Credit Suisse top ideas for 2021

As we happily farewell 2020, it’s time to look to 2021 and identify the most promising investment opportunities. Here are our top ideas for 2021.

1. Keep cash to a minimum

Cash rates will remain very unattractive in 2021. We don’t see the RBA moving above the current official rate of 0.10%. Instead, investors can aim to achieve reasonable returns with well-diversified multi-asset portfolios that bring some stability while benefiting from an overall economic recovery.

2. Favour higher yielding bonds over government issues

In 2021, credit spreads are likely to narrow on the back of an overall improving global economic outlook and continued central bank asset purchases. In a case of a rising tide lifting all boats, central banks are forcing bond investors to look beyond government debt for yield pick-up. Diversified exposures to Asian emerging market debt, high yield, and investment grade corporate credits look relatively attractive.

3. Hybrids provide yield but tread warily

Hybrids shouldn’t be used as a substitute for fixed income. They are high yielding listed securities that fall with crashing markets, and so don’t provide capital stability in stressed situations. But buyer beware, hybrids are complex and differ as to the conditions surrounding them so do your research. Issuers have a strong incentive to call at first call, but there is no guarantee that will happen.

4. Supertrend equities

These are investments that follow a thematic framework reflecting societal trends. There are six themes we have identified: population ageing, generational change, technological revolution, infrastructure, decarbonisation of economic growth, and re-balancing of opportunities in a more inclusive form of capitalism. Within these themes are things such as the digital revolution, robotisation, infrastructure upgrades and clean energy.

5. Chinese and Asian equities

China is among the few countries to actually have grown in 2020. It should expand by more than 7% in 2021. We believe Chinese and Asian equities more broadly should outperform developed markets.

6. COVID-19 recovery stocks

As a result of the US election and the development of vaccines, share markets have become pro-cyclical. Favouritism has moved from long term growth stocks to stocks leveraged to a pick up in economic activity. In the short term, share markets in countries like Germany and Australia, which have a stronger cyclical element, should do well. Within Australia we like the large miners. We also think the banks will do well as bad debts look to be much less than expected, and APRA is allowing them to increase their dividends again.

7. Hedge funds are set to enter 2021 amid more favourable conditions than in 2020

They should be supported by ongoing economic recovery, better liquidity conditions as well as a reduction in systemic risks. That said, the term “hedge fund” covers a lot of different styles and approaches. There will be winners and losers and research is critical. Private equity also has an opportunity to do well with post Covid and post government support fall out.

8. ESG stocks

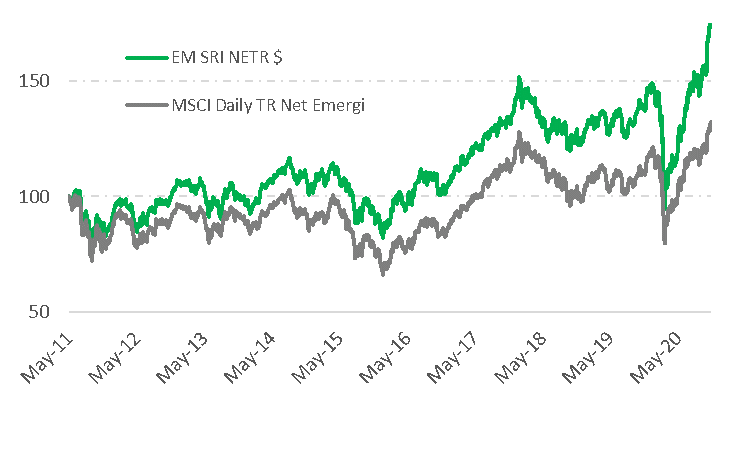

Awareness of environmental, social and governance criteria (ESG) is rising, and applying these criteria in investing has provided a positive return contribution during a difficult 2020. The MSCI World ESG Leaders Index outperformed its traditional counterpart by around 90 basis points last year. We expect this trend to continue. The outperformance is particularly pronounced in emerging markets, as shown below.

MSCI Emerging Markets Versus MSCI Emerging Markets ESG (Green)

Source: Bloomberg, Credit Suisse

9. We expect both precious and base metals to remain well supported and see some further upside in 2021

Base metals have already recovered to above pre-COVID-19 levels on the back of strong Chinese buying. Yet, the anticipated recovery outside of China should keep metals prices well bid next year. Also, the combination of USD weakness and ultra-low real yields should continue to attract investor flows into precious metals such as gold.

10. Stick to your strategy

Often even the best research and analysis can’t predict what will happen. However, pick a strategy and stick with it. For our clients it means a multi asset class portfolio. If you understand how your strategy will perform in bull and bear markets, and you fully accept what that means in a market correction, you are less likely to sell at the bottom. Getting out of the markets with the intention of getting back in at the right time rarely works.

Learn more

Credit Suisse Private Banking specialises in asset diversification, holistic wealth planning, next generation training, succession planning, trust and estate advisory, philanthropy. Stay up to date with our latest insights by hitting the follow button below.