ESG factors: Key parts of credit risk management

As more and more investors consider environmental, social and governance (ESG) factors when making investment decisions, it follows that these factors have the potential to materially impact capital flows to bond issuers. Importantly, these impacts may go beyond simply influencing an issuer’s cost of capital. In fact, they may determine an issuer’s ability to access debt markets full stop. In such a world, ensuring that active managers have the appropriate processes in place to take advantage of the value-adding opportunities arising from these capital flows becomes increasingly important.

Why is consideration of ESG factors now more important?

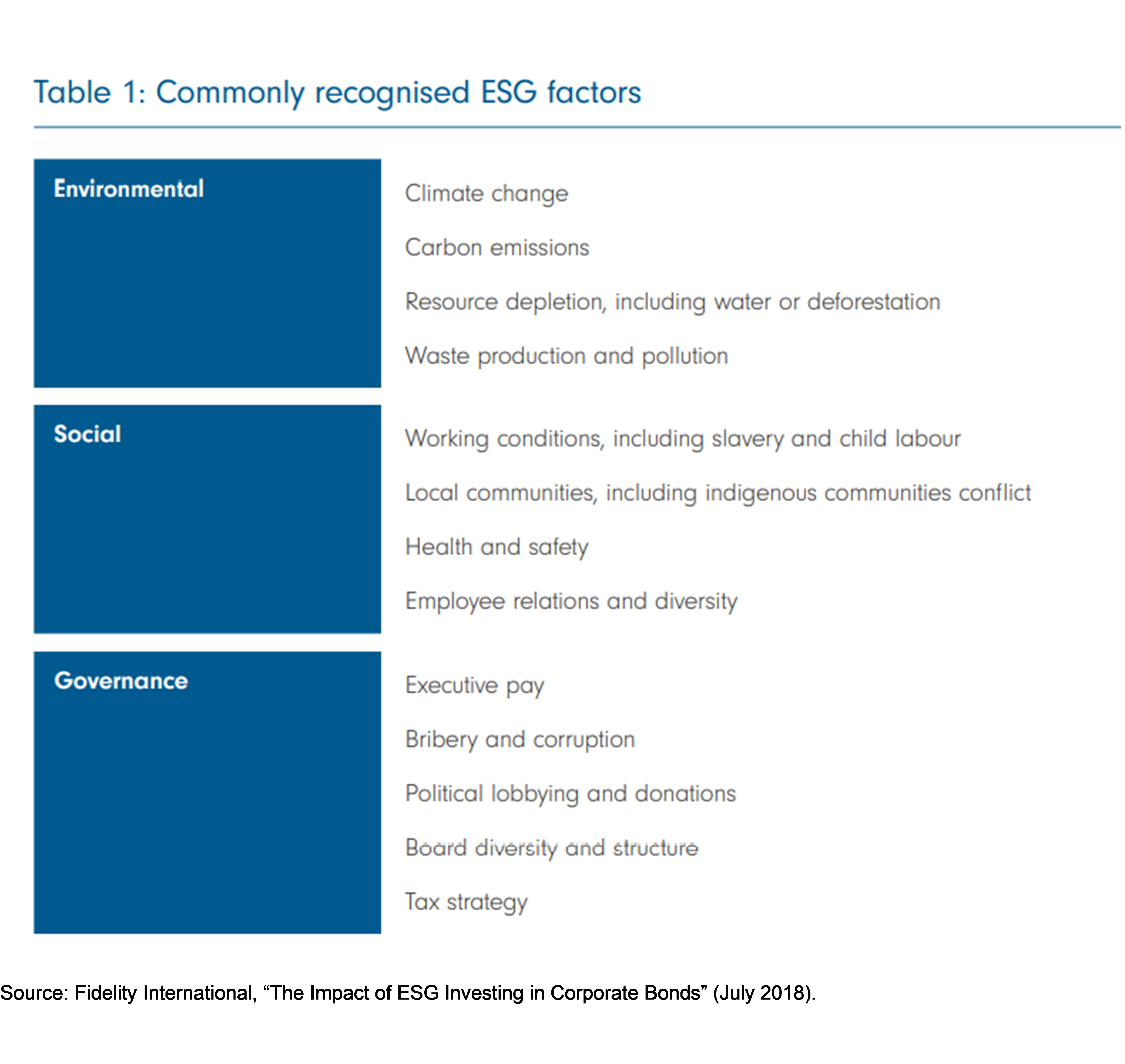

ESG considerations have become increasingly important as investors factor in the impacts of corporate activities beyond simple profit maximisation. ESG factors encompass a range of considerations, some of which are set out below:

As can be seen from the ESG factors listed above, at a general level the purpose of monitoring ESG factors is to measure and control the risk of ‘negative’ shocks, or what economists refer to as ‘externalities’. By considering such factors, investors are explicitly recognising the broader impacts of a corporation’s activities on the ultimate sustainability of such activities. In this sense, ESG factors are not new as bond investors have always considered such 'priced risks' when evaluating bonds; though they may not have been explicitly labelled ESG factors. This is particularly relevant for governance, which has always been a key factor in assessing the credit risk associated with issuers. More notably, environmental and social factors have become important drivers of investors' perceptions of the overall desirability of being associated or invested in such activities. This has brought about the consideration of ESG as a category of risk factors to be more explicitly quantified when investing in bonds. Increasingly, ESG factors are being considered alongside – and quite distinctly from – the traditional factors historically monitored by analysts.

An important impact from the more explicit recognition of ESG risk factors is that it has extended bond risk assessment beyond purely considering debt serviceability. Given the best a bond investor can do is get back their principle at the maturity of a bond, the focus of traditional credit analysis has been on assessing those risks impacting debt serviceability over the life of the bond. As ESG factors are simply additional risk factors, where they have been severe enough to impact a company’s ability to service its debt during the life of the bond, they have probably already been captured by traditional credit analysis. Yet, importantly, ESG considerations are also impacting the concept of risk beyond purely debt serviceability. The reason for this is that how a company is perceived from an ESG perspective will increasingly impact its ability to attract capital flows from investors. Put another way, ESG factors are increasingly impacting a company’s ability to access investor capital, not just the cost of that capital.

To illustrate how this evolution in capital flows may impact bonds, it’s useful to consider the potential impact on liquidity. As ESG factors become a more important part of investors’ behaviour, ESG negative issuers, i.e. those issuers viewed negatively from an ESG perspective, may end up having a materially smaller investor base as socially conscious investors avoid exposures to such companies. This lower level of liquidity may result in a higher liquidity premium for such issuers and hence a higher cost of capital. This smaller investor pool, and lower resulting liquidity, may also impact on trading costs via not only the bid/offers spread but also the volumes that can be traded without impacting the market price. These impacts on liquidity may be magnified as socially conscious investors shun not just the issuers but also other investors providing funding to that issuer. Ultimately, ESG considerations in the extreme may impact the ability of an issuer to access debt markets. Accordingly, ESG considerations of others, including those not even investing in the company, may have adverse impacts on bond issuers well beyond their ability to service debt.

Does being socially responsible mean higher returns?

Potentially exacerbating the impact of capital flows is the weaker relationship between ESG risk factors and bond returns. Though there is some evidence that a positive ESG bias in equity portfolios has the potential to generate higher returns, the situation with bond markets is a bit more nuanced. The reason for this is that in general the exhibiting of a positive ESG bias by an issuer is typically interlinked with other risk factors. Firstly, as previously highlighted, ESG factors are really risk factors. This implies that, by definition, ESG risks are linked with the overall risk profile of the issuer. Secondly, issuers exhibiting positive ESG characteristics also tend to exhibit other characteristics, such as being larger corporations, having lower debt levels, etc. Such interlinkages mean that better/worse ESG scores are often associated with superior/inferior credit ratings, which in turn are known to decrease/increase beta. Strengthening this interlinkage between ESG scores and official credit ratings are the steps taken by both Moody’s and S&P to explicitly consider ESG factors when determining credit ratings. Accordingly, investors directing capital away from ESG negative issuers need be less concerned that they are forgoing risk-adjusted returns, potentially strengthening ESG-driven capital flows.

The interlinkage between ESG factors and overall issuer risk means that it is useful to determine whether bond pricing is in equilibrium or not. For the purposes of this discussion, bond pricing is in equilibrium when prices accurately reflect all information regarding the risk characteristics of an issuer. When a market is in pricing equilibrium it follows that the risk attached to an issuer, including ESG risks, are accurately reflected in the current pricing of bonds. As lower risk borrowers should be able to access lower funding costs from the bond market, the yields earned will also be lower. This suggests that in equilibrium investors are neither rewarded nor penalised for favouring ESG positive issuers over ESG negative issuers on a full array of environmental, social and governance matters.

In contrast, bond markets may not be in pricing equilibrium where market participants are pricing in changes to the risk profile of an issuer as new information flows to market participants. In such a situation, there may be superior returns to be earned by being able to pre-empt such reassessments of ESG risks associated with an issuer.

An additional source of value add for active managers

It is the impact on bond pricing as market participants reassess ESG risks associated with an issuer which ‘opens up’ new alpha opportunities for active bond managers. Though the linkage between ESG scores and official ratings may reduce the impact of separate ESG scores, it does not mean that ratings agencies may fully factor or correctly assess ESG risks. Given this, and the potential for ESG factors to have a greater impact on capital flows, evolving ESG risk factors open up a new source of value add for active managers beyond pure financials. It follows that active managers should be able to earn higher returns if they can identify changes in ESG risks not necessarily captured by official ratings. This arises as bonds will either outperform or underperform as the market more accurately assesses the ESG risks associated with the issuer. This highlights why viewing ESG factors as standalone factors within the credit assessment process is becomingly increasingly important for active bond managers.

The impact of ESG-driven capital flows on pricing also highlights the increased importance of investor engagement with issuer management. Corporate engagement has traditionally been seen as the province of shareholders. However, as ESG factors become more important determinants of the cost of debt finance, and indeed the capacity to access debt finance at all, the ability of bond managers to effect change via engagement increases. This makes it increasingly important for bond managers to have active engagement processes in place to be able to positively drive returns from bond holdings by favourably altering management/corporate behaviour.

ESG factors have become a much more important determinant of capital flows within bond markets. Importantly, compared to other factors which simply impact the cost of capital, ESG factors may increasingly impact the availability of capital to bond issuers. Given their potential impacts, ESG risk factors could ‘open up’ additional value adding opportunities for active managers. To be able to take advantage of such opportunities, managers should not only have explicit processes in place for identifying the evolution of ESG risk factors, but also a proactive engagement process. By having these processes in place, active managers will not only be able to better assess risk within a portfolio, but also take advantage of value adding opportunities associated with evolving ESG risk factors.

It is worth noting that while, on an outright return basis investors should not expect to earn a higher return, the portfolio with a higher ESG bias is likely to exhibit superior risk and liquidity characteristics. As the implicit bias will be towards higher-quality issuers, the portfolio will likely outperform when there is a flight to quality. It follows that ESG factors can be utilised to enhance portfolio drawdowns characteristics and reduce portfolio volatility.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

Four reasons to register for Livewire’s 100 Top-Rated Funds Series

Check it out now for:

· To get first access to a list of Australia’s 100 top-rated funds

· Detailed fund profile pages to help you compare performance, fees, and philosophy

· Exclusive in-depth interviews with expert researchers from Lonsec, Morningstar and Zenith.

· One-on-one videos and articles with 16 of Australia’s best fund managers

2 topics

Clive Smith is an investment professional with over 35 years experience at a senior level across domestic and global public and private fixed income markets. Clive holds a Bachelor of Economics, Master of Economics and Master of Applied Finance...

Expertise

Clive Smith is an investment professional with over 35 years experience at a senior level across domestic and global public and private fixed income markets. Clive holds a Bachelor of Economics, Master of Economics and Master of Applied Finance...