How to access an under-researched segment of the market

There is a constant trade off in markets. In order to find opportunities in underpriced stocks, one has to move down the market cap spectrum. But with that comes increased volatility.

On the other hand, large cap stocks have less volatility but they're well researched and often crowded.

At Fidelity, we believe the choice between one and the other isn't binary.

The Fidelity Global Future Leaders Fund targets global mid-caps, typically companies that possess a market capitalisation of anywhere from US$1 billion up to about US$35 billion. We think that companies of this size occupy a sweet spot in the market.

In this Fund in Focus, I run you through the investment case for global mid cap stocks, how our process finds the best of them, and also identify two companies we have high conviction in right now.

Edited Transcript

Both James and myself were previously analysts before becoming portfolio managers, and covered a range of different sectors. We seeded the concept of Global Future Leaders in 2019 and launched the fund in 2020, and we've been co-managing the fund together for the last three years ever since.

So why global mid-caps? And so the Global Future Leaders Fund focuses exclusively on global mid-caps. And so it's probably worth defining what global mid-caps are, because they are very different from a global context to Australia. According to MSCI, global mid-cap index is typically companies with a market cap range of anywhere from US$1 billion up to about US$35 billion. So if you sort of convert that into Aussie dollars, that's somewhere around the region of $50 billion.

We're not talking about small concept stocks or stocks that are speculative or illiquid. In a lot of these instances, and certainly in the ones that we focus on, a lot of these business operations have been around for decades and are very, very profitable.

But why do we like this segment of the market? We believe it fits in a nice sweet spot between the large cap end of town and the small cap end of town because despite the prevalence of large caps performing really well over the past decade, historically speaking, global small or mid-caps have tended to outperform large caps.

And that's purely because there's less people looking at this space, there's less research conducted on some of these smaller companies compared to say an Apple or an Amazon or a Tesla, etc.

So when you have less research, you have less eyes looking at it, that creates more opportunities for mis-pricing and it does increase the potential and the scope for alpha. So historically global mid-caps have outperformed large cap end of town. And then relative to the small cap end of town, mid-caps give you lower risk, they give you less volatility, less drawdowns, but they also give you better liquidity. So it combines the best of both worlds, in our view, and it sort of sits in that Goldilocks spot there.

The other thing is also a lot of people may think that if you have exposure to a global equity manager, for example, that you may be getting exposure to this segment of the market. What we've found through our work is a lot of the popular global large cap mandates or strategies or products that are available in Australia, don't have a lot of correlation or overlap with the holdings in the mid-cap index. And if they do have a few holdings there, by and large, a lot of the alpha tends to be still generated at the large cap end of town. That's why we think it's worth definitely thinking about having a dedicated exposure to this segment of the market, which is in our view, potentially untapped.

So just to give you sort of an idea for the strategy, it is a relatively plain vanilla strategy. It's a long-only fund. We don't do any shorting. We typically hold, or historically have held between 50 and 55 stocks, although we can go a little bit higher and lower than that. Like I said, the MSCI world mid-cap index and typically the market cap range is somewhere in the region of one to about US$30 to US$35 billion. And we launched the fund here in Australia in 2020.

We've got some portfolio risk guidelines in terms of stock limits and industry and country limits, and then we also have some exclusions in there. And also because it's a mid-cap index, some stocks that do really well can graduate outside of the index. And so we have a sunset clause in there that means that we typically will have to sell them within a set amount of time so that we remain true to label.

Now the investible universe has about 4,000 names and we're investing in about 50 or so of those names. So you can see there's a very aggressive filtration or funnelling process that takes place. So typically what we do at the top is James and I will run our own screens focusing on cashflow, return on investment. We typically like to screen out companies with excessive debt, companies that then have sustainable business models. And then also, in conjunction with that, we tie in the Fidelity Global Network. So we have about 400 investment professionals around the world, from analysts to portfolio managers, to traders. And so we're really leveraging that network, leveraging their insights, their conviction, buy-rated names, and looking to sort of bring that in.

Typically what we end up with is a short list somewhere in the region of about 200 names, which James and I will further do our own work on top of that. And so the things we then do in stage three and four, stage three, we basically score the stocks on three metrics, what we call the three pillars of success, viability, sustainability and credibility, which I'll sort of touch on shortly. But then also in stage four, what we're looking at is the portfolio risk characteristics from a quality value transition momentum lens, and I'll also touch on that. Then we have our valuation overlay, and that's sort of how we get to our 50 or so holdings.

So what I mentioned earlier: viability, sustainability, credibility. They are the three pillars, we're scoring each stock on these metrics. The viability is effectively the here and the now. So what are the current business fundamentals look like? What are the current margins? What are the current return profiles of that business? The sustainability is really looking at the duration of that, so how long can these returns and margins persist? You could have a high returning business that could have its returns compete away over time because it has no competitive advantage, for example. So we are really looking at the duration or the persistency of those returns into the future. And then credibility is really looking at our conviction level. So ideally you want a stable, predictable business with honest and trustworthy management and clean accounting. And so they're typically what we're sort of looking for predominantly.

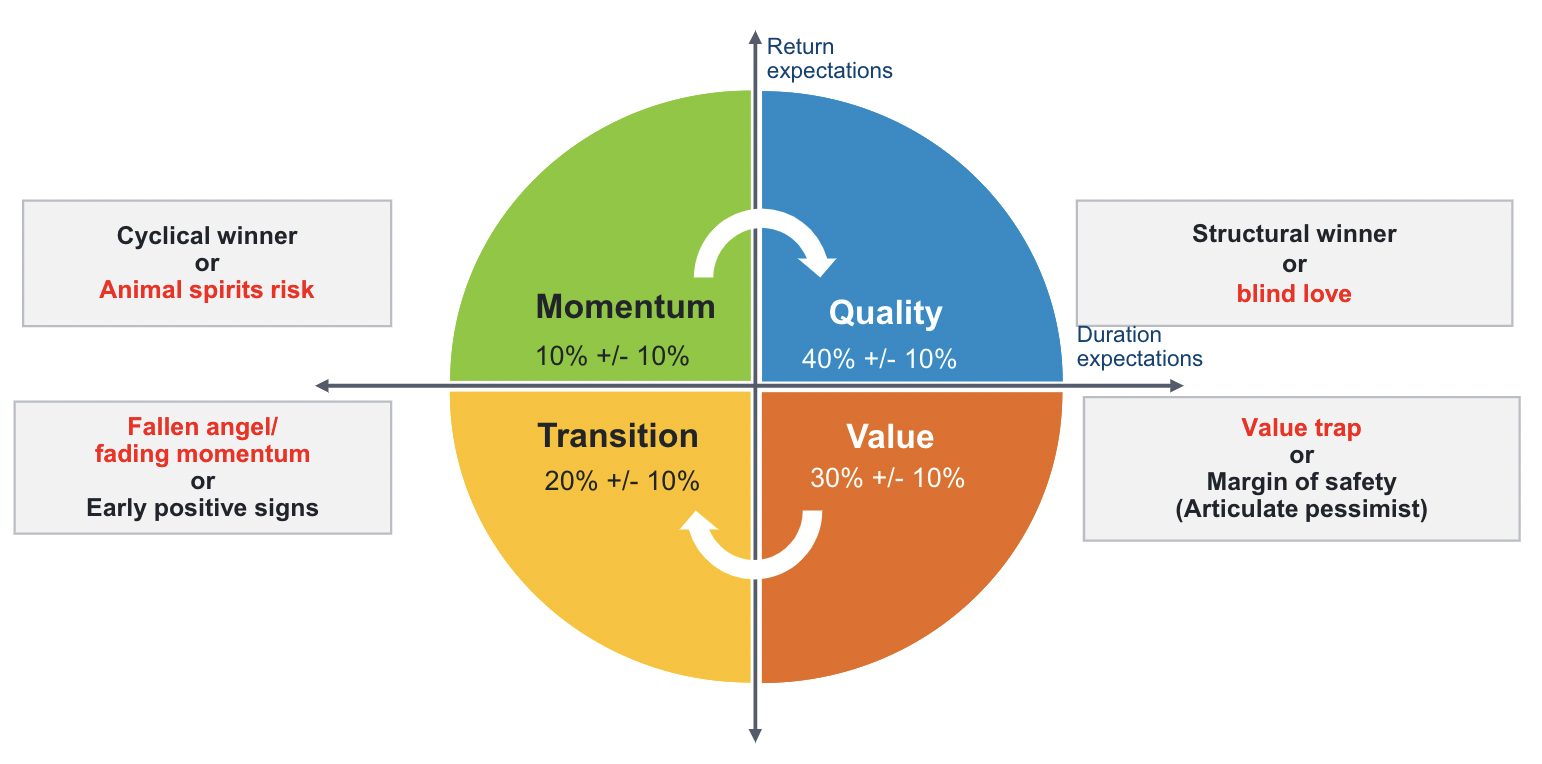

I mentioned quality, value, transition, momentum, and that's our portfolio risk management lens. What we do then after scoring each stock on those three metrics is then also assign a stock to one of those buckets, depending on its characteristics. So quality would be, for example, a long-term structural compounder, value could be a very cheap unloved stock, a transition could be a stock that's undertaking some sort of turnaround or restructuring, and momentum is really where it's sort of the market or a particular fad or theme sort of taking hold and the stocks are sort of moving up and down.

And so why we like to group these stocks into these buckets is if you have a pronounced style bias, because styles do come in and out of favour. So for example, quality has been a outperforming style for quite a long period of time, but it had a very negative 2022. Conversely, value struggled for most of the last decade, but for the last 18 months has done incredibly well.

So if you have a very extreme style bias, in our view, to one or the other, you can have periods of really good performance but then have periods of really bad performance, depending on which style is or out of favour.

What we like to do is effectively create a more balanced portfolio, something that has more all weather characteristics that can do well across all different market environments. And so for example, in 2022, despite having a number of quality names, we also had exposure to a lot of value names in that, particularly in the energy space, and that sort of worked out really well for us.

And just going through performance, you could see there the process coming together really nicely with the performance slide. We've been quite pleased with our performance since inception of almost 3% alpha. And for us, the really interesting aspect is in the last three years we've actually seen a number of different market cycles. We've seen a bear market, we've seen a bull market. And so to be able to outperform consistently across different market environments and different environments where different styles are in favour, is really something that we're quite proud of.

This gives you an idea of just our sector positioning. So I did mention that we are sort of relatively diversified. We diversify across sectors, we don't exclude any sectors, and that's because we do like having exposure to lots of different styles. And so if you sort of think about quality focused investors, they tend to gravitate more towards technology or healthcare or consumer names, whereas the value investors tend to gravitate more towards energy, financials, industrials, in some instances. We like to have a good spread across all those sectors and across all geographies as well, so that we're making sure that we are building that all weather portfolio that can weather most market environments.

I thought I'd give you a couple of stories that really typify what we're looking for.

So the core of what we're doing is really finding those long-term compounders that can sort of grow their earnings in a stable gradual fashion over time.

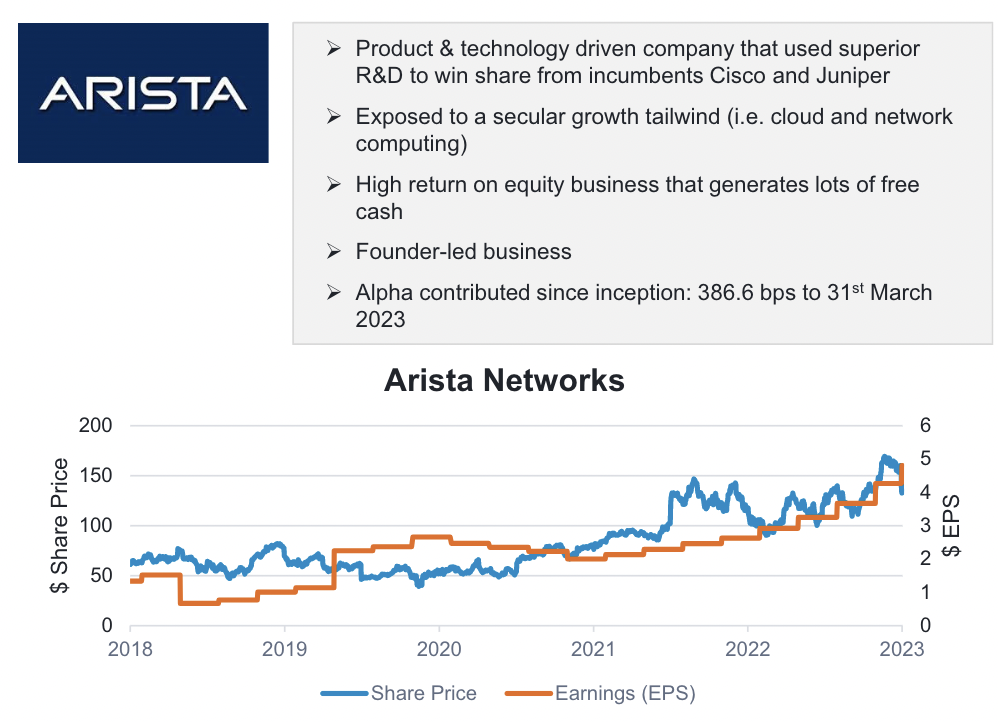

So one of these is Arista (NYSE: ANET).

Arista does network switches. So if you sort of think about a computer network or a cloud, different devices talking to each other, they need a piece of hardware to be able to communicate with each other, Arista does that.

Why we like Arista, is that it's a product and R&D driven business as opposed to some of its competitors like Cisco, which are more sales and marketing driven. There's a growth tailwind there, cloud computing and network computing is obviously growing.

It's still led by the founder who's the chairman, owns a lot of stock, generates a lot of cash, generates really high returns on equity, and it has been a big contributor to our fund for the time that we've held it.

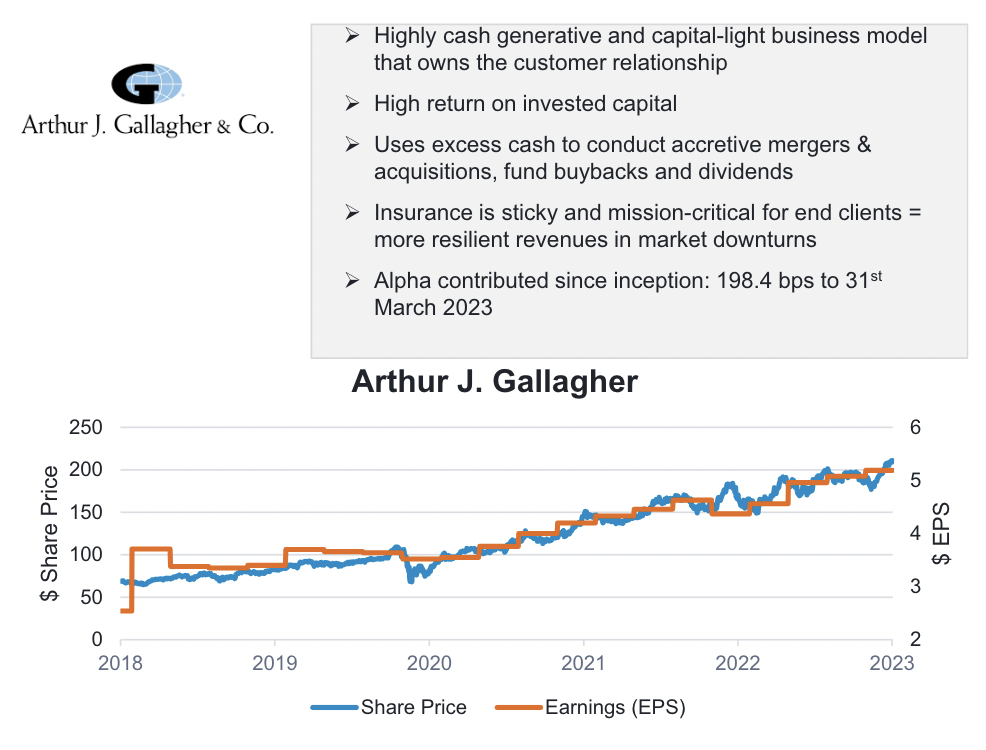

At the same time, Arthur J. Gallagher (NYSE: AJG) is an insurance broker.

Why we like about this business is that insurance is very sticky, it's relatively recession resilient. If you sort of think about a business, if you're facing a recession and your revenues are down five to 10%, insurance isn't something that you typically skimp on. Things like professional indemnity and public liability insurance, those things, you sort of need to keep them, so they're mission-critical. Arthur J. Gallagher is a broker, they don't underwrite risk themselves. So it's a capital light model, generates a lot of cash.

And the most important thing I think to point over those two examples is the earnings have grown steadily over time. And so, the share prices tended to follow those earnings. So really what we are looking for is companies that we have conviction are capable of growing their earnings over time and we tend to hold them through thick and thin and let the share price compound over time.

Okay, so just to sum up there, why Fidelity Global Future Leaders? We feel like we have a very robust and time-tested process that is repeatable and able to deliver consistent results over time. James and myself know this segment of the market quite well. We harness the entire global research network, as I mentioned earlier, over 400 investment professionals around the world, and it is a relatively under research segment of the market, so we do feel as though there is lots of scope for alpha there. And we are quite proud of the track record that we've been able to achieve for clients since inception.

Thank you for your time. For any further information, please visit our website where you can find a dedicated page for the Fidelity Global Future Leaders Fund, or alternatively, you can contact our client services team.

Seeking the large-caps of tomorrow, today.

Our Future Leaders funds offer investors a unique approach to portfolio construction which aims to deliver consistent returns through different market cycles.

2 topics

2 stocks mentioned

1 fund mentioned