How to bypass inflation and recession

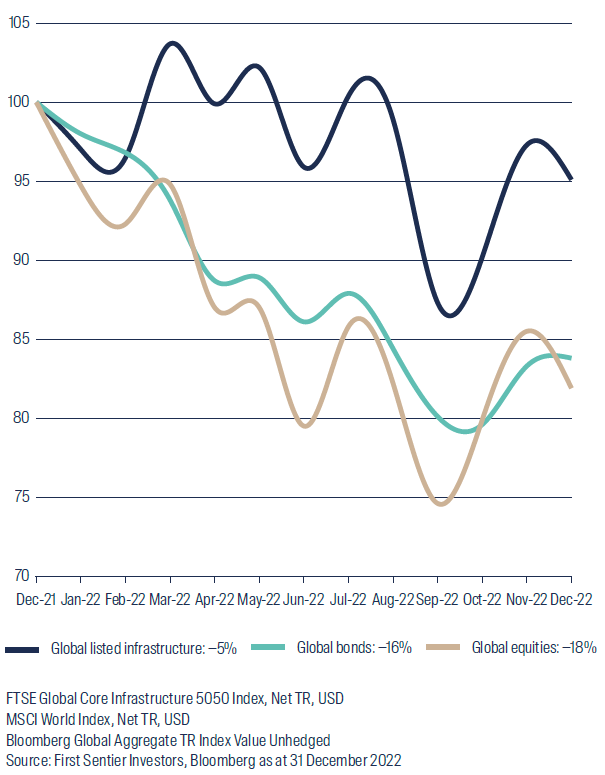

It was a challenging year for financial markets with high inflation, rising interest rates, supply chain disruptions, political uncertainty and the Russia Ukraine war that drove Europe to prioritise energy supply over energy transition. Infrastructure proved attractive to investors in this environment providing exposure to essential services with strong pricing power, high barriers to entry, structural growth and predictable cash flows. These characteristics are likely to remain attractive to investors in 2023 as global economic growth slows.

Global infrastructure, equities & bonds performance (CY 2022)

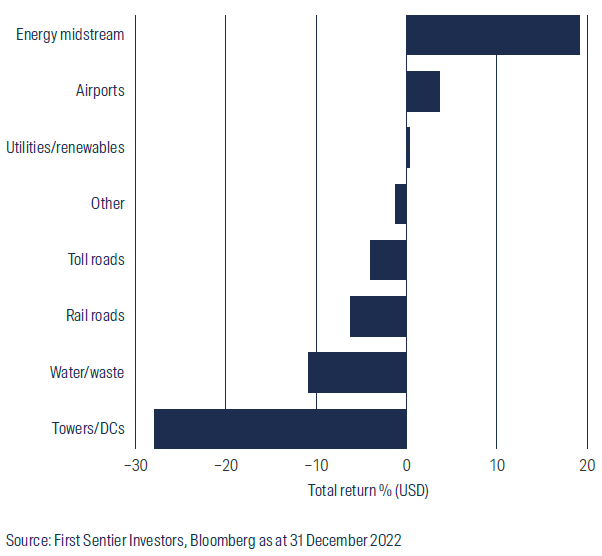

At a sector level, positive earnings momentum was seen in energy midstream, airports and toll roads, while the opposite was seen in railroads, towers and data centres. US utilities are in the midst of a multi-decade structural growth story. European utilities risk reduced demand and increased political interference.

Global infrastructure performance by sector

Higher inflation demonstrated the importance of pricing power. We estimate more than 70% of the assets we invest in have the ability to pass through inflation to the end customer. US electric and gas utilities such as NextEra Energy and Xcel Energy operate within regulated frameworks which enable them to earn an allowed rate of return on money spent maintaining or improving their asset base. Toll road operators like Transurban (ASX: TCL) have concession agreements that specify how much prices can be increased by, with an option to follow the inflation rate or an agreed percentage – whichever is higher.

In the US, listed infrastructure stocks benefited from the introduction of the Inflation Reduction Act (IRA). The Act is a sweeping climate initiative which commits more than US$369 billion to subsidies and tax credits over a decade to encourage decarbonisation and cleaner energy, including measures to support the development of hydrogen as a fuel source. We expect the IRA will encourage global capital to move increasingly towards US-based projects, to the benefit of US utilities. But higher capex will need to be managed in the context of affordability, reliability & sustainability.

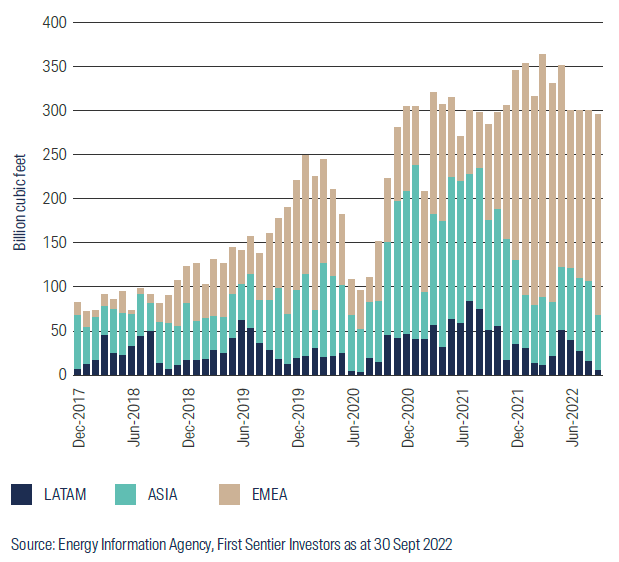

The Russia Ukraine war reinforced the importance of energy independence and security. With more than 40% of Europe’s gas coming from Russia, the invasion of Ukraine created an energy crisis. Commodity prices rose sharply and the demand for alternative sources of Liquefied Natural Gas (LNG) accelerated. US infrastructure companies with LNG export facilities such as Energy Midstream operator Cheniere Energy and utility Sempra Energy outperformed in this environment. As a reliable and relatively cheap source of gas, new long-term contracts for US LNG are likely in the coming years.

US LNG Exports by region

With COVID restrictions easing in many parts of the world, we saw the return of international travel after two years of closed borders. For the GLIS team, this meant the welcome return of face to face meetings, on-the-ground research and asset tours. A few photos of the team on their travels below.

Outlook

We anticipate slower global economic growth in 2023 and believe the recession risks are high enough for it to be considered the base case in our valuation models. We think it is likely the UK and the European Union are already in recession with a mild recession likely in the US in the year ahead. China should see a steady acceleration in growth over 2023 as the country winds back its COVID Zero policy and gradually reopens itself to the rest of the world.

We expect public policy support for infrastructure investment to remain strong globally, especially where it relates to the replacement of aged infrastructure assets, the buildout of renewables to help decarbonise electricity generation, and the globalisation of natural gas markets. We also expect private sector funding of new infrastructure investment to remain strong in 2023 although rising interest rates will likely see M&A activity slow. We anticipate a robust pipeline of capital investment opportunities for the vast majority of global listed infrastructure companies for the year ahead.

The global listed infrastructure asset class is forecast to grow EBITDA and EPS at 6% and 7% respectively over the next two years. Furthermore, we expect dividends to grow faster than earnings, with sector DPS growth forecast at 8% over the next two years.

In our view, balance sheets are under-geared in Asia and fairly geared in North America and Europe. We expect leverage to remain in focus through 2023 with the market penalising companies that need to borrow, or raise equity, in order to fund growth. Debt maturity remains strong at over 11 years for our portfolio today.

We take a closer look at the sector outlook for the asset class in the section below.

Utilities (~50% global portfolio)

The outlook for electric, natural gas and water utilities in 2023 is mixed. On the positive side, investment opportunities from decarbonisation, resiliency, safety, digitalisation and electrification are large and accelerating. These investments are driving an increase in the rate base growth of utilities globally which in turn drives earnings growth.

Visit to Xcel Energy’s regional office in Denver

Source: First Sentier Investors

However, this earnings growth in the short term is likely to be tempered by higher debt costs and by increased regulatory and political risks. Higher energy prices mean electric and natural gas utility customers face 20–30% elevated bills in early 2023, although this pressure may reduce as we move through the year. Higher utility bills increase the political and regulatory risks for the sector globally. We expect lower allowed returns from regulators despite a higher cost of capital, political pressure to defer a portion of price increases, and increased government interference in utility markets in the form of new “windfall” taxes, price caps and government-led investment to reduce price pressure on voters.

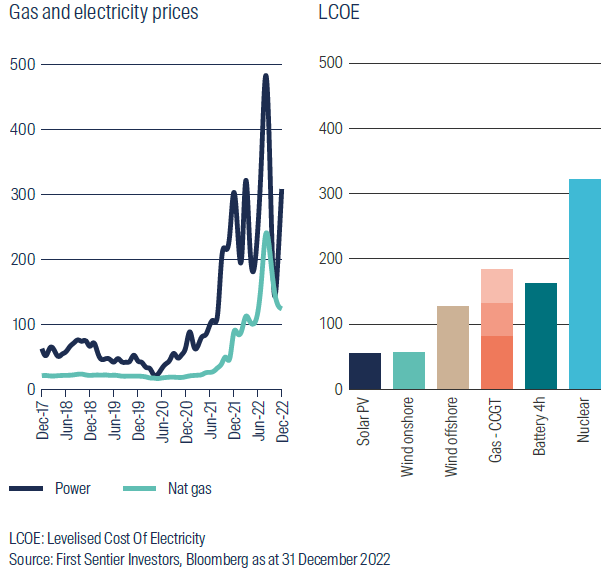

Gas prices reinforcing shift to renewables

Key themes we see for utilities in 2023 are:

- the acceleration of solar and battery investments (especially in the US, following the Inflation Reduction Act),

- increased government support for climate change-related grid hardening and resiliency investment,

- a higher focus on energy security related investments in Europe and Asia,

- an increased focus on the decarbonisation of natural gas via Renewable Natural Gas (RNG) and (in the longer term) hydrogen,

- a higher cost of capital, leading larger utilities to divest assets to private market participants, while some smaller utilities may seek to be acquired,

- politicians continually reminding utilities that there can be no sustainability without affordability and reliability and

- Chinese gas utility volume growth to accelerate through the year as the country re-opens and its property market stabilises.

Despite higher debt costs and with limited impact from a weaker economic environment, strong capital investment should still see utilities deliver earnings growth in 2023, albeit below the medium term trend of 5–7% p.a. This, combined with solid balance sheets, should allow for similar if not higher growth in dividends for the sector.

Transportation (~30% global portfolio)

The transport sector has been about volume recovery in 2022, with most toll roads having returned towards 2019 levels of traffic and airport activity up significantly as COVID restrictions eased and ‘revenge’ travel began. We expect the underlying recovery in demand to continue in 2023, but remain cautious of the economic headwinds globally as higher interest rates and inflationary pressure on the cost of living start to bite.

In 2023 the majority of toll road operators will benefit from their inflation-linked toll escalators, with many developed market roads set for year-on-year increases in tolls of between 4% and 7%. This will be highly supportive for earnings growth and whilst we expect an element of demand destruction from these increases, toll roads have demonstrated their highly favourable demand elasticity in the past.

In terms of overall demand for inter-city roads (e.g. travelling from Paris to Bordeaux on Vinci’s ASF), we remain cautious that these roads which have largely recovered to 2019 levels face pressure on valuable truck traffic in the event of a recession (typically ~3x car toll). Whilst for intra-city (e.g. travelling from suburban Toronto to Toronto CBD on Ferrovial’s 407 ETR) 2023 will be a year of reckoning as the market seeks to determine the true ‘new normal’ for commuter traffic as the return-to office trend settles. Overall, we expect toll roads to be strong performers in 2023 as toll increases support earnings growth and demand proves more resilient than market expectations.

Asset tour of Transurban’s WestConnex tunnel (opening 2023)

Source: First Sentier Investors

Airport traffic should hold strong in 2023, with the continued recovery in traffic from COVID offsetting recessionary impacts on consumer demand. The exception is Mexico, where traffic is already 20–30% above 2019 levels and will likely be more susceptible to traffic declines as a result. We continue to expect global air traffic to recover in 2024–25. From an operations perspective, we expect the operating cost inflation that airports have faced in 2022 to continue into 2023 as labour costs rise and energy costs remain elevated. However, we expect that this will partially be offset by the benefits of inflation flowing through on the retail side of the business via the higher cost of goods sold, resulting in higher sales commissions and variable rents received by the airports from retail concessionaires. Overall, we remain selective in our exposure to the sector and continue to favour leisure airports with a strong network of low cost airlines.

We believe that business travel is likely to remain under pressure in 2023 as a result of high ticket prices, particularly from the legacy carriers who are in the process of repaying state aid and repairing their balance sheets.

The low cost carriers' push for scale and growth post-COVID will likely see ticket pricing ease to support continued passenger growth in the event of signs of a weakening consumer demand. This will support airport earnings which apply the same passenger charge irrespective of the airline.

For the North American railroad sector we expect pricing to remain strong and volumes to be challenged in 2023. Consumer and housing related freight have already started to show signs of weakness and we expect this to continue through the first half of the year. Bulk freight demand should remain resilient given the global energy and food crisis.

Communications (~10% global portfolio)

The outlook for towers and data centres remains positive albeit rising interest rates may be more of a headwind to earnings per share growth than in previous years. In the US, tower companies are benefiting from increased activity from telecom carriers deploying spectrum to support new 5G networks. The result is increased revenue with little to no additional cost to the tower company. The European tower market remains attractive with multiple M&A opportunities through mobile phone operators selling their tower assets to independent tower companies.

Consumers and businesses continue to move activities onto digital platforms underpinning demand for capacity on communications infrastructure such as cell towers and data centres.

In 2023, we expect carriers and mobile network operators to continue the multi-year rollout of 5G mobile technology which will require tower leasing. In data centres, we expect enterprises to seek efficiencies in IT architectures through a combination of colocation (facilities in which users operate their own data centre hardware) and cloud (the delivery of computing services, run from the cloud provider's data centre) services. The benefit of inflation-linked contracts will be especially evident in European towers.

Energy midstream (~10% global portfolio)

The outlook for the energy midstream sector in 2023 is collectively neutral. On one hand, producers in North America will face moderating volume growth driven by cost and capex inflation, an unfriendly regulatory backdrop and higher excess cash flows allocation to dividend growth and buybacks. Moreover, global recession risks could exacerbate the recent weakness in energy prices.

On the other hand, the energy midstream sector ends 2022 with strong balance sheets, limited capital expenditure opportunities relative to the past and therefore excess free cash flow that will likely be allocated to dividends and buybacks. Additionally, the ongoing global energy crisis, and particularly Europe’s needs to replace fossil fuel (natural gas, crude oil, Natural Gas Liquids [NGLs] and refined products) imports from Russia, will increase demand for North American hydrocarbon exports. The expected reopening of China’s economy will further support US export volumes.

It is worth highlighting that an inflationary environment tends to be a positive driver of midstream earnings, due to the inflation protection in most contracts.

Within this space we are most optimistic on energy midstream companies with exposure to natural gas (such as Cheniere Energy), due to the need for LNG exports to replace Russian natural gas; and with exposure to NGLs (such as Pembina Pipeline), where we expect demand to be driven by higher Chinese economic activity levels(2).

Investment opportunities in carbon capture, sequestration, utilisation and storage (CCUS) and anything related to hydrogen infrastructure will also be significant topics in 2023. However, we believe that the earnings potential from these themes are still some years away.

Conclusion

Global listed infrastructure provides investors with exposure to essential services with strong pricing power, high barriers to entry, structural growth and predictable cash flows. These characteristics are likely to remain attractive to investors in 2023 as global economic growth slows. We expect the asset class to deliver EBITDA, EPS and DPS growth of 6%, 7% and 8% respectively p.a. over the next two years. The First Sentier Global Listed Infrastructure team remains focused on bottom up stock picking, seeking mispriced, good quality companies trading at attractive relative valuations. We believe the mix of inflation protected income (3–4%) and structural growth (5–7%) will prove attractive to investors for many years to come.

1 stock mentioned

1 fund mentioned