Grassroots Tour of India - Day 1

India Avenue conducted its inaugural Grassroots Tour of India over 3 days from March 11th to the 14th. The tour included nine delegates from Australia and the Pacific with the purpose of exploring India as a long-term investment opportunity as well as myth-busting some antiquated stereotypes. We travelled to Mumbai and Pune to observe India at a grassroots level. The tour involved visiting companies and factories and meeting with strategists, management, government officials, the Reserve Bank of India and even a slum!

We seek to run our Grassroots Tour annually, across varied locations in India to build a deeper understanding of the country’s potential, now and into the future. Next year, the Australian Cricket team will also be in Bangalore for a T20 and no doubt this will be an essential part of the itinerary!

Insights Day 1

On day one of the tour our intention was to bring several speakers to our conference centre at the Grand Hyatt in Mumbai. Despite it being a Grassroots Tour, Mumbai is a difficult city logistically, thus we made the speakers come to us as delegates would be dealing with jet lag. Nonetheless, we ended the day with a visit to the world’s 3rd largest slum, to witness consumption and activity at the bottom of the pyramid!

Our first few presentations on Day 1 were given by Gautam Chhaochharia, Head of India Equities Research at UBS as well as several sector analysts from a local stock broking house. The key takeaways were as follows:

India is growing at a pace above its developed and developing partners. This is being driven by India’s demographics and policy reform initiatives which lays the platform for secular growth over the next few decades. Typically, in some growth economies, stock markets are not investible. However, in India, the market is deep, liquid with several sectoral and stock opportunities.

India vs China

- India’s demographics will drive its growth at a faster pace than China. It has significant catch up on a GDP per capita comparison, working from a low base

- Working age population of India’s is expected to stay at close to 68% while China will start dropping rapidly, given that they have an ageing population. India will contribute significantly to the global working population going forward

- Trade openness as a % of GDP has caught up to China. China’s manufacturing wage has accelerated significantly, not making it a comparative advantage it once had

- India needs to catch up on internet penetration, particularly in terms of number of users

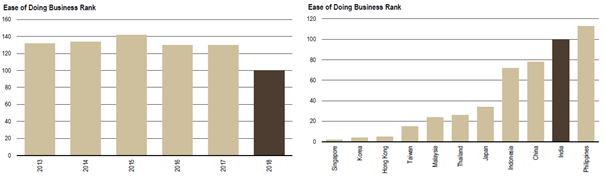

Ease of Doing Business

Foreign businesses continue to invest in India and ownership laws were being relaxed by the Government. Companies like Unilever, Proctor & Gamble, Nestle, Colgate, Castrol, Suzuki, Honda, Gillette, Siemens and Oracle to name a few have been in existence in India for a long period. In fact, the ease of doing business has taken on significant priority with simpler and faster systems, greater transparency and efficiency, online processing and documentation and reducing hurdles for labour and licensing. Prime Minister Modi aims to move India up the ranks to 50 in the next few years.

Source: World Bank, UBS

Source: World Bank, UBS

Infrastructure

The Government is focussing on significantly improving India’s infrastructure over the next decade. The following are some of the major reforms/projects under way;

- Housing for All by 2022 will involve the significant building of low-cost housing. This will require significant spending and can add again significantly to GDP

- Significant spend on roads ($90bn over next five years) and Ports (60% higher traffic by 2022). 100% FDI is now allowed in both areas (Macquarie recently bid for and won the rights to operate toll roads in India)

- The Government is to spend $140bn on railways in the next 5 years including hi-speed, projects related to coal mines, ports, electrification and suburban corridors. $18bn of which will be spent on a dedicated freight corridor. (currently passenger and freight occupy the same rail network which is inefficient)

- Estimates $1 trillion required for 100 Smart Cities by 2022. Private investments and PPP models for townships and cities

Consumption

The main thematic exciting investors in India is consumption.

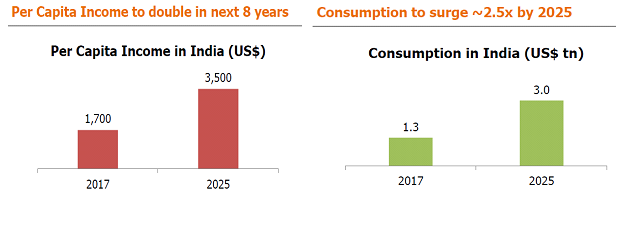

Studies estimates consumption spending will multiply by 2.3 times to US$3tn by 2025 as India overtakes China with the world’s largest population. Furthermore, India’s demographics of 50% under the age of 25 means the runway for consumption will be unprecedented.

Other drivers include a doubling of GDP per capita from a very low base of US$1,700 currently, increasing rate of urbanisation given 65% of the population lives in rural areas and the number of rising households (264m to 305m) with increasing number of aspiring, affluent and elite (from 12% in 2015 to 36% by 2025).

Source: Report by Edelweiss titled “India 2025: Another Tryst with Destiny”

Source: Report by Edelweiss titled “India 2025: Another Tryst with Destiny”

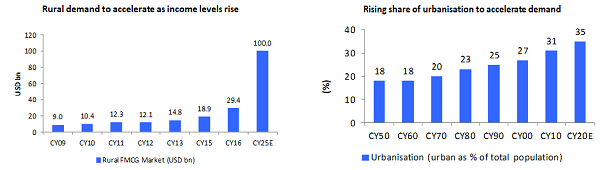

Shift from unbranded to branded will increase post GST with organised retail expected to grow 20% p.a. from 9% (FY16) to 12% (FY20) market share. Categories and companies with high focus and scope of increasing rural penetration will perform well as rural incomes grow. The implementation of GST, higher prices of agricultural products, increase in social spends in rural markets (considering the National Election next year) and improvement in road infrastructure will be key catalysts for growth in consumer products in this space.

Source: Antique Stockbroking Presentation on Consumer and Retail Sectors

Corporate Meetings

Dabur

Dabur is the 2nd largest FMCG company listed in India, in terms of its product portfolio. Ayurvedic medicine has been core to its philosophy for 133 years and they aim to make Ayurveda accessible to every household in India. The company undertakes a stringent quality test of every ingredient and has a strong R&D component consisting of Ayurvedic doctors and scientists.

Dabur is focused on increasing health awareness and a growing emphasis on natural medicines and holistic lifestyles. The underpinning fundamentals are increasing GDP per capita, increasing consumption, increasing self-awareness around health and rising wealth in rural areas.

The company has 6.3 million outlets which has provided an economic moat for its distribution prowess and its ability to maintain and grow market share. However, Dabur is also an international player, with 30% of sales in overseas markets, indicating an increasing preference of foreign consumers as Ayurvedic medicine becomes more mainstream. The company has a market cap of over US$11bn and has experienced 15% p.a. revenue and profit growth over the past decade.

Indusind Bank

IndusInd Bank is a Mumbai based private bank established in 1994 and was one of the first new-generation private banks in India. The Bank has over 1,300 branches across India and revenue of US$2.8bn.

IndusInd Bank is well capitalised and does not suffer the same NPA issues as can be seen in many of the Public-Sector Banks. The Bank has a Capital Adequacy Ratio of close to 16% and NPA’s of 0.46% and has been growing its profits at above 20% per annum. The Bank has a stable loan book and has focused on innovation, offering a wide range of banking products and working together rather than in competition with the fintech industry.

Sanjay Malik, the Head of Investor Relations went through the banking system in India and the history and legacy of public and private banks. He stated the private sector today receives 70% of the new flow as they are quickly gaining market share from the large incumbent Public Sector banks.

Dharavi Slum Tour

Dharavi is a municipality of India’s most populated city, Mumbai, and is the world’s third largest Slum, covering an area of 2.1 sq. kilometres. The Slum (where they filmed the movie Slumdog Millionaire) is home to about 700,000 people, with one of the densest populations in the world. The Slum was founded in 1883 and grew in part due to the factories and corresponding residents who were migrating to Mumbai to find jobs.

Total annual turnover of the Slum is around US$1bn! The core products produced internally are leather, textiles and pottery products. Recycling is also a big industry and reportedly employs 250,000 people in the Slum.

The Slum signifies India’s low GDP per capita, but significant spending power given the masses. The growth potential is significant as wealth rises. Several jobs are not recorded in employment data given it belongs in the informal economy, but the slum is highly productive and generates income for many of its residents. The district has an estimated 5,000 businesses and 15,000 single room factories. Dharavi also has two major train lines feeding into it and goods are exported to US, Europe and the Middle East.

Tomorrow we will highlight the events and insights of Day 2 of the tour where we travel to Pune, a city 4 hours south east of Mumbai, known as the "Oxford of the East" due to the presence of several well-known educational institutions.

Stay tuned…

5 topics