Why my mum might help pop the CBA bubble

Extreme investing

Valuing shares is inherently challenging. As humans, we tend to be overconfident in our estimates and naturally drawn to definitive numbers. But is share XYZ worth exactly $30? Or is its value closer to $33?

It’s usually far easier to know when a share is trading at extreme levels. In our view, CBA is one of those stocks.

We’ll take CBA’s current absurd valuation as a given. There’s been enough written on this elsewhere, but to trade at nearly 2x a comparative Australian bank and 3x a US one, for lower or similar growth, makes no fundamental sense.

Despite the bubble-like valuation, we believe there are some logical reasons that explain it. While these reasons may provide some clarity in explaining the share price rally thus far, there is no sugarcoating the risks now embedded in the share price.

As I explained the numbers to my mum, it occurred to me that she—and retail investors like her—might ultimately be the ones who help pop the CBA bubble.

A break from reality

One reason we believe CBA’s share price has defied gravity in recent years has been ‘price momentum’.

Momentum is an investment characteristic that is evident in almost all asset classes and regions, globally. The simple premise is that investors buy what has been going up and sell what has been going down. Quant manager AQR distils the approach as “Ride your winners and cut your losers”, a simple way of explaining this clearly non-fundamental phenomenon. It simply works.

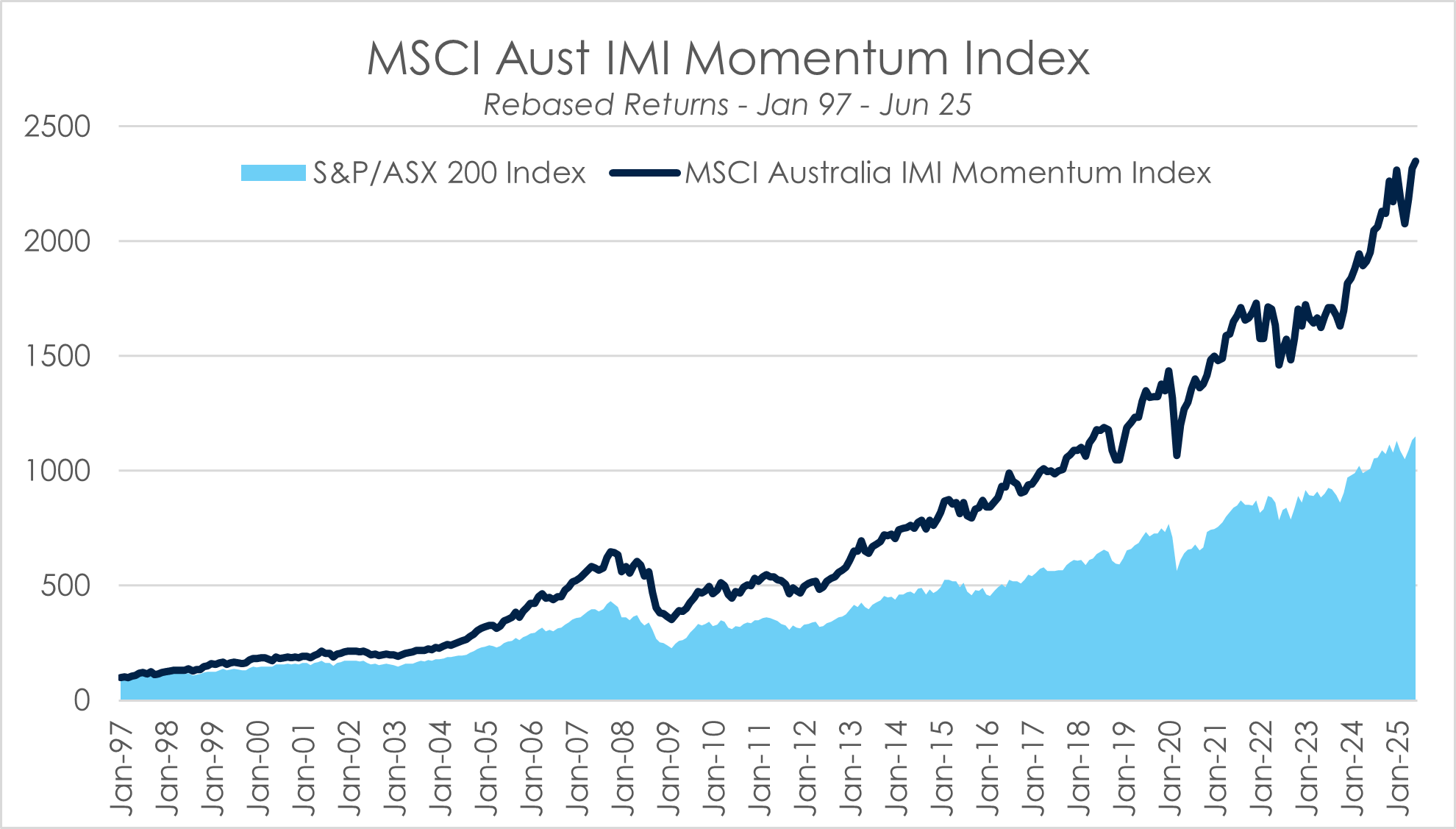

Professional investors call this characteristic a ‘factor’, which in Momentum’s case, has consistently delivered returns higher than the broader sharemarket. In the Australian market this is evidenced by the longer-term performance of the MSCI Australia IMI Momentum Index, which simply buys a basket of shares that has been appreciating the most over the past 6-12 month period.

Momentum can occasionally create headaches for fundamental investors (let’s call them rational, price-sensitive investors), who prefer to target Quality companies whose share price offers good Value. Occasionally these headaches can be very painful, particularly when the largest stock in the Index is being bought by other investors simply because… the share price is going up!

‘Quality’ and ‘Value’ are also factors with ample evidence of delivering better returns than the sharemarket over time, however the excess returns of all factors will likely ebb and flow.

Rational investors exit the register

As the share price has moved ever higher, price-sensitive active managers have found the valuation impossible to justify, largely voting with their feet to sell and exit the register. This is evidenced in a recent report from Zenith which notes that over 90% of active managers are now underweight CBA relative to their benchmark, plus that the average advised client portfolio (which may include some benchmark hugging exposure) is on average 6% underweight CBA.

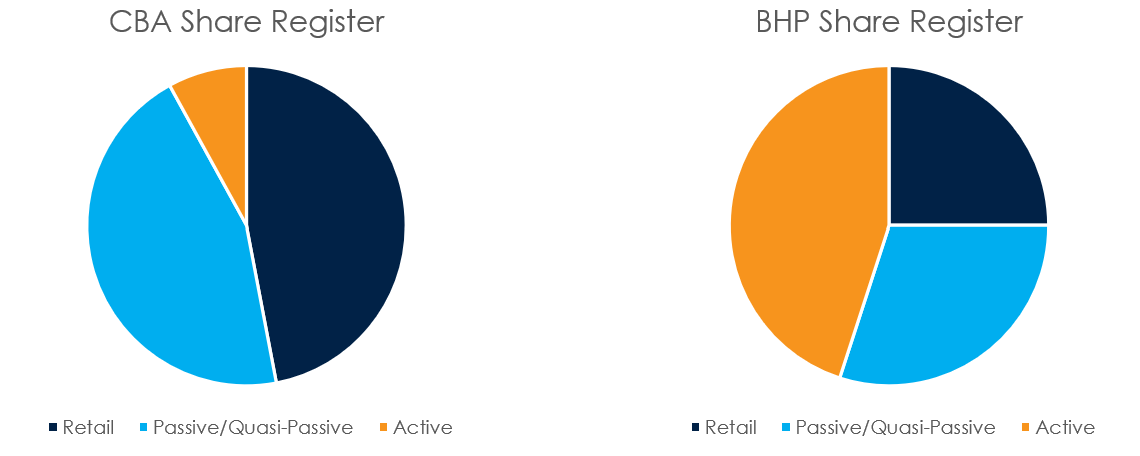

The exodus of active managers is also consistent with estimates from Barrenjoey, which suggests that active managers now account for only 8% of the CBA register, versus 18% for the major banks and 27% for the rest of the ASX200.

By comparison, the composition of the BHP register (the second largest share in the ASX200), has far greater ownership from active managers and far less from Retail and Passive.

A unique register that cares less about price

Since IPO in 1991, CBA along with the other major banks have retained an unusually high percentage of Retail investors on their register (ranging from 40% at NAB to 47%at CBA). While this is gradually declining, the Retail component has proven a relatively stable and therefore less price sensitive element of the register.

Furthermore, with the increased penalties applied by APRA to underperforming MySuper funds, many larger superannuation funds have migrated their portfolios to resemble more benchmark hugging approaches. This migration has further increased the share of less price-sensitive investors on the register.

As a result, and assuming the Retail component remains sticky, over 90% of the shareholders of CBA could be considered to be far less price (or valuation) sensitive. In other words, they are unlikely to sell their shares at any price.

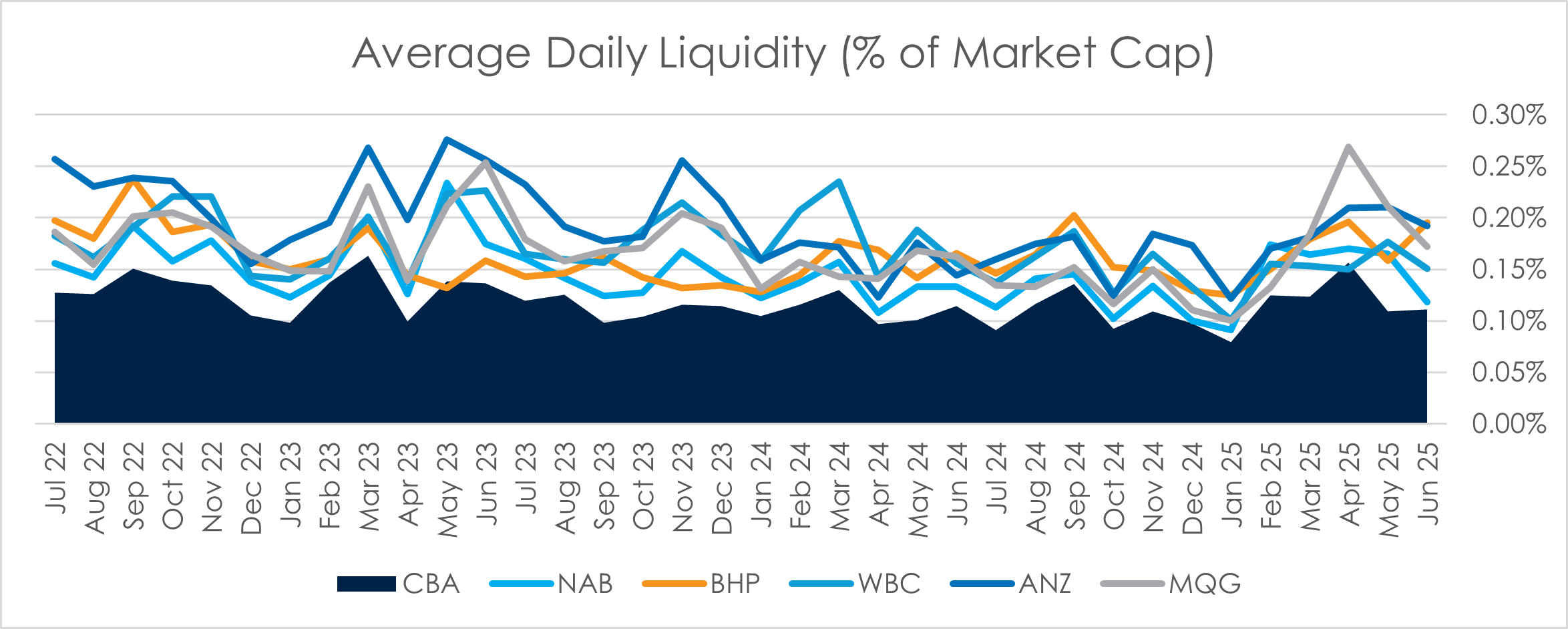

This may be one reason why liquidity (the value of shares traded each day) is consistently lower for CBA than for the other bank stocks, and other large companies listed on the ASX. Often up to half as liquid.

This combination of Retail and Passive effectively reduces the supply of marginal sellers as prices move higher, which can create a mismatch with demand when there is a surge in new buyers.

When a lack of marginal sellers collides with the growth in passive

Passive investing is experiencing a period of secular growth that is well covered elsewhere. Passive represents the purest form of price insensitive investing, where valuations mean nothing and capital is allocated purely based on the size of the company in an index.

Where the growth in passive becomes interesting is when it collides with an extremely tightly held share register, where the effective free float is materially smaller than the weight of money trying to own a fixed dollar exposure.

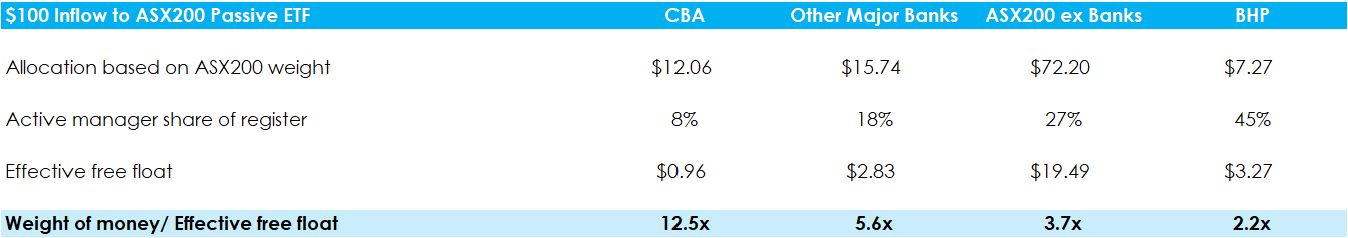

In the table below, we outline how the weight of money impacts CBA and the other major Australian banks, versus BHP and the rest of the ASX200.

Source: Elston, Barrenjoey Research (report not publicly available)

- When $100 flows into an ASX200 ETF, this creates a buy order for $12.06 worth of CBA. However, the lack of marginal sellers and a free-float that may be closer to $1 has the potential to create a dramatic price squeeze.

- Momentum strategies having observed the price is rising then also seek to buy more CBA, amplifying the squeeze.

- Conversely BHP, which has a far larger ownership base of ‘rational’ active investors, is far less sensitive to passive inflows.

We do not believe it is the growth of passive flows alone that is behind the rally in CBA shares.

Rather, it is the combination of passive flows plus a very tightly held register, with the squeeze amplified by Momentum strategies.

The BHP example

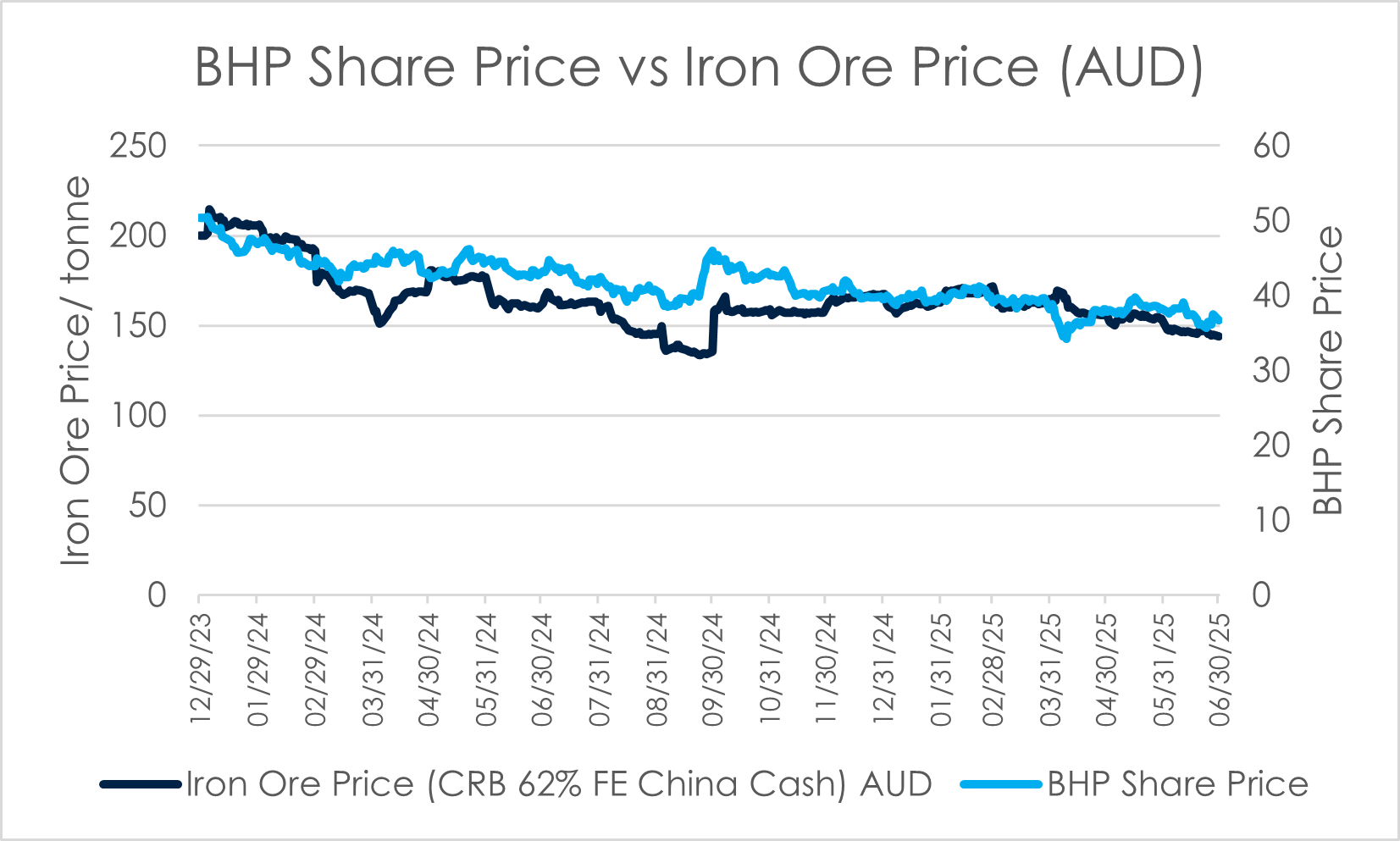

We believe there may be evidence to support our view in the BHP share price. If passive alone was the reason why CBA has been rallying, then BHP, as the second largest share, should also be positively affected. However, this has clearly not been the case, with the share price falling near 20% since December 2023.

As we illustrate above, the shareholder register of BHP is very different to that of CBA, with far greater levels of ownership by price-sensitive active investors. As a result, the stock is far less likely to get ‘pushed-around’ by passive or momentum flows.

Evidence of this is reflected in the share price versus the price of the company’s core export product, Iron Ore. The chart needs little explanation. The share price appears to be clearly trading on fundamentals and the company’s ability to generate profit. Rational price-sensitive investors dominate the register, and appear willing to buy or sell based on fundamentals.

This is in complete contrast to CBA, where the share price has rallied despite little to no change in fundamental operating conditions or the potential for future profit growth.

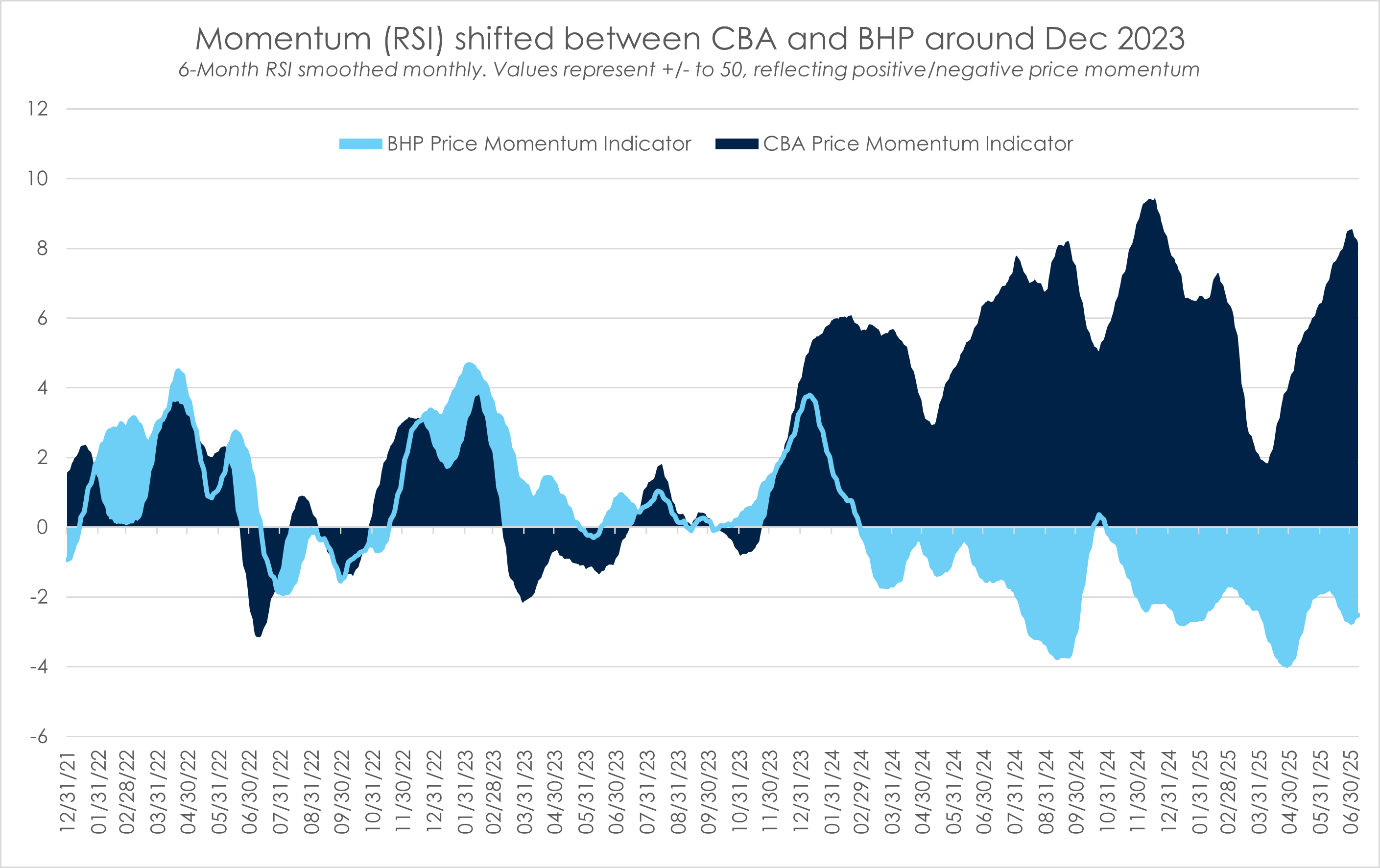

Furthermore, Momentum investors would likely have shown little interest in BHP since December 2023. Price momentum, as measured by a Relative Strength Indicator (RSI), very clearly shows divergent trends in the CBA vs BHP share price from December 2023.

While we caveat that RSI is a fairly basic indicator and simply reflects price momentum, the chart does illustrate clearly the different ‘popularity’ between the two stocks.

Momentum adds fuel to the CBA party

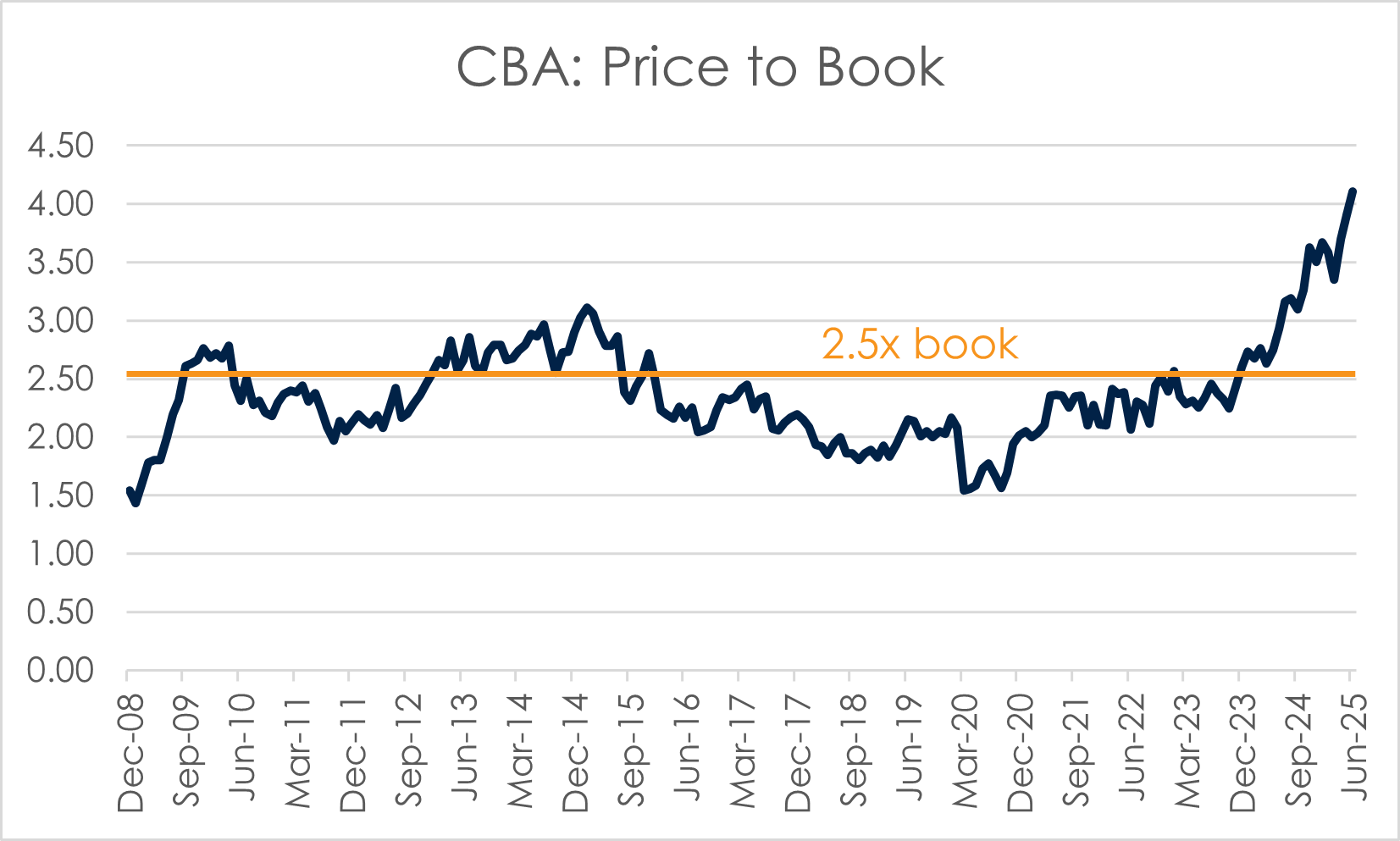

Post GFC the price/book of CBA would rarely be above 2.5x. Arguably, even this price represents a very full valuation relative to other global banks with a similar growth profile, where multiples are often half (or less). However, CBA has always traded as a premium bank, so perhaps 2.5x is close to where rational investors might contemplate owning the shares again.

In contrast, as the CBA valuation moved above 2.5x in December 2023, this is precisely the time when Momentum strategies would likely have just been getting interested.

After understanding the unique structure of the CBA share register, plus the impact of Momentum investors, it starts to make sense why the share price has become so untethered from fundamentals. Something has to give and so far, that thing has been the share price.

As a result, we’d suggest that the valuation air pocket appears genuinely extreme. Should the bubble start hissing... watch out below¹.

Why my mum could help pop the CBA bubble

Buried deep within the 47% of CBA that is held by Retail investors, is my mum. Mum bought her first CBA shares in 1994 at the price of $9.45. In fact, as a true ex-bookeeper she still has the cheque butt filed away. Over the years she bought a few more, but has never sold a single share.

In recent years after reviewing her outsized exposure to Australian banks, we would discuss selling her CBA shares. However, once the maths was tallied and the taxes estimated, it became obvious that the erosion in capital (due to taxes paid) would also materially impair her income. With mum in retirement now and income the primary purpose of the portfolio, we decided we could simply never sell her CBA shares².

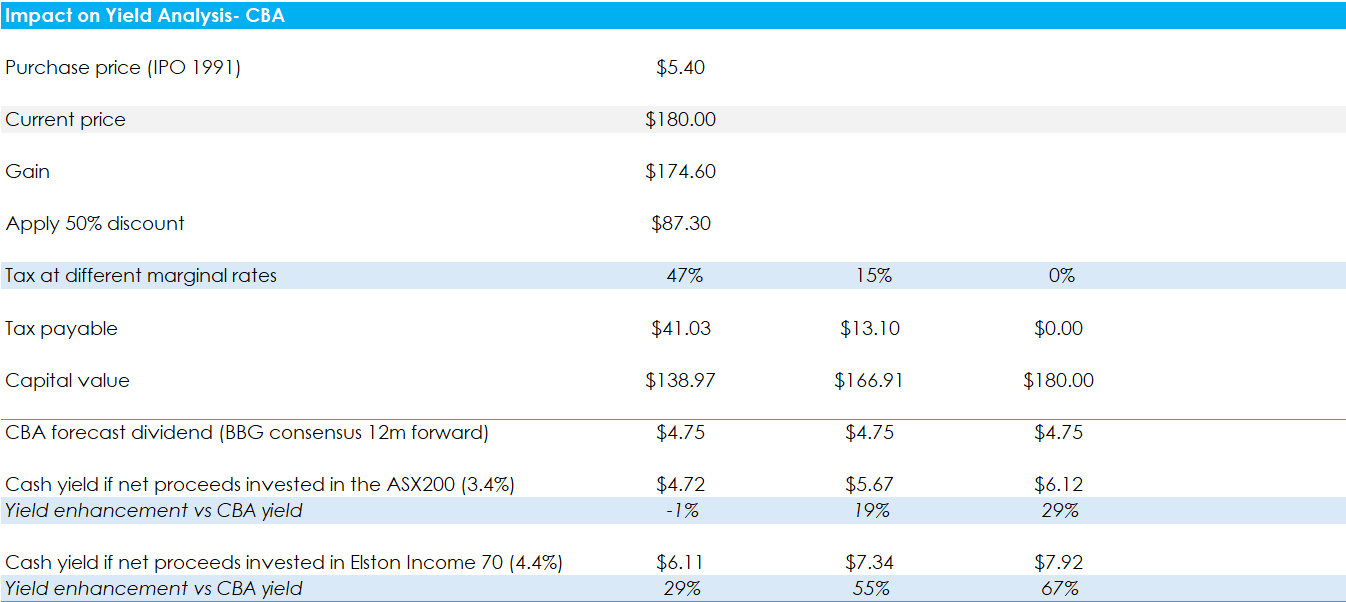

‘Never’ can turn out to not be a very long time. During our most recent chat using current CBA pricing, it became clear that the goalposts have moved. Even assuming:

- the highest possible gain for an investor (bought shares during the IPO in 1991 for $5.40), and;

- applying the highest marginal tax rate (47%);

we estimate that an investor would receive the same income return simply by selling their CBA shares, paying the taxes, and reinvesting the net proceeds into the ASX200. Hence, there is no obvious income disadvantage, instead there is a material diversification advantage resulting from selling one very expensive share and buying a basket of 200 shares.³

Furthermore, for anyone who bought shares later and has a higher entry price than $5.40, or whose marginal tax rate is lower than 47% (particularly investors in Pension), the opportunity to materially enhance yields alongside adding diversification and reducing risk, becomes compelling.

If more Retail investors realise that on a post-tax basis, their cash income may be materially enhanced and their portfolio risk materially reduced (via diversification), then the ‘sticky’ Retail component of CBA’s share register may become far less sticky… introducing a large marginal seller.⁴

"THE EMPEROR IS WEARING NO CLOTHES!", we shout;

"LONG LIVE THE KING!", the crowd retorts;

"Caveat Emptor", we believe.

One marginal seller becomes two

Momentum is a fickle bedfellow. The factor will love you when you are popular but shun you when your stocks are heading south. Should rusted-on Retail investors become more price sensitive at CBA and start selling their longer-term holdings, the change in register dynamics could be dramatic.

One characteristic of Momentum though is that just as it can ignore fundamentals on the way up, it can also ignore fundamentals on the way down. This can drag share prices way below fair value and into oversold territory, areas where Rational investors with a disciplined sense of value can be presented with opportunities.

Whether or not this plays out — and when — remains anyone’s guess for now. But until the price/book ratio falls to something closer to half its current level, my mum will be enjoying the higher yields from across far more diversified exposures. Others may do well to run their own numbers.

¹ This is general market commentary and should not be interpreted as a recommendation to buy or sell CBA or any specific investment

² While this example reflects a specific experience, it is intended solely to illustrate broader investment concepts and does not constitute personal financial advice.

³ This is a hypothetical scenario and does not consider any individual's personal tax position or income needs. Investors should seek advice before making any changes to their portfolio

⁴ This is general market commentary and should not be interpreted as a recommendation to buy or sell CBA or any specific investment

4 topics

2 stocks mentioned