How Buffett banked $9.7bn and six ETFs to follow his lead

A set of five investments purchased six years ago by Berkshire Hathaway has gained $9.7bn in value – and none of these are the Magnificent Seven. In fact, none of them are US based. The Oracle of Omaha may famously be US-focused, but these businesses are an exception.

The surprise location these businesses are domiciled? Japan.

After two “lost decades” of deflation and extremely low growth and productivity, the Japanese economy has turned a corner. Active investors are taking note – and there’s plenty to like in the economy and business world today.

But what triggered these changes and how can Australian investors get their own slice of the pie?

In this article I’ll explore what is happening, the companies that Buffett holds and six ETFs listed on the ASX with exposure either broadly to Japan, or specifically to Buffett’s Japanese holdings.

Japan’s changing fortunes

Rising inflation may have been a challenge for much of the world, but it was a boon for Japan’s stagnant economy. Global price shocks from the COVID-19 pandemic and energy crisis sparked by the Ukraine War supported inflationary growth and wages growth in Japan – which had been deflationary for years.

The Bank of Japan finally ended its negative interest rate policy in 2024, and slowed its quantitative easing bond-buying program. The cash rate is currently 0.5% in Japan, the highest in 17 years.

A weaker Yen has supported the economy too, both in terms of making its exports more attractive, along with a big jump in international tourism. For example, Japan has seen a 21% increase year-on-year in foreign visitors, with 21.5 million visiting from January to June this year alone.

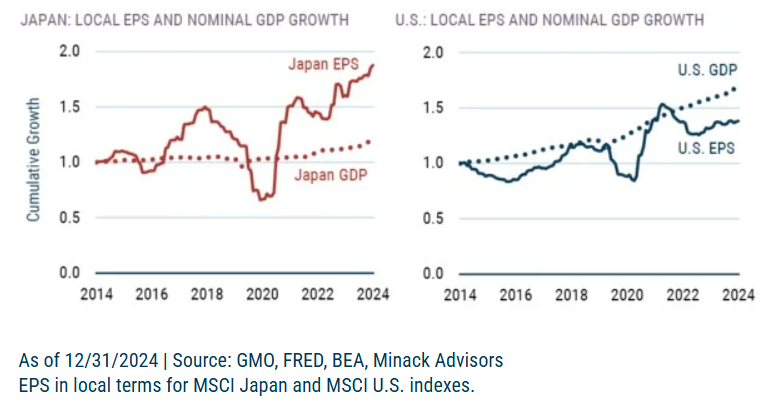

Japanese companies have also seen stronger returns in recent years. There are a few factors behind this.

Corporate governance reforms have supported improving profitability and encouraged Japanese companies to start participating in share buybacks, activist engagements and M&A activity. This has been a project over many years, kickstarted with Prime Minister Shinzo Abe’s “Abenomics” back in 2013 with initiatives for investor engagement, increased board member numbers and reducing numbers of cross-shareholdings held by companies.

Rising returns

The Tokyo Stock Exchange also restructured in 2022, classifying the market into three tiers and incentivising companies to improve their operations to move to a higher tier.

The corporate environment has benefitted from these changes, becoming more profitable, and boosted interest from international investors.

The Nikkei 225 recently hit record highs, gaining 15.15% in the past year and climbing 93.26% in the last five years. To put that in perspective, it’s not far off the S&P 500 which has gained 99.75% in the last five years. By contrast, the S&P/ASX 200 rose 52.38%.

Japanese companies have traditionally traded at a discount to US companies.

The Nikkei 225 Index Forward P/E is currently 21.5x, while the S&P 500 is at 23.44x and the Nasdaq100 is at 26.96x.

Where Buffett is investing

Berkshire Hathaway invests in large-scale Japanese conglomerates, known as ‘sogo shosha’.

Each business has diversified interests, ranging across energy, real estate, metals & mining, food, chemicals, infrastructure and retail. These “very successfully operate in a manner somewhat similar to Berkshire itself,” Buffett notes, and they operate throughout the world.

The five companies Berkshire Hathaway holds are the five largest sogo shosha in Japan.

It holds 9% of each with the intent to increase that further in coming years.

- Mitsubishi Corp (TYO 8058)

- Sumitomo Corp (TYO: 8053)

- Marubeni Corporation (TYO: 8002)

- Itochu Corporation (TYO: 8001)

- Mitsui & Co (TYO: 8031)

In the 2024 annual report letter, Buffett noted that the aggregate cost of these holdings was US$13.8bn, and their market value was US$23.5bn. He also expected the annual dividend income for 2025 from these investments to total around $812 million.

Berkshire Hathaway have also invested in Japanese fixed-rate debt, highlighting after-tax gains of $2.3bn from yen-denominated borrowing in the shareholder letter.

This is expected to be a long-term investment for Berkshire Hathaway, with Buffett stating, “I expect that Greg and his eventual successors will be holding this Japanese position for many decades and that Berkshire will find other ways to work productively with the five companies in the future.”

Five ETFs for Japanese exposure

Australia has two ETFs focused purely on Japan. Venturing beyond this, you’ll find exposure in a range of global equity ETFs. For the purpose of this article though, I’ve identified four that include most (if not all) of Buffett’s picks - it's not an exclusive list.

For pure Japan…

-

Betashares Japan Currency Hedged ETF (ASX: HJPN)

HJPN aims to track the performance of an index (before fees and expenses) that provides diversified exposure to the largest globally competitive companies, hedged into Australian dollars. It includes Mitsubishi Corporation, Sumitomo Corporation and Marubeni Corporation.

Management fees and costs: 0.56% pa

Current price: $22.66 (as at 3.15pm, 1 October)

Benchmark: S&P Japan Exporters Hedged AUD

1 year performance (to 29 August): 14.40%

5 year performance (to 29 August): 17.39%

-

iShares MSCI Japan ETF (ASX: IJP)

IJP aims to provide investors with the performance of the MSCI Japan Index, before fees and expenses. The index is designed to measure the performance of Japanese large & mid-capitalisation companies. It includes all five of Buffett’s picks.

Management fees and costs: 0.50% pa

Current price: $120.96 (as at 3.15pm, 1 October)

Benchmark: MSCI Japan Index

1 year performance (to 29 August): 15.07%

5 year performance (to 29 August): 10.45% p.a.

And onto broader exposures...

-

Vanguard All-World ex US Share Index ETF (ASX: VEU)

VEU seeks to track the performance of the FTSE All-World ex US Index and provide a convenient way to get broad exposure across developed and emerging non-US equity markets around the world. It includes all of Buffett’s picks and Japan represents 15.6% of the portfolio.

Management fees and costs: 0.04% pa

Current price: $71.37 (as at 3.15pm, 1 October)

Benchmark: FTSE All-World ex US Index

1 year performance (before fees): 19.85%

5 year performance (before fees): 11.97% p.a.

-

iShares MSCI EAFE ETF (ASX: IVE)

IVE aims to provide investors with the performance of the MSCI EAFE Index, before fees and expenses. The index is designed to measure the performance of stocks from Europe, Australasia and the Far East and may include large- or mid-capitalisation companies. It includes all of Buffett’s picks and Japan represents 22.1% of the portfolio.

Management fees and costs: 0.32% pa

Current price: $139.61 (as at 3.15pm, 1 October)

Benchmark: MSCI EAFE Index

1 year performance: 17.38%

5 year performance: 12.55% p.a.

-

VanEck MSCI International Value ETF (ASX: VLUE)

VLUE aims to track a diversified portfolio of 250 international developed large- and mid-cap companies with high value scores as calculated by MSCI at each rebalance. It holds all of Buffett’s picks and Japan represents 24.81% of the portfolio.

Management fees and costs: 0.40% pa

Current price: $30.84 (as at 3.15pm, 1 October)

Benchmark: MSCI World ex Australia Enhanced Value Top 250 Select Index

1 year performance: 22.44%

5 year performance: n/a

-

Betashares Global Shares ETF (ASX: BGBL)

BGBL aims to track the performance of an index (before fees and expenses) that provides exposure to an index comprising approximately 1,300 developed markets companies (ex-Australia). It includes all five of Buffett’s picks and Japan as a whole is 6.5% of the portfolio.

Management fees and costs: 0.08% pa

Current price: $79.33 (as at 3.15pm, 1 October)

Benchmark: Solactive GBS Developed Markets ex Australia Large & Mid Cap Index

1 year performance: 20.47%

5 year performance: n/a

Have you included an exposure to Japan in your portfolio? Let us know what you are using in the comments below.

3 topics

6 stocks mentioned

5 funds mentioned