Hair on Fire

HOW TO PLAY THE RECOVERY TRADE

The hopes for a vaccine sent the Dow up 911 or 3.85% on Tuesday - the market was flying along with its hair on fire. The S&P 500 was up 3.15% with the UK up 4.29%, Germany up 5.67%, France up 5.16%. The oil price was up 8.12% and BHP and RIO were up 8.32% and 8.05% in the US.

The US Healthcare sector is now just 2% from its high this year, the S&P 500 down just 12.9%, the US Technology sector down just 6.05%.

The market hasn't followed through overnight but for a moment there we saw what would happen if the herd started to focus on the possibility that there is a vaccine, on the possibility that the coronavirus will miraculously go away.

It is a potentially powerful market driver, it has all the ingredients. It is easy to understand and we all, including the herd, so desperately want it to be true. So it will be easily (recklessly) adopted. Believe and invest first, facts later. And the herd turned, for a day at least.

The impact of the coronavirus going away, if true, would be priced into the stock market very quickly. It would turbo-charge the recovery in company earnings and the bounce back in the global economy. The 'thinkers' will be left behind in a blink, just as the 'thinkers' were left behind in the fall. Sometimes you have to act fast and this just might be one of those moments.

Not convinced? Don't believe in a vaccine? You're missing the point. Your opinion doesn't matter, if the stock market begins to believe it you have to factor in. Especially if you are a benchmarked fund manager, because it could end of one of the best stock market opportunities in a decade and the underperformance will be permanent.

CLICK HERE for yesterday's Podcast of this article - We do a regular podcast for our Members and SMA fund investors:

ZERO to 100

Zero on the stock market sentiment scale is the most bearish end of the spectrum. Zero is the expectation that COVID-19 is with us forever, there is no vaccine, there will be constant relapses, lengthy re-lockdowns and a depression rather than a recession.

100 is the expectation that a vaccine will be available immediately, we don’t have to worry about COVID-19 ever again, every company is going to get back to work immediately and a V-Shaped economic recovery starts today and there will be no permanent economic damage.

Obviously there is a scale and we are somewhere on it and on Monday the needle just moved closer to 100.

The TV anchor debate in the US post the vaccine rally was a microcosm of all investors. One decided it was time to sell into strength saying the market is ahead of itself (predictable finger wagging chicken response). Another said “go to the sidelines” (paralysed at exactly the wrong moment). Another said “there is a risk people are getting too optimistic" (Zero value-add making a living out of stating the blinking obvious). A fund manager said "It'll end in tears" (obviously short and hoping it does but getting it badly wrong as he loses another few million). Another said “I don’t know” (honest but will never make money in the stock market waiting until they do know). Disappointingly none of them said “Buy with your hair on fire”. Let me add that as a view some of you might take.

The real answer, and the key to the market in the end, is buried in medical fact. The Medical facts are also, probably, unknown as yet and we, let alone TV anchors, need not debate or express a strong view, because they, and we, simply cannot know. Its pointless having a “view” on that without being a medical expert. Its just posturing, for the camera perhaps.

But the stock market is driven by sentiment not fact. It moves on what the stock market herd believes and wants to believe irrelevant of medical fact, and on a scale of zero to 100 measuring what level of an instantly virus free world the stock market is going to price in, the herd is, obviously, off zero and not at 100%.

But its definitely off zero. The vaccine rally tells you that the herd is clearly, easily, interested in this theme, and they are keen to run with it.

So lets assume we are somewhere between 0-100%.

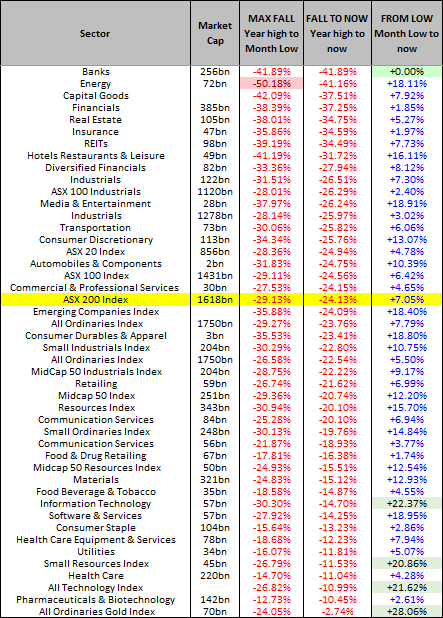

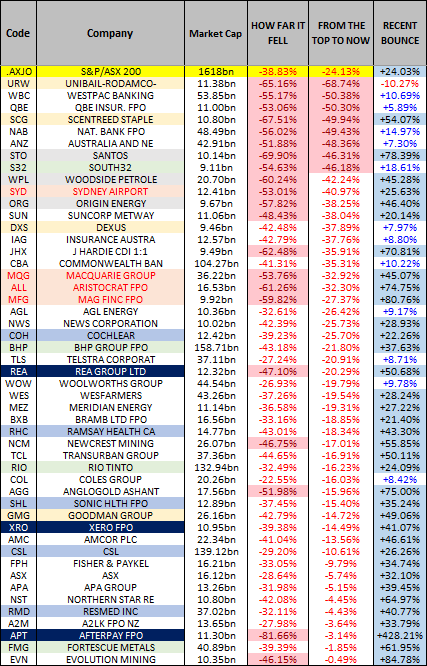

Where you personally choose to be on that scale is your choice. I know where I am – I’m at 30-40%, which is probably too high, but it is influenced by being a benchmarked fund manager, I simply cannot afford to miss it if its right, the cost of being wrong is permanent performance damage and permanent opportunity lost. If the herd grabs the theme, the market is going to move fast and we are going to miss the opportunity to buy the market, the energy sector when it is 41% off the top, the REITs 35% of the top, Qantas 54% off the top, Worley 49% off the top, URW 68% off the top, Santos 46% off the top, Flight Centre 76% off the top, Webjet 74% of the top, IEL 41% off the top, and all the other stocks and sectors that have not yet recovered. Here is a list of Australian sectors and how far they have fallen from the top:

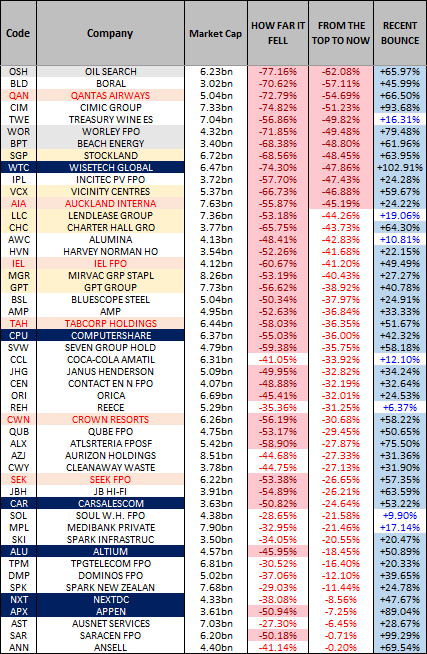

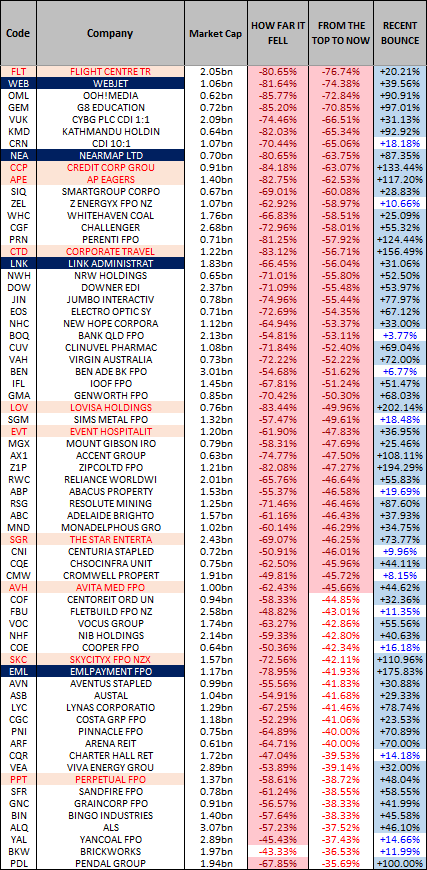

Here are our regular lists of TOP STOCKS and how far they have fallen from the top:

TOP 50

NEXT 50

WORST OF THE REST

After Monday we are factoring in a higher possibility of a recovery rally continuing. So we got more fully invested. But that's us. Your investment decisions are based on your risk tolerance, your time frame, your level of greed, and its your choice. Its personal. Read the newswires, delve into the medical facts, and you make your decision.

WHAT TO BUY FOR A MOVE CLOSER TO 100

Whilst I cannot correctly predict where we are on the scale and spoon feed cash into your bank accounts, the value I can add post Monday is to tell you almost exactly what stocks to buy if you wanted to factor in a vaccine cured virus free world, what to buy if we were moving towards 100.

Wall St told us the whole story on Monday. The performance in the US on Monday was a crystal clear window on what will happen if CV-19 went away, on which stocks will move the most if the virus goes away.

Some bullet points on that:

- Forget the headline indices being too high, the S&P 500 being ‘just’ 12.9% off its high should not make you wary. The S&P 500 bounce is a function of US Technology stocks. But you’re not going to be buying Amazon and Netflix for recovery and there is plenty of opportunity underneath.

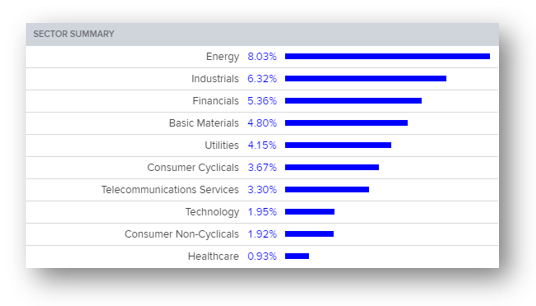

- Sectors in the S&P 500 overnight. The message is obvious – If you think the vaccine sentiment will build you clearly buy Energy, Financials, Resources, and highly indebted credit crunch sensitive stocks like Utilities, Infrastructure, REITs. This is a table of the US sectors on Monday night. This is simple stuff. If you want to play recovery all the opportunity is in the recovery sectors.

- Airlines – Best performing stock in the S&P 500 on Monday was United Airlines up 21.1%. Delta Airlines up 13.9%. Boeing up 12.8%.

- Travel & Leisure – Expedia (online travel) up 18.6%. Norwegian Cruise Line up 17.95% the third best performing stock in the S&P 500. Royal Caribbean Cruises up 16.7% the 9th best performing stock in the S&P 500. Carnival Corp up 15.1% (Travel Leisure).

- Hotels & Restaurants – Marriott International up 17.38%.

- Energy stocks – Halliburton up 17.2%. Marathon Petroleum up 15.3%. Schlumberger up 12.%.

- Financials – JP Morgan up 5.3%, Wells Fargo up 8.8%. Citigroup up 8.9%. Morgan Stanley up 8.0%.

- Stock Market Stocks – The investment banks. ETFs, Fund Managers.

- Avoid – Healthcare, Staples, Technology based virus beneficiaries – Stocks that did well in the falls. Domino’s Pizza was down 3% in the US overnight, third worst performing stock. Netflix fell last night by 0.35%. Amazon was up just 0.6%. Other stocks underperforming included healthcare, big safe industrials, technology, online shopping – stocks like Gilead (COVID-19 treatment), Newmont (Gold), Eli Lilley, Bristol Myers, Kimberly Clark, Pepsico, Biogen, Abbott Labs, Paypal, Visa, Electronic Arts (gaming), Merck, Verisign.

- Gold - Underperformed overnight. Gold is a play on uncertainty and money printing. This is the opposite.

THE BIG DECISION

Cash or the market - The first decision for all investors is to get the market decisions right, whether to be in the market or not and to what extent. For those who want to factor in some virus optimism and are not traders/stock pickers, the general message is to think about your asset allocation. If you were in 100% cash the prospect of a vaccine should prompt you to get more fully invested.

Its your choice. We were 85% invested before Monday. We will be 100% in again very soon. That's our call. You have to make yours, not mine.

STOCK PICKS IN AUSTRALIA

Summary for a virus free world...or at least an improvement in virus sentiment - stick this on the fridge and remember who gave it to you:

BUY

- The stock market (get more fully invested). A lot of you play ETFs.

- Energy. Big plays - STO, WPL, ORG, WOR, BPT, OSH (least preferred).

- Stock market stocks - MQG, MFG, PTM, IRE, NWL, HUB

- Financials. Lets hope banks have a sentiment improvement but unlikely to rally hard. Wouldn't be underweight yet.

- Travel, Airlines, Tourism - QAN, AIA, SYD, FLT, WEB, HLO, CTD, EXP, REX, ALG, EVT, SLK,

- Education - IEL

- Motor Industry - APE, CAR, ARB, DUD, SIQ, MMS, AMA, SGF, ECX

- Advertising - NEC, OML, SXL

- Discretionary Retailers - LOV, HVN, JBH, AX1

- Gaming, Casinos - ALL, CWN, SKC, TAH

- Housing - REA, REH, BIN, GWA, DHG

- Sentiment stocks - WTC, APX, ALU (APT has probably done enough) - and other high PE technology, biotech, mid-cap and small stocks.

- COVID-19 damaged stocks.

OK BUT NOT HIGHLY GEARED TO RECOVERY

- Banks - Well down but you won't get as much bang for your buck.

- Resources.

- REITs - GMG, URW, SCG, DXS, MGR, SGP, GPT, VCX

- Infrastructure, Utilities - TCL, SYD, APA, AZJ, AIA, ALX, AST

UNDERWEIGHT

- Healthcare.

- Food - Staples.

- Telecoms.

- COVID-19 beneficiaries - online anything. (KGN, APT, Z1P)

- Big boring industrials that held up in the fall. (WOW, WES, COL).

- A2M, FPH, DMP.

We offer our investors and newsletter Members complete transparency on our investment decisions. You can follow what we do in our portfolios on a daily basis via our daily podcasts and in the newsletter. For our daily Strategy advice you can join Marcus Today - click here to SUBSCRIBE or to sign up for a FREE TRIAL

4 topics