Euro vision: Why Europe is now home to some of the world's hottest stocks

If the age of US exceptionalism is coming to an end, where should you be looking for the next great market?

China and India would seem good bets as emerging markets with economic superpower potential.

But investors might be better served following the smart money instead.

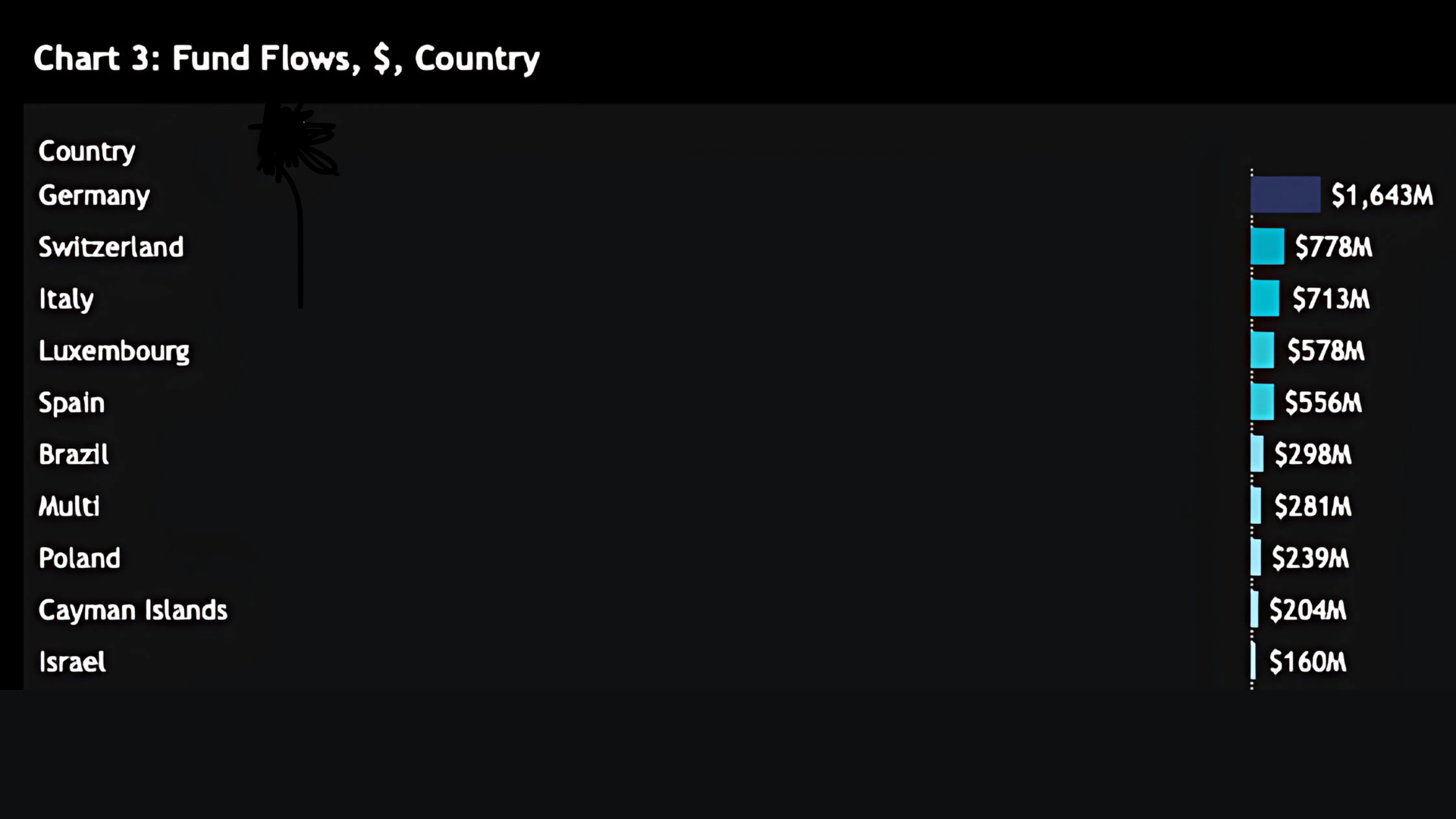

According to recent data from Copley Fund Research, European stocks are currently seeing the highest net inflows from global fund managers, and it's not close.

In fact, European countries occupy the top five spits on Copley's list, with Switzerland and Germany leading the multi-billion dollar charge.

As you can see in the graph below, recent inflows into Germany have exceeded US$1.6 billion, with more than $500 million also flowing into Switzerland, Italy, Luxembourg and Spain.

So what's behind this trend? And which stocks are they buying?

It's arguably a perfect storm of uncertainty around the US, fiscal stimulus, fairer stock valuations, macroeconomic conditions, and political tensions that have led global investors back to Europe.

As Profeta Investment's Garry Laurence wrote a few weeks ago for Livewire, global investors are looking to diversify from the US and Europe offers a lot of attractive opportunities.

"European equities offer a rare combination of quality and value. Robust European businesses (often founder-led with durable earnings streams) are trading at meaningful discounted valuations compared to those in the US," wrote Laurence.

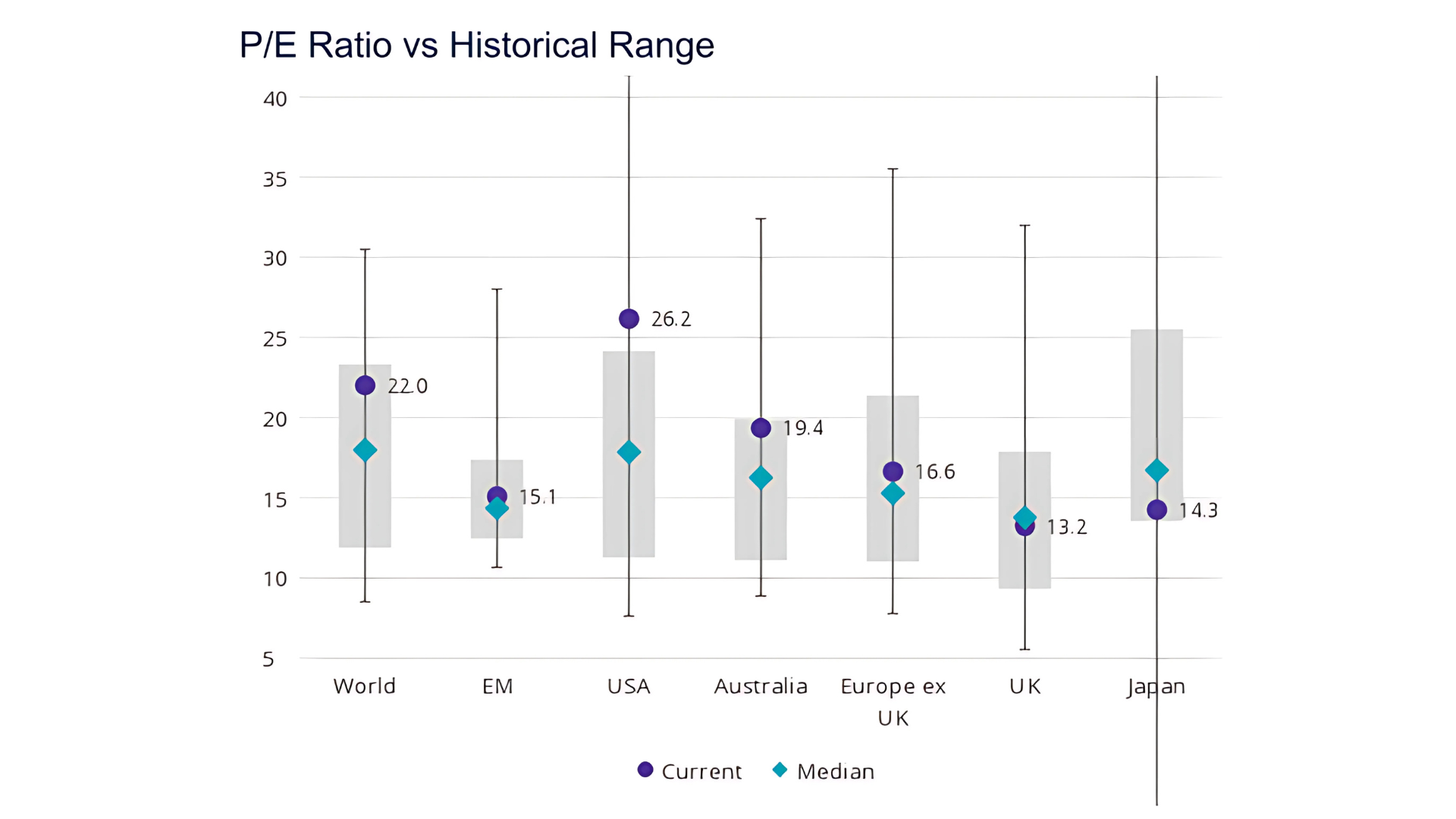

Data from Schroders Australia backs this up.

While Australia and the US trade far above their median PE ratios, Europe and the UK are trading around their historical median.

How expensive global markets are right now

Using longer-term measures like CAPE (cyclically adjusted price-to-earnings) ratios, Europe is trading at a 10% premium to its historical average while the US is trading at closer to 30%.

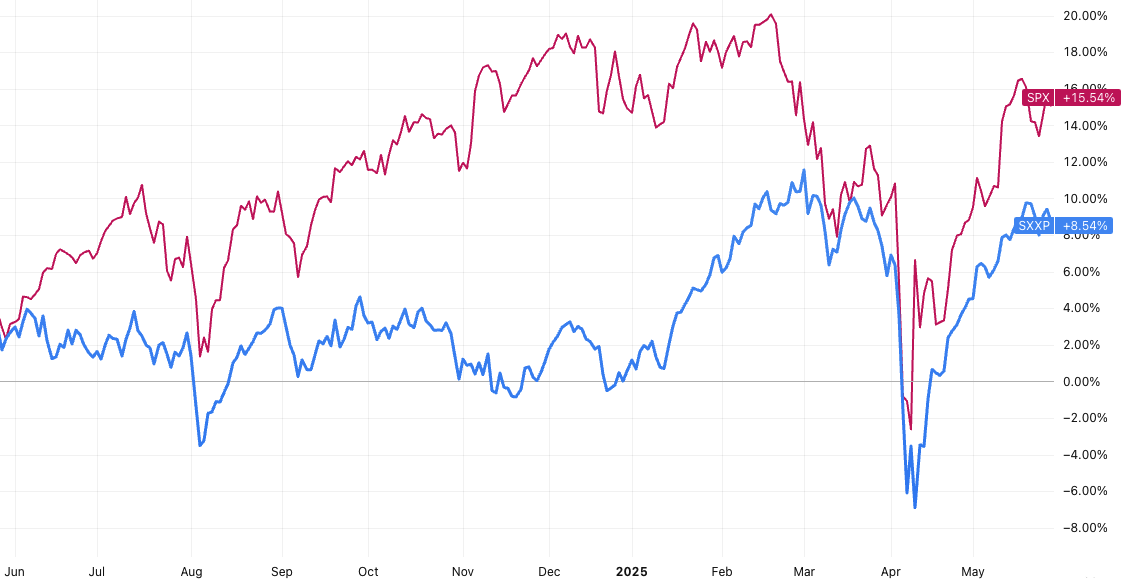

And even then the STOXX Europe 600 index, which tracks 600 of the largest European stocks, has also greatly outperformed the S&P 500 over the last 12 months.

US vs Europe

Europe is home to some of the world's leading luxury, fashion, cosmetics, car and pharmaceutical companies, and offer higher dividends than their US counterparts.

Couple that with ongoing economic growth, lowering interest rates, fiscal stimulus and a continent-wide commitment to increase defence spending to 3.5% of GDP, and it's clear why investors are flocking to Europe.

With the ongoing war in Ukraine, bubbling geopolitical tensions and tariff uncertainty, defensive and domestic spend have become the order of the day for many of the big European powers.

"Germany has been very fiscally conservative. They're now increasing their fiscal spend by 3.5% of GDP on defence infrastructure and even tax cuts," Schroders' Sebastian Mullins told me in a recent interview.

At the recent ASX Investor Days, both Antipodes Partners and Plato Investment Management suggested European defence stocks is one area of the market they find appealing right now.

Even Europe's historical underperformers are now offering opportunities. As Mullins put it, "even the PIGS are flying".

The PIGS in this case being Portugal, Italy, Greece and Spain - European countries that felt the full brunt of the Eurozone crisis but have borrowed sensibly when rates were low and are now growing.

The stocks they're buying

According to Copley Fund Research data, the most commonly held European stocks by global funds are:

- Novo Nordisk A/S (NYSE: NVO) - held by 46% of funds

- ASML holding NV (NYSE: ASML) - held by 41% of funds

- AstraZeneca PLC (NYSE: AZN) - held by 34% of funds

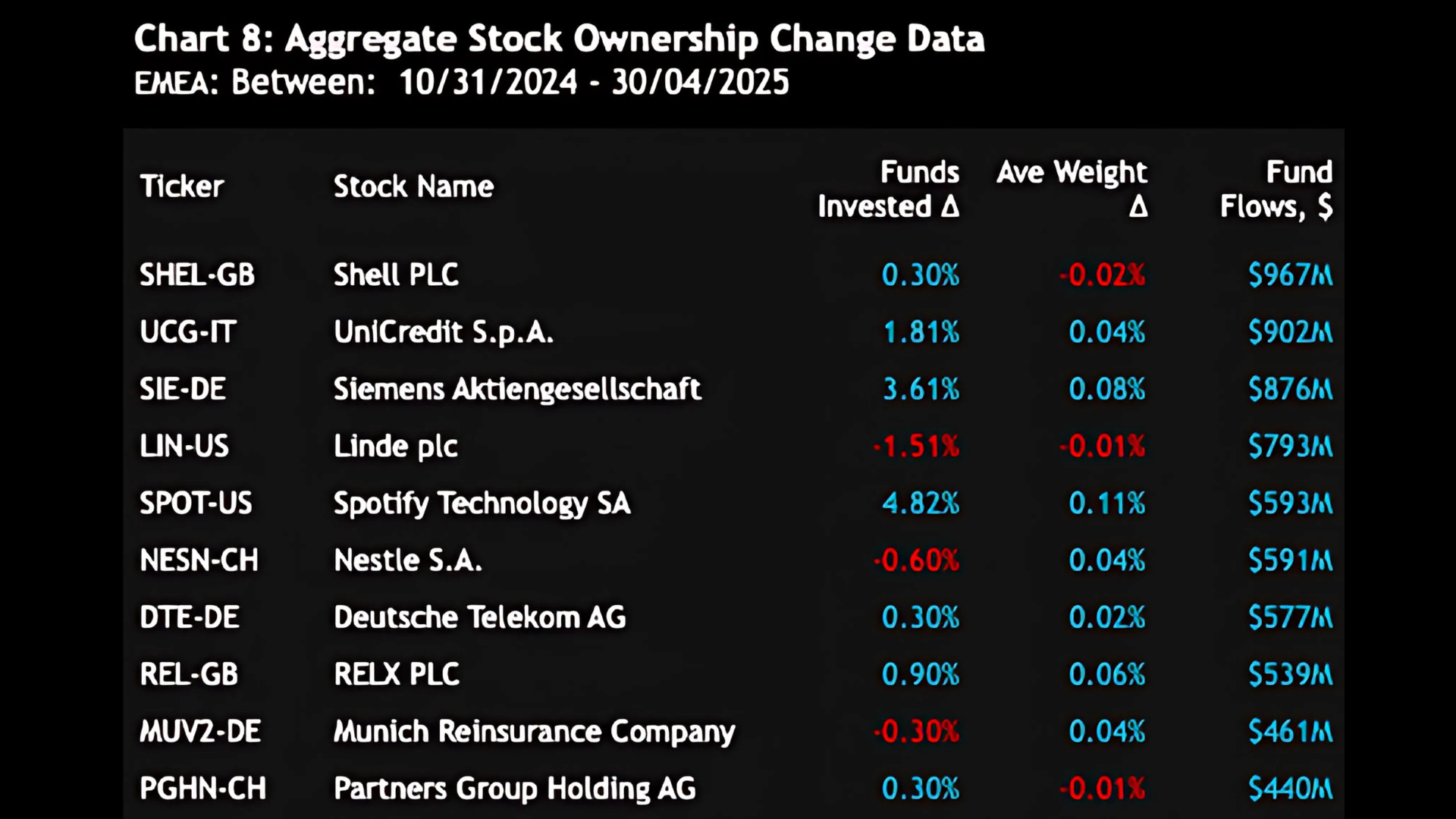

But what's more interesting are the net flows over the last six months.

According to Copley, here are the top five European stocks by net inflows in the 6-month period to 30 April (in US dollars):

- Shell PLC (LON: SHEL) - $967 million net inflow

- UniCredit S.p.A (BIT: UCG) - $902 million

- Siemens AG (ETR: SIE) - $876 million

- Linde plc (NYSE: LIN) - $793 million

- Spotify Technology SA (NYSE: SPOT) - $593 million

You can see the rest of the top 10 in the graph below.

You can learn more about Copley Fund Research here.

3 topics

5 stocks mentioned

4 contributors mentioned