Does Omicron quarantine the recovery in travel stocks?

Wilsons Advisory

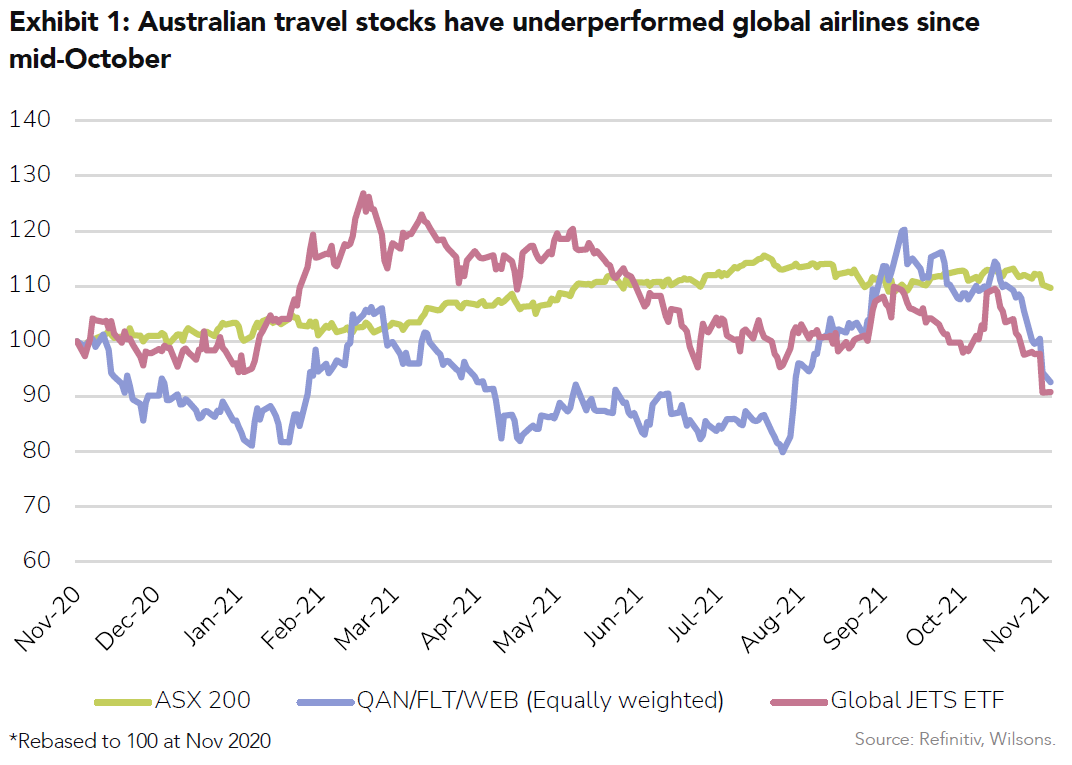

Australian travel stocks have been beaten up over the past month over concerns around the pace of reopening and rising energy prices. The emergence of COVID variant Omicron as a potential threat to the travel recovery over the past week has taken the retreat in travel stocks to around 20% since mid-October.

At this stage, it’s difficult to be too definitive around the ultimate impacts of Omicron on economies and economic reopening until more data is available - likely mid-December. As a result, travel-related stocks will remain price sensitive to news flow surrounding the Omicron threat.

Our positive thesis on QANTAS (ASX:QAN) is based not so much around the international border reopening, but on domestic activity resuming.

This is in contrast to travel peers Corporate Travel (CTD), Flight Centre (FLT), and Webjet (WEB) where the real value they create for clients is primarily attached to more complex forms of travel like overseas travel.

Whilst the recovery in travel will take some time, we outline how QAN can get back to earning >80% of pre-COVID earnings without any contribution from the international business.

QAN domestic and Loyalty are the key generators of income for the airline and are likely to remain so. If the international business were to reach QAN's internal targets post COVID it would present >20% upside to consensus numbers in 2024/25. We continue to see the medium to long-term risk/reward of QAN skewed 2:1 to the upside.

Performance of Australian Travel Stocks

Travel stocks are now trading at similar share price levels as 12 months ago when news broke of effective vaccines.

After rallying through much of 2021 on reopening optimism, travel stocks have fallen back by ~20% since mid-October. We suggest several reasons behind the recent weakness:

- Prospects of northern hemisphere winter and the potential for re-emergence of travel restrictions

- Higher energy prices impacting airline stocks.

- Stalling of vaccination rates, with an emerging push for vaccination boosters

- The slow pace of borders reopening domestically, but also into popular international destinations like Asia and NZ

Since mid-October, the underperformance of Australian travel stocks vs the US Global Jets EFT (JETS.US) - a collection of global airlines - looks like an anomaly in our view, given the likelihood of further border reopening in Australia in the coming months.

Travel Agents are Overweight International Travel

Since the equity market bottomed in March 2020 investors have lumped travel stocks into a single basket with a similar performance, bar Corporate Travel (CTD) which has outperformed considerably following a large acquisition. Over the past six months the performance between all four travel stocks has been similar.

As the recovery emerges, share prices are going to show greater divergence as the actual recovery takes place at different speeds, impacting each company differently.

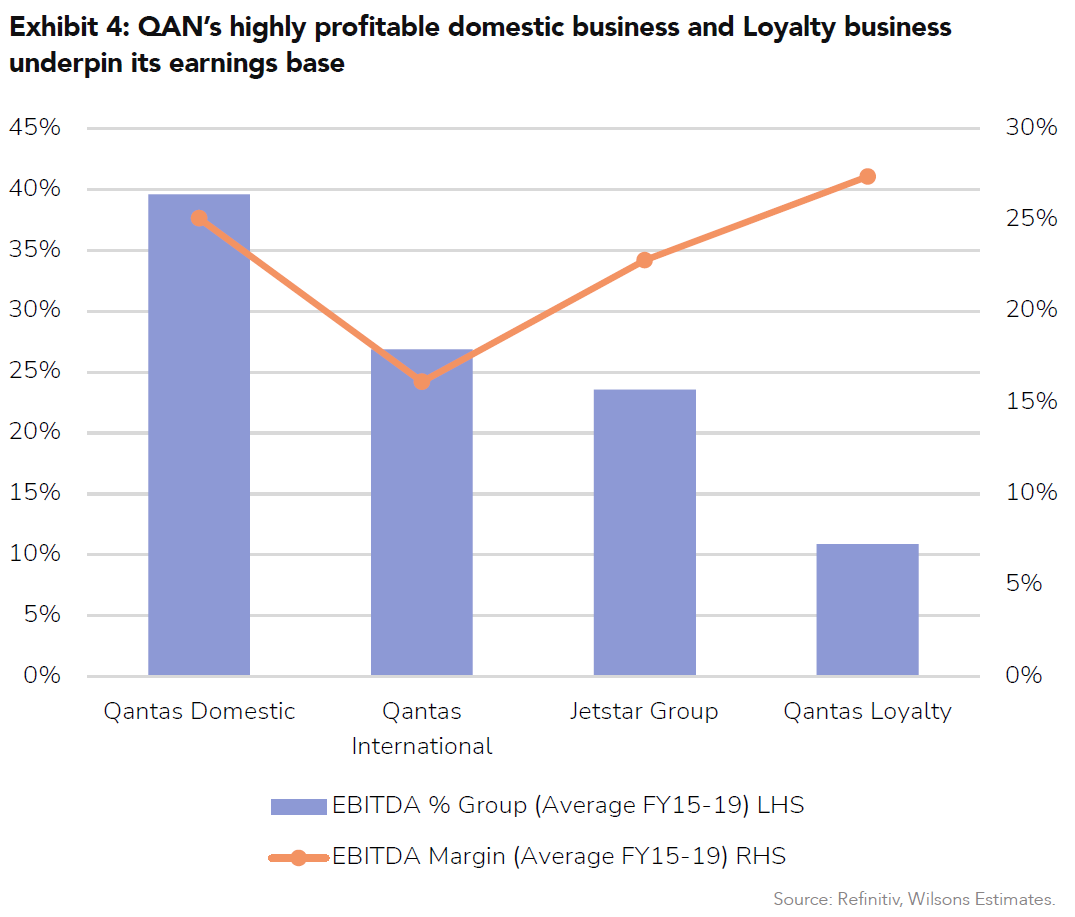

We see QAN as being differentiated from the travel agent stocks for the simple reason that QAN can return to profit-ability without the need for international borders to open. We estimate that >70% of the QAN profitability is derived from domestic activities. This is important as we see the domestic pathway for reopening as being clearer, nearer and without the complications that international travel is likely to contain well into 2022.

Travel agents earn most of their income from international travel, which has a higher degree of complexity in terms of booking (i.e. travel which is multi-destination, multi-modal, and or an all-inclusive package). We see this style of travel as taking longer to return to normal than simple domestic aviation. The likely reopening of the QLD border in December 2021 will open up the highly profitable ‘gold triangle’ of the Brisbane, Sydney, Melbourne corridor for QAN.

In contrast, we estimate more than 80% of travel agent revenue is linked to high complexity/international travel.

Earnings can Recover but will EPS?

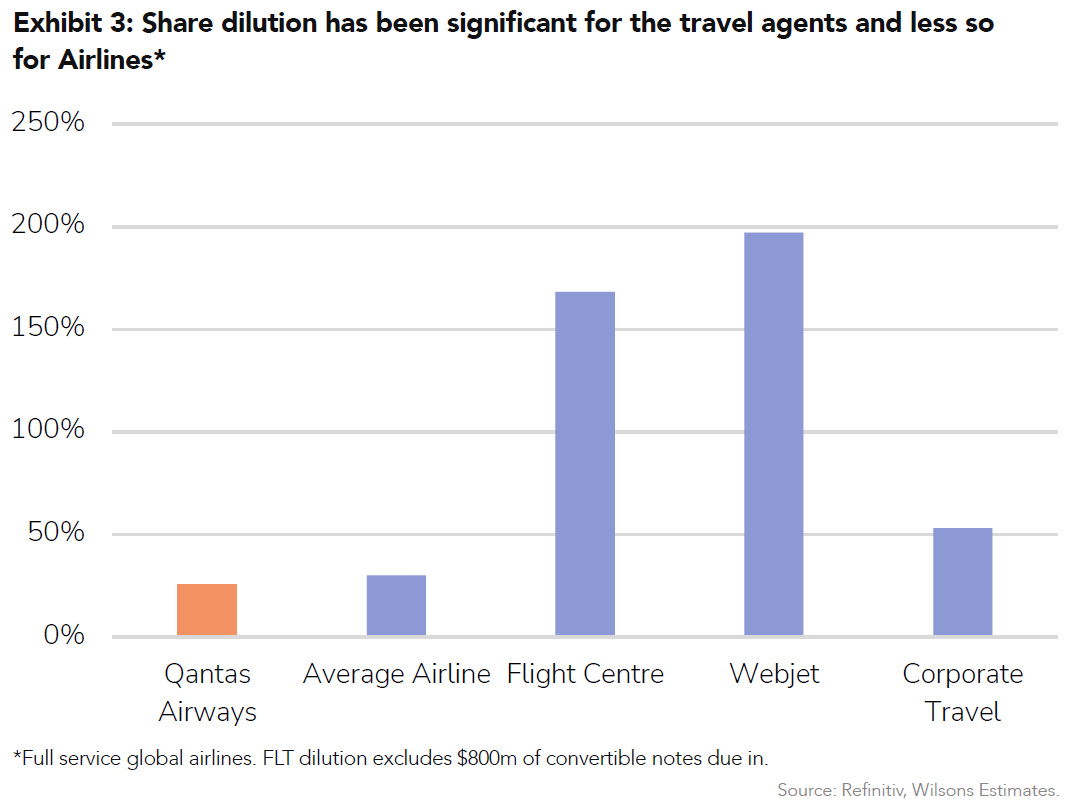

To date, the market has not differentiated on the ability of travel stocks to return to pre-COVID levels of earnings-per-share (EPS). We see this as short-sighted given the significant dilution both Flight Centre (FLT) and Webjet (WEB) have undertaken to survive.

For FLT, the dilution could be significantly higher than what we show, depending on what price the $800m of convertible notes are converted into equity. For QAN, the share dilution is just 26%. We can see a pathway to where QAN is generating enough free cash flow (FCF) to consider a share buy-back. Between 2009-2019 QAN bought back over 30% of its outstanding shares. We expect QAN will look to do the same once earnings normalise.

QAN Divisional Earnings

We expect the domestic aviation business to continue to be the core earnings driver for QAN into the recovery. With >70% market share, generating a 25% margin, the premium domestic business is strong and has proven itself to have the ability to withstand concerted attempts of new competition. Normalised profitability is likely to be higher with a scaled-down Virgin Australia (ASX:VAH) (post private equity ownership) and with a manage-for-profit pricing mentality.

Jetstar is the fast-growing low-cost airline wholly owned by QAN. Pre-COVID, Jetstar represented almost 25% of group earnings. Post-COVID, the earnings prospects are unlikely to have been diminished.

Combined with the Loyalty business, we estimate these three businesses can return QAN earnings to around 80% of pre-COVID levels.

QANTAS International - COVID Presents a Pathway to Reset

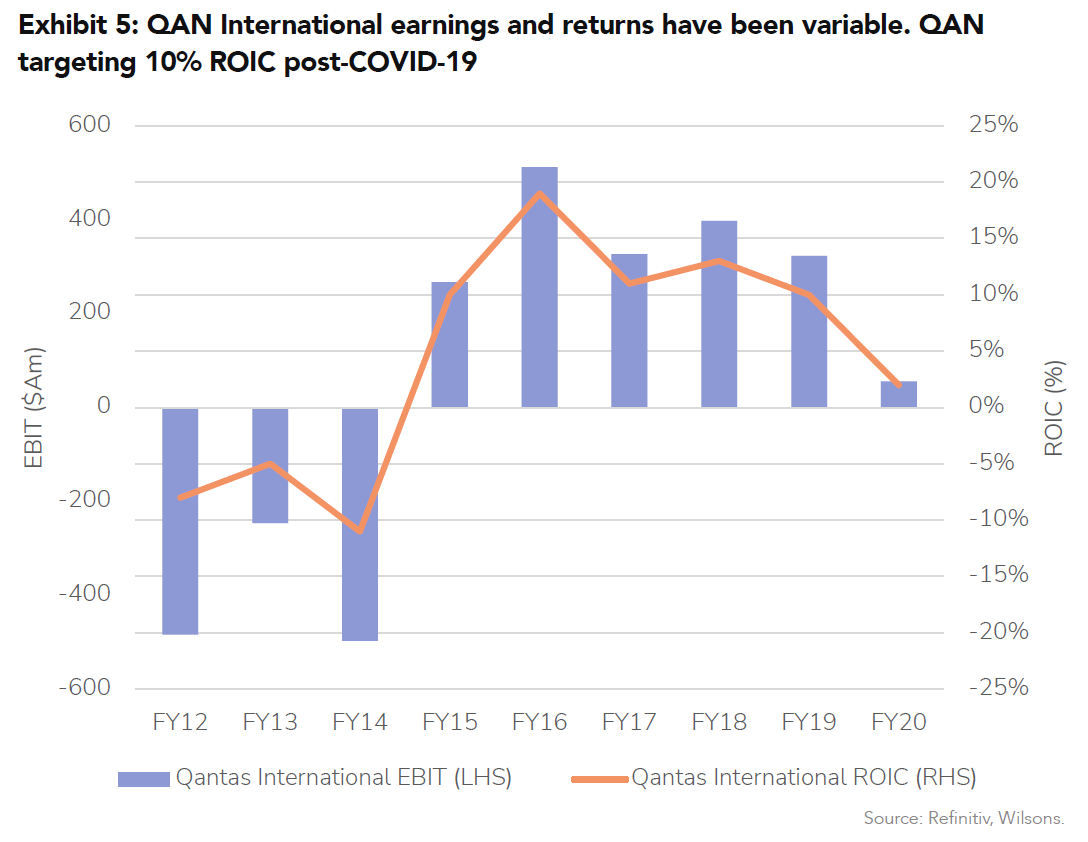

QAN runs a premium international airline. Full-service international long-haul businesses typically destroy capital. This is a function of government-owned airlines with ultra-low-cost of capital.

QAN is using the lull in international travel to reset the cost and capital base (fewer planes) of the international division. Removing unprofitable routes and scaling down some of the international operations will decrease revenue, but have a much smaller impact on overall profitability.

Partnerships, rather than ownerships of planes, will ensure an end-to-end customer experience. QAN is targeting a 10% return on capital by FY24.

Valuation

Historically QAN has traded at a ~25% discount to its full-service Asian and US full-service airline peers (both EV/EBITDA and PER). QAN’s track record on capital discipline, high margin domestic business, and Loyalty are overlooked, with QAN’s relatively small scale and long-haul aspect ultimately counting against it in the view of investors.

At present, QAN’s relative pricing is not too different to history. Investors are paying around the long-term average on an FY23E basis (i.e. a ‘normalised’ year of earnings) at 4-5x EV/EBITDA or 10x PER. In the absence of a global airline re-rate, share price upside resides primarily through earnings recovery.

QAN valuation sensitivity

The investment appeal of QAN is that future normalised earnings could be considerably higher than pre-COVID earnings by FY24/25E – which would present considerable upside to market estimates.

Bull case

Assumes a faster recovery from COVID-19. In FY23, domestic revenue is higher than in FY19, but international revenue will still be lower. Profit margins expand further than consensus is expecting after a successful cost-out program and less competition.

Base case

Our base case assumes a slower recovery in passenger demand, in line with what we have seen globally. In FY23, domestic revenue equals FY19 levels, and international capacity is down by 40% compared to FY19. Profit margins are expected to improve after the cost-out program and less competition.

Bear case

Assumes a significant delay to travel restrictions being lifted, potentially from the Omicron variant. Travel demand declines for both the corporate and leisure markets leading to a longer recovery profile. Fuel costs increase, and profit margins do not increase as much as expectations – the cost-out program is relatively ineffective.

The >$400m pa of earrings is valued by the mark on QAN group multiple.

QAN Loyalty: cash generative growth business

QAN Loyalty or Frequent Flyer rewards program is the largest customer reward program in the country with >12m members, capable of generating >$1.6bn in revenue per year.

Loyalty business is not only highly strategic for QAN, but is extremely valuable generating ~15% QAN earnings in normalised periods. Importantly, the Loyalty earnings are somewhat immune from the aviation cycle, providing QAN with a counter cyclical earnings stream. In 2021, Loyalty was the only division to generate income.

The Loyalty business generates most of its income by selling frequent flyer points to partner providers (>650 companies) which are incorporated into their own reward programs. QAN sells these points at a margin above costs.

Over the years, QAN has looked at alternative ownership structures for the Loyalty business. The >$400m pa of earrings is valued by the mark on QAN group multiple. Loyalty as a standalone could attract an earnings multiple double that of the airline business given its growth profile and highly cash generative nature irrespective of the economic cycle.

With listed loyalty programs now largely owned by investment firms or financial sponsors, valuation reference points are more challenging. We see QAN Loyalty was being an integral part of QAN earnings going forward.

Realise your ambition

At Wilsons, we think differently and delve deeper to uncover a broad range of interesting investment opportunities for our clients. Stay up to date with all my Australian Equity insights by hitting the follow button below.

5 stocks mentioned

John Lockton joined Wilsons in 2010 as Senior Investment Strategist and has more than 20 years’ experience in investment markets. His primary areas of focus are equity strategy, security analysis and portfolio management. John is the Head of...

Expertise

John Lockton joined Wilsons in 2010 as Senior Investment Strategist and has more than 20 years’ experience in investment markets. His primary areas of focus are equity strategy, security analysis and portfolio management. John is the Head of...