Five reasons for optimism

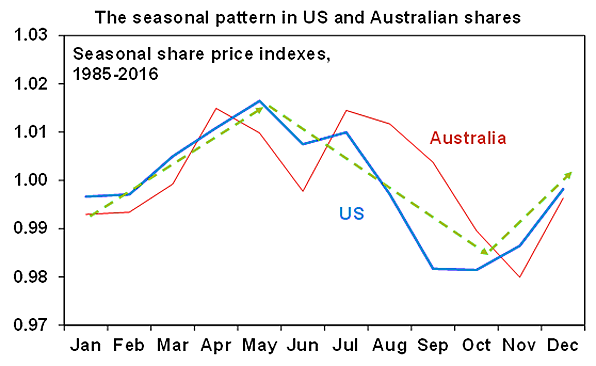

Share markets have had a great run and are arguably due a decent (5% or so) correction as a degree of investor complacency has set in. The latest scandals around Trump along with various other risks – North Korea and the ongoing march of Fed rate hikes – could be the trigger. (Corruption scandals in Brazil are a sideshow and are unlikely to have much impact beyond Brazil.) And it's well known that the best time for shares is from November to May and the worst time is from May to November. This can be seen in the next chart, which shows the seasonal pattern in share markets since 1985.

Source: Bloomberg, AMP Capital

Most major share market falls have occurred in the May to October period (1929, 1987, worst of GFC, etc). Hence the old saying "sell in May and go away, come back on St Leger's Day" still resonates. The seasonal pattern reflects tax loss selling by US mutual funds around the end of their tax year that sees them sell losing stocks around September in order to reduce capital gains tax bills, followed by having to buy shares back in November, the investment of year-end bonuses, New Year optimism and the absence of capital raising over Christmas and New Year all serving to drive shares higher from around October/November, which then peters out around May giving way to weakness that's accentuated by tax loss selling in the September quarter. The only difference in Australia is that July tends to see a strong boost (as investors buy back after tax loss selling), but it otherwise follows the same pattern as the US.

Five reasons for optimism

However, beyond current short-term risks and threats, there are five reasons for optimism.

1) Valuations for most share markets are not onerous.

While price to earnings multiples for some markets are a bit above long-term averages, that is not unusual in an environment of low inflation. Valuation measures that allow for low bond yields show shares to no longer be as cheap as a year ago but they are still not expensive.

Source: Thomson Reuters, AMP Capital

2) While US share market may be vulnerable on some measures, other share markets are not.

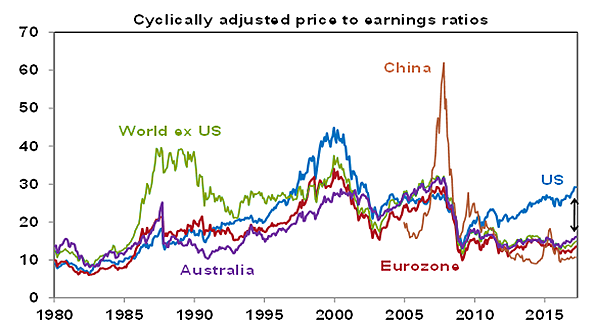

If US shares are compared to a ten-year moving average of earnings (referred to as a Shiller or cyclically adjusted PE) then they are expensive and of course monetary conditions in the US are gradually tightening. However, the so-called Shiller PE remains cheap for most markets globally including Eurozone and Australian shares (next chart). Note also the last ten years include the GFC earnings slump and this will drop out next year, which will see the Shiller PE fall in most countries including the US.

Source: Global Financial Data, AMP Capital

3) global monetary conditions remain easy

In the absence of broad-based excess (in growth, debt or inflation) conditions look likely to remain easy. The Fed is likely to hike rates two more times this year and start allowing its balance sheet to run down later this year but it’s still from a very easy base & other central banks are either on hold or easing. So a shift to tight money bringing an end to the economic cycle looks a fair way off.

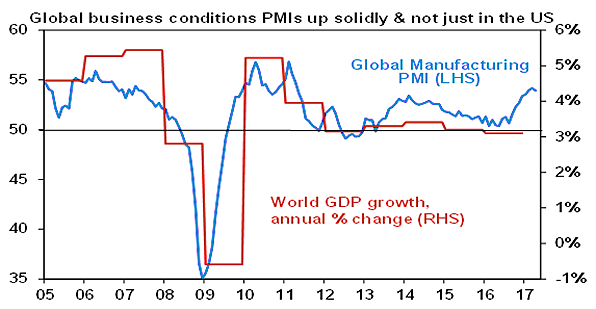

4) Global economic growth is looking healthier

Global business conditions indicators (or PMIs) are strong (next chart), the OECD’s leading economic indicators have turned up, jobs markets are tightening and for the first time in years the IMF has been revising up (not down) its estimates of global growth. US growth looks to be bouncing up again after a seasonal soft spot early this year, Chinese economic growth appears to be stabilising around 6.5% after an earlier upswing, Japanese growth looks to be good, the Eurozone looks strong and Australia is continuing to muddle along (not great but not bad – but nevertheless highlighting the ongoing case for Australian investors to have a decent global equity exposure).

Source: Bloomberg, AMP Capital

5) Profits are strong

US profits are up 14% year on year, Japanese profits are up 15%, Eurozone profits are up 24% and Australian profits look set to rise 20% this financial year.

Concluding comment

After strong gains over the last year and a strong start to the year until their recent highs, shares are vulnerable to a short-term correction as we go through seasonally weaker months. The political scandal around Trump, North Korea and Fed worries could all be a trigger. However, with most share markets offering reasonable value, global monetary conditions remaining easy and global growth and profits looking good, the trend in shares is likely to remain up.