Can these companies capitalise on their depressed share prices?

Much has been written about the growing divergence between value and growth. Some have called it the ‘death of value’. Companies with perceived long-term growth runways have outperformed companies with (near-term?) challenges for most of the last decade.

In November 2020, when vaccines against COVID-19 were proven to be effective, the one-way trajectory of value stocks was briefly halted. But the long-awaited resurgence of value has only come in fits and starts.

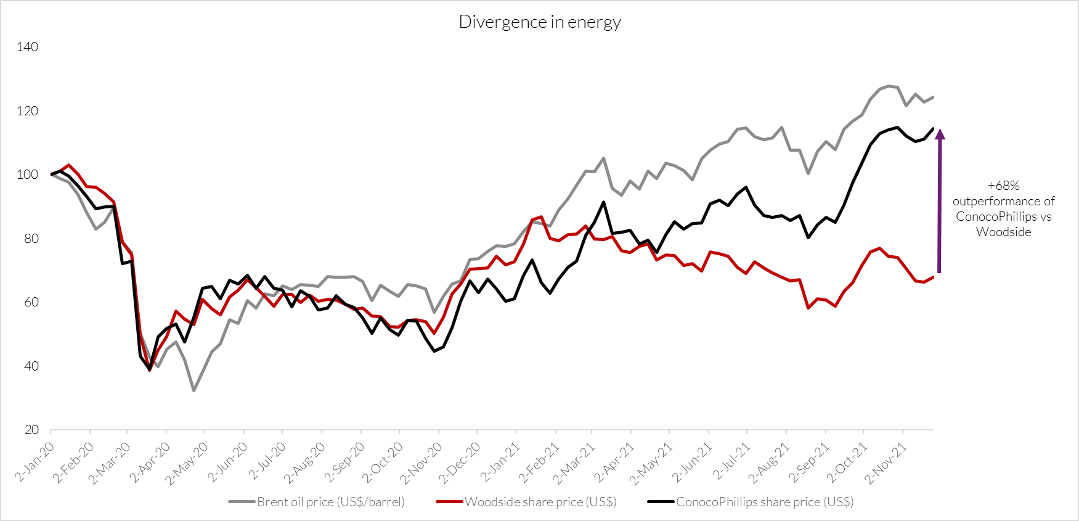

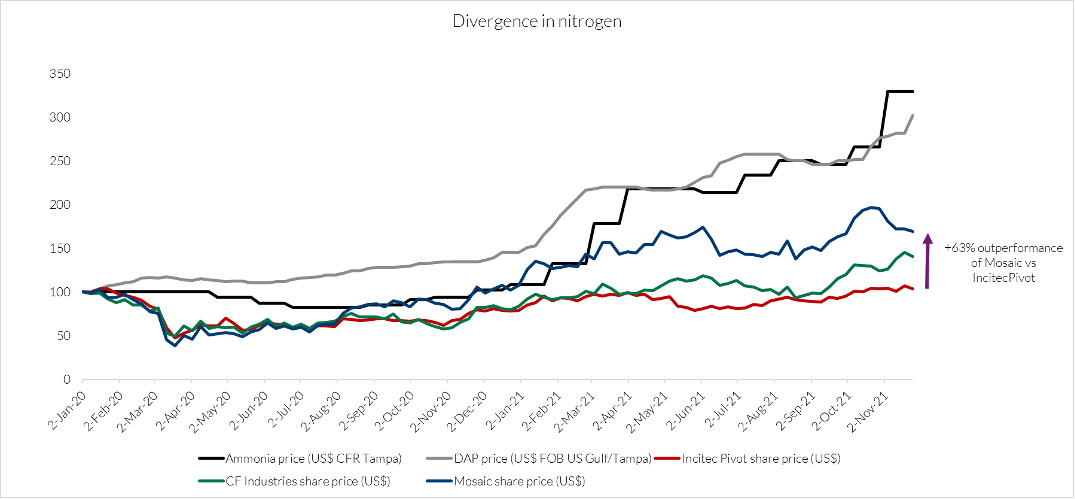

As we enter 2022, value’s performance is puzzling, given what has happened to the underlying drivers of earnings. While 2020 saw value stocks sold off heavily, mostly alongside their falling underlying earnings, the stocks have not rebounded even as those earnings drivers have returned to pre-COVID highs in 2021. This is especially true for many commodity-related stocks, and even more so for commodity stocks in Australia versus their global counterparts.

The graphs below show the divergence between Australian stocks and their underlying commodity drivers as well as their listed overseas peers.

Charts: Australian commodity-related stocks have underperformed their overseas peers

Source: Jefferies, Factset

Why are Aussie shares underperforming?

We have heard many explanations for this divergence. Some say it is due to company-specific challenges and missteps, but it is hard to see how this could be the issue for each and every one of these value stocks.

Others attribute it to ESG-related headwinds, even though some coal stocks have done very well, and despite performance not being nearly as woeful for similar companies operating out of Europe and the United States.

And others say it is only natural for resource companies to lag underlying commodity prices near cyclical peaks, because investors sensibly do not want to capitalise peak earnings in perpetuity, but the lag seems to have started at the bottom of the cycle, which is not how cyclical earnings are typically priced.

No matter the reason, the market has decided that a dollar of earnings, even normalised earnings, from these Australian companies is not worth nearly as much as it used to be. In fact, in times gone by, investors in cyclically-exposed companies have needed to sacrifice immediate earnings for the prospect of a higher share price when the cycle turns – a cost of carry. Today, that doesn’t appear to be true. Earnings are reasonable and share prices are very low. There is no cost of carry. In fact, the market has instead put a very high hurdle rate on investment in these companies.

For many companies, this presents a great opportunity to make high-returning capital investment decisions.

Low gearing, good earnings and strong cash flows, sometimes backed by high near-term commodity prices, means many companies are in a better position than they ever have been to deploy capital into a high-returning investment they know better than anyone else: their own shares.

The proven benefits of share buybacks

A company buying back shares can be controversial. Some argue that it shows a lack of growth options. Others say that it is financial engineering, especially if those companies are borrowing a lot to enable the buyback.

Financial literature, however, is littered with articles about the benefits of buybacks. Done well, each share should give its shareholder a greater slice of the earnings stream from the company. There are many examples of companies who have done buybacks well and have been rewarded over time.

Using cashflows to do this when share prices are low and hurdle rates are high should, mathematically, create significant value for shareholders. And, importantly, it shows the market that there is good operating and financial discipline.

After all, if a company cannot convince itself to buy back shares when those shares are cheap and out of favour, what chance is there of convincing other investors?

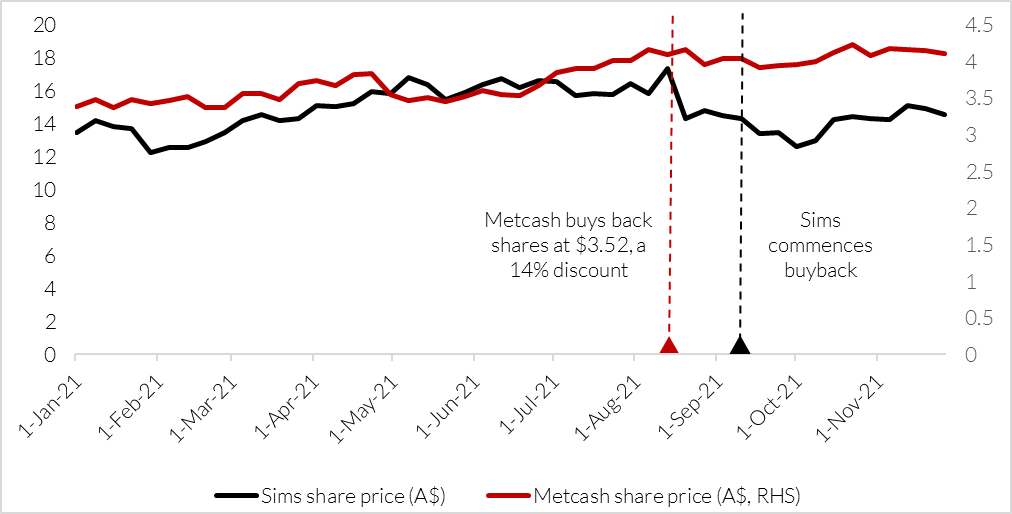

In Australia, franked dividends clearly take precedence over buybacks, and rightly so. But recently, a couple of companies have demonstrated their willingness to return surplus capital: Metcash and Sims, and their shareholders have benefitted from these decisions, as shown in the chart below.

Shareholders have benefitted from some companies returning surplus capital

Source: Factset, company announcements

Four Australian companies well positioned to buy back shares in 2022

We believe there are a number of other companies, in resources and other industries, that are well positioned to also buy back shares:

Woodside Petroleum (ASX:WPL)

Higher commodity prices, including record-high LNG prices, will result in strong cash flows at Woodside. This together with the sell-down of Pluto T2 (the new LNG train Woodside is building to process the Scarborough resource), the enlarged earnings base that will come with the BHP Petroleum merger, and only one large growth project (Scarborough) getting off the ground means the company will soon find itself under-geared (and undervalued, in our opinion!).

But what really pushes us over the line on a share buyback is the potential to unlock an asset currently valued at zero by most: a US$1.8b-and-growing pile of franking credits.

By conducting an off-market equal-access buyback, the company can buy back already low-priced stock at (up to) a 14% discount, to the benefit of all shareholders, including those who don’t participate in the buyback.

Incitec Pivot (ASX:IPL)

After two or three extremely challenging years due to drought in Australia, floods in Queensland, very low ammonia and diammonium phosphate (DAP) prices, and poor reliability of a major plant, Incitec Pivot is now enjoying much higher prices for its key commodities.

The company also de-geared in 2020 via a capital raising and now has a growth plan that is intentionally capital-light (no more large nitrogen plants on the horizon).

With a low franking credit balance, a strong balance sheet, healthy cash flows and an adjusted share price that is still well below pre-COVID levels, we believe the company should institute a buyback program.

G8 Education (ASX:GEM)

The childcare operator raised a large amount of capital during 2020 when their earnings were hit as a result of lockdowns. While earnings have not yet climbed out of their hole, the company is in a net cash position and its shares are priced below those of other operators.

With limited value-accretive investment opportunities, the company’s best course of action may well be to return cash to shareholders via a buy-back, while also improving underlying operations of their existing centres. That is certainly something we would like to see.

Monash IVF (ASX:MVF)

During 2020, this operator of IVF clinics undertook a huge capital raising relative to its size. Meanwhile, underlying demand for its services has dramatically increased since the start of COVID-19, to well above pre-COVID levels. With the benefit of hindsight, the capital raising was not required and it is unlikely that inorganic opportunities are priced anywhere near as attractively as its own share price.

It is time to reward shareholders – money raised has now clearly been shown to be far in excess of requirements and could be put to good use through a share buy-back.

Now is not the time to chase the next hot thing

When many would be urging these companies to deploy capital into the next ‘hot’ investment (hydrogen, green energy, lithium and battery minerals, software-as-a-service, decentralised finance…) to get a ‘re-rate’, it is inevitable that ‘hot’ investments are overpriced and companies will pay up for that privilege, or that returns will disappoint.

It would be far better to see companies exercise good judgement and patience by slowly chipping away at their own shares, especially as the market is giving them an opportunity to buy those shares so cheaply.

2022 may well be the year we see this happen.

Learn more about Allan Gray

Contrarian investing is not for everyone, however there can be great rewards for the patient investor who embraces Allan Gray’s approach. For further information hit the contact button below.

1 topic

4 stocks mentioned

1 fund mentioned