EU carbon price at €400 by 2040?

In contrast with the UK Prime Minister’s much-publicised U-turn on green initiatives, you may have missed the European Union’s new head of climate change policy, Wopke Hoekstra last week saying he supported a 90% cut in net greenhouse gas emissions by 2040. While the target is still a long way off from being adopted, financial analysts from London Stock Exchange Group say, if implemented such a move would send EU carbon prices above the €400 mark.

Earlier this year, the EU’s official science advisers recommended cuts of 90-95% by 2040 to honour its promise of limiting global heating to 1.5C this century.

Carbon prices on the EU Emissions Trading System currently stand at around €81 per tonne after peaking at €100 a tonne in February. With the current 2030 decarbonisation target a 55% reduction Bloomberg NEF forecasts the average carbon price to reach around €149 by the end of the decade. In the long run, more aggressive supply cuts of carbon credits are expected to lower emissions by 62% by 2030 compared to 2005 levels, providing tailwinds for the value of carbon credits.

However, should a 90% cut in emissions be implemented by EU legislators, that figure could potentially go much higher.

“The EU’s 90% decarbonisation target – if met – will see near full-decarbonisation across the power, manufacturing, transportation, and construction industries – creating an emissions trading system that will likely look very different to the ETS we have now,” Paula VanLaningham, director of LSEG Carbon Research, said in a statement.

“It’s important to stress that the €400/t price is not the cost of decarbonisation, but rather the potential cost facing the businesses that fail to decarbonise under the 90% scenario,” VanLaningham added.

The European Commission is due to table its 2040 climate target plan in the first quarter of next year, a proposal that will be submitted for approval to EU member states and the European Parliament, which will have the final say.

The EU’s new climate chief Wopke Hoekstra also says he aims to increase the level of ambition at the November COP28 summit in Dubai. COP28 President Sultan Al Jaber, says he is focused on “phasing out” fossil fuel emissions, while “phasing up viable, affordable” zero-carbon alternatives.

The new appointment comes following a volatile month for carbon prices, together with a broad-based retreat in energy stocks. EU countries are preparing to push for a global deal on phasing out fossil fuels at COP28 where nearly 200 countries will try to strengthen efforts to rein in climate change.

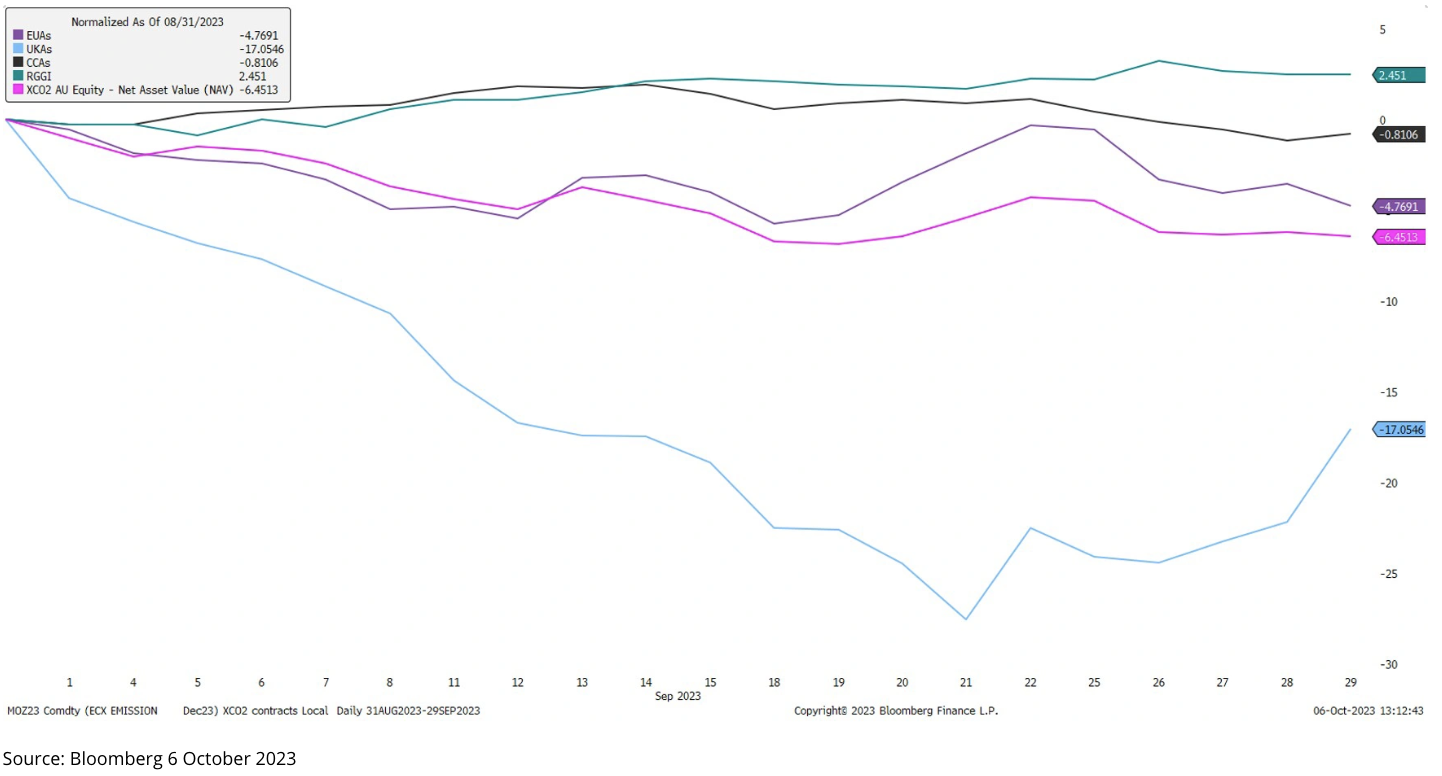

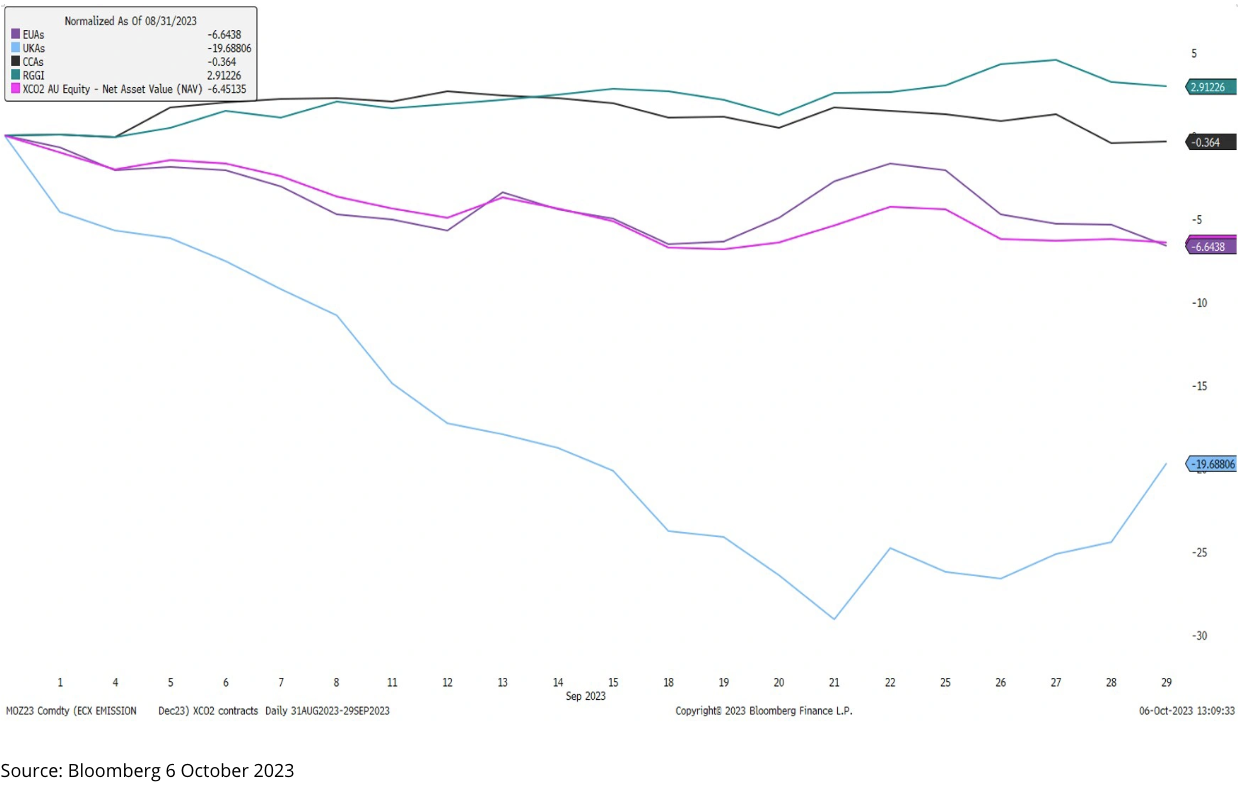

European carbon prices (EUAs), fell over September as the continent transitions away from Russian gas with LNG and renewables, cutting emissions from coal. Scientific data shows natural gas emits almost 50% less CO2 than coal1. The fuel switching from coal to cleaner LNG led to a temporary drop of demand in carbon permits. The short-term risk remains from the front-loading allowance supply to raise money for the REPowerEU plan to shift away from Russian fossil fuels2.

The EU’s endeavour to become climate neutral notched up a gear last week as the bloc’s carbon border tax enters a trial period. The Carbon Border Adjustment Mechanism — or CBAM — was adopted last year with the aim of ensuring that goods manufactured in Europe, and subject to the EU's Emissions Trading System, which sets a price on carbon emitted, will be able to withstand competition from products made in countries where polluting doesn’t come with the same price attached.

Starting October 1, the EU's trading partners will have to report the greenhouse gas emissions tied to their exports of iron, steel, cement, aluminium, fertilizer, hydrogen and electricity.

"CBAM will encourage industry worldwide to embrace greener technologies," EU Economy Commissioner Paolo Gentiloni said in a statement. "It will also prevent so-called carbon leakage, or the relocation of production outside our borders to countries with lower environmental standards."

Meanwhile, elsewhere in the world, the amount of UK carbon permits to be auctioned to industry next year under the UK ETS will fall by 12.4% to their lowest-ever level, to be aligned with British government plans for net zero emissions. According to Reuters, the UK Emissions Trading Scheme (ETS) Authority said the move should support energy intense industries to move away from using fossil fuels to generate electricity. Companies in sectors such as manufacturing, power and aviation are required to buy allowances to offset every unit of carbon they emit. With fewer permits available to buy, these sectors will need to take further steps to cut their emissions, the authority said.

RGGI, the carbon credits scheme covering the power sectors in the eastern coast of the US, rose following a workshop in which potential changes to the program's rules market cap for the next compliance period were discussed. RGGI prices hit all-time high in the process, surpassing the 2023 Cost Containment Reserve (CCR) trigger price of $14.88 per short ton on 26 September. One unique feature of both RGGI and CCAs (California’s cap-and-trade program) is that there is a price floor which may provide a free inflation hedge. For instance, for RGGI, the CCR trigger price increases by 7% per year. In addition, there is a price ceiling so that volatility in the market is managed. Given we are still in a sticky-inflation environment, the US carbon credits futures could be an inflation-hedging tool in portfolio construction.

Over the past month the major currencies moved sideways. AUD strengthened against Euro (+1.77%) and British Pound (+3.09%) due to recessionary concerns in the EU bloc, yet weakened against USD (-0.76%), resulting in further volatility.

Performance in local currencies

Performance in AUD

Investors can access global compliance markets on the ASX via the VanEck Global Carbon Credits ETF (Synthetic) (ASX: XCO2).

Sources

1U.S. Energy Information Administration. Carbon Dioxide Emissions Coefficients. https://www.eia.gov/environment/emissions/co2_vol_mass.php

3 topics

1 stock mentioned

1 fund mentioned