Compare The Pair – It’s not too late for this coal laggard

Unless you’ve been living under a rock, perhaps one formed over millions of years under significant pressure, you’ll know that the coal market has had a dramatic turnaround over the past year.

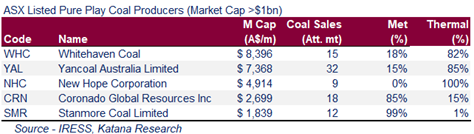

As we see it, quality

pure-play coal producers on the ASX are limited to a handful of stocks:

With soaring coal prices these companies have been generating record revenue and eye-watering cash flow. All bar one has received their share of air-time, and we think this laggard screams value.

That company is Yancoal Australia (ASX: YAL). Despite a market cap in excess of $7bn it lacks coverage and remains under-researched. There are a few possible reasons for this. 62% of the company is owned by Yankuang Energy Group based in China, and until recently the company was facing a very different fate with crippling debt. This presents the opportunity, fuelled by strong coal prices the company has significantly de-risked over the past year, and now sits in a net cash position. This turnaround has gone largely unnoticed due to the lack of coverage leaving the share price trading at a significant discount to peers.

To highlight the case, we’ve undertaken a ‘Compare the Pair’ against their closest peer Whitehaven Coal (ASX: WHC).

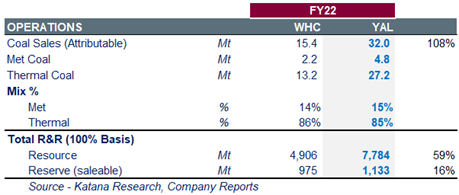

Operations

Both Yancoal and Whitehaven are predominantly thermal coal producers with a rough 85% thermal and 15% metallurgical coal (“met”) split. This gives them good exposure to the current high thermal prices which are likely to last well into CY23 driven by the energy crisis. In terms of volume, YAL sells more than double the volume compared to WHC. In fact, YAL has the largest volume out of all the pure-play producers listed above.

All of Yancoal’s operating assets are in a tier 1 location within Australia (5 in NSW and 2 in QLD) and have a long average mine life of 21 years.

Cash Flow & Balance Sheet

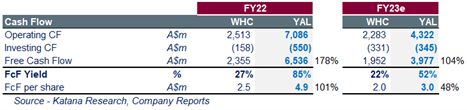

YAL and WHC have little to no commodity hedging in place, leaving them exposed to the high spot price. The cash flow they’re generating from these prices is quite extraordinary, and we think there’s further to go. Over the past 6 months, FOB Newcastle thermal prices averaged US$320/t, and the current spot sits 28% above this at US$410/t.

YAL and WHC have similar operating cash costs of A$84-86/t (excluding royalties), while YAL generates almost double the free cash flow per share. This is partly driven by YAL selling double the volume.

What really stands out is YAL’s FcF yield of 85% in FY22 vs WHC 27%, representing significant cashflow to shareholders. In other words you’re paying just 1.2 times free cash flow per share vs WHC at closer to 4 times.

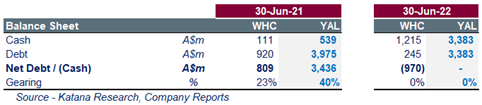

Fair to say both companies have significantly de-risked over the past year, and they no longer have highly geared balance sheets hanging over them. On 30 June WHC had a A$970m net cash balance, while YAL has moved from net debt of A$3.4bn and gearing 40%, to a net cash position as of July. YAL also recently announced they intend to repay US$1bn of debt in October which will save them US$207m in financing costs over the loan period.

Risks

Clearly, the biggest risk to both stocks is the coal price. This is unsustainable at the current level and it is only a question of when it will retrace not if. But on this point, our thesis is based upon the view that we will make a lot more in dividends than we will lose in capital when the price eventually retraces. We expect coal prices to remain higher for longer, and in the case of YAL, to generate free cashflow (ie after tax/capital/everything) of ~130% over the next 2 years.

Consistent with the whole industry, cost inflation is also an issue. YAL recently reported a 30% rise in operating cash costs, while WHC reported 15% higher unit costs compared to FY21. A big contributor to this has been diesel prices which for now have shown some stability.

Finally, with all their assets located on the east coast, excessive rainfall is a key risk to both companies. YAL recently downgraded full year production by 12% and flagged all mines are at full water storage capacity. Similarly, WHC was impacted by rain and achieved FY22 production 11% below the previous year. Further unseasonal rainfall could impact productivity for both.

Value & Yield

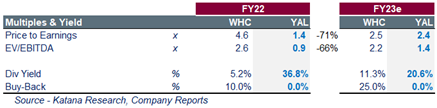

YAL is currently trading on a FY22e P/E of 1.4x and EV/EBITDA 0.9x. By comparison this represents a 71% and 66% discount to their closest peer. It’s not often that you see a company generate billions in profit while trading on a P/E of <2x.

Consensus also forecasts YAL paying an FY22 full-year dividend yield of ~37% (unfranked), which is ~8x the ASX200 average and means you get over a third of your investment back in dividends in one year. In contrast, WHC paid an effective yield of 15% in FY22 (5% dividend and 10% buyback). WHC does however intend to undertake an additional 25% buyback if approved at the AGM this month, which would put them on a similar effective yield.

Summary

YAL is a clear laggard

from a lack of coverage, and their dramatic turnaround has gone largely

unrewarded. Trading on a P/E of <2x and paying a dividend yield of ~36%

screams value and it’s only a matter of time until they re-rate.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

And you can follow my profile to stay up to date with other wires as they're published – don't forget to give them a “like”.

4 topics

2 stocks mentioned