Evergrande and equity market ructions

So far, the equity market has only fallen a few percentage points. A lot of ink spilled for a relatively modest market reaction. (Examples: here, here and here to list only a few.)

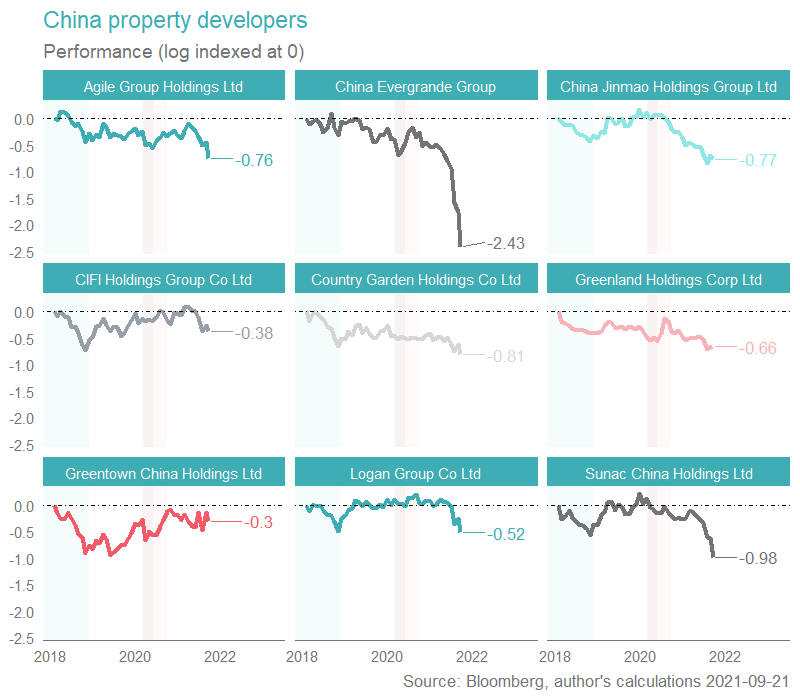

Evergrande, the embattled Chinese property developer, has been "embattled" for much of the past year, and the newish news (escalating fears that the company is bankrupt, with minimal expectation of policy support) doesn’t change our overarching narrative all that much.

What do we mean by this?

Well, for a long time we’ve been underweight emerging market (EM) equities, because we think China is:

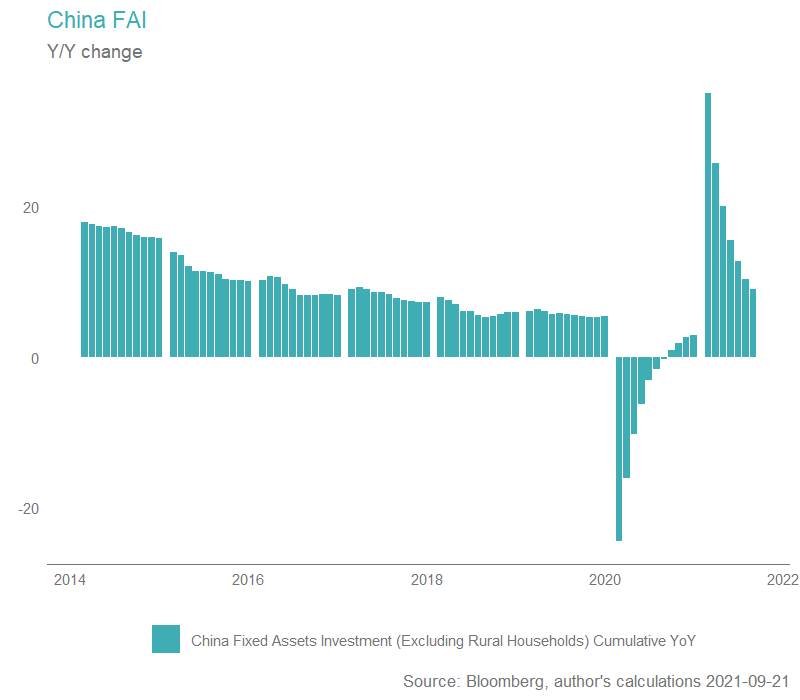

a) over-geared with an unsustainable model of economic growth reliant on ever expanding household credit and fixed asset investment, and

b) a very large part of the EM index, which makes the EM region unattractive.

So the Evergrande issues are really just confirmation of a view we already hold. Will Evergrande be a “Lehman” moment for China?

Well, probably not.

The Lehman’s moment, to us, was about counterparty risk, and the ensuing collapse in credit (credit crunch) that ensnared even otherwise quite solvent businesses. That contagion effect, from not knowing who you could trust, who you could lend to, was the real villain, and here, China (as the “collective”) either owns, directs, or influences both sides of the trade, which makes it less likely that unrelated sectors will be suddenly denied access to credit. Michael Pettis, the famous academic and China commentator, makes this point more forcefully here, for those wishing to read more.

Most of the debt is local debt (which makes it difficult to get a “sudden stop” balance-of-payments type crisis going, the usual hallmark of an EM financial crises), and in any case China has several trillion in USD denominated foreign reserves, more than sufficient to buy their way out of capital-flows related trouble.

None of that changes the view that mal-investment in unproductive fixed asset investment, or residential property overbuilds, are a very negative backdrop to commodities, where we remain underweight.

Likewise, none of that changes the view that China will go through a likely painful internal readjustment process, rebalancing away from investment orientated growth, towards less commodity-intensive domestic consumption, (e.g. services across healthcare, social security, entertainment, education), and hence we remain underweight EM.

You could plausibly broaden that out to include a negative outlook for China’s luxury consumer story, which has been one of the longer-running “bull market” narratives used to justify EM overweights (a secular growth story), with dedicated products designed to tap into this part of the market.

Portfolio positioning

At the level of international shares, well, Evergrande and China are just a part of the broader worry list, which centres on good old fashioned valuations concerns (e.g. are markets overvalued?) and good old fashioned policy forecasting concerns (will tapering and subsequent rate hikes derail markets or the economy, or both, and will fiscal stimulus fade away just as the monetary concerns are lifting?). Nothing really new there.

For the sake of completeness, although it’s not the point of the note, we round those worries out with our other flagship concern, namely how likely is it that corporate profit margins can be maintained at present record highs, given wages growth and the difficulty firms face in passing on those costs.

In our view, equity markets are modestly overvalued, and a correction of at least 10% is eminently possible. There’s nothing special in saying that, markets often have intra-year drawdowns of that magnitude, and that whilst assessing exactly when they will occur is basically impossible, our dynamic asset allocation (DAA) process is designed to reduce the exposure of portfolios to risk where they are more likely. Given our modest current DAA underweight (-3% to international equities, -3% to Australian shares) we are effectively suggesting that now is a more likely environment for a drawdown than normal.

Should equities meaningfully drawdown, we would look to deploy capital into the asset class. With our current overweights to cash and alternatives, and the option of additional underweights to fixed income, we have plenty of firepower (at least 12-16 percentage points) no matter what happens.

And, as it has proved in the past, we think that will likely be enough.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

2 topics