Fund managers most bullish in seven months despite record valuation fears

Global fund managers turned increasingly optimistic in September, with equity allocations jumping to a seven-month high despite a record number believing markets are overvalued, according to Bank of America's latest Global Fund Manager Survey.

The survey features 196 respondents, managing $490 billion in assets. We highlight some of the key takeaways below.

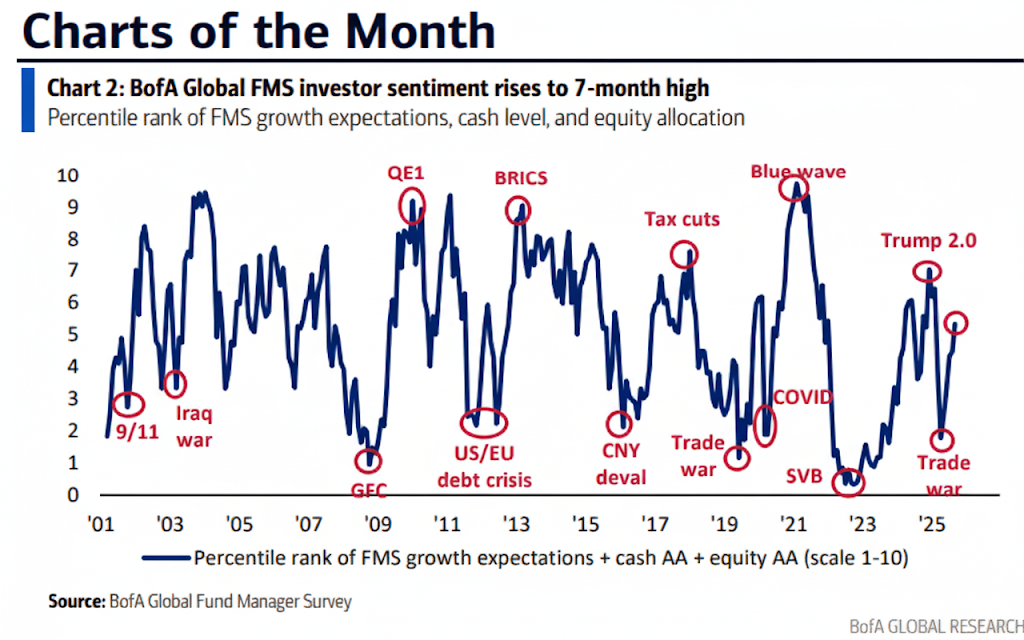

Sentiment rebounds sharply

Global growth expectations jumped 25 percentage points to net 16%, the biggest monthly jump since October 2024. This marks the highest optimism level in seven months, driven by Fed rate cut expectations and diminishing trade war concerns.

Fund managers boosted equity allocations by 14 percentage points to net 28% overweight, the highest level since February.

Despite this bullish positioning, a record 58% of investors now view global equity markets as overvalued, up one percentage point from August.

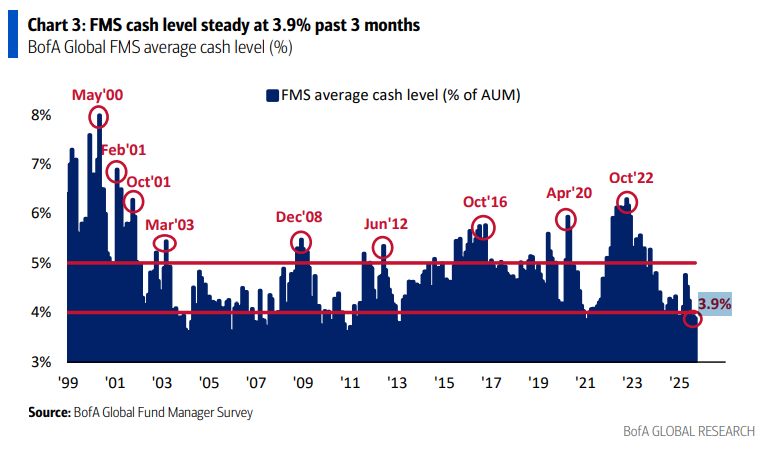

Cash levels at lows

Portfolio managers maintained cash levels at 3.9% for the third consecutive month, keeping allocations at the threshold that triggered BofA's sell signal in July when cash fell from 4.2%. The signal reflects the theory that low cash levels mean less dry powder available to fuel further upside.

.png)

However, when the signal first triggered in July, Bank of America strategist Michael Hartnett didn't expect an immediate market pullback, since equity overweight positions hadn't reached extreme levels and bond volatility remained subdued.

Inflation concerns persist

While growth optimism has surged, inflation worries are becoming stickier. Key inflation indicators show:

- Net 24% of managers expect higher global CPI over the next 12 months, up from 18% in August

- 77% anticipate a stagflationary global economy over the next year, up 7 percentage points since August

- "Second wave of inflation" has emerged as the top tail risk, cited by 26% of respondents

- "Trade war triggers global recession" fell from the biggest tail risk last month to fourth

Fed policy expectations

The survey flagged aggressive rate cut expectations, with 47% of managers anticipating four or more Fed rate cuts over the coming year. The breakdown shows:

- 30% expect four cuts

- 29% expect three cuts

- 17% expect two cuts

- 10% expect five cuts

- 7% expect more than five cuts

Regional allocation shifts

Most regional equity allocations saw outflows, with notable changes including:

- US equities: Net 14% underweight (improving from 16% underweight in August)

- Eurozone stocks: Net 15% overweight (down from 24% in August)

- Emerging markets: Net 27% overweight (down from 37% in August)

- UK equities: Net 20% underweight (tumbling from 2% underweight in August)

Crowded tech

The "Long Magnificent 7" trade remains the most crowded position for the second straight month, cited by 42% of managers. This follows two months when "Short US Dollar" and "Long Gold" topped the list of most crowded trades.

Market Outlook

The survey findings align with bullish commentary from several strategists. In recent days, RBC Capital Markets raised its year-end S&P 500 forecast by 100 points to 6,350, while Morgan Stanley's Mike Wilson reiterated his optimistic view, citing expectations of a growth-friendly policy environment.

The Fed is widely expected to cut rates at its September meeting, which takes place at 4:00 am AEST on Thursday. A Bloomberg article, citing data from Ned Davis Research shows the S&P 500 averaging gains of 15% a year after rate cuts resume following a six-month pause, compared to 12% after regular easing cycles.

The S&P 500 has rallied almost 18% since the Fed began cutting rates last September with an initial 50 basis point move. This performance is in-line with the typical 17% gain observed across the five previous easing cycles since 1984 where the economy did not quickly enter a recession.

2 topics