Despite the short-term euphoria, AI is a long-term play (and 2 sectors for patient investors)

A General Purpose Technology (GPT) is a technology with a wide range of applications across different industries and sectors. These technologies have the potential to significantly increase productivity and efficiency, continuously evolve over time, and are likely to be highly disruptive.

Past examples of GPTs include the steam engine, railroads, electricity, electronics, automobiles, computers, modern medicine, and the internet. There have been around 25 GPTs throughout history.

While there is a lot of energy and enthusiasm around Artificial Intelligence right now, Kevin Hebner, a global investment strategist for New York-based EPOCH Investment Partners, sees AI as a long-term opportunity - in line with previous GPTs.

"The experience with previous general purpose technologies (GPTs) like the internet or electricity, is it takes a long time. It takes longer than a decade. So investors will need to have patience".

In the following, Hebner shares his thoughts on how AI is already having an impact, where he sees opportunities within the AI "stack", why people shouldn't just buy the incumbents, and the major risks to the entire opportunity set.

He also shares two major sectors that where AI could have the most profound impacts.

.png)

True or false? AI will be the key driver of equity markets over the next decade.

Yes. Our view is that over the next decade - maybe a bit longer - AI and everything that comes with AI will be the key driver of equity markets.

We're now in the early stages where we're building out the infrastructure, the platform, the picks and shovels - and that's what's been driving the return. At some point, we need to transition to actually producing services that households and businesses find useful. That's still quite a long time away.

You mentioned a decade. A decade sounds like a long time, but the experience with previous general purpose technologies (GPTs) like the internet or electricity, is it takes a long time. It takes longer than a decade. So, investors will need to have patience.

And my sense in meeting with people is people don't seem to be in a really patient mode.

Which sectors have been impacted most so far?

If you look at what has happened so far in terms of where AI is having an impact, there have been two main applications.

1. CODING - A lot of software engineers have used it. Studies suggest that it makes an average coder about 55% faster.

2. MARKETING COPY - We all hate writing marketing copy but that's actually the number one use of generative AI so far. The next areas are things like call centres. That gives you, say, a 15% bump in productivity. A majority of radiologists are using it and that certainly helps productivity.

Where do you see AI having the most impact?

1. HEALTHCARE - The healthcare sector is one place where we hope it has an enormous impact. It's about 20% of GDP, and a similar percentage of employment. There are lots of areas where AI can be used in the healthcare sector. For diagnosis, working with radiologists, drug discovery, and new antibiotics. The problem with the healthcare sector is that it's highly institutionalised. It's very resistant to change.

2. EDUCATION - The second big area is education. A company called Khan Academy is run by a phone named Sal Khan. They have an AI application called Khanmigo, and it's being rolled out to a small number of schools. This is terrific. It enhances the education process and gives every student an AI tutor focused on their needs. And then the role of the teacher changes dramatically where the teacher is more monitoring, supervising, and acting like a conductor.

Broadly speaking, how will the labour market be disrupted?

The starting point is we've previously had 25 GPTs; things like AI, the internet, electricity and so on. In each case, it's increased our productivity, increased our wages, and created lots of new jobs.

I think AI is going to be similar. And so people might worry and say, "Oh my god, if you look at coders, we're going to need fewer coders." No, I think coders are going to be more productive and they're going to be doing lots of things. Or writers, it's not going to reduce the number of writers. Writers are going to be doing lots of things.

OpenAI's Sora application came out on the weekend, focusing on creating animated content. It immediately reduces the cost of producing animation by 99%. So it's going to create challenges for places like Disney and Netflix, but ultimately, we're going to have a lot more animation. So, I think the best way to think about AI is it augments our abilities.

If you are a financial analyst or a portfolio manager - I'm a strategist - it means we can do much more. We're going to be more productive. And if I had twice as many hours as I have now, there are so many more things I'd like to be doing.

So net-net is positive but you want to be working in a role in which AI augments what you do. It helps you do better. And I think that's certainly true for most roles that are creative, white-collar jobs.

When most people think of AI, they think of ChatGPT and Bard (now Gemini), but there is much more to the opportunity. Can you take us through the "stack"?

You can think of the platforms and to some extent, the platforms and cloud providers overlap - so Google (NASDAQ: GOOGL) and Meta (NASDAQ: META), for example. These are interesting companies for investors in the sense that they have very high return on invested capital, great operating margins and generate a pretty enormous amount of free cash flow. In the case of Google and Meta, they're pretty reasonably priced. Microsoft's (NASDAQ: MSFT) a bit more expensive, Amazon's (NASDAQ: AMZN) a bit more expensive than that. But a number of the platform cloud companies, I think are very interesting.

The next layer would be semiconductor companies. So TSMC (NASDAQ: TSM), Samsung and Intel (NASDAQ: INTC). TSMC is by far the leader. It's producing the best returns, invested capital, free cash flow margins. Intel is definitely struggling. They haven't created economic value in over 20 years. And I think if it wasn't for the infusions of cash they're receiving from the government, they'd be in a very difficult position.

Beyond that, we have software companies, design companies like Nvidia (NASDAQ: NVDA), which is super interesting. But the price of Nvidia now assumes that Nvidia will grow earnings by 20% a year for the next 18 years. Other companies have done that - Apple did it, Microsoft did it. But they did it when they were relatively small companies. There's never been an example before where we had a huge firm like Nvidia grow earnings that way. So it's possible but we think it's improbable. I think one would probably want to be careful about Nvidia and you could say similar things about Tesla (NYSE: TSLA) because its price is predicated on it being a vehicle Elon Musk uses to monetize AI and all the data he has either through Tesla X or his satellites. And that seems to me to be a pretty big leap at this point.

You've talked about digital tech featuring a "winner-take-most" dynamic. What does that mean and which companies are best placed to be the winners?

I think that's a key implication. We now see enormous concentration in the stock market, reflecting the economics of digital tech.

Companies must have, upfront, enormous investments in intangible capital, which allows them to lower marginal costs and prices, which is great for consumers. But it does mean that you have to be in big, and you have to be in fast, to lock up the market.

Once you do that, you generate an enormous amount of free cash flow but everybody else loses money.

So, in all levels of the stack, you will have a very small number of winners. For example, on platforms, the maximum you'd have six. Maybe it'd be a smaller number than that. If you think about semiconductors, the design level, you have Nvidia, AMD, but not many more than that. Semiconductor equipment, ASML (NASDAQ: ASML) is doing so well but we only have one ASML. Fabrication, it's TSMC.

The economics of digital tech mean that you need to be big; you need to be fast getting in so that you can get a return on your enormous upfront investments.

And that means there's room for only a small number of winners in each area and those companies get the vast bulk of free cash flow and profits going forward. And that's an integral feature of digital tech and AI.

The natural follow-up question there is, should people just go out and

buy the incumbents? Is there any chance that they're displaced?

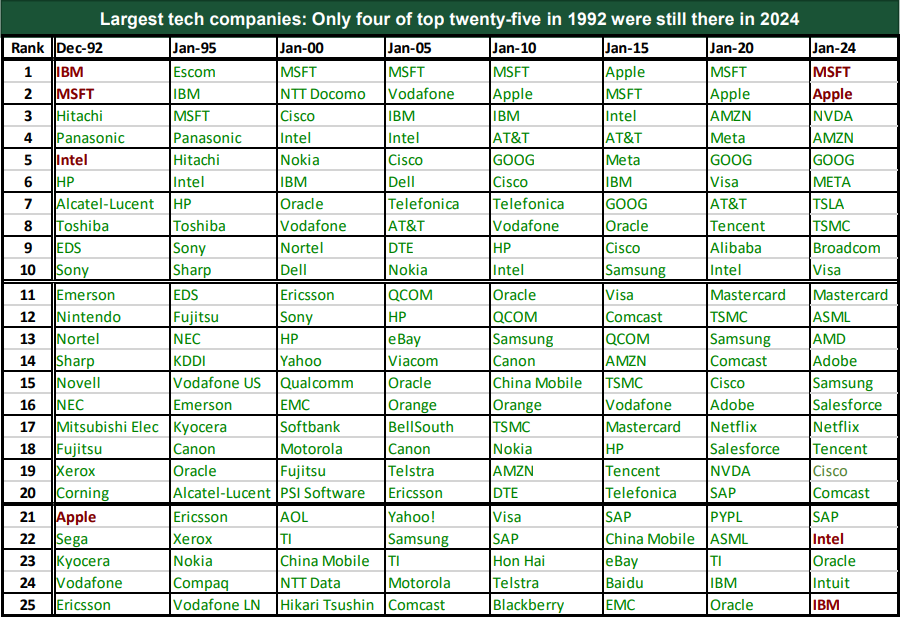

It's always the case that there are titans and then titans rise and titans fall. If you look at the top 25 tech companies, every year, say for the last 30 years, you see a lot of movement.

Microsoft has been consistently near the top, but aside from Microsoft and maybe Apple, there's a lot of movement up and down.

If we think of the top tech companies now, you can be pretty sure that if we're having this conversation in 2030, it's going to be a different mix of companies.

Some of them will fall and often they fall through what we call an innovator's dilemma.

That is, there's a disruptive technology like AI, and they're not able to pivot or adapt to this. This always occurs. So I'm not sure I'd want to predict which of the current titans is most likely to fall from grace, but some will. And then some new companies will come. And maybe it'll be OpenAI - net worth $80 billion. That could well be one of the next titans.

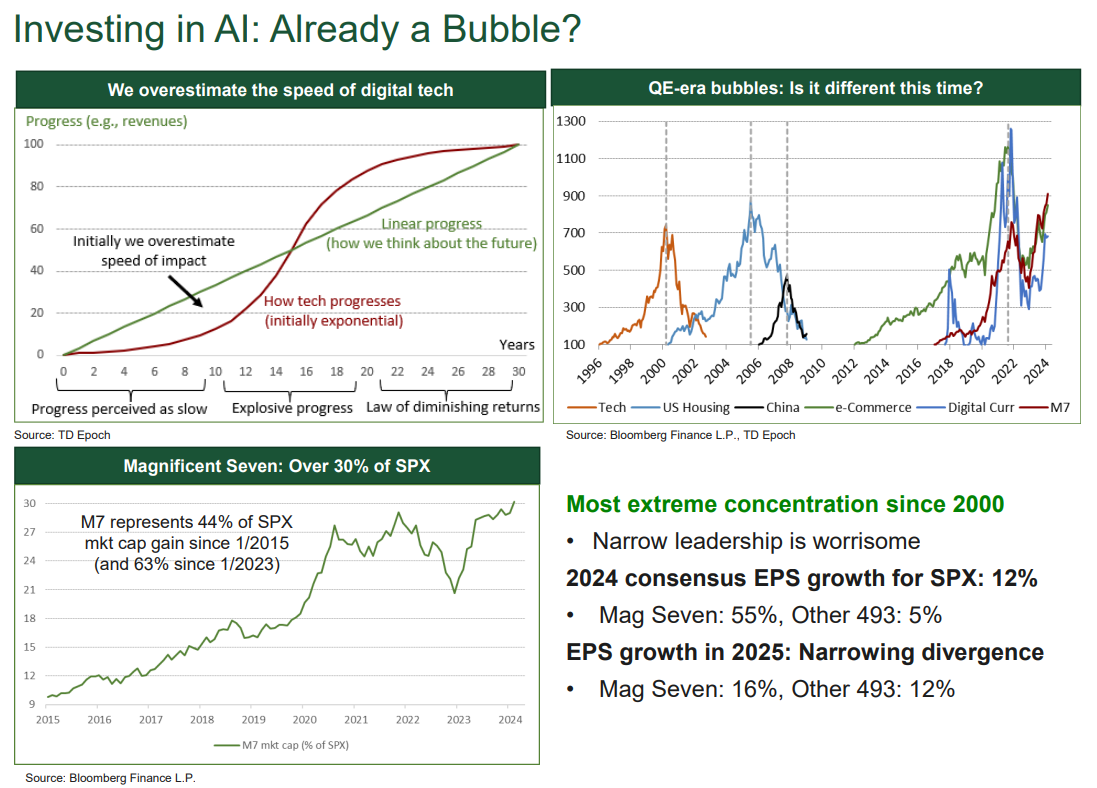

So, I don't think we should just run out and buy them because If you look at the Magnificent Seven now, we think Meta, Google and maybe Microsoft and Amazon, look interesting. Apple, maybe the valuations are stretched for such a big company - we think it's hard to see that earnings growth embedded in their prices will be realised. So I don't think it makes sense just to go out and buy the incumbents, particularly now when there are several reasons to believe that we are in the early stages of an AI bubble.

What's the most interesting application of AI that you've seen in your travels, something that's really stood out?

One unconventional application of AI that I like to talk about is a company called Deere (NASDAQ: DE). It's an agricultural equipment company and it now has more software engineers than it does mechanical engineers. They produce combines that perform numerous tasks; across a field, it'll put seeds in, moisturises, fertilises, de-weeds, and then harvests. It also does this with a satellite GPS, so you actually don't even need a driver.

As the combine is going across the soil, it takes samples and looks at the moisture content and the quality of the soil. Does it need fertiliser? Does it need de-weeding? It's a very interesting case of a traditional company trying to pivot and become an AI company.

What are the biggest risks that you can see in this opportunity? What would make it not work?

I think the risk is that we exaggerate the short-term benefits and we underestimate the long-term benefits.

We're now at the point where the market has become really concentrated, valuations have become stretched, and the commentary from many pundits is quite euphoric. It feels like the 1990s.

I think the risk is that we get a bit too far over our skis.

We're seeing right now great returns in cash flow from the companies but it's all being driven as we build out the infrastructure, we build up the picks and shovels, but then we have to cross this chasm to where we're producing killer apps, services that are useful for households and businesses. And we've got some isolated examples but we don't really have enough to move the needle.

I think it's important that investors realise they will have to be patient because this is not a process that plays out over a couple of quarters or even a couple of years. It's going to take decades to play out.

It does feel like right now, we are getting to the point where too much is being priced into quite a few names, and I don't think it's going to happen this year because growth expectations are so strong, and they look like they're delivered. But on the 12 to 18-month view, I think the chance of a reassessment and pullback is pretty important... and certainly, not on the scale we saw in 2000 and 2001, but something meaningful.

Learn more about Epoch Investment Partners here.

2 topics

10 stocks mentioned

2 funds mentioned

1 contributor mentioned