House prices rise for first time in October

Writing in the AFR today I am happy to report it here first: Australian home values have officially increased for the first time in October since the (tiny) COVID-19 induced correction started in May according to the best-in-class indices produced by CoreLogic. AFR subs can read the full column here or via Twitter, or view the excerpt below:

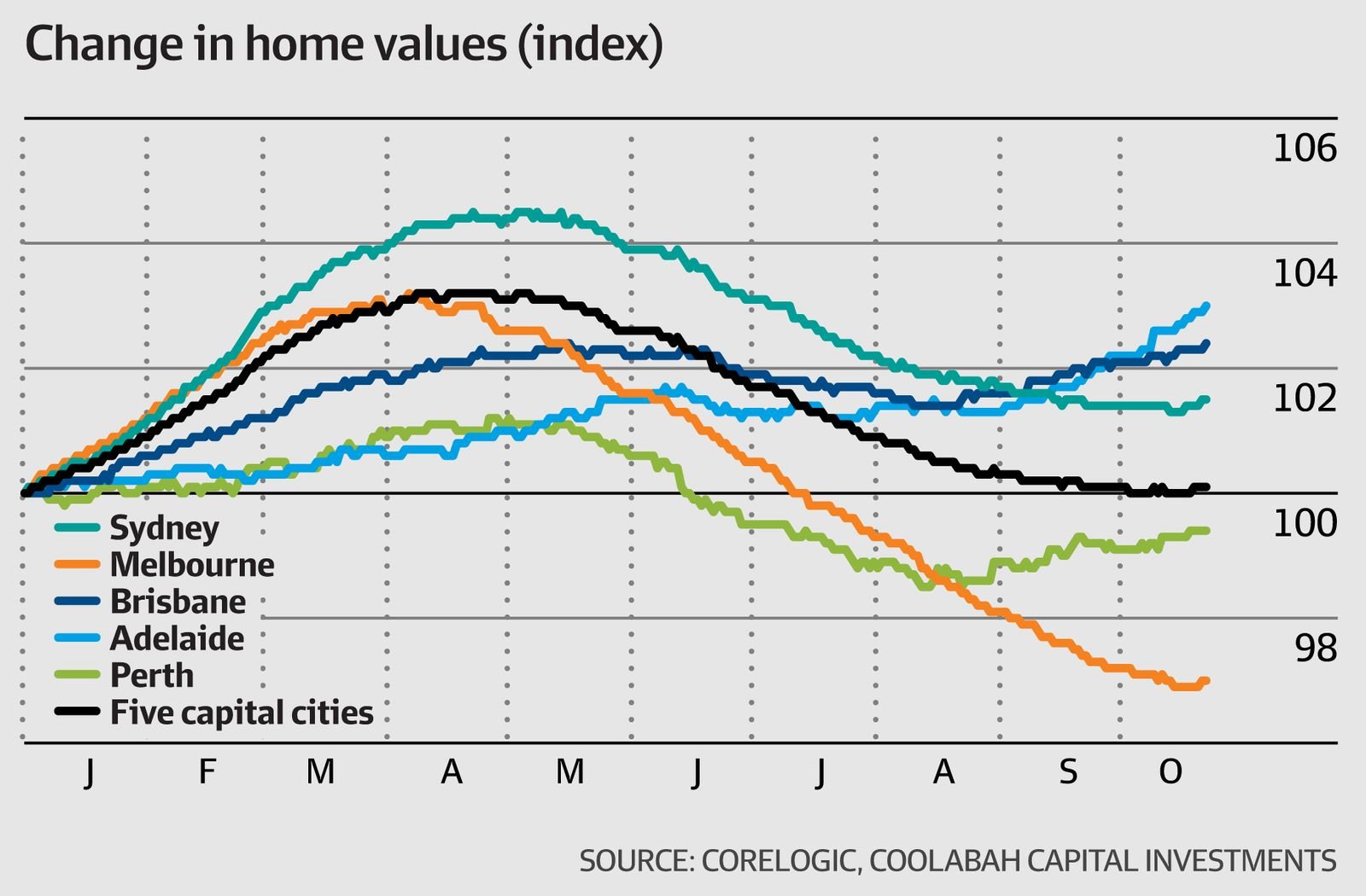

And in encouraging news for the prospects of a broader economic recovery, dwelling prices in Sydney look to have begun climbing again in October, albeit very modestly. While stability might be a more appropriate descriptor for Sydney housing right now, this should shortly make way for more substantive gains.

Collectively, the value of bricks and mortar across 7 of Australia’s 8 capital cities has appreciated in October, though we will have to wait to see how the final days of the month fare.

Significantly, non-metro regional housing markets also appear to be registering capital gains this month, as they did in September (alongside six of the eight capital cities).

The one exception is the locked-down Melbourne market. Yet even here there is good news. Over the first 22 days of October, Melbourne has recorded what is by far its smallest capital loss (minus 0.2 per cent) since its correction commenced in April. Visually inspecting the date, Melbourne seems to have reached a turning point.

And the first weekend of decent auction volumes in Melbourne resulted in an impressively high clearance rate of 60 per cent based on 186 property sales. On this front, Sydney continues to strengthen as well, securing its best final clearance rate (69 per cent) since March based on 702 sales.

All of this means that the peak-to-trough decline in Aussie housing will have been a minuscule 2.8 per cent in line with our non-consensus March 2020 projection for a zero to five per cent loss over a three to six month period followed by a recovery around September.

It begs the awkward question why every other analyst in the market got their forecasts so badly wrong. These analysts also failed to predict the 10 per cent decline in Aussie house prices between September 2017 and May 2019 and the 10 per cent rebound between June 2019 and April 2020.

I think the essential error they make is to massively underestimate just how interest rate-elastic Aussie housing demand is given the dominance of variable rate mortgages (and short-term fixed-rate loans), which has certainly been one insight we have harnessed to anticipate these turning points and the magnitude of the ensuing price increases/falls.

Before we get ahead of ourselves with talk of a housing bubble, it pays to remember that Aussie house prices have not increased for four years. That is, the current value of Aussie dwellings remains below their February 2017 levels. After the record boom between 2012 and 2017, this is precisely what RBA governor Phil Lowe wanted to see: years of little-to-no house price growth.

And that is what we have experienced on a point-to-point basis (with a 10 per cent decline followed by a 10 per cent rise and then a tiny 3 per cent fall in the meantime). Yes, we will see a strong new housing cycle that will have some boom-time characteristics. But this is the RBA’s monetary policy transmission mechanism at work and will be crucial to assuring the wider recovery. As the biggest source of household wealth, the performance of residential real estate is an essential building block supporting consumer sentiment, spending, construction, and jobs.

While there is much misguided talk about zero population growth, this does not account for the fact that 480,000 Aussies have returned home in the last year, mostly as a consequence of COVID-19. And there are many more waiting in the wings hoping to restart their lives in one of the safest, most prosperous, and stable, AAA rated countries in the world. Add to these expatriates the literally millions of talented and/or financially successful individuals seeking to flee escalating health or political risks in the US, UK, Europe, Taiwan, Hong Kong, and China. It has the makings of an eventual net overseas migration tsunami, which will provide a powerful tailwind for aggregate demand, contrary to what everyone else is telling you about weak population growth.

Another profoundly important difference in this cycle is that APRA has been relentlessly bashing the banks on the quality of their lending standards for the last 5 to 10 years. Aussie banks are more conservative in their credit assessment approaches today than they have been at any time in our modern financial history. While there is definitely a big latent risk in the relatively unregulated non-bank lending market, one would hope that APRA will impose its exceedingly tough, 34 page residential mortgage prudential practice guide on all non-banks as well.

APRA has the legislative ability to do so, and could simply require all non-banks to have their lending audited each year against these standards at the non-bank’s cost. This would create a level playing field between banks and non-banks in loan quality terms and ameliorate the otherwise non-trivial financial stability risks of non-banks running amok.

On a lighter note, with the onset of the warmer months, Coolabah’s famed search and rescue drone has ramped up its patrols of Sydney’s beaches. Last weekend we found two great whites stalking metres off a Sydney beach, which you can watch via our YouTube channel by clicking here. Jet skiers swimming in the water nearby were warned and evacuated. See the YouTube image below.

1 topic