Food inflation hits the shopping trolley

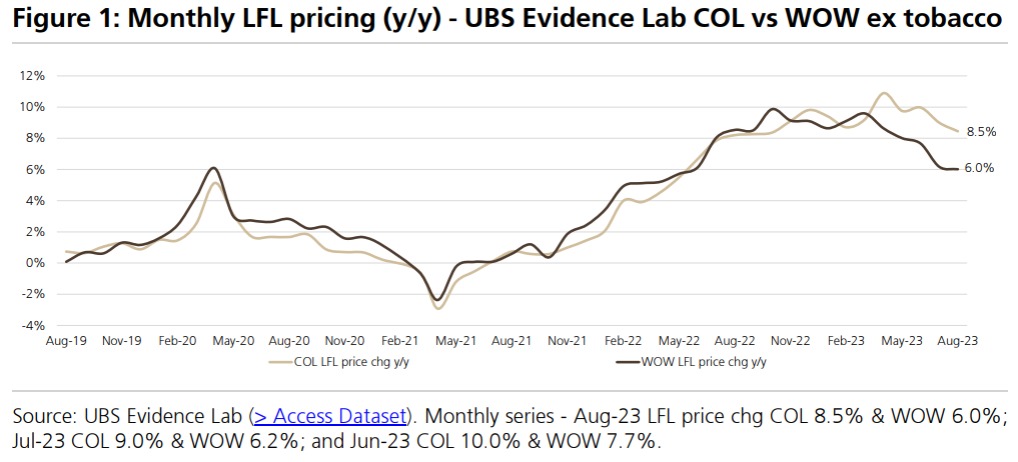

UBS’ Global Research and Evidence Labs has released the results of its 31st grocery price study which tracks more that 60,000 prices(online) across Coles (ASX: COL) and Woolworths (ASX: WOW).

Over the last 4 months, average inflation of this basked of goods (equally weighted and excluding tobacco) has decreased, from a high of 8.9% in May 2023, down to 7.2% in August.

Fresh is best, but...

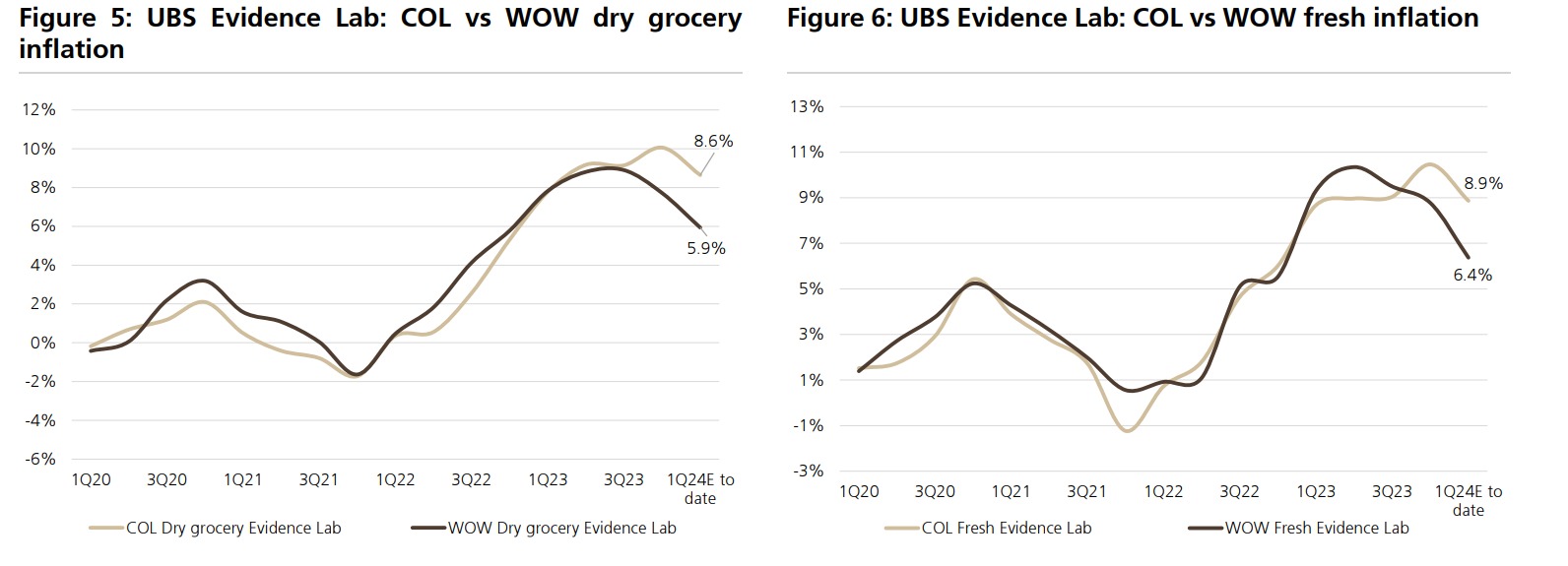

Drilling down into the data shows how inflation across fresh groceries of 7.5% is running higher than dry groceries of 7.1%. While both are down on the prior two months, both figures are elevated over the longer term. And there is a noticeable difference in that level of inflation between Coles and Woolworths on a quarterly basis.

UBS notes trade feedback on fresh groceries indicates inflation is trending lower for vegetables and red meat, while remaining high in bakery and dairy. And while dry grocery inflation is moderating, UBS expects this to remain elevated “due to ongoing domestic supply chain pressures including labour.”

Looking ahead, the respondents to UBS’ latest Supermarket Supplier Survey forecast food inflation to reach 4.8% in the next 12 months (FY24).

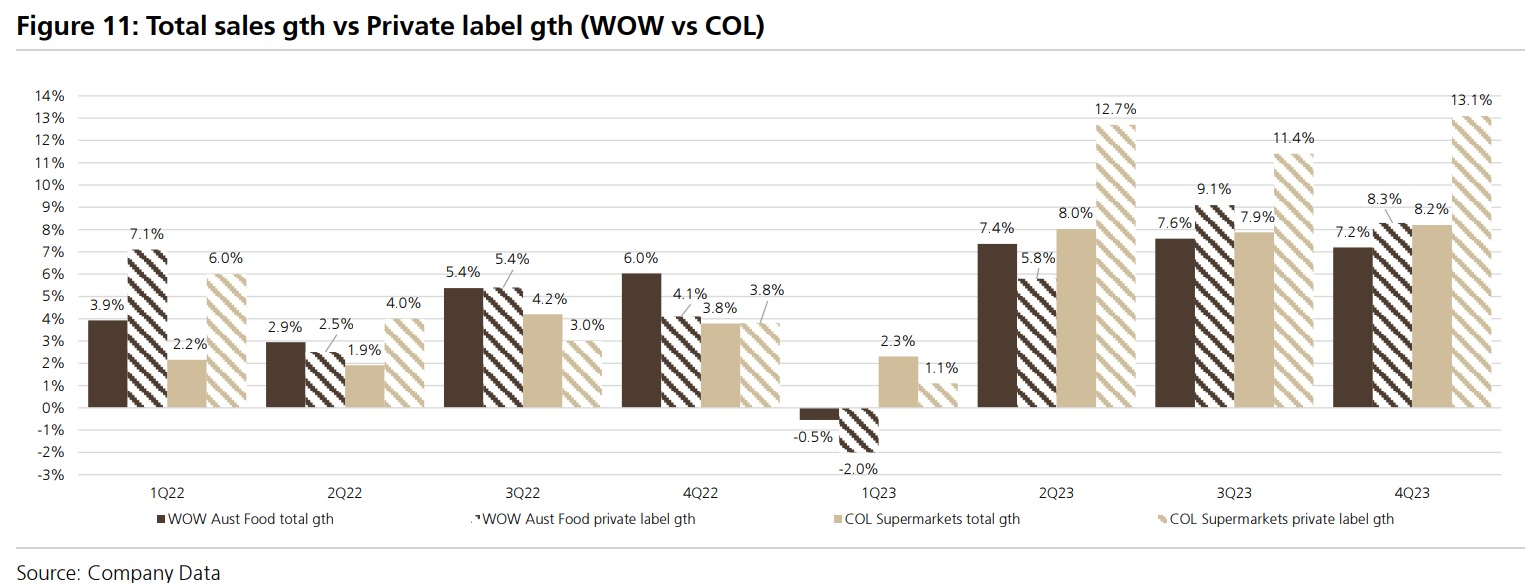

Shift towards cheaper products

A measure of changing consumer behaviour is seen in the shift from brand labels to private labels. Company data shows that shift continues. UBS interprets this trend as consumers changing the mix of products in their shopping baskets to those that are lower priced.

UBS notes this shift is gross profit dilutive and expects this trend to continue.

Outlook

UBS analysts interpret the impact of inflationary pressures on consumer behaviour in their earning’s forecasts for these two consumer staples. They estimate Coles’ Q1FY24 sales to be negatively impacted, while expecting the impact to be positive for Woolworths.

They are NEUTRAL on Coles but see WOW as a BUY.