How Molly Benjamin is breaking down financial barriers (and her tips for other investors)

Selling her shares was the point that really sparked Molly Benjamin’s interest in investing. While it may sound unusual, the reason makes sense. Molly was no stranger to the process of investing. In fact, her parents had tried to encourage her interest from eight years old. But there is nothing like having a capital gain to really give you a sense of how powerful investing can be. The shares in question were ANZ and helped fund an overseas move.

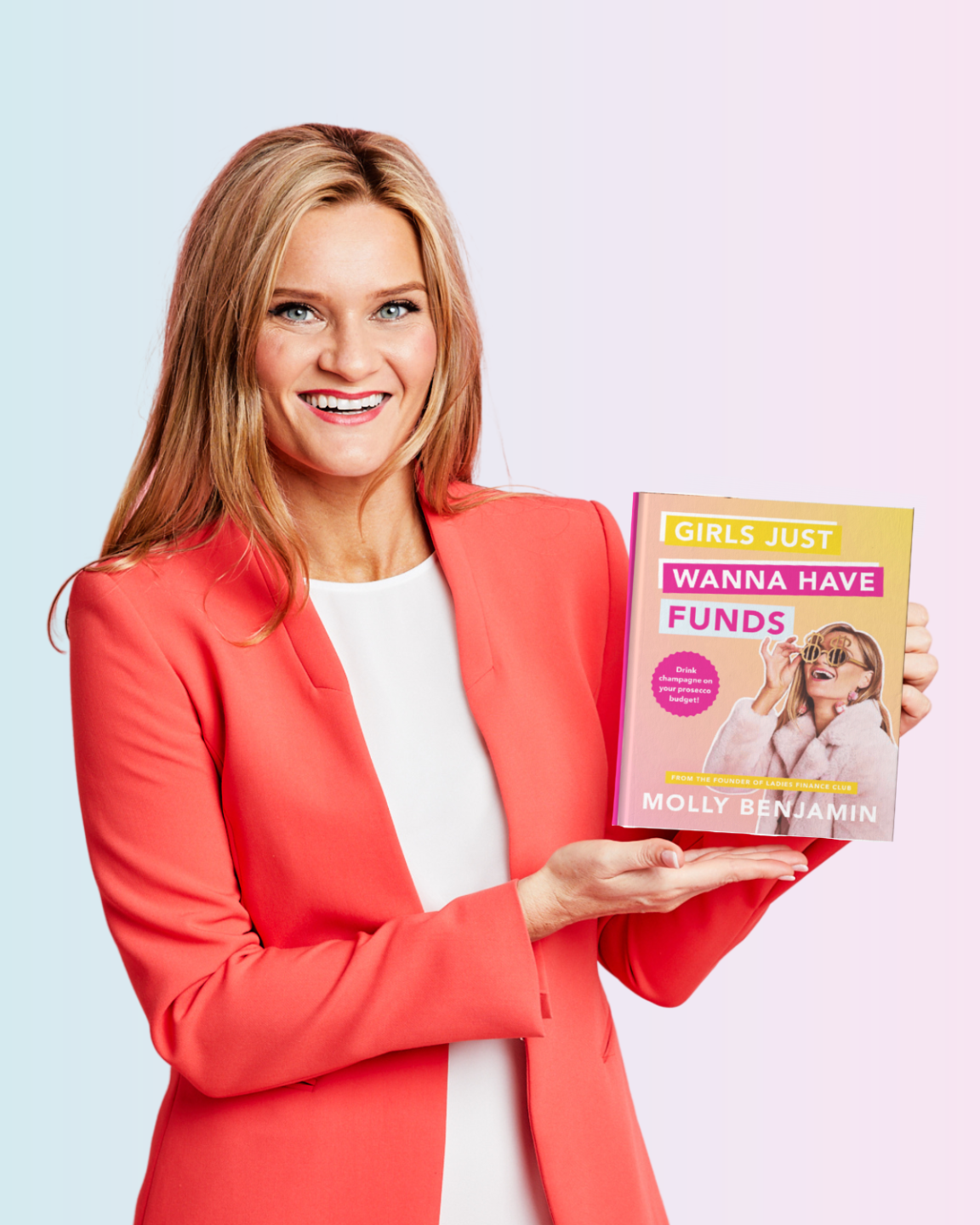

Flash forward to today and Molly Benjamin is not only focused on her own financial journey but is passionate about bringing other women along the way. She launched the Ladies Finance Club in Australia in August 2019 and released a book Girls just wanna have funds yesterday.

I spoke to Molly about investing and the work she is doing to educate women on finance. The idea of finance as dull is just one of the barriers she’s dispelling. In fact, she’d love finance to be the new book club discussion.

“Finance is just a part of adulting, you just have to do it. It’s like negotiating your salary, you just have to do it. My book is designed to be done with friends. It’s about having those conversations, getting curious about your money, finding out where your super is and what it’s doing,” she says.

Barrier #1: Investing is complicated

Molly started out as a stock picker but primarily uses ETFs these days. It is advice she shares with both members of Ladies Finance Club and her readers.

“If I was starting out, instead of trying to pick those stocks, I would start by setting myself up with some base ETFs. I’m running a business and don’t have the time or expertise to really analyse a stock and monitor it so I would choose some international ETFs along with a few sectors or themes I believe in. I have a global healthcare ETF and some ethical ones,” she says.

She takes a set and forget approach to her portfolio with regular consistent payments to her portfolio, describing it as ‘vanilla’ or ‘plain Jane’. She spreads it across asset classes, including A-REITs. She primarily uses international ETFs rather than Australian focused products.

“Australia is very heavily skewed to the finance and mining sectors. We also make up 2% of the world’s market. So using international ETFs is about the exposure to those companies that are changing the world,” she says.

Her personal top 3 investments include:

- BetaShares NASDAQ 100 ETF (ASX: NDQ)

- BetaShares Global Sustainability Leaders ETF (ASX: ETHI)

- CSL (ASX: CSL)

She also holds some Vanguard ETFs. Her keen desire to see her money do good has also seen her use impact investing apps like Bloom or Kwala.

Keen eyed readers would have noticed the stock in the list. CSL is very much Molly’s personal exception to the rule.

“I like that one, CSL is not necessarily a safe bet but it is a solid one and I like having it. It’s Australian and they do great work on the healthcare front,” she says.

She notes many women are overwhelmed by the investment world and fear losing their money by selecting the wrong stock. ETFs have been a natural fit for this audience to start at a lower cost base. Some of members have moved on to stock selection after growing their confidence using ETFs.

Barrier #2: Investing is expensive

Across working with a range of members in Ladies Finance Club, Molly has noticed a common concern. Needing the spare cash to invest. Some of her members comment that minimum investment numbers might be out of reach, while others assume that they need a big budget to just start.

“It’s important to dispel that myth that you need thousands of dollars to get started. When some of our members find out ‘I can just invest with a dollar, I can invest with $50’, it helps to build their confidence up and that’s when they start getting more into it and try ETFs. Some move from there to individual stocks,” Molly says.

She suggests a good starting point can be using micro investing platforms to get a foot in and learn how investing works. It’s worth noting that sometimes the fees on these can be high so you should take a close look at these when using them to make sure your investment isn’t eaten up – that’s worth doing for investment though. As investors have more budget for investing and develop more confidence over time, they can start using broker platforms to invest in ETFs or shares pending their needs, budgets and abilities.

Barrier #3: Fear of the unknown and losing money

“Once you teach people about diversification and the range of products where you don’t have to just pick one stock, that helps people on their journey. Some women think they’ve left it too late, they’re too old, which is never the case. That’s a big myth we like to bust,” says Molly.

Pleasingly, Molly recounts that at a recent event Ladies Finance Club ran, all of the members were relaxed about market volatility. The message about investing for the long-term was truly entrenched.

She has noticed some key differences between male and female investors along the way.

“The main thing is a greater interest in ethical investing. It’s the number one question we’ll get at our live events around making sure money is doing good and not destroying the environment. Women are driving the interest in this. They are also really good at sticking to their goals and they like to have an emergency fund, cash in case they need it. There’s a lot of reasons why women like to have a lot of cash,” Molly says.

Molly’s tips to investors

Molly is a big believer in finance as a conversation starter. Having conversations with friends and family. Doing your research and educating yourself.

“The first tip is to just get started. We do some work with Danielle Ecuyer who wrote the Shareplicity series and she says, ‘the best way to swim is to get your toes wet’. Another tip would be there’s so much content out there. We’re got an investing podcast. Find someone you like and listen. You’re never going to magically know it all unless you do your own research. And diversify,” she says.

While a lot of people don’t have a specific goal in mind when they invest, Molly thinks setting goals is key to good investing practices.

“It’s so much better when you know what you are investing for. Whether it’s a retirement fund, buying a house, a gap year or targeting reoccurring dividends for a passive income,” she says.

Getting started with your investment research? You can explore a range of investment funds here.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

You can follow my profile to stay up to date with other wires as they're published – don't forget to give them a “like”.

3 topics

3 stocks mentioned

2 funds mentioned