Growth at reasonable yield (GARY): January 2024

In an environment characterized by elevated inflation, rising interest rates, burgeoning debt levels, geopolitical tensions, and economic volatility, yield investing faces a myriad of challenges and opportunities. Navigating this complex landscape requires a nuanced approach that considers the interplay of these factors and their impact on various market cycles.

One of the primary challenges in such an environment is the impact of inflation on real returns. Elevated inflation erodes the purchasing power of fixed-income investments, posing a significant threat to traditional yield-focused assets like bonds. Investors seeking yield must grapple with the delicate balance of generating income while safeguarding against the eroding effects of inflation. Dividend-paying stocks and real assets such as real estate and commodities may become attractive alternatives as they have historically demonstrated resilience in inflationary environments.

Rising interest rates add another layer of complexity to yield investing. As central banks tighten monetary policy in response to inflationary pressures, fixed-income like securities become more sensitive to interest rate movements. This dynamic underscores the need for a diversified portfolio that can weather interest rate fluctuations and adapt to changing market conditions.

The global debt burden further complicates the yield investing landscape. High levels of public and private debt across economies amplify the risks associated with interest rate hikes and economic uncertainties. Investors must carefully assess the creditworthiness of their fixed-income like securities, considering the potential impact of economic downturns on debt repayment capabilities.

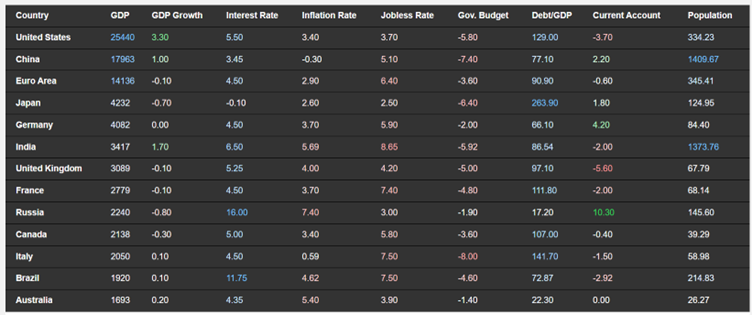

Apart from unique economies like China and Japan, Australia has the lowest interest rate despite having the highest inflation in developed economies. Despite most economies sitting on extreme debt and relatively low growth, markets are expecting dramatic rate cuts to further stimulate debt and inflation at historically low unemployment rates. Governments are expected to have numerous years of deficits with historical high debt to GDP as interest rates remain elevated in recent decades.

Geopolitical tensions introduce an additional layer of uncertainty. Political events, trade disputes, and regional conflicts can lead to sudden market shifts, affecting the performance of various asset classes. Yield-seeking investors must remain vigilant to geopolitical developments and their potential ramifications on investment portfolios.

In such a volatile environment, economic indicators and data releases become crucial drivers of market sentiment. Investors must stay attuned to economic reports, central bank communications, and global macroeconomic trends to make informed decisions. Flexibility and adaptability are key as economic conditions evolve.

Despite these challenges, elevated inflation and interest rates can create unique opportunities for yield investors. Yield investing in a backdrop of elevated inflation, interest rates, debt, geopolitics, and economic volatility requires a strategic and dynamic approach. Diversification, careful risk assessment, and a focus on real assets may be crucial components of a successful yield-oriented investment strategy in this complex environment. Investors must stay informed, adaptable, and prepared to adjust their portfolios as market dynamics evolve.

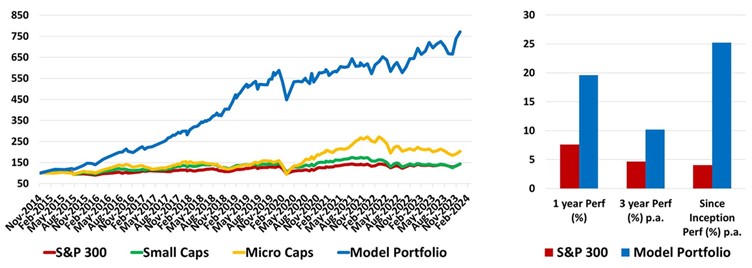

In a market characterized by changing macro cycles with never-ending Central Bank and government interventions, data-driven investment strategies offer a beacon of hope. By leveraging data, Deep Data Analytics can help investors make informed decisions, manage risks effectively, and seize growth/yield opportunities that may otherwise remain hidden. In an era where data is king, harnessing its power can be the key to unlocking yield in uncertain times.

The best Q4 performers in the GARY Top 10 at Dec 2023 are: Ansell (ASX: ANN), ASX (ASX: ASX), Elders (ASX: ELD), Regis Resources (ASX: RRL) and Telstra (ASX: TLS)

Note: DDA may or may not have made changes to the model holdings since the end of December. The model portfolios will continue to evolve with the economic/market cycles.

5 topics

5 stocks mentioned