European private debt: a growth story away from the limelight

In a financial landscape where tradition often takes precedence, Europe is gradually shifting gears. Away from the VC limelight and the bank-dominated headlines, the European private debt market has quietly stepped in to fill the void left by the conventional banking system.

At a Glance:

● Europe's transition towards private debt highlights a significant shift from traditional banking, propelled by regulatory adaptations and market dynamics.

● Investors are attracted by private debt due to higher yield opportunities, minimal competitor exposure, and a hedge against economic volatility.

● While in Europe the funding pace is slowing and the risk of defaults is increasing, Australia's private debt market emerges as a promising frontier, offering a robust growth runway for investors.

A decade ago, the scene in Europe was heavily bank-centric, with 80% of the financial activity led by banks and a mere 20% by alternative lenders. Today, the tables have turned dramatically.

As of June 2023, European private debt funds have amassed a substantial €9.6 billion. The market is on an upward trajectory, as evidenced by the flurry of activity within private debt funds in the first half of 2023.

PitchBook’s H1 2023 Global Private Debt Report shows a steady rise in fundraising and an increase in dry powder available for investments.

Private credit growth in Europe

The private debt market in Europe is on a growth trajectory, with France recently overtaking the UK in terms of private debt deals.

In a challenging global financial landscape, private debt has emerged as a haven of stability and opportunity, with financial institutions like Société Générale and Brookfield launching new private credit funds through strategic partnerships.

Starting with seed capital of €2.5 billion, this venture has an ambitious target of accumulating €10 billion over a four-year span.

Deutsche Bank AG has incubated an investment management entity dedicated to exploring private credit investment avenues. Operating autonomously from the German lender, DB Investment Partners will scour the global scene, investing across corporates, real estate, and asset-based finance.

Alternative asset managers such as Apollo, Blackstone, and Brookfield are also transitioning from a dependency on traditional banks for debt financing to the establishment of private credit funds.

The European Debt Finance Intelligence Report 2023 by DLA Piper revealed a vacuum in mid-cap liquidity filled by larger direct lending funds, a trend sparked by a lack of liquidity in 2022 due to geopolitical events and other market dislocations.

Why Europe is big on private debt

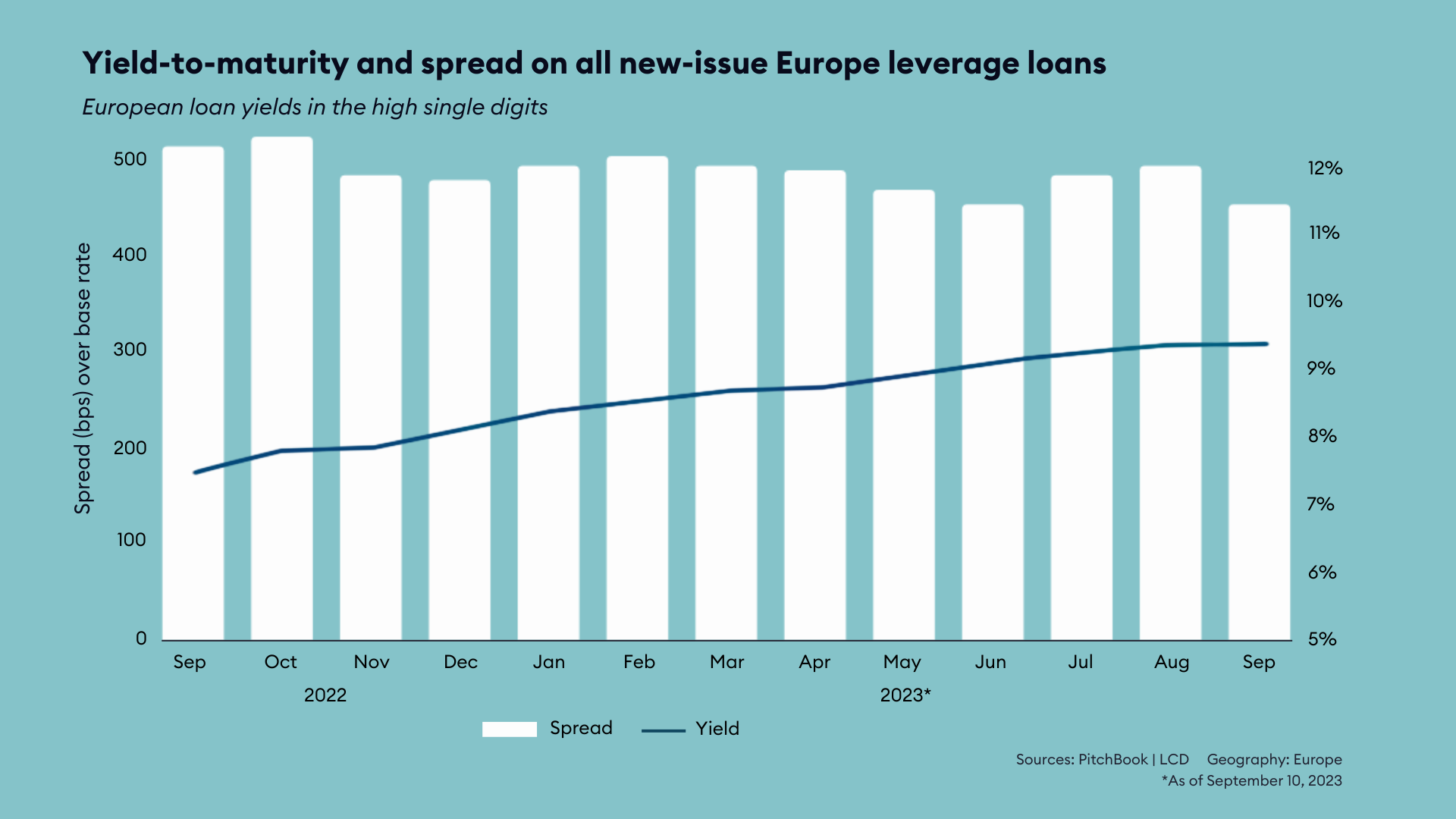

The boom in private credit was driven in large part by aggressive interest rate increases that started in early 2022, which forced more borrowers to seek alternative lending sources. The pressure from monetary tightening, compounded by the collapse of several regional banks in the US, prompted some traditional lenders to divest assets or retract from certain business segments.

Specific to Europe, there are several factors behind the growth of the sector:

1. Regulatory environment

The European Union (EU) has established a somewhat lenient fiscal stance towards countries with higher levels of debt, which in turn has created a conducive environment for private debt transactions. This relaxed stance provides an alternative avenue for companies to secure the funding they require outside of traditional bank loans.

2. Market dynamics

2022 witnessed significant dislocations in financial markets which led to the temporary closure of high yield debt capital markets and bond markets. With these avenues temporarily unavailable, private debt filled the liquidity void by providing the necessary capital to companies in need.

3. Asset-based lending

The year 2023 anticipates more entrants in the market, particularly credit funds that leverage Asset-Based Lending (ABL) techniques. By adopting ABL techniques, these credit funds are broadening the scope and appeal of the private debt landscape, making it a more viable and attractive option for both lenders and borrowers.

4. Competitive capital deployment

The competitive nature of capital deployment has driven sponsors to push for restrictive conditions around loan transferability. On the other hand, private debt provides a level of assurance and control for those involved, making it a more attractive option for capital deployment.

What it means for investors

The creation of new special situation-type funds and other private credit funds offers investors a chance to explore higher yield opportunities. In Europe, big investors are increasingly channelling funds to capitalise on these benefits, which is propelling the growth of the entire sector.

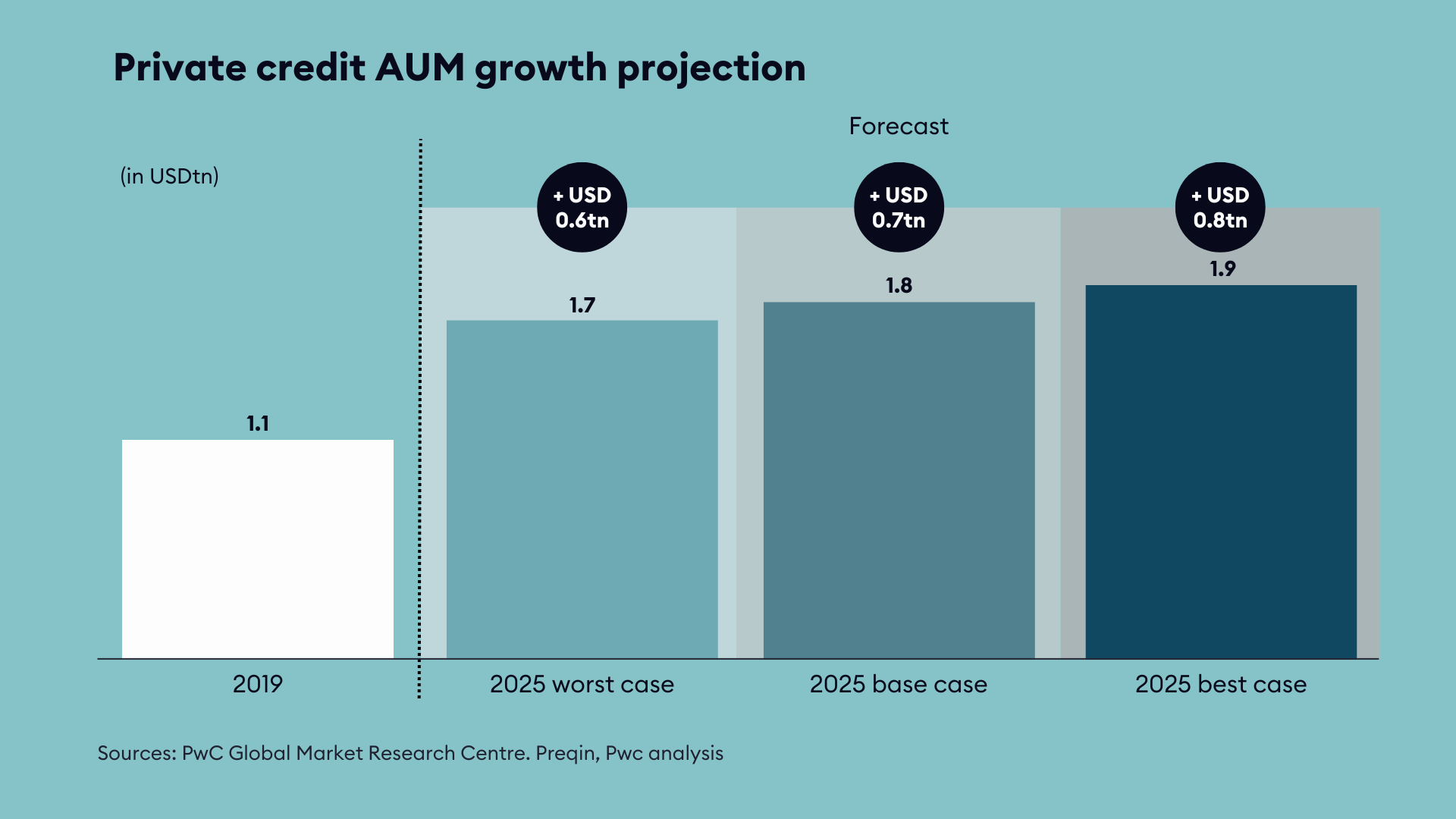

It is expected that by 2025, the private credit sector in Europe will be predominantly fund-driven.

Besides the benefits offered by funds, private debt also serves as a hedge in times of economic volatility. Risk-averse investors should consider it as a prudent allocation within a diversified portfolio.

However, the evolving regulatory landscape in Europe means that investors, or their advisors, should stay abreast of compliance updates to ensure investment strategies are both sound and lawful.

And for those investors seeking opportunities like the one offered by the European private debt market in the recent past, there’s some good news. With conditions reminiscent of Europe's over the past decade, Australia could be well-positioned to mirror a similar growth trajectory.

Is Australia tomorrow’s Europe?

Much like Europe pre-GFC, Australia’s financial sector has historically been dominated by traditional banking institutions. However, as the landscape evolves, this narrative is gradually shifting.

Here's why Australia is poised to follow Europe’s footsteps:

The market is mature

Australia's institutional private debt market has been around for over 20 years, significantly impacting corporate lending through broadly syndicated loans, club loans, and direct loans.

This enduring market has accumulated a value of around A$2.85 trillion. The corporate loan sector accounts for about A$1 trillion of this total, signifying a mature market with a robust foundation.

The private credit sector in Australia continues to grow at a remarkable pace, similar to the trend observed in Europe. New managers are entering the market, and existing ones are expanding their platforms, indicating a maturing market destined for future growth.

The bank dominance is declining

The unique opportunities offered by the private debt sector are attracting more investors and fund managers, gradually diluting the dominance of traditional banks. With only 9% of non-bank lenders, the 'lucky country' has a substantial growth runway in the short to medium term, akin to the transition Europe experienced post-GFC.

Investors are catching on

Much like their European counterparts, Australian investors are beginning to warm up to this asset class. The growing attraction for private debt is not confined to large investors alone; SMEs in Australia are also gravitating towards alternative funding routes to fuel their ventures.

The regulatory environment is evolving

Australia too, is on a pathway of evolving its regulatory framework to foster growth in the private debt sector. Key legislative measures such as the Financial Accountability Regime Bill 2022 and the Financial Services Compensation Scheme of Last Resort Levy Bill 2022 are set to simplify financial services under the Corporations Act.

Additionally, the Australian Securities and Investments Commission (ASIC) is adapting licensing and regulatory frameworks to better accommodate the changes in the category, enhancing consumer protection and transparency in the process.

The introduction of open banking under the Consumer Data Right (CDR) regime will allow consumers to securely share their financial data with third parties, which ultimately will increase competition and innovation in the category.

Australia is aligning with global standards

The transition to International Financial Reporting Standards (IFRS) 9 is a testament to Australia’s alignment with global financial practices. This change paves the way for smoother international financial interactions and investments.

Let’s not forget that Australia is a developed economy, part of the OECD, and governed by commonwealth laws, conditions that facilitate debt recoverability. All these factors usher Australia into the limelight as a the next frontier for investors venturing into private debt.

5 topics