Dear Santos: ‘Non-cash’ was Cash!

‘Bad’ write-downs are characterised by impairments to assets that may be temporary or cyclical in nature. For example, writing down the value of oil reserves due to a drop in the oil price. In theory, there is the potential for these impairments to be reversed in subsequent periods, for example as the oil price recovers. Whilst these types of impairments don’t sound too ‘bad’, there are 2 issues. The first is that impairments are rarely reversed- so if it has been written off then the reality is it is usually gone. The second issue is that impairments reduce the carrying values of assets which in turn reduce future depreciation and amortisation charges. This can inflate the operating profit in subsequent periods and give the impression that the company is doing better than it is.

‘Worse’ write downs occur where there is no hope whatsoever of economic recovery. For example, when an exploration program falls short of expectations and previously capitalised expenses now need to be written off. In our experience, there is the potential for ‘sleight of hand’ in all of this, notwithstanding the increasing focus of auditors.

To term both of these types of impairments as ‘book entries’ is an insult. Cash was spent. The money is gone. It just didn’t happen in this financial period.

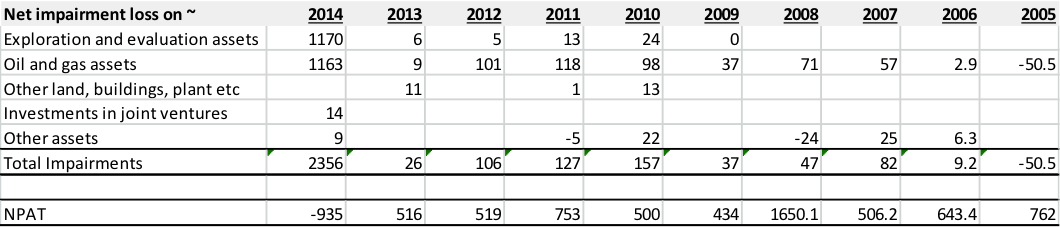

In the case of Santos Limited, their track record has actually been very good for much of the past decade. As the table below highlights, for the 9 years to and including 2013, impairments totalled $541m. This compares well to a cumulative NPAT of $6.3bn including the cost of one-offs. However in 2014, ‘bad’ impairments equalled $1.16bn and ‘worse’ impairments $1.17bn – for a combined total of $2.36bn.

And the outlook is worrisome. In the latest investor presentation, Santos have indicated that their current oil price forecasts or ‘stack’ assumes $US70 in 2016 and US$80/bbl in 2017. If these assumptions were reduced by US$15/bbl , then the entire Santos portfolio would incur a further impairment of $3.4bn.

And whilst management may term this ‘non-cash’ or a ‘book entry’, the reality is that the write-off reflects real money that was really spent!

2 topics

1 stock mentioned

.jpg)

.jpg)