Coal is threatening to rise like a phoenix

As we all know the Coal Sector was arguably the darkest corner of the market in 2019 with the likes of Whitehaven Coal (WHC) down over 70%. The fall was attributed to 2 primary factors in our opinion:

1 – Over the last 2-years, the coal price more than halved dragging with it the whole sector.

2 – The world is witnessing a substantial migration to non-fossil fuel investing by global money managers driven by demand, these “clean” mandates by definition reduces the demand for stocks driving down the comparative valuations.

Hence, we have an extremely cheap sector that can / does bounce sharply when the coal price bounces. Medium-term MM expects the Coal market to remain under pressure amid growing natural gas-powered production and rising share of renewable energy generation as more countries attempt to become more environmentally friendly. Hence any foray into the coal sector by MM is very much an active, relatively short term play.

Today we see thermal coal has bounced almost 40% over the last few months and although we remain well below the levels of recent years the upside risk/reward is improving for a market which we feel still has few admirers within the investment community. However, as we all know when too many investors position themselves in one direction major opportunities arise. At MM we believe the whole energy complex – oil, gas, LNG, coal, uranium – should recover in terms of demand and price in line with an uptick in global growth (post-COVID-19) hence MM is overweight oil and wondering if the coal sector is offering good risk/reward for the more aggressive investor.

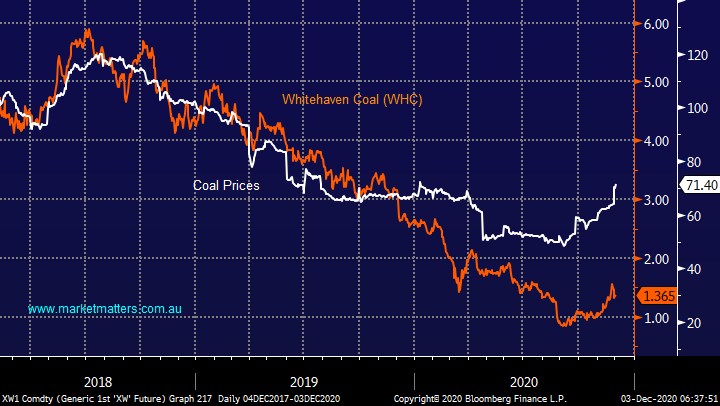

Coal Price ex-Newcastle ($US/MT) Chart

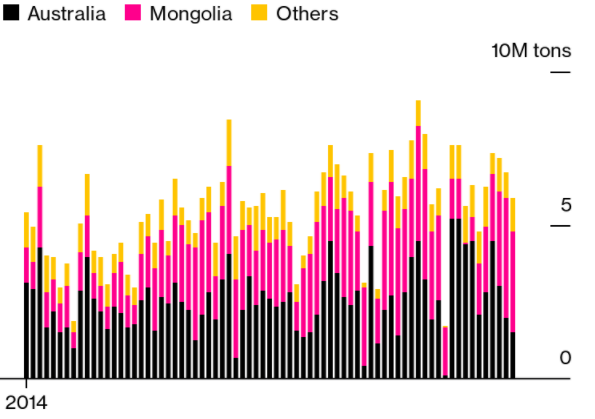

Coking coal prices have actually soared to 4-year highs following a fresh COVID breakout which has slowed transport across the Mongolian border by ~80% when combined with tensions/restrictions around Australian coal into China this specific part of the fossil fuel has shot higher – hopefully with vaccines looming this will only be a short term issue around supply.

Australia & Mongolia are China largest Coking Coal suppliers

Source: General Administration of Customs / Bloomberg

The recent 3-year coal trading partnership between China and Indonesia implies that Australian thermal coal is heading in the same direction as our wine as we continue to fall further out of favour with the world’s second-largest economic superpower. At this stage, volumes have not been stipulated but assuming everything becomes formalised analysts expect China to start buying 200m tonnes of Indonesian coal. Fortunately coal out of Indonesia is of lower quality than our own making it hard to use in power generation but it’s another reason Scott Morrison needs to improve diplomatic relations with China while not bowing to their bullying tactics – not easy I acknowledge!

However, the stoush between China and Australia maybe producing opportunities in the local Coal Sector as its understandably tempered recent advances. The chart below illustrates the nervousness towards the local sector, when coal was at current levels in 2019 Whitehaven Coal (WHC) was trading at $3, over double the price it is today, implying some catch is a strong possibility.

MM likes coal on a risk/reward basis.

Coal Prices v Whitehaven Coal (WHC)

Today I have revisited at 3 local stocks in the out of favour Coal Sector – we are mindful that the world is becoming much greener but as we often say when optimism/pessimism goes too far money can be made.

1. Whitehaven Coal (WHC) $1.36

We continue to feel the coal sector looks good, Peter O’Connor our analyst in the space thinks Whitehaven Coal (WHC) has ‘$2 all over it’, that’s a potential gain in excess of 50%. We have kept away from the sector indeed putting it into “the too hard basket” but considering WHC has fallen 85% over the last 2-years it’s proven to have been the correct approach.

However just like all great stocks eventually have a pullback the “dogs” of the market often at the very least bounce strongly. For the aggressive players, we think coal stocks offer some attractive risk/reward at current levels with WHC an obvious candidate but further pertinent news flow is highly likely and plenty of day to day 10% swings should be expected – it’s a higher risk play.

MM likes WHC as an aggressive play.

Whitehaven Coal (WHC) Chart

2. New Hope Coal (NHC) $1.36

Thermal coal business NHC remains a billion-dollar business even after its shares have fallen so dramatically and again the stocks looking interesting as it recovers from the $1 region. This coal play looks good for fresh 2020 highs.

MM likes NHC with an initial target ~20% higher.

New Hope Coal (NHC) Chart

3. Yancoal Australia (YAL) $2.09)

YAL is the largest ASX listed coal company with a market cap of $2.6bn, a fact that might surprise many as its probably the least discussed of the 3 covered today, probably due to it having a small free float given its primarily owned by Chinese state-owned Yancoal.

A relatively new CEO who has a strong track record at least appears to have stabilised the stock, although we have no interest here given the ownership structure.

MM is neutral YAL.

Yancoal Australia (YAL) Chart

Conclusion

MM likes WHC as an aggressive coal play.

Get regular market updates

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

2 topics

3 stocks mentioned