ETFs / ETMFs – watch the bid-ask spreads

Risk Return Metrics

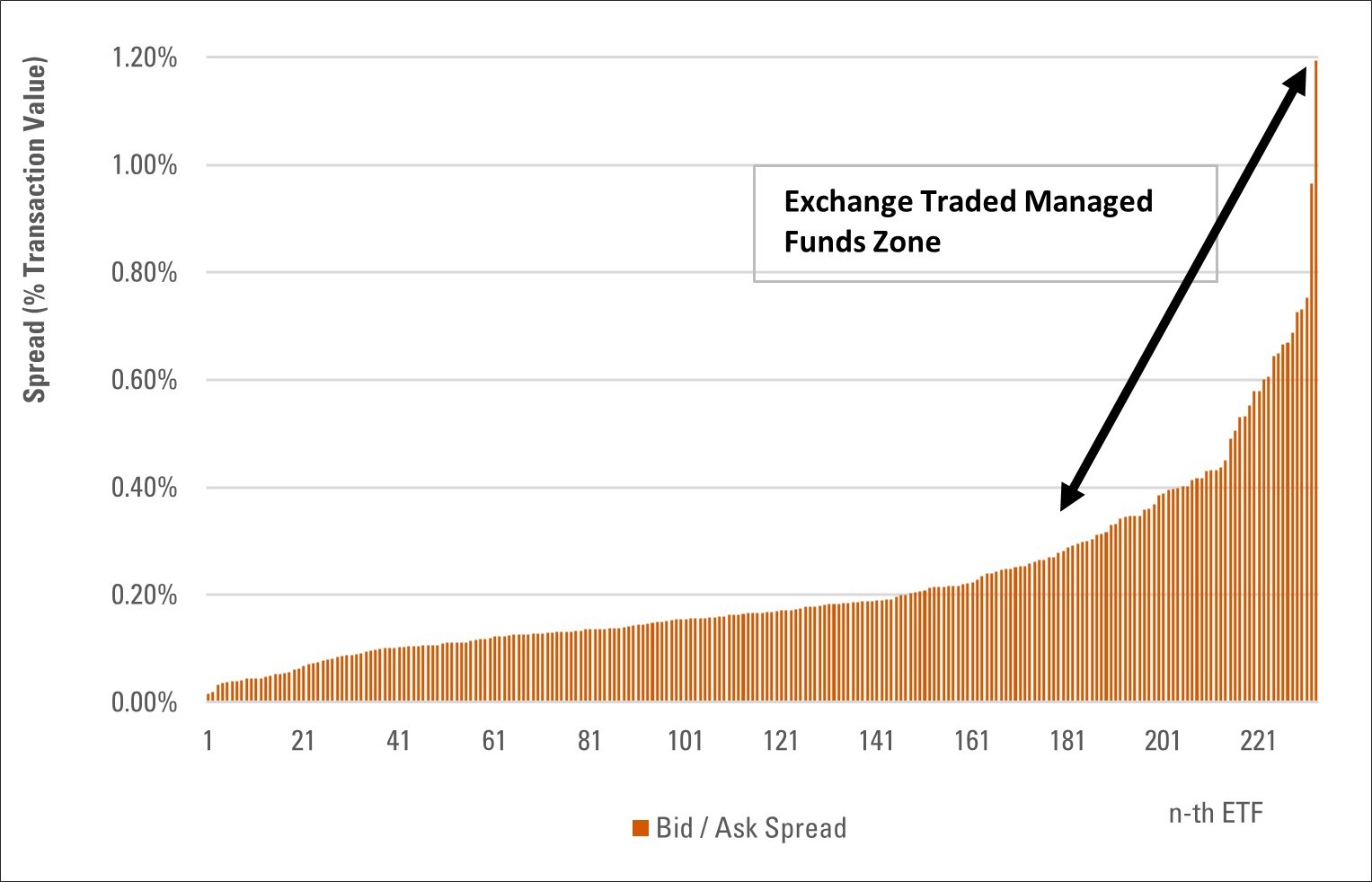

Bid-ask spreads for ETFs / ETMFs (Active ETFs) vary materially between vehicles from 1.5 basis points all the way up to 120 basis points as an average. They can be as almost significant as the applicable MER of a particular ETF / ETMF and are therefore worth bearing in mind and monitoring.

We saying monitoring because what average spreads conceal is the material changes that can occur over a trading day. These intra-day variations and the variations between ETFs / ETMFs follow certain discernible patterns, notably:

- Intra-day timing – Be conscience of when you trade;

- Internal or External Market Making – That is ETMFs versus ETFs;

- Activity - The traded volume of the ETF,

- Risk and Information - The nature of the underlying portfolio; and;

- Competition - Potentially the number of APs or market makers, contracted or otherwise, that regularly trade in an ETF.

Two times of the trading day you should not trade ETFs / ETMFs

While supply and demand vagaries will impact actual intra-day levels, there is a distinct U-shaped pattern in ETF bid-ask spreads during the trading day for ETFs based on Australian equities. Specifically, there are elevated bid-ask spreads at the opening of the trading day (10:00 to circa 10:09am) and then taper during the trading day and then increase again in the after-market close ‘auction’ (circa 4:00 to 4:10pm).

A similar dynamic exists for Asian equities based ETFs, with spreads typically being wider during Australian trading AM hours while Asian markets are pre-open and then typically taper as Asian equities markets open.

For broad global equities mandates and/or Europe or US specific equities ETFs the intra-day pattern is less distinct (or not materially present at all) as these markets are generally closed for the duration of ASX trading hours. ETFs are priced by the AP / market maker by way of appropriate futures contracts.

Download the PDF to access the full ETF Flows report

Click on the pdf below to access bid-ask data highlighting material variations between:

- ETFs and ETMFs (Active ETFs):

- Australian and International based ETFs / ETMFs;

- Asset class;

- Style: Passive, Thematic, Active

3 topics

Investment analyst with particular experience in listed and unlisted investment strategies, equities and structured products.

Expertise

Investment analyst with particular experience in listed and unlisted investment strategies, equities and structured products.