High valuations are the cost to play in equity markets

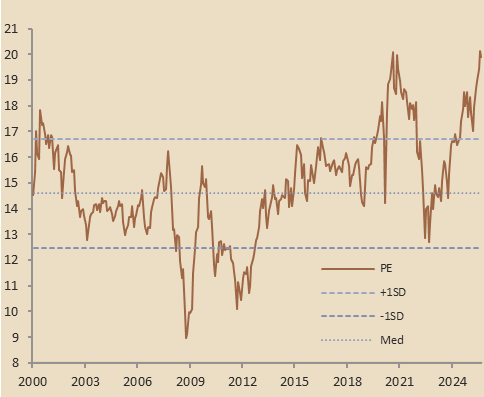

We think high valuations are a “necessary evil” if you want to play in the equity market at the current point in time. We hate that valuations look expensive, but the cost of being out of the market seems a lot higher than getting over the discomfort that elevated valuations are causing.

The good news is that once you get past valuation concerns, we think the outlook for equity markets becomes a little easier to navigate - notwithstanding there are certainly other risks present.

We can’t recall when the narrative around the market outlook has been so at odds with the performance of asset markets.

Maybe it’s the Trump effect where it’s acceptable to take the other side of (almost) everything and not feel guilt-ridden if it’s wrong. Truth be told, we just can’t explain this divergence. The equity bull market is alive and prospering. Global bonds have also now entered into a bull market, credit spreads are at multi-decade lows, corporates continue to deliver on earnings, and the global economy has not crashed and burned. There are cracks, but there always are because the outlook, no matter how good, is never perfect.

ASX200 PE’s are high but not a constraint to upside

Source: FactSet, Macquarie Strategy

We have never been afraid to challenge the consensus narrative, but we are now wondering if we are looking at a different set of markets than most others. In yesterday’s Livewire Live Symposium, it was hard to filter out the words of caution. The Australian market is overvalued, earnings growth is weak, we can’t find stocks to own, we are recommending stocks to protect against downside risks and then there were the structural headwinds that the global economy and markets are barrelling their way into.

Whatever words of caution could be used, they were. We have no issues with this, but this narrative has been in play for some time and markets have gone in the opposite direction. We’re sure caution will ultimately prevail, but meanwhile it shouldn’t be at the expense of ignoring what’s going on in equity land. If things were so bad here in Australia, why then is the equity market up 10% YTD and why are two of the most domestically sensitive sectors, Consumer Discretionary and Industrials, up 16% and 12% respectively?

Certainly, Australia has been a laggard, but it usually is when equities are running so not much to see here. Unless you believe equity fund managers are going to become cash account managers, then they have to invest. Whether the market is expensive or cheap. Thankfully there are ways to lower valuation risks, but for a benchmark that is very concentrated in large cap stock, this is always difficult to achieve.

At Ten Cap we have been and remain, more bullish than the consensus. But if the RBA delivers on additional rate cuts, consumer spending picks up as real incomes rise and broader cyclical tailwinds become more pronounced, then outside of a US/global equity sell-off, investors should expect at least a few more years of decent returns.

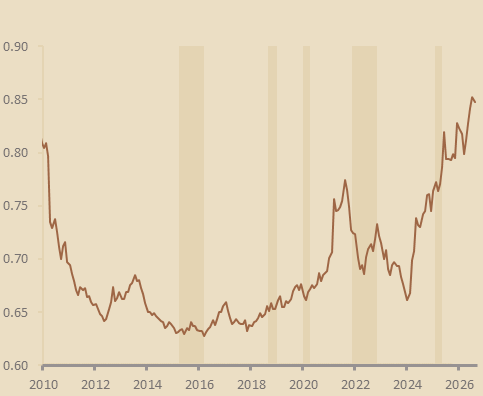

US equity returns dominated by large caps

S&P Market Cap Weighted / Equal Weighted

There are risks but highlighting “risks” versus “when risk matter” are two different things. Trade impacts are still working their way through the global economy, inflation may slow / prevent rate cuts and the tech sector is looking richly valued and carries a lot of hype. But at this stage we don’t believe the ebbs and flows around the economic outlook, the pace of policy easing or AI is enough to end the bull market. This does not discount the potential for tactical corrections or seasonal factors coming into play through September and into October.

Finally, there are murmurings of bubble risks coming from well-seasoned investors and when they speak, its worth listening. The most recent cautionary tale has come from Howard Marks (co-founder of Oaktree Capital) where he discusses at length the possibility of a bubble forming around AI and tech stocks. Bubble theory is not just about high prices but psychological phenomena (lending support to the idea that if you have to ask whether you are in a bubble you probably aren’t). Bubbles are usually characterized by a high degree of irrational exuberance and a fear of missing out (FOMO). While valuations can reach extreme levels, it is often speculative behaviour that leads to “no price being too high” which provides the real sign that a bubble is forming. Therefore, it requires watching but not acting: Technology stock valuations are lofty, they are also supported by solid fundamentals; There are limited signs of speculative behaviour at a retail level via margin accounts or credit growth; IPO’s and issuance is not frothy; And equity market breadth has been broadening out as measured by equal weighted indices. For now, it think it is a “thought bubble” rather than an actual “equity market bubble”.

Looking ahead, we remain positive on Australian equities. We believe the combination of supportive policy settings, resilient earnings, and evolving market leadership provides a durable foundation for further gains and this will extend the bull market – that began in March 2020 – for some time to come. As a result, we think gains for equity investors will be above average levels at least while the cyclical outlook is improving and before the direction of policy rates reverse. We recommend selective exposure to cyclicals and small-to-mid-caps while remaining cautious around crowded trades. We would use periods of weakness to raise domestic cyclical and interest rate exposures rather than becoming defensive.

Ten Cap is a boutique investment management company with a singular focus on providing our clients with exceptional returns and experiences. Visit out website here.