Don’t overpay for value

Value investing, like bargain hunting, is about buying companies that appear to be cheaper than they are worth. This often means buying companies that are out of favour with investors. In some cases, these companies may have been oversold and investors can make great returns when they return to their intrinsic value. The danger is that sometimes the market’s pessimism is justified due to poor financial prospects or poor management. These stocks can become ‘value’ traps and avoiding them is important, but there are a few methods savvy investors utilise to avoid them.

Value investing history

First, it’s worthwhile understanding how the ‘value’ of a company is measured. Common valuation metrics, such as earnings or price-to-book value ratios have traditionally been used to measure value. Those with low metrics are considered ‘value’.

The concept of value was developed by economists Benjamin Graham and David Dodd in the 1920s. Their book Security Analysis (1934) and Graham’s later book The Intelligent Investor (1949) introduced investors’ methods that could be used to identify ‘value’.’

Graham and Dodd believed that the true value of a stock could be determined based on its assets, future earnings, dividends and prospects. The lower the price of the security relative to this intrinsic value, the higher the ‘margin of safety’. Graham and Dodd developed value investing - a methodology to identify and buy securities priced well below their intrinsic value. Behind this concept of value investing is the belief that “cheaply” valued assets tend to outperform more expensive stocks over a long horizon.

Over the very long term this has proven to be true. One of the world’s most successful investors, Warren E. Buffett, got an A+ from Ben Graham at Columbia in 1951, and he has made his fortune since using the principles of Graham and Dodd's as the CEO and shareholder in Berkshire Hathaway Inc. Buffett has made a career identifying value when others have been selling. Key to his success has been identifying real value stocks and avoiding the cheap and nasty. A low price alone does not indicate good value, and those who pursue low price alone can easily fall into ‘value traps,’ or “trying to catch a falling knife”. The possibility of these ‘value traps’ means investors have to consider beyond traditional ‘value’.

Looking beyond income

Earnings stability and dividends were two of the seven fundamental measures Graham cited in The Intelligent Investor when assessing a company’s value. This led to many value investors to look at these backward measures to determine future value. However, value investors should consider what a company’s potential is, so forward earnings may be a better guide.

The use of forward earnings estimates can help mitigate the potential for investing in “value traps”, those companies whose valuation might appear favourable, but where earnings growth is low or even negative, causing book value to stagnate.

Reducing the reliance to price-to-book

According to a paper written by MSCI in 20151, a big part of the value underperformance is the mis-definition of value by relying on price-to-book in a world where intangibles are increasingly important. To overcome this many value managers now place greater emphasis on enterprise value, a measure of the company’s total value (typically based on debt plus equity market cap less cash). It also serves as the basis for many financial ratios that measure the performance of a company. Firms with high enterprise multiples have high expected cash flows relative to operating income, implying high growth opportunities and a relatively lower discount rate than firms with low multiples.

Further, MSCI’s analysis also found that forward earnings has helped provide protection against value traps, and that whole-firm valuation measures, such as enterprise value, have reduced concentration in highly leveraged companies, meaning those that have borrowed heavily.

Why is ‘value’ in the news now?

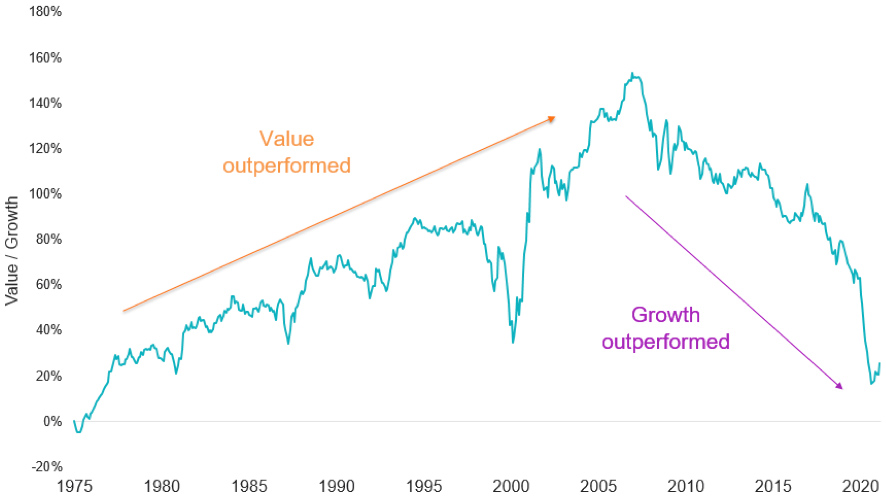

The relative returns of value and growth companies are negatively correlated. In other words, when value outperforms growth underperforms and vice versa. Prior to the GFC (global financial crisis) excluding the dot com period, value outperformed growth. However, since the GFC, growth companies, identified as those that generate significant positive sales or earnings, outperformed value as shown in Chart 1.

According to MSCI, individual factors have been shown to outperform during different macroeconomic environments. Value is “pro-cyclical”, meaning that this type of strategy historically outperforms during rising market conditions over the study period.

In recent months, however, changes in macroeconomic indicators potentially bode well for a value rotation. MSCI World Value outperformed MSCI World Growth by 8.31%, in Australian dollar terms, over 6 months to 28 Feb 2021.

Chart 1 – Cumulative performance of MSCI World Value Index relative to MSCI World Growth Index since 1975

Source: Bloomberg, MSCI 31 January 1975 to 28 February 2021.

The above graph is a comparison of performance of the MSCI World ex Australia Value Index and the MSCI World ex Australia Growth Index. Results are calculated to the last business day of the month and assume immediate reinvestment of all dividends and exclude fees and costs associated with investing. You cannot invest in an Index. Past performance is not a reliable indicator of future performance of the indices or VLUE. VLUE does not track the MSCI World Value Index.

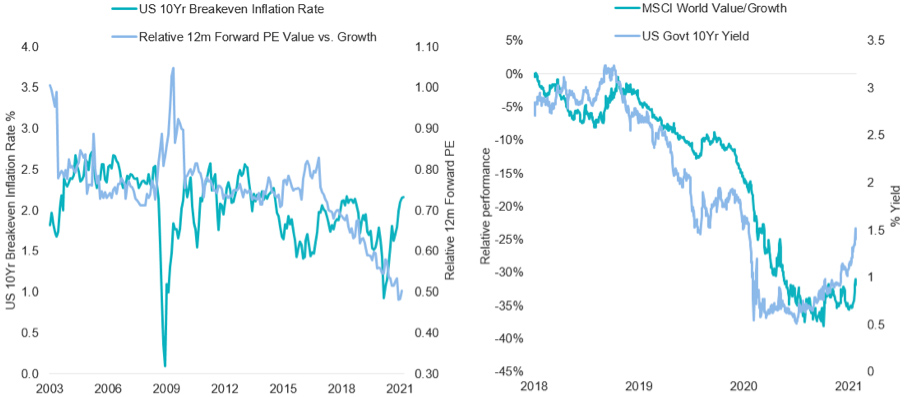

Inflationary expectations have sharply improved since Q2 2020 reaching 5-year highs. A high inflation environment supports Value company valuations relative to Growth (Chart 2) and puts upward pressure on long dated bond yields, a reflection of early economic cycle expansion (Chart 3).

LHS: Source: Bloomberg, VanEck, to 28 February 2021. RHS: Source: Bloomberg, VanEck to 28 February 2021.

The graphs show a comparison of performance of the MSCI World ex Australia Value Index and the MSCI World ex Australia Growth Index. You cannot invest in an Index. VLUE does not track the MSCI World Value Index. Past performance is not a reliable indicator of future performance of the indices or VLUE.

Traditionally, there has only been one way everyday investors have been able to gain exposure to a ‘value’ portfolio, high fee active funds focussed on identifying ‘value’ opportunities. To date, only institutional investors have been able to access low-cost passive international value investments.

VanEck has partnered with MSCI and recently launched the VanEck Vectors MSCI International Value ETF, which is listed on ASX under the ticker ‘VLUE’. VLUE tracks MSCI World ex Australia Enhanced Value Top 250 Select Index.

MSCI’s Enhanced Value Index applies three valuation ratio descriptors on a sector relative basis:

a. price-to-book value

b. price-to-forward earnings; and

c. enterprise value-to-cash flow from operations.

Compared to a traditional value approach, MSCI’s enhanced value overcomes many of the criticisms of value because it puts less weight on price-to-book as a metric and moves away from backward-looking dividend yield altogether. It uses a whole-firm valuation measure in enterprise value which could reduce concentration in leveraged companies. It also employs a sector neutral approach which MSCI found mitigates some of the drawdown inherent with the value investing style.

Value investing has come a long way since the days of Graham and Dodd, but the underlying principles remain the same: identifying companies that appear underpriced using fundamental analysis.

Enjoyed this wire?

Hit the 'follow' button below to be notified every time I post a wire or hit the 'like' button to let us know you enjoyed it. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

5 topics