of the factors behind bitcoin and what these could mean in 2024.

US Spot Bitcoin ETFs approved and launched

The US SEC decision to approve spot bitcoin ETFs from 11 fund managers was a watershed day for bitcoin. The decision has revived crypto and has added further confidence to the digital asset ecosystem.

Since the launch of spot bitcoin ETFs in the US on January 12th, the two top spot bitcoin ETFs in the US, Backrock's iShares Bitcoin Trust and Fidelity FBTC have raised over $11B of AUM and Blackrock’s ETF already sits in the top five among all ETFs in terms of inflows for 20241.

There is no doubt that the ETFs provide an avenue for new investors to get involved with bitcoin, offering a legitimate way to purchase without the security related concerns that investors may have had in the past, and has arguably relieved some pent-up demand.

The Bitcoin Halving

One of the major attractions of bitcoin is that the maximum number of bitcoins that will ever be produced is written in its code, in addition to the rate at which new coins are created, and when that rate declines. The reason this is attractive is because you effectively have a monetary system that is fully transparent.

Historically, the halving has been positive for bitcoin. There have been three halvings to date and whilst not representative of future performance each has led bitcoin into a new bull market resulting in new all-time highs as shown below2.

Halving #1

- The first halving occurred on November 28, 2012, and reduced the block reward to 25 BTC from 50 BTC.

- Price at time of halving: $13

- Following year’s peak: $1,152

Halving #2

- The second halving occurred on July 16, 2016, and reduced the block reward to 12.5 BTC.

- Price at time of halving: $664

- Following year’s peak: $17,760

Halving #3

- The third halving occurred on May 11, 2020, and reduced the block reward to 6.25 BTC.

- Price at time of halving: $9,734

- Following year’s peak: $67,549

Probability of lower interest rates

According to Betashares Chief Economist, David Bassanese “the most likely outcome for 2024 appears to be a further modest slowing in growth – but not recession – which allows for further declines in inflation and central bank interest rate cuts by year end3.

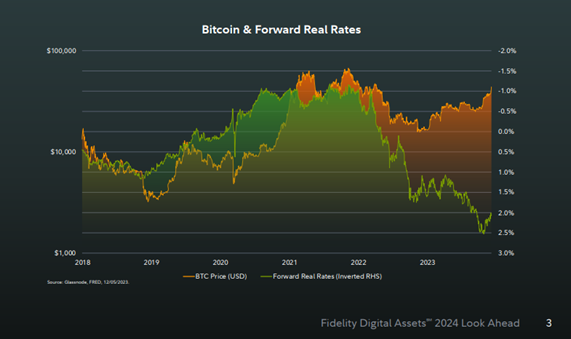

Lower interest rates are positive for risk assets and have historically been positive for Bitcoin. More recently there has been an inverse correlation to the price of bitcoin and real interest rates, as declining rates all throughout 2020 and into 2021 were accompanied by a rapid increase in bitcoin’s price. This inverse correlation held in 2022, when real interest rates quickly rose and bitcoin subsequently fell. As bitcoin is a non-cash-producing asset, it looks relatively more attractive during low and negative real rate environments and less attractive in higher rate environments.

The X Factor - More adoption?

Despite a lot of criticism, El Salvador’s President Nayib Bukele made history by legalising bitcoin as legal tender in September 2021. By November of that year, the price of bitcoin topped out and started its descent over the next couple of years. Despite this, the country’s bitcoin position is now back in the black, and El Salvador’s story of bitcoin adoption has garnered a lot of attention4.

President Bukele has been re-elected in 2024 and will reportedly continue implementing bitcoin-related policies. His administration has introduced the ‘El Salvador Freedom Visa Program’ which allows individuals to apply for Salvadoran citizenship by investing in USDT or BTC, the deployment of bitcoin ATMs and the Chivo wallet which allows Salvadorans to send and receive bitcoin without commissions to one another5. It will be interesting to see how other countries take to President Bukele’s initiatives, noting in particular that other neighbouring Latin American countries are big users of crypto in general6.

Bitcoin continues to play out making new highs followed by deep drawdowns and recovery. After the collapse of FTX in November 2022, bitcoin’s price turned to the upside. The approval of ETFs has given investors a new and easy way to access. Currently the hype is around the upcoming halving which will continue till mid-April, and there is a probability of lower interest rates later in the year.

Whilst not indicative of future outcomes it’s pleasing to see that for the short term at least, there are some positive catalysts behind the asset.

Crypto-assets are highly speculative in nature and can be expected to have a very high level of return volatility.

2 topics

1 stock mentioned