Charts and caffeine: The outlook for ASX mining stocks as China slows

Welcome to Charts and Caffeine - Livewire's pre-market open news and analysis wrap. We'll get you across the overnight session and share our best insights to get you better set for the investing day ahead.

MARKETS WRAP

- S&P 500 - 3,795 (+0.95%)

- NASDAQ - 11,698 (+1.47%)

- CBOE VIX - 29.20

FedEx is in focus after it matched the street's estimates for profit and missed estimates for revenue by a hair's breadth. But the outlook for earnings was better than expected so shares rose in the after-hours. US PMIs fell in line with expectations - but price pressures still remain elevated.

- FTSE 100 - 7,020 (-0.97%)

- GERMAN DAX - 12,913 (-1.76%)

Investors are still digesting data out of the German economy showing producer prices (ie the cost of manufacturing stuff) is compounding at record levels. Last month, it was up - get this - 33%.

Sticking with economic data and PMIs fell across Europe during the prior month. Weakness was recorded with all components of the composite index falling. Those figures won't be good news for the Eurozone's GDP figure which would already be under significant pressure from the war.

- USD INDEX - 104.39

- US10YR - 3.089%

- GOLD - US1824/oz

- CRUDE OIL - US$104.03/bbl

THE QUOTE

The measures are legitimate, lawful and beyond reproach.

This quote from the Foreign Ministry in Beijing caught my eye. It was in response to new Prime Minister Anthony Albanese's request for tariffs to be dropped on Australian products if it wants to consider a new, more serious relationship with Canberra. But, as is the case for those of us who watch China closely, don't try to fight with their horns.

If these tariffs remain or worsen, then expect our frosty relationship with our largest trading partner to get even icier - if that's even possible.

STOCKS TO WATCH

It's been a huge week for the ASX miners. From iron ore to coal and even gold, there has literally been no way to escape the news rush affecting corporates. Let's go through each commodity bit-by-bit, with the help of some notes from Morgan Stanley, Goldman Sachs, and Bell Potter.

First up - iron ore - our largest export and, of course, the one that China needs. Or so we thought. A recent piece in the Financial Times suggested China is moving to consolidate its iron ore imports by the end of this year. This is as China is in the midst of a material economic slowdown and a recovery that most likely won't be anywhere near 2008's levels.

If economic activity is down and a frosty trade relationship still is not resolved, what might that mean for the big three (BHP, Fortescue, and Rio Tinto)?

The short answer is that the outlook is unclear. While some projects could be brought forward, growth may not pop up in the official figures for a few quarters.

Rio Tinto gets top marks at MS based on its balance sheet while Fortescue is the underweight call because its share price may not warrant all the spending it is making on its Future Industries arm.

Coal hasn't had a quiet week either with the Queensland government eyeing taking more from company royalties due to a new, tiered tax royalties system. Nonetheless, the dirty commodity gets top marks at Morgan Stanley because prices are set to remain higher for longer. After all, with thermal coal at well over $100/tonne, why wouldn't you want a slice of that?

Whitehaven Coal and South32 get the top marks at this broker. Goldman Sachs sees better opportunities in BHP and Coronado Global Resources and would rather dump New Hope Coal on poor valuation grounds.

Finally, gold is getting a heap of attention because of the R and S words (recession and stagflation). Pundits on all the business news networks now think that if a recession isn't in the market's future then stagflation could be the endgame for this rate hiking cycle.

Bell Potter's David Coates has had stagflation as his base case for some months now - and says the risks have only increased since. While not there yet, he does highlight the staying power of gold bullion - and in turn, gold stocks. The biggest challenge in a stagflationary environment is cost. That is, how can gold producers keep costs low in a world where growth is low and production disruptions are still plentiful?

Coates' solid buy ratings are on Regis Resources, Gold Road Resources and micro-cap Pantoro Resources. Ironically, Morgan Stanley has just moved Regis to a sell - so that should be an interesting watching brief.

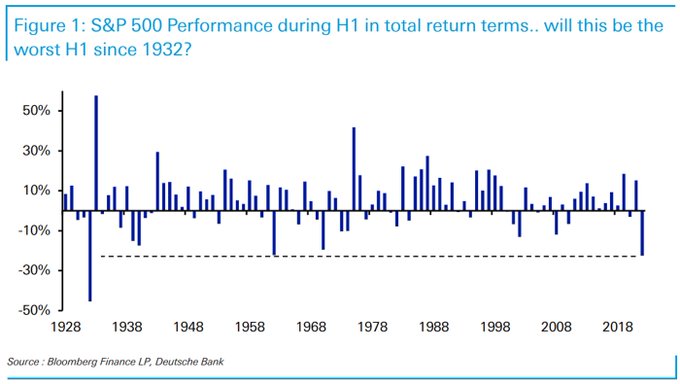

THE CHART(S)

THE TWEET

Get the wrap

We're trying something new around here - a daily market preview with an intelligent twist. If you've enjoyed this edition, hit follow on my profile to know when I post new content and click the like button so we know what you enjoy reading.

If you have a chart and/or a stat that you would like to see featured in a future edition of the newsletter, drop us a note at content@livewiremarkets.com.

5 topics

12 stocks mentioned