Chart of the day: China credit growth soars

(Ed's update: China's official GDP figures were unveiled after this article was published. Its economy contracted 6.8% in Q1, the worst performance since 1992).

Gross domestic product shrank 6.8% in the first quarter from a year ago, the worst performance since at least 1992 when official releases of quarterly GDP started, missing the consensus forecast of a 6% drop

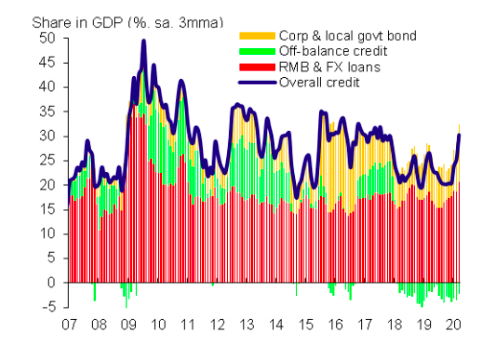

Last week, March credit data for China soared above expectations with growth in credit (total social financing) accelerating almost 1% in the month to 11.5%, its fastest pace since mid-2018. New bank loans and corporate bonds were the strongest contributors, according to UBS. In terms of new credit flowing to the economy (our chart today), this jumped from 25% to 30% of China’s output in March, a level on par with 2017. The pick-up in credit growth reflects the authorities’ efforts to support activity in light of Q1’s COVID-19 outbreak. Along with China, recent massive global fiscal and monetary support should be a powerful growth support for the world economy through H2 2020 and into 2021.

China remains an interesting case study, arguably, of what a V-shaped recovery could look like. Having experienced the COVID-19 outbreak in Q1 2020, and largely containing it during the quarter, the subsequent substantive return to work is expected to underpin a sharp rebound in activity in Q2. The Q1 collapse and Q2 rebound could potentially be mirrored by the rest of the world through Q2 (collapse) and Q3 (rebound), though the likely pace of return to work is expected to be more muted than in China. Moreover, while ‘peak disease’ is emerging, there remains significant uncertainty globally of just how much normality can return by end-Q2. Our central case is more U-shaped across Q3 and Q4 2020. For China, there also remains the question of sustaining a sharp rebound when external demand for its goods will be weak mid-year.

Today brings heightened clarity on the first phase of the journey. China’s Q1 GDP is due (around 1pm AEST), and consensus is centred on a 10% fall in the quarter, taking the annual pace of growth in China from around 6% in Q4 2019 to -6% in Q1 2020. A rebound of similar magnitude is expected in Q2. Interestingly, the March ‘month’ data today for China is expected to rebound from its February lows, providing insight into the extent work was resumed late in Q1. Industrial production is expected to rise from -13% to -7% and retail sales recover from -20% to -10%. This data today will be important in understanding how quickly China has returned to work, and demand recovered, and the likely rebound in Q2 growth.

For the rest of the world, China is shining a lamp on the path of growth through 2020, albeit one quarter ahead. Unlike China, the likely containment of Covid-19 and government decisions around phased returns to normal human activity are more uncertain. However overnight news of positive results for Gilead’s experimental ‘recovery’ drug Remdesivir in Chicago testing trials is only likely to embolden world (and Australian) governments’ desire to get economies back to work to limit the depth of the imminent recession. China’s data today will be a small window into that journey.

China credit growth soars – total social financing

Source: CEIC, UBS estimates

Be the first to know

I’ll be sharing Crestone Wealth Management's views as new developments unfold. Click the ‘FOLLOW’ button below to be the first to hear from us.

1 topic

1 contributor mentioned