Elections and other geopolitical risks also hold opportunity for this global asset class

2024 is set to be a pivotal year for the global economy, as we move past peak rates, growth moderates, and inflation continues its downward path to central bank target bands. There is still a potential window open for a recession considering the “long and variable lags” of monetary policy transmission.

For now, however, the market is pricing in a “Goldilocks scenario” where inflation settles and growth doesn’t suffer a hard landing. This last mile of disinflation could be harder to achieve than the market is hoping for, meaning that rate cuts start in the second half of the year. Either way, lower rates are a tailwind for long-duration infrastructure assets which we forecast to continue to have strong earnings growth driven by multi-decade thematics.

A year of geopolitical risks: A busy election calendar in 2024

With 40 nations scheduled to go to the polls, including four of the five most populous countries, covering 40% of the world’s population and GDP. Elections bring instability to both domestic developments at the policy level, as well as global consequences. Key dates to watch include:

- February sees presidential elections in Indonesia after a successful decade under Joko Widodo. It’s set to be a three-pronged race, with a potential run off in June and a new government in Oct.

- March 17 sees Russia go to the polls, with little surprise expected, while Ukraine’s planned March 31 presidential vote is likely to be postponed due to martial law.

- April/May sees India go to the polls, with Modi trying to secure a third term – he is ahead in the polls at this stage.

- June sees European parliament elections and a Mexican presidential vote, which could impact trade and border security with the US.

- In the US, government debt sustainability and fiscal path are set to be key in the November election. Despite this environment, large deficits limit the prospects of fiscal giveaways. A 6 % US deficit level would suggest that whoever ends up running for president in 2024 will not be doing so on the promise of major tax cuts. Foreign policy predictability, immigration, infrastructure, the economy and continued aid to Ukraine are also important election topics.

- Sometime in Q4 (unless snap elections are called) the UK goes to the polls. The opposition Labour party is well ahead in the opinion polls and appears set for victory. Higher taxes may be on the cards, with the high levels of public debt. There is a risk that consumers and businesses take a ‘wait and see’ approach to spending and investing ahead of the election.

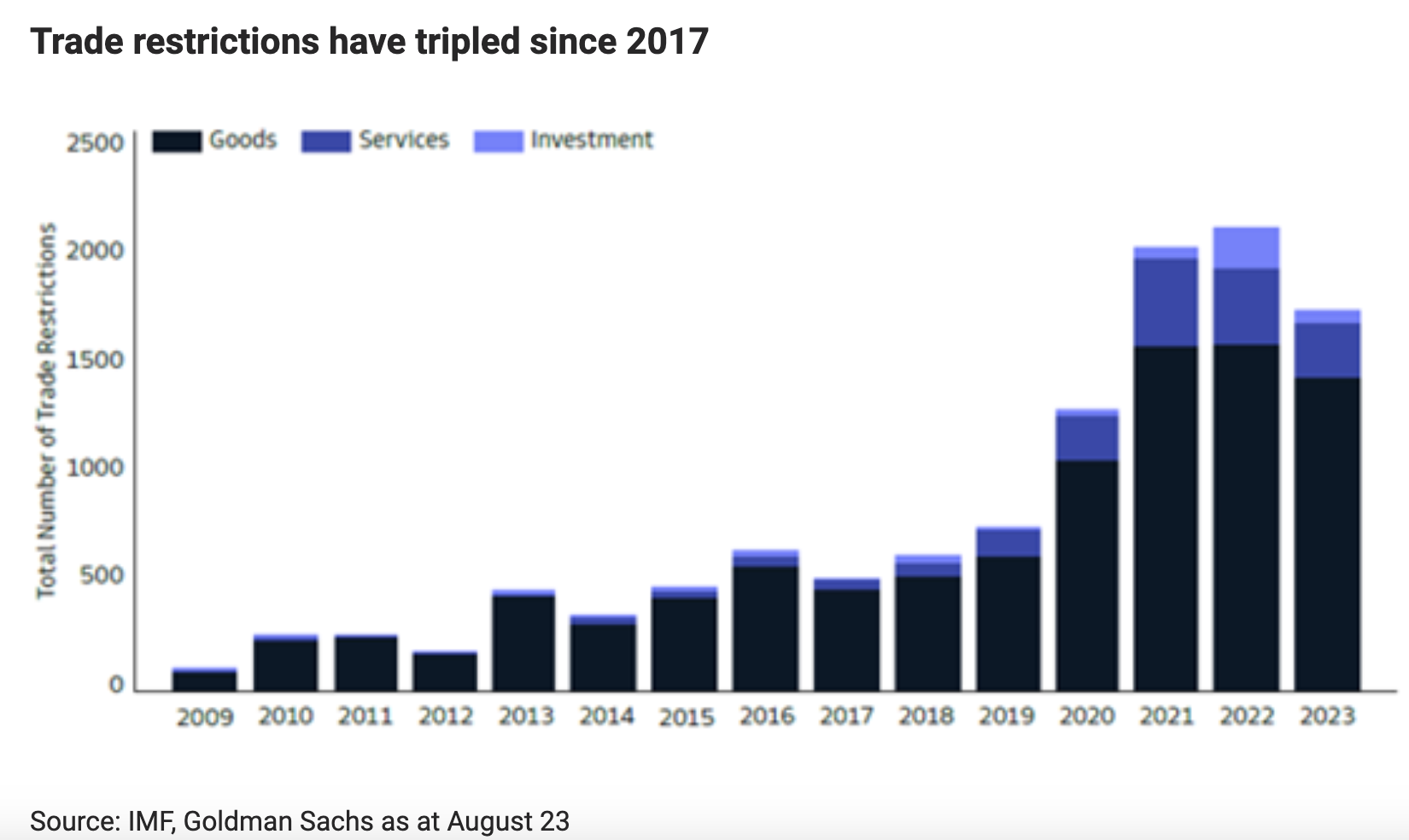

Trade restrictions – The potential for trade restrictions, with ‘re-shoring’ critical supply chains and economic security becoming even more front and centre of political powers. These include critical mineral inputs into the supply chains of the green energy transition.

A year of conflict

Ukraine is likely to step down as winter progresses and with lower funding from the West, but a negotiated settlement (the only way for a meaningful end to the conflict) seems highly unlikely.

The Israel-Gaza conflict is set to become a bigger issue if it is not contained to Hamas (Gaza) and Hezbollah on the southern Lebanese border. That is, if Iran has any direct role, it would impact oil prices much more, both directly and via trade through the Strait of Hormuz (20% of global supplies pass through)

The China-Taiwan conflict continues to evolve and be front of mind early in the year. The Democratic Progressive Party (DPP) won a historic third successive term in January, but with a minority 40% of parliament (from majority) meaning it will have to negotiate with opposition parties on all legislation and budgets. It remains to be seen if the new relationship between incoming President Lai and Beijing will involve a hardening or softening of approach from either party.

What does this mean for infrastructure?

We remain conscious of the volatile economic environment as well as the 2024 political overhangs, and we’re positioning accordingly.

Macro uncertainty and geopolitical tensions can also create unjustified market volatility and noise. We look to separate the resilience of the infrastructure asset class from this noise, and we remain optimistic about the long-term fundamentals underpinning the infrastructure investment case.

We believe that infrastructure, as an asset class, can always play a vital role in portfolio construction due to its unique characteristics such as inflation passthrough, visible and resilient contracted or regulated earnings profiles, and exposure to numerous long-dated growth thematics.

Infrastructure also offers truly global exposure with assets across developed Asia, Europe and North America, as well as emerging markets. This allows investors to capitalise on in-country economic cycles and gain exposure to domestic demand stories. With economic trends currently diverging, certain regions offer greater relative upside at present, and we can position for this. At the moment, we started the year overweight Europe and emerging markets.

Through 2023 we were overweight user pay assets and inflation, remaining underweight the utilities that could not pass through inflation or the interest rate moves. This is how we ended 2023. Moving into 2024, we will be monitoring the regional economics and politics closely, and positioning ourselves to best capture these at an in-country level. At this stage we expect the following:

- Inflation to settle above the historical levels of the 2010s, and we look to compound this where possible.

- Interest rates are expected to remain higher through at least the first half 2024, so that will factor into our allocations. We also expect rate cuts in developed markets that have had very sharp rate increases, but feel the market may be a bit too aggressive with 100-150bps cuts priced in. Considering the higher ongoing inflation and deficits, long bond rates should remain elevated (10 years), i.e. US >3.75-4% even if cash rates get cut. All cuts, however, will be supportive of infrastructure assets and, in particular, the utility sector – which will see increased allocation as this plays out.

- Growth should normalise. 2023 was very strong and took everyone by surprise. Consumer is key, and the labour market not breaking is key to them powering the economy through a mere slowdown. However, we are not anticipating contraction at this point, and remain positive on the consumer, particularly in travel.

- Energy risk seems to be dissipating, with some countries positioned better than others to capitalise on/insulate from any ongoing risk. We continue to position for this through our midstream and utility exposure.

- While it’s hard to see a quick fix for China given property issues, trust / shadow bank issues, increasing savings rates and weak confidence, the market has priced this in and valuations look very cheap.

- Robust travel momentum continues to surprise, as travellers seem willing to give up other forms of discretionary spending amidst cost-of-living pressures in order to continue investing in travel and associated experiences. While we expect the pace to slow, we continue to position for solid travel demand into 2024.

- Politics is an overhang and noise can be disruptive. We favour those regions that have less exposure to this dynamic, albeit will use any market volatility around the elections as a buying opportunity should it present itself.

Outside these near-term influences, we also see five key and integrated growth dynamics within the infrastructure space that are long-term, significant and completely immune to short-term economic events. We continue to position to capitalise on:

- Developed market replacement spend – our infrastructure is old and inefficient, and a failure to upgrade it could have significant social and economic consequences (health, safety, efficiency).

- The global population growth, but with changing demographics – the West is getting older, but much of the East younger. Both dynamics require increased infrastructure investment.

- The emergence of the middle class in developing economies, which offers a huge opportunity with infrastructure both as a driver and a first beneficiary of improved living standards.

- The energy transition that is currently underway – while the speed of ultimate decarbonisation remains unclear, there appears to be a real opportunity for multi-decade investment in infrastructure as every country moves towards a cleaner environment.

- The rise of technology and all the associated nuances of its use and impacts on infrastructure needs.

Conclusion

At 4D, we continue to prioritise companies with strong leadership, defined strategic goals that integrate with a sustainability policy, strong balance sheets to support much-needed investment, and those that are best in class within their sector in building their infrastructure footprint in countries with strong economic fundamentals, balanced risks and outlooks.

We believe that with active management, a listed infrastructure equity portfolio can be positioned to take advantage of the long-term structural opportunity, as well as whatever near-term cyclical events may prevail – whether they be environmental, political, economic or social.

This is the abridged version of the article published by 4D Infrastructure. To view the full article, click here.

Invest across the globe

4D Infrastructure is a Bennelong Funds Management boutique that invests in listed infrastructure companies across all four corners of the globe. For more insights on global infrastructure, visit 4D’s website.

2 topics

2 funds mentioned

1 contributor mentioned