Crypto beyond bitcoin: 3 ways it could change the financial world

For the majority of people, the first thing that comes to mind when they think of crypto is bitcoin.

And bitcoin itself represents a volatile curiosity, a digital gold proxy, and maybe a macro hedge if you squint hard enough (although recent price action would make that vision a little clearer).

And that’s a great place to start, bitcoin is the only crypto asset with real recognition and serious mainstream capital flows behind it.

But beyond bitcoin lies a very deep, experimental and often misunderstood world of thousands of crypto assets.

A lot of it, and I mean a lot of it, is uninvestable garbage.

But there are pieces of genuine financial infrastructure, future financial rails being built and tools, networks and ideas that can, and likely will, matter in the long run.

So let’s dive in.

Layer 1s: Crypto’s application layer

Layer 1s are distinct crypto networks that can facilitate a huge range of functions, including economic activity, gaming and any other digital apps.

Bitcoin itself is a layer 1, but it is expensive and slow and has instead found its place as a secure, decentralised store of value.

Other layer 1s are much more scalable – fast, efficient and cheap to run transactions on.

And as a result, these other solutions have become crypto’s application layers. Digital playgrounds where developers can build financial applications and products from the ground up.

Two you may have heard of:

Ethereum: The original smart contract chain. It’s where most of the crypto developer talent lives and where concepts like DeFi (decentralised finance), NFTs, and DAOs first took off.

Ethereum has real adoption, real fee revenue, and a roadmap toward scalability, though high transaction fees and slower speeds have been a long-running issue.

Solana: The high-speed, low-cost alternative. It’s faster and cheaper than ethereum, making it ideal for high-frequency applications like trading.

It’s also become the go-to chain for memecoin speculation and new app experimentation, for better or worse. And while it had a rocky start with network outages, it’s seen a major comeback.

Ethereum vs Solana

There are plenty of others (Avalanche, Sui, Aptos, etc.) and also a growing number of “Layer 2s” built on top of Ethereum, but that’s a deeper rabbit hole.

For now, just know these platforms are where the bulk of crypto’s apps and use cases live.

Stablecoins

Mostly behind the scenes, stablecoins have become crypto’s killer use case.

Stables are digital tokens pegged to fiat currencies, like the US Dollar (as is the case for USDT, USDC and many more).

They are used to move money quickly across blockchains, as a means of exchange, and as a global method of payment or money transfer.

They can revolutionise the payments world by advancing us beyond the legacy, low-latency infrastructure of the traditional system. No t+2 settlements, no middle office involved, just instant, fast and cheap settlement.

In high-inflation countries, they’re a lifeline, offering a stable alternative to local currencies that lose value daily.

For crypto users, stablecoins are the go-to “unit of account,” a safe harbour to park funds between trades or transactions.

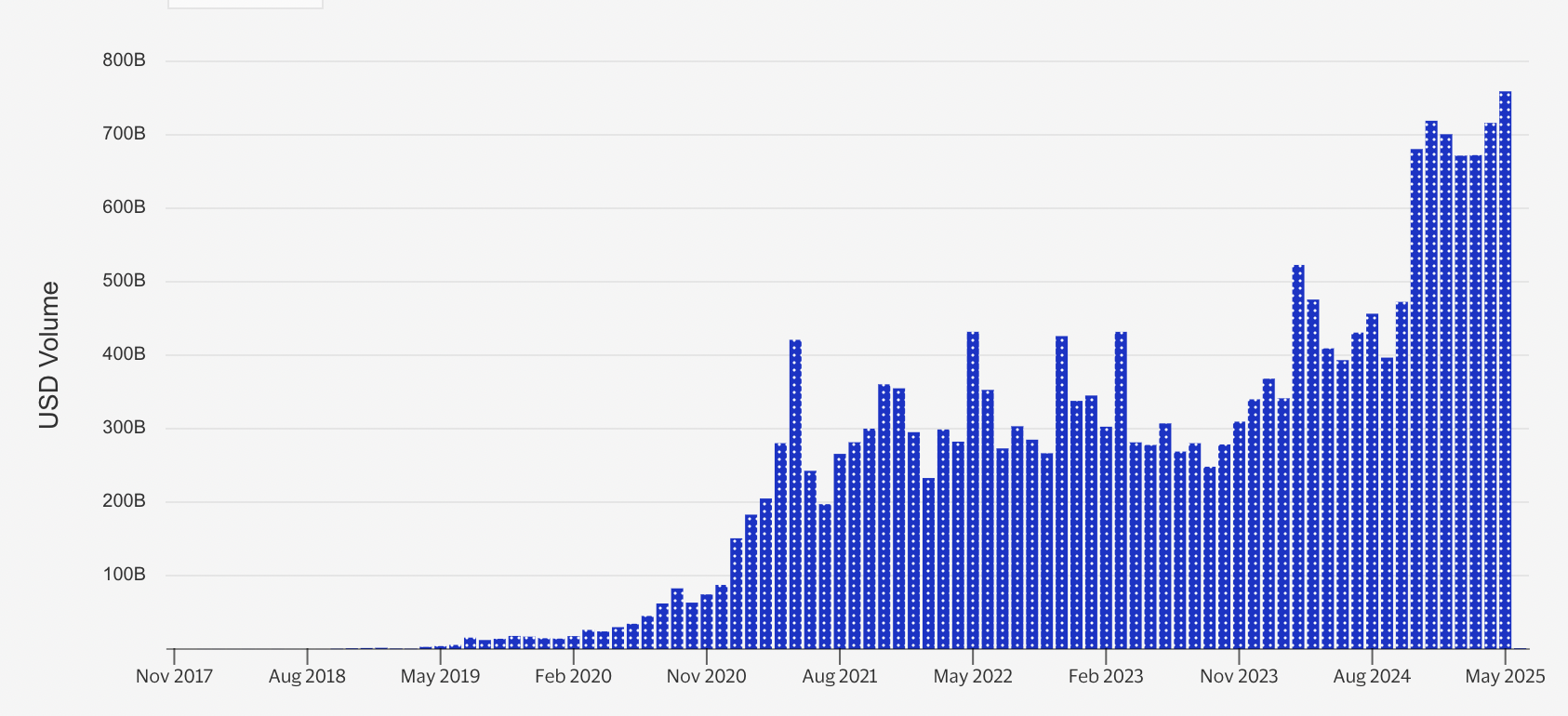

Globally, their transaction volume hit a staggering $27.6 trillion in 2024, outpacing giants like Visa and Mastercard combined.

Stablecoin adoption

Big names are starting to get involved. PayPal's PSYUSD stablecoin is available on Venmo, Stripe lets businesses use USDC for instant payments, and JPMorgan's stablecoin settles bank transactions instantly.

And in the meantime, the US is advancing regulatory frameworks to add robustness to the sector.

Stablecoins are quietly becoming crypto's biggest growth story beyond bitcoin.

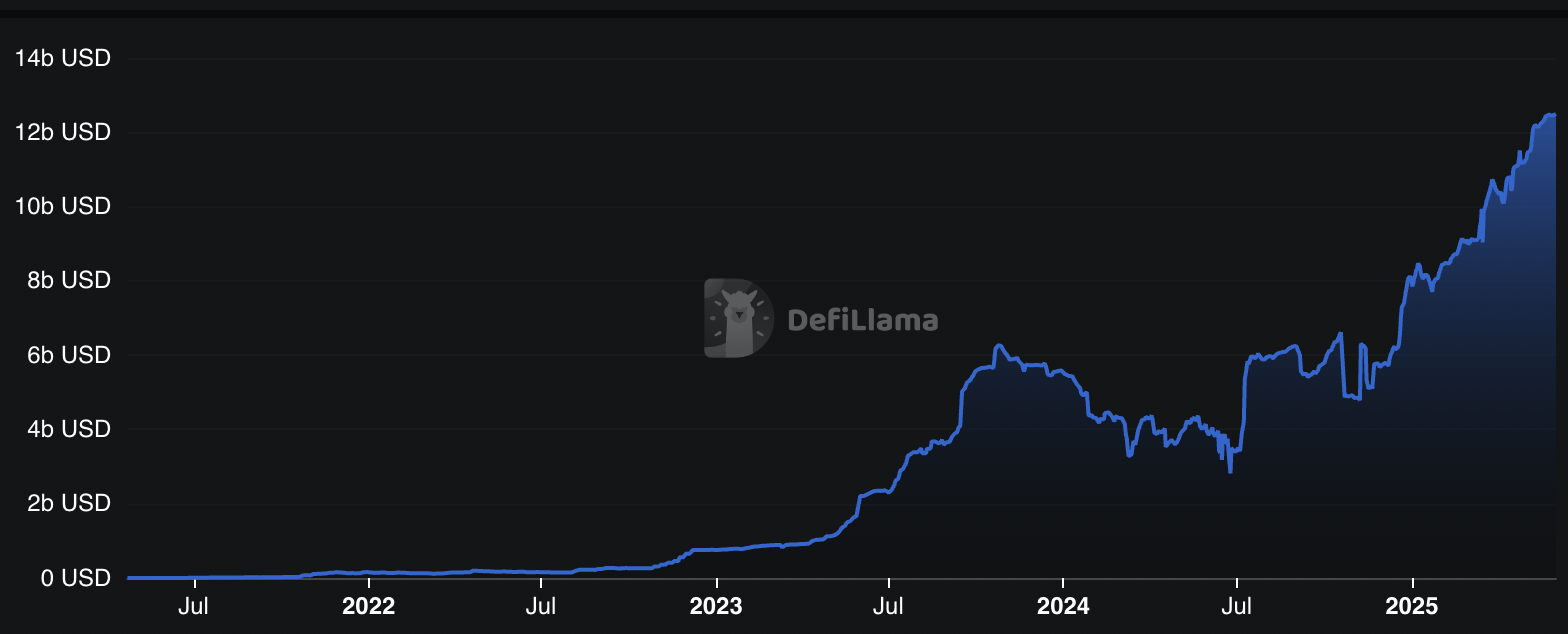

Tokenisation

Another trend gaining momentum, especially in tradfi (traditional finance) circles, is the tokenisation of real-world assets (RWAs).

The idea is simple: bring traditional instruments like bonds, funds, or even real estate on-chain.

Tokenised treasuries, for example, are already seeing traction, offering investors on-chain access to yield-bearing assets.

It’s early, but the potential to merge crypto rails with legacy markets is one of the space’s more compelling long-term plays.

RWA adoption is growing

In summary

Ultimately, bitcoin leads the crypto space, and it probably always will.

But it’s not the only thing worth paying attention to.

Around it, a broader ecosystem is forming, from stablecoins reshaping payments to new networks enabling entirely different use cases.

None of it has reached the scale or clarity of bitcoin yet, but if crypto ever finds its next breakthrough, it’ll come from what’s being built around, and beyond bitcoin.

4 topics