Funding the net zero transition via debt capital

I’ve written quite a bit recently about the energy transition in Australia. There is a need for capital to fund investments, not only in the raw materials but also in infrastructure. With the energy transition being a global theme, investment is also required in other markets.

One way for governments to fund this investment is to issue debt. Increasingly in Australia and globally, such debt takes the form of a green bond. In this wire, I will explain how green bonds are constructed, their purpose, and how you can access them.

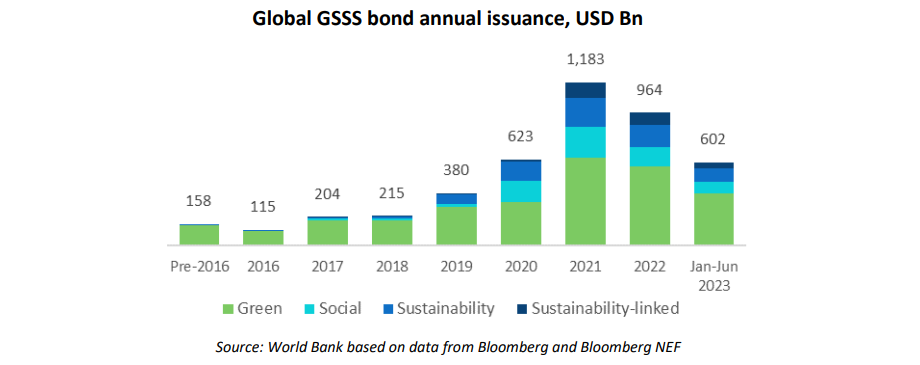

The latest research from Ninety One indicates green bonds make up only a fraction of sovereign debt issuance worldwide. Nicholas Jacquier from Ninety One notes how the global market has moved on since the first sovereign green bonds six years ago.

“The market has been maturing rapidly since then, with the development of social and sustainable bond issuance and then sustainability-linked bonds (SLB) more recently. “

The sunburnt country's love of green bonds

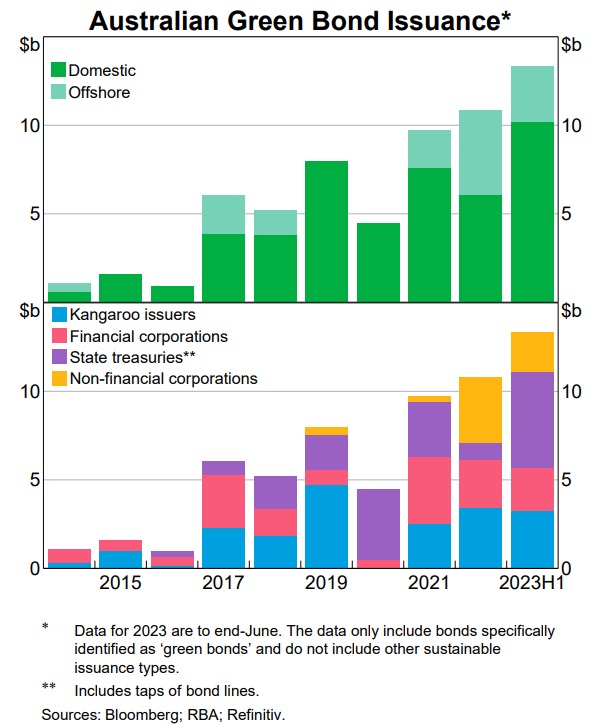

The RBA notes there was $13 bn of green issuance in the first half of 2023, with the main issuers being state treasury corporations, the major banks and ‘kangaroo issuers (non-resident organisations that issue bonds denominated in Australian dollars into the Australian market, such as supranational development banks).

While our Commonwealth Treasury is somewhat late to this party, only announcing its intention to set up a green bond framework earlier this year - with the first issuance expected in mid-2024 - other state government treasuries have been more active with issuing green or sustainability bonds such as the treasuries in NSW, Victoria and Queensland. Where bonds have been issued, they’ve typically been oversubscribed, so there is an appetite for this kind of sovereign debt.

The increase in green bond issues in Australia is reflected in the top graph below, while the bottom graph shows the breakdown of who is issuing.

Use of proceeds

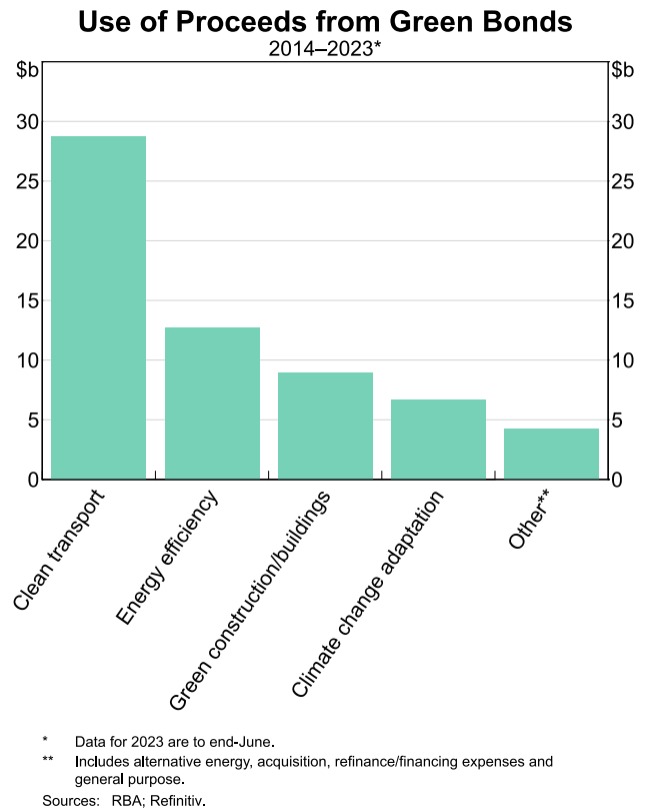

For a use of proceeds green bond, the annual reports required by the International Capital Markets Association (ICMA) Green Bond Principles or the sovereign/public sector's own bond framework provide an information advantage over your usual corporate bond or treasury issuance.

For a bond that is not labelled green, such as your typical corporate bond, the purposes for which the capital is sought could be linked to a specific project but more frequently are slated to be deployed for ‘general corporate purposes’. To track how the money has been spent, you need to keep a watchful eye on the company's annual reports and investor presentations.

As set out in the graph below, a common use of proceeds for green bonds over the period 2014-2023 is for infrastructure, such as the Parramatta Light Rail, Melbourne Water’s Western Treatment Plant and the Sunshine Coast Solar Farm.

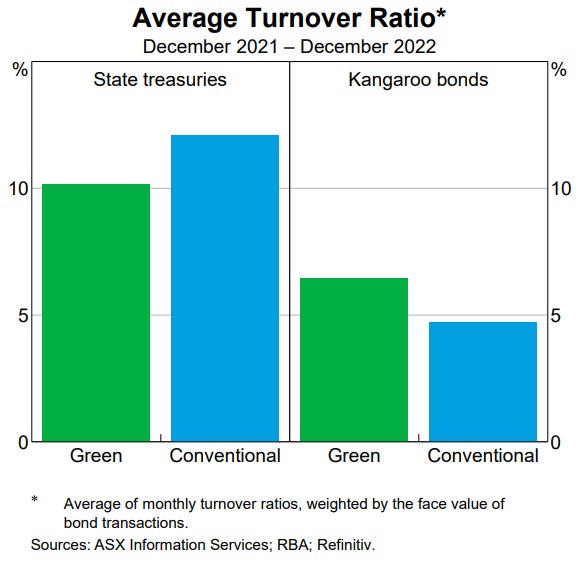

What about liquidity? The RBA dispels a myth about liquidity in the secondary markets for sovereign green bonds. Its analysis for the period December 2021 to December 2022 indicating that:

“the bulk of green bond turnover is due to trading in state treasury corporation and kangaroo bonds. For these two issuer types, turnover levels are roughly similar regardless of whether bonds are classified as green or not. As such, the secondary market for green bonds appears to be no less liquid than their conventional counterparts”

Global sovereign green bonds

Globally, sovereign green bond or social bond issues were used by governments in 2020 to respond to the Covid health crisis. As Jacquier notes:

“Since then, other countries have begun to tap the broader GSSS (green, social, sustainable and sustainability linked) bond market – e.g., in 2022, the Philippines issued its first sustainable bond, the proceeds of which are earmarked for green projects as well as targeted social projects aiming to improve the country’s healthcare, education system and food security.

Looking ahead, vast sums of money will be needed for the global energy transition, making transition finance a key focus of the GSSS market.”

Data from the World Bank shows the total issuance of GSSS bonds annually is standing at US$602bn for the first six months of 2023. Of the US$4.4tr of GSS bonds on issue to the end of June 2023, 64% are green bonds, and emerging markets account for 16% of the total issuance.

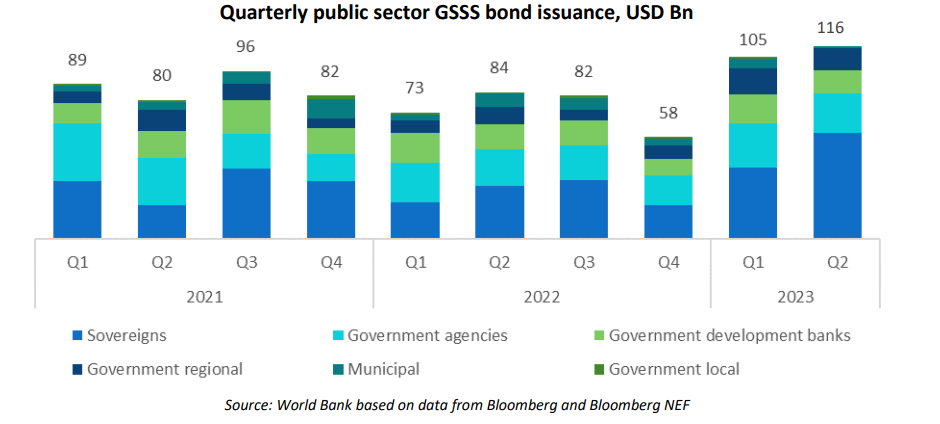

The public sector, which includes sovereigns but also government agencies, government development banks, regional governments, municipalities and local governments, represents 31% or US$1.37 trillion of the total amount on issue to date. Green bonds are the preferred instrument for these issuers (60%) and the sovereign segment is the biggest segment (31%). They note that:

“ In Q2 2023, the public sector issued US$116 billion in GSSS bonds, an 11% increase compared to Q1 2023 and a 38.3% increase compared to Q1 2022, mainly pushed by sovereigns and regional governments.”

Emerging markets

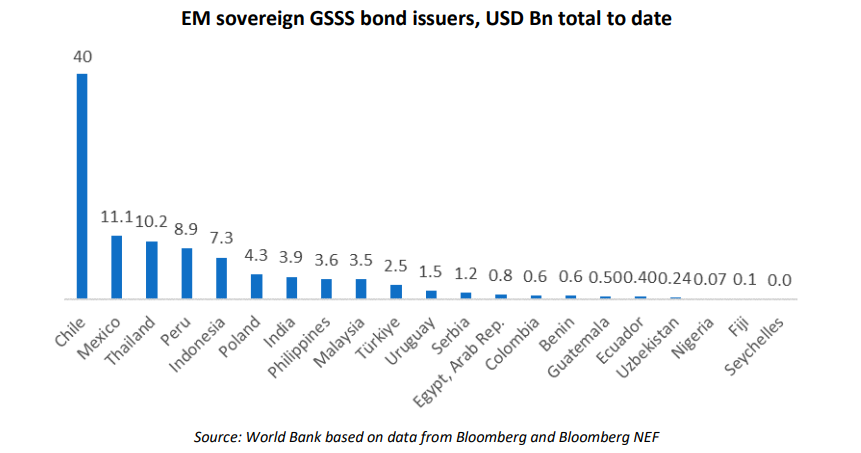

While GSSS issues are still largely within established markets, emerging markets are also deploying this type of investment instrument to attract capital. The World Bank notes that Chile remains the largest issuer of GSSS bonds (US$39.6bn), followed by Mexico (US$11.1bn) and Thailand (US$10.2bn) as of June 2023.

While issues in hard currency (US dollars or Euros) have dominated, a few sovereigns are starting to issue in local currency (for instance Colombia, Chile, and Thailand). Jaquier comments on this trend:

“This is heartening, as sovereigns, especially smaller/frontier sovereigns, cannot exclusively rely on foreign currency debt to finance the energy transition and need to be able to borrow in their local currencies to mitigate risks and adapt to climate change. In addition, this helps develop sustainable finance in their home markets. We expect continued growth and diversification in this sector.”

Sustainability-linked bonds

Sustainability-lined bonds or SLBs are more flexible than GSSS because they are not attached to specific projects but are instead linked to the issuer committing to reach sustainability targets with a higher coupon payment applying if it misses these.

“SLB issuance sends a strong signal of a country’s commitment to climate targets and allows even small sovereign issuers to establish a presence on sustainable finance markets:, says Jacquier

He adds that while Chile and Uruguay are the only two sovereigns to have issued an SLB to date in emerging markets, he expects more countries to follow.

40 shades of green

Investors seeking to green their portfolios can be lured by greenwashing. We’ve seen regulators globally take issue with both funds and corporations whose claims to green fade to black in the sunlight of close scrutiny.

And while the green and sustainability bond frameworks offer better disclosures for investors and third-party assurance of the claims, Jaquier notes:

“GSSS frameworks should ensure strict exclusion lists that are relevant to the issuer, some independent oversight in the project selection process, and a critical assessment from a reputable third-party provider, such as Sustainalytics or Moody’s ESG Solutions.”

As the market has matured, he notes that Standards have improved, but monitoring allocation and impact reports remains important.

“These are useful resources to monitor progress ex-post and confirm adherence to ex-ante commitments included in the initial bond frameworks”, he says.

Green bond funds and ETFs

While I am not recommending any of the products below and, as always, investors need to do their own research to understand if a product is suitable, the most common way to invest in this area is via a green bond fund or a green bond ETF, which includes sovereign bonds within its portfolio. There are several available in this market, such as:

- Australian Unity Green Bond Fund

- BetaShares Sustainability Leaders Diversified Bond ETF - Currency Hedged (ASX: GBND)

- BNP Paribas Green Bond Trust (wholesale investors only)

- Janus Henderson Sustainable Credit Active ETF (Managed Fund)

- PIMCO ESG Global Bond Fund (wholesale investors only)

Bond ETFs and funds

Another way you might get exposure to this theme is via a sovereign bond fund or ETF or a bond fund or ETF, which includes sovereign bonds (and thus also could include GRSS bonds). There are several available in the market for retail investors, such as:

- BetaShares Australian Government Bond ETF

- BetaShares LeggMason Australian Bond Fund (ASX: BNDS)

- Franklin Australian Absolute Return Bond Fund

- Yarra Australian Bond Fund

4 topics

4 stocks mentioned

9 funds mentioned