Don't miss the ASX Investor Days - there's something for everyone

Livewire has once again partnered with the ASX for its latest round of Investor Days, the first of which was held in Brisbane last weekend at the Brisbane Convention and Exhibition Centre.

Upcoming events will be held in Melbourne this weekend, Saturday the 24th, and Sydney the following weekend, Saturday 31st, at the Grand Hyatt Melbourne and the Hilton Sydney, respectively.

(Don't miss the discount code at the bottom of this wire if you're interested in attending the Melbourne or Sydney events).

As always, the ASX has put together a stellar lineup of economists, fund managers and product specialists to help navigate the current market volatility.

If you haven’t attended an ASX investor day before, I cannot recommend them highly enough. There is something for everyone, from beginner to advanced, and not only do you get to hear from the experts but also interact with them during the Q&A sessions and at the stalls outside the auditorium.

Welcome and economic update from Gemma Dale – nabtrade

The event kicks off at 9:30 am with an introduction from the ASX, before the always entertaining Gemma Dale provides an economic update… and there’s plenty to unpack at the moment.

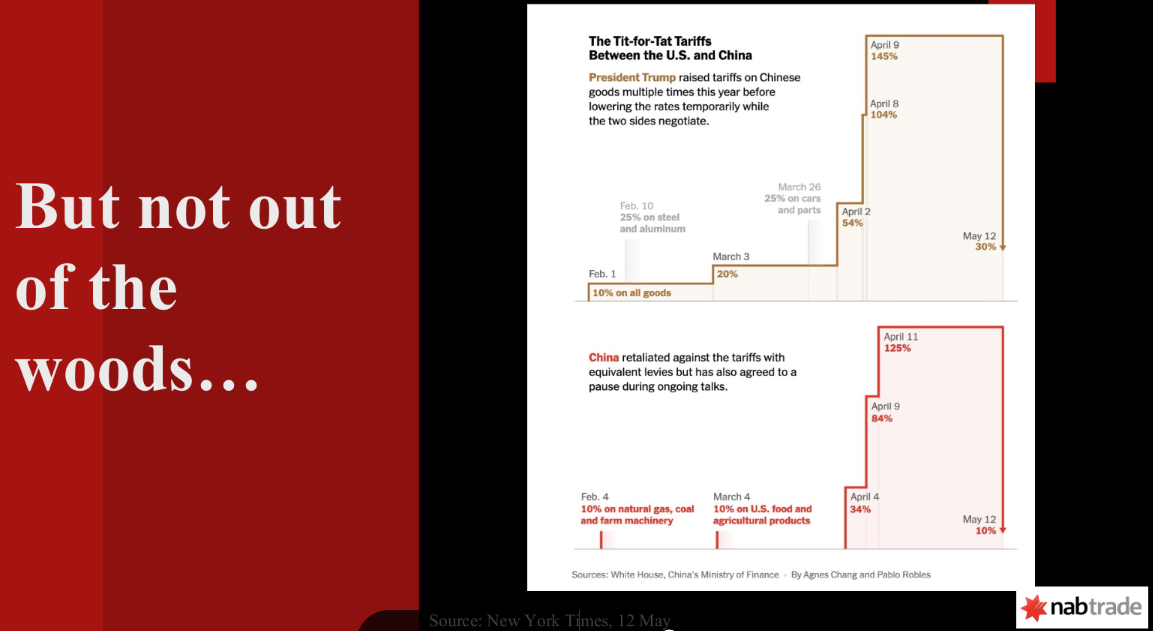

She takes us through what’s working (it’s not all doom and gloom) and not working in the global economy, and explains why, despite recent events and the market rally, we’re not out of the woods yet.

Perhaps the highlight of Gemma’s presentation (being a racing fan) was her opening analogy about economics (and forgive me, I’m paraphrasing);

Economics is like an F1 race… most of the time, it's cars going around in a circle, following each other, powered by a large amount of technical (and actual) horsepower.

Every now and then, however, a lot of action arrives suddenly – an overtake, a pitstop gone awry, or a crash as all the cars pile into turn 1. No points for guessing where we are right now.

Hunting for opportunity in an uncertain world - panel

Next up, I hosted global fund managers Antipodes, Munro and Plato to discuss navigating the current market environment.

For the Brisbane instalment, Vihari Ross (Antipodes), James Tsinidis (Munro) and Dr David Allen (Plato) did a cracking job of setting the scene, unpacking the key drivers for markets now and into the future, and highlighting how their investment philosophy helps them navigate the volatility.

Where the session really took off, however, was when the guests shared which parts of the market they are liking (and not liking), as well as the bull case on a handful of stocks in their portfolios – including some you might find surprising.

Audience participation for this session was off the charts, with more questions submitted than we could answer (sorry to those we didn’t get to!).

Morning tea and breakout sessions

Morning tea was served at 11 am and was delicious and plentiful (the only problem you will have on the day is not overeating, given how well these events are catered), before the breakout sessions kicked off.

Attendees have two options – the gold room or the green room – depending on their level of experience and interest.

Finding value in an expensive market – Global X

I stayed in the gold room to hear Global X Senior Product and Investment Strategist Marc Jocum deliver a talk on finding value in an expensive market.

The thrust of Jocum’s talk was about paying the right price in the current environment, where valuations are stretched, whilst not compromising on quality, and – with the power of some cool data and charts – he provided an excellent review of the big picture and long-term themes that investors should always be mindful of.

He then focused on the Global X S&P World ex Australia GARP ETF (ASX:GARP) , which, as the name suggests, employs a growth at a reasonable price (GARP) methodology. Jocum highlights that GARP is typically defensive in drawdown periods, whilst also solid in recoveries.

The ETF focuses on paying a reasonable price for growth-oriented companies in developed markets that have solid earnings and revenue, with high ROE and low debt.

Worried about putting all your eggs in one basket? – Fidelity

Staying in the gold room, next up was Fidelity’s Head of Wholesale Sales, Lauren Jackson, who talked about the opportunity in mid-caps.

It was a timely address, given the strong concentration in the Magnificent 7 in the US and in our banks and miners, and it highlighted the wealth of high-quality opportunities sitting right under the often overcrowded, mega-cap names that get most of the headlines.

Once again, packed with intriguing data and insights, a few really stood out;

- Mid-cap does not mean new entrants or young companies – the average age of a mid-cap is 28 years; these are companies that have seen multiple economic and business cycles

- The market cap of global mid-caps is US$16 trillion – to put into perspective the size of the pool you can fish in, the total market cap of the entire ASX is around $3 trillion, according to Jackson

Moneyball, The Big Short and overcoming the flaws in human judgment – VanEck

After a very satisfying lunch, I moved to the green room to hear from VanEck’s Cameron McCormack.

McCormack delivered a compelling and insightful session, drawing inspiration from Moneyball (a book written by Michael Lewis and turned into a movie starring Brad Pitt) to highlight how data-driven decision-making can challenge conventional wisdom - both in baseball and investing.

McCormack used the story of the 2002 Oakland A’s to explain how systematic, rules-based approaches can outperform traditional methods that are often swayed by bias and emotion.

Transitioning to the world of investing, he outlined how human judgment is prone to noise and cognitive bias, citing academic research and market studies to back the case for quantitative models. He introduced VanEck’s Australian Long Short Complex ETF (ASX: ALFA), designed to capture signals of outperformance while shorting potential underperformers, based on factors like return on equity, inventory turnover, and macroeconomic indicators.

With practical insights into market dispersion, factor-based strategies, and smart beta investing, McCormack demonstrated how innovation in data and computing power is reshaping portfolio construction. His session was not only educational but energising, showing how modern tools can unlock new opportunities for Australian investors.

The art of adaptation: strategies to thrive amid volatility – Schroders

Next up, it was back to the gold room to hear from Schroders' Head of Multi-Asset and Fixed Income, Sebastian Mullins.

Mullins delivered a cracking presentation, offering attendees a clear-eyed, engaging view of today’s complex global economic and market environment. Kicking off with a strong U.S. economic backdrop – robust GDP growth, healthy wage gains, and confident consumer spending – Mullins illustrated how these tailwinds have recently been challenged by political shocks, particularly escalating tariffs under Trump.

Mullins outlined the rapid rise in economic uncertainty and collapsing CEO confidence as key risks to growth. He made a compelling case that while recession risks have eased due to a rollback of some tariff measures, the U.S. remains vulnerable due to limited fiscal and monetary firepower in a stagflationary setting.

In contrast, regions like Europe, China, and Australia are better positioned, with more scope for stimulus and stronger household or government balance sheets. Importantly, Mullins highlighted that while U.S. equities appear expensive, short-term rebounds are likely due to overly bearish positioning.

His insights into global policy dynamics, equity valuations, and the evolving China story (including a major shift in private sector policy) were both accessible and thought-provoking. This was a timely, intelligent session – the kind of practical macro perspective that makes ASX Investor Day unmissable for anyone managing their own money.

Top investment ideas in 2025

Following afternoon tea, everyone was back in the main room to hear from Wilson Asset Management’s Nick Healy and Janus Henderson’s Jonathon Costello, who shared their top investment ideas in 2025.

Healy talked about how WAM Global is navigating volatile markets with a clear, disciplined approach. He outlined the fund’s strategy of investing behind enduring, long-term themes while remaining opportunistic during periods of market dislocation.

He highlighted exchange operators like CME, ICE, Tradeweb, and MarketAxess as high-quality, all-weather stocks benefiting from increased market uncertainty. Artificial intelligence remains a core theme, with holdings in Intuit, SAP, Quanta, and Alphabet (Google) selected for their long-term potential and disciplined valuations.

Healy also shared recent additions made during market weakness, including Hemnet, Sweden’s dominant real estate platform, and IDEXX, a global leader in veterinary diagnostics riding the “humanisation of pets” trend.

Costello’s session was a real eye-opener - who knew you could invest in Australian universities? Through the Janus Henderson Sustainable Credit Fund, Costello showed how fixed income investments can offer both strong returns and real-world impact.

The standout idea was the opportunity to lend to top-rated Australian universities via sustainable bonds, offering yields of 4.7–5% while supporting education, employment outcomes, and climate initiatives.

He walked us through the credit landscape, highlighting how active management can extract more yield from low-risk issuers, like Deakin University and University of Technology Sydney, than even the major banks. These institutions boast solid credit ratings, strong social outcomes (like 90% graduate employability), and sustainability initiatives from solar panels to mental health programs.

The session was rounded out with both Healy and Costello joining the ASX’s Jacinta Schlosser for a discussion about how they are navigating markets, plus a healthy dose of audience questions.

Buy, Hold, Sell - Bell Direct

Rounding out the day was a high-energy session from Bell Direct’s Grady Wulff, who hosted the well-known fan favourite Buy, Hold, Sell—but with a twist. Audience members were able to actively participate, pitting their stock-picking skills against Wulff, before the host analysed a handful of stocks.

The final word

Having been to a handful of ASX Investor Days over the journey, the highlight for me nowadays is the audience participation and the ability for investors to interact and ask questions of the professionals.

Financial market coverage is usually one-way traffic, so being able to be in the room, for both managers and attendees alike, is a fantastic change of pace. Well done to the ASX for putting on another extremely well-constructed event. If you’re thinking of coming along in Melbourne or Sydney, please take advantage of the special offer below – and don’t be afraid to come up to me and say hello. I look forward to seeing you there!

SPECIAL OFFER

For any Livewire readers wishing to purchase a ticket to the Sydney event this weekend, you can do so via this link – make sure to use code LWMAY for a 20% discount.

Please note that the Investor Day series is being held in partnership with the ASX Refinitiv Charity Foundation, with all ticket sales going towards a range of Children's Disability and Medical Research Charities.

3 topics

2 stocks mentioned

2 funds mentioned

7 contributors mentioned