‘Climate tech’: Innovation to save our planet

Time is running out to prevent climate change from wreaking havoc on our environment, economy, and society. According to a recent report from the Intergovernmental Panel on Climate Change, extreme weather events (bushfires, floods, droughts etc.) and ecological disruptions are increasing in both frequency and intensity1. The window of opportunity to respond is closing rapidly, and any further delay in acting will only bring us closer to crucial tipping points, which would further intensify the economic and social impacts of climate change. The world must act fast and act together to address this existential threat.

From crisis to opportunity

While climate change remains a significant threat to our planet, the rapid advancements in technology over the past few decades, and the emergence of new technologies, can play an important role in tackling this global challenge2.

Climate tech can be defined as technologies and innovations enabling decarbonisation of the global economy. Climate tech includes a broad array of physical and digital technologies. At a high level, it includes technologies which reduce greenhouse gas emissions, increase energy efficiency, and those enabling adaptation to rising temperatures.

Some of the key themes within climate tech include:

- Renewable energy technologies such as solar and wind power which help reduce fossil fuel usage for energy

- Energy efficiency systems, such as smart grids and energy management systems which contribute to optimising energy usage and reducing waste

- Low-emissions transport including electric vehicles (EVs)

- Low-carbon manufacturing including sustainable materials and process reengineering,

- Circular economy including reuse and recycling, and.

- Precision agriculture, which enables farmers to optimise resource usage, minimise greenhouse gas emissions, and enhance agricultural productivity.

The evolution of climate innovation: ‘clean tech’ to ‘climate tech’

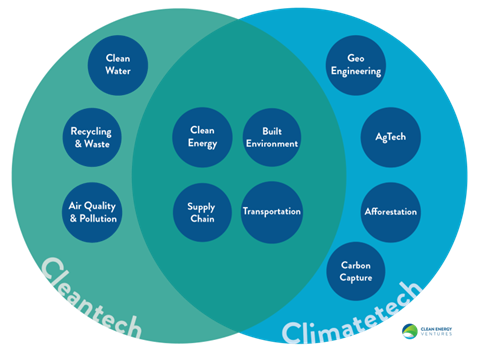

While Bell Labs invented the solar panel in 19543, the term ‘clean tech’ gained prominence in the late 1990s and early 2000s with Silicon Valley firms pouring billions of dollars into technologies such as solar, wind and biofuels4. This wave of innovation was driven by growing awareness and urgency in dealing with increasing emissions and the use of fossil fuels. The cleantech movement began by focusing on developing technologies which were cleaner alternatives to fossil fuels, including renewable energy technologies such as solar, wind, and bioenergy. Over time, cleantech evolved to include technologies focused on reducing air pollution and waste and improving water quality. Water treatment systems, air-purifying devices, and waste management technologies can also be grouped under cleantech.

Although the emergence of cleantech enabled the development and adoption of renewable energy technologies, it became evident that addressing climate change required going beyond just targeting energy generation. This led to the evolution from cleantech to climate tech, thus broadening the focus from clean energy to a more comprehensive range of climate-related solutions.

Climate tech addresses broader complexities of climate change by including a wide range of fields, from carbon sequestration in materials, the oceans, forests, and soils to blockchain, green hydrogen, and virtual power plants. It applies an all-hands-on-deck approach to solving climate change with technology.

While in theory the two terms may be different, the distinction between climate tech and cleantech is not always clear-cut, as many technologies have both environmental and climate benefits.

Climate tech saw a surge in interest in 2020, driven by growing public demand to act against climate change. Youth-led climate movements and geopolitical considerations have forced governments across the world to take decisive action on securing existing climate tech supply chains and investing in the development of new technologies. Adults tend to pay attention when teenagers sternly address the United Nations with messages like: “We are in the beginning of a mass extinction, and all you can talk about is money and fairy tales of eternal economic growth. How dare you!”5

Follow the money

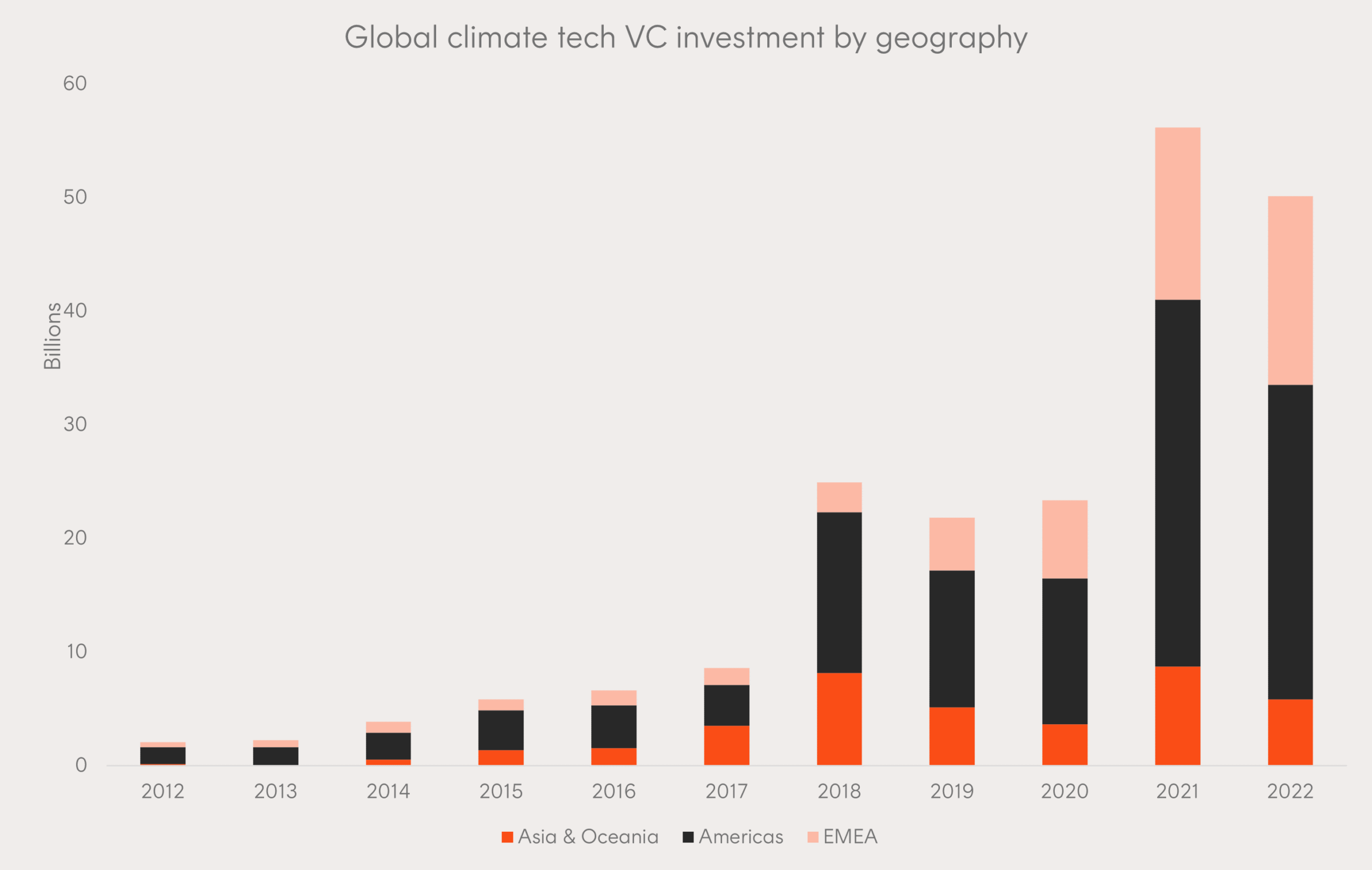

The market for climate tech is projected to grow at a rapid pace in the coming decades. Research from the International Renewable Energy Agency (IRENA) estimates that a 1.5 degree-aligned energy transition could lead to the creation of about 85 million additional jobs compared to 2019, which would more than offset the loss of about 12 million jobs in the fossil fuel industry. Unsurprisingly, this has attracted the attention of investors, especially in the venture capital space, who are keen to invest in new technologies, innovation, and growing markets. Venture capital investment in climate tech startups has increased 24x during the last decade6.

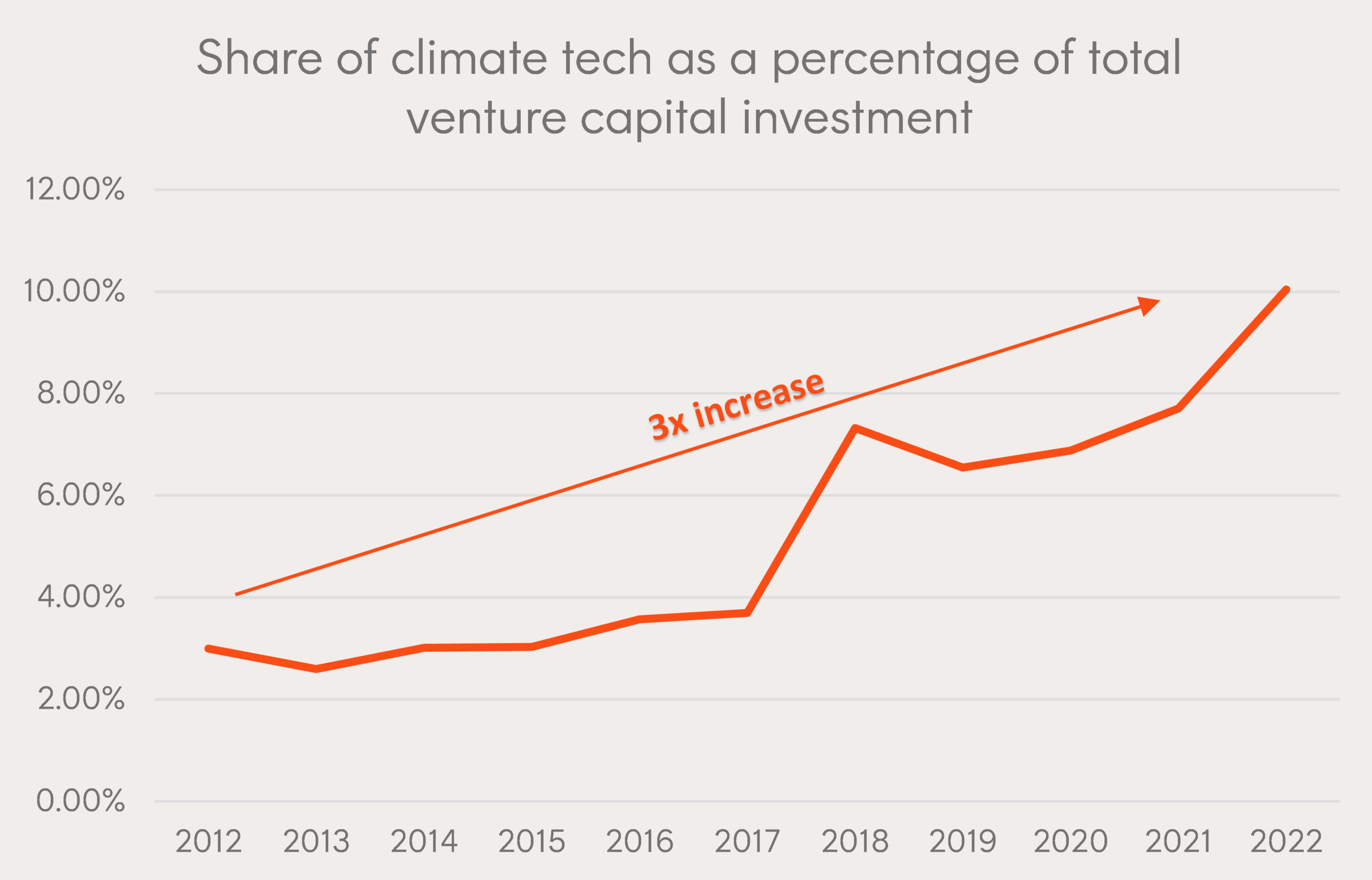

The share of climate tech as a percentage of total venture capital investment has increased 3x in the past decade and now accounts for 10 cents of every dollar of venture capital investment deployed globally6.

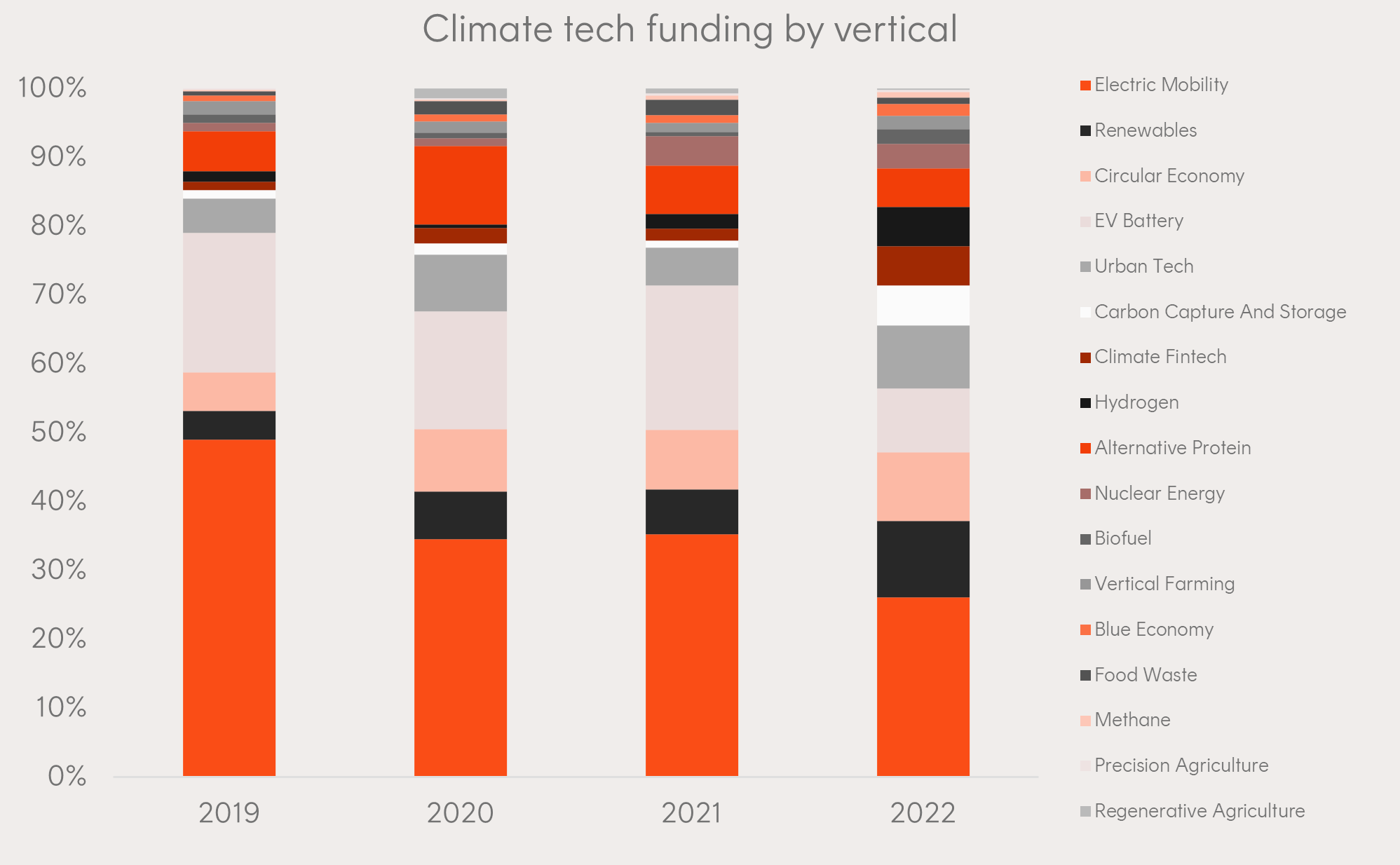

Electric vehicles, renewable energy, and battery technologies have consistently accounted for more than 50% of investment flows into climate-tech. Hydrogen and CCS were the fastest growing segments during 2019-2022, with investors remaining hopeful of a technological breakthrough which will make these technologies viable at scale6.

In the listed equities space, prominent companies focused on climate innovation and technology include:

- Tesla (NASDAQ: TSLA): Tesla is a pioneer in electric vehicles (EVs) and renewable energy solutions. It is the largest EV manufacturer in the world and its continuous focus on battery technology and autonomous driving capabilities sets it apart from traditional car makers.

- Bloom Energy (NYSE: BE): Bloom Energy focuses on solid oxide fuel cell (SOFC) technology for clean and efficient energy generation. Bloom’s technology can convert a wide range of fuels, including natural gas and biogas, into electricity with reduced emissions.

- Ecolab (NYSE: ECL): Ecolab provides innovative solutions for water and hygiene management across various industries. Ecolab offers advanced water treatment technologies, sustainable cleaning and sanitisation products, and digital monitoring systems to conserve water, reduce waste, and enhance hygiene standards. Ecolab’s innovations promote responsible resource usage and environmental protection.

- Kingspan Group (LON: KGP): Kingspan is a building materials company specialising in sustainable insulation and construction solutions. It develops innovative insulation materials, such as high-performance insulated panels and advanced insulation boards which enhance energy efficiency and reduce greenhouse gas emissions in buildings. Kingspan’s products contribute to sustainable construction practices and energy conservation.

What does the future hold?

During the last few years, climate tech has seen a convergence of various technologies, including artificial intelligence, machine learning, biotechnology, and nanotechnology. This convergence has unleashed a wave of innovation, allowing for more sophisticated climate solutions. The future of climate technology and innovation is looking bright and holds immense potential to address the challenges imposed by climate change.

With ongoing advancements in renewable energy, energy storage, decarbonisation, circular economy practices, and the integration of emerging technologies like artificial intelligence and machine learning, we can pave the way for a more sustainable and resilient future. We believe that while we will continue to see a rise in climate technologies focused on emissions reduction, there will be increasing interest in the development of climate adaptation technologies, as focus shifts to the potential consequences of failing to reach Net Zero by 2050.

How to invest in climate tech

Tesla, Bloom Energy, Ecolab, and Kingspan Group are held by the Betashares Climate Change Innovation ETF (ASX: ERTH) (as at 8 September 2023), which holds a portfolio of up to 100 leading global companies helping to address climate change and other environmental concerns through the reduction or avoidance of CO2 emissions. This covers clean energy providers, along with leading companies tackling green transport, waste management, sustainable product development, and improved energy efficiency and storage.

References:

- AR6 Synthesis Report: Climate Change 2023

- Technology and the UNFCCC

- This Month in Physics History

- Cleantech venture capital: Continued declines and narrow geography limit prospects

- 'This is all wrong': A transcript of Greta Thunberg's Climate Summit speech

- Climate tech

There are risks associated with an investment in ERTH, including market risk, international investment risk, sector risk and non-traditional index methodology risk. Investment value can go up and down. An investment in the Fund should only be considered as a part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on risks and other features of the Fund, please see the Product Disclosure Statement and Target Market Determination, both available on this website.

1 topic

6 stocks mentioned

1 fund mentioned